The media industry has had a rough year as advertising spending slowed globally. That’s led to firms looking at alternative ways to generate revenue and several bankruptcies after some failed to pivot.

Let’s check out some of today’s media news to see how things are developing. 👇

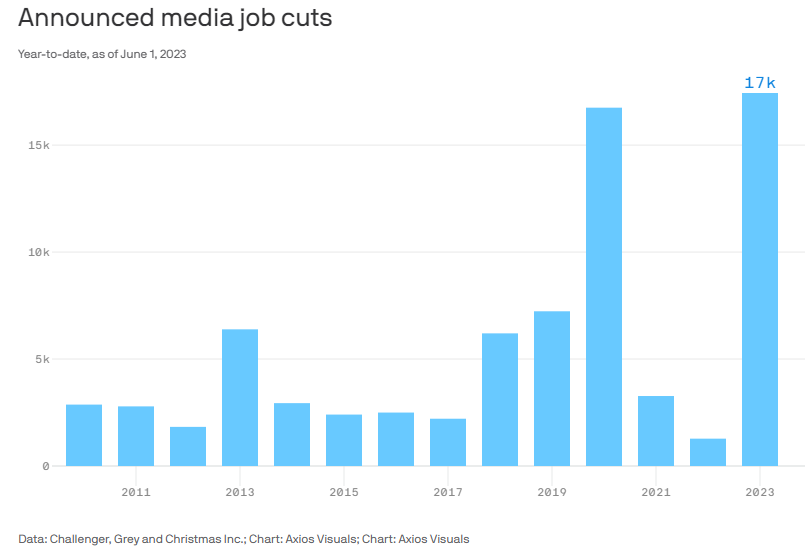

First up is a chart from Axios showing the number of media job cuts announced in 2023. So far, the 17,436 cuts have marked the highest year-to-date cuts on record, surpassing even the pandemic-era numbers. And while these companies are facing headwinds on the revenue side, they’re also struggling with workers as layoffs impact morale and increase union pressure. ✂️

Additional cuts were announced this week at The Athletic, DotLA, Los Angeles Times, and Morning Consult. Many of these companies claim they are “right-sizing” their headcount after overhiring during the pandemic. Still, some industry experts are concerned about the cuts going too far in the other direction. 😬

Speaking of additional monetization efforts, many Reddit communities went dark this week in protest over the company’s new API pricing, which has become cost-prohibitive for many third-party apps. That sparked more than 8,000 of the platform’s communities to go private in an effort to force the company to reconsider its move. ⛔

However, Reddit’s CEO is taking a hardline approach towards the subreddit blackout, saying it will pass. The internal memo sent to staff encouraged them to block out the noise and focus on the company’s long-term vision. He said the blackout hadn’t impacted revenue significantly and that he expects many of the protesting subreddits to return online by Wednesday.

In the meantime, he warned employees not to wear Reddit items in public, saying users’ frustration and anger could be directed at them. How this ends remains to be seen. We’ll have to see if the company’s efforts to prepare for an initial public offering (IPO) seriously damage its long-term health or if this will blow over as CEO Steve Huffman expects. 🤷

And finally, some industry players are still raising serious funds despite the difficult environment. The ad tech firm Madhive reportedly raised $300 million from Goldman Sachs at a nearly $1 billion valuation. 💰

The company makes money by licensing its ad tech software to primarily local TV companies so that they can sell their own CTV ads. It also takes a cut of the transactions facilitated by media companies using its tech.

The new cash will ultimately help the company expand its business and customer base. It’s looking to go after retailers and direct-to-consumer companies next. The funding, which comes at roughly ten times Madhive’s annual revenues of $100 million, will give Goldman Sachs Asset Management a minority stake and three of nine board seats. 🤝

In loosely-related news, Fanatics held its second investor day in a year as the company continues to prep for an eventual IPO. The global platform company was valued at $31 billion during its last funding round and has made several acquisitions of late to help bolster its growth. 🛒