The highly-anticipated inflation data delivered another win for the bulls as it continued its downward progress. 🐂

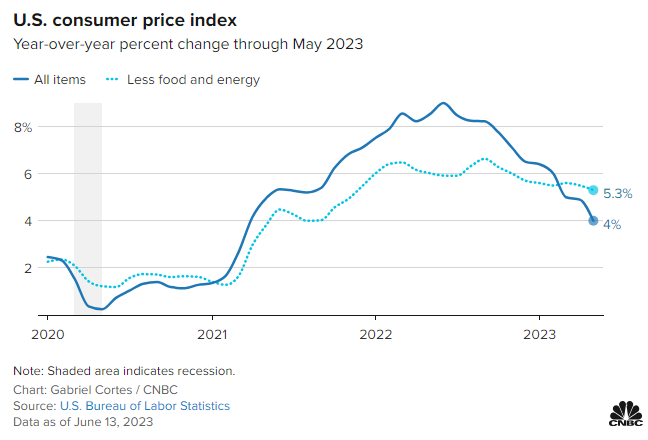

May’s headline consumer price index (CPI) rose 0.1% MoM and 4% YoY, marking its smallest 12-month increase since March 2021. A 3.6% decline in energy prices helped offset gains elsewhere, with food prices also rising just 0.2%. ⛽

However, core inflation, which excludes food and energy, rose 0.4% MoM and 5.3% YoY. A 0.6% increase in shelter prices was again the largest contributor, as housing-related costs account for a third of the index’s weighting. 🏘️

Also contributing to the sticky number was a 4.4% increase in user car and truck prices, which rebounded sharply in April and May following over a year of declines. Transportation services were also significant, rising 0.8% MoM and 10.2% YoY. 🚚

The chart below from CNBC shows the slowing downward progress of core inflation. The market remains optimistic that shelter and the services components of inflation will come down, but the Fed is looking at a potential plateau well above its 2% long-term target. 🤔

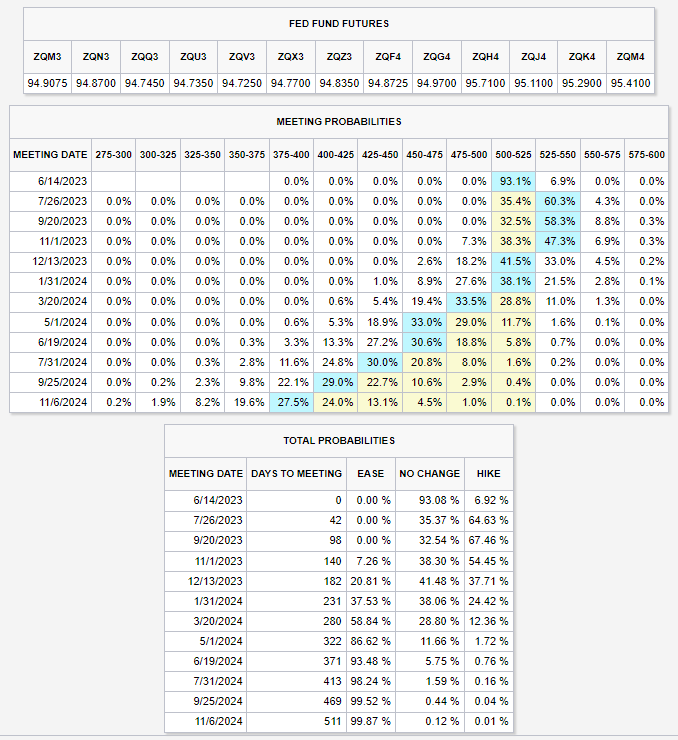

Despite those concerns, the market is convinced that the progress is good enough to warrant a Fed pause at its next meeting.

As of today’s close, the CME FedWatch Tool indicates that the bond market is pricing in a 93% chance of the Fed leaving rates unchanged tomorrow. However, the volatile expectations have shifted toward one more 25 bp hike in July, followed by another pause. We’ll see how these expectations change after tomorrow’s PPI data, Fed decision, and commentary. 👀

Meanwhile, the People’s Bank of China (PBOC) continues stimulating the world’s second-largest economy after a lackluster COVID reopening. The central bank cut its key policy rate by ten bps a week after the country’s largest banks reduced deposit rates, signaling that more monetary easing is likely. 💸

During the pandemic, almost every economy worldwide faced the same challenges. But now we’re in an environment where each is facing its own unique set of circumstances, leading to a more diverse approach to fiscal and monetary policymaking. And for China, driving growth is its number one priority again as the country faces deflation risk.