Tale of the Tape

Happy Wednesday everyone. Markets snapped their seven-day gaining streak. 💔

Nifty and Sensex cooled off after hitting a new record high. Midcaps (+0.3%) and Smallcaps (-0.3%) were mixed with two stocks falling for one gainer. 😓

Most sectors ended in the red. PSU Banks (+0.7%) and FMCG (+0.3%) were the only exceptions. 🤗

HDFC Bank jumped +3% after the Reserve Bank of India allowed the lender to issue new credit cards. 💳 The stock erased all gains to end flat. Read more below.

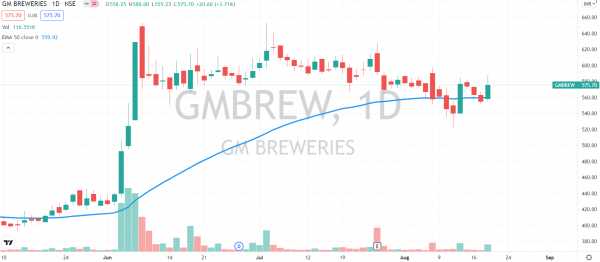

Liquor stocks were buzzing in trade. United Spirits, United Breweries, and GM Breweries rallied between 6%-10%. 🍻Check out their charts below.

Canara Bank will raise Rs 2,500 cr. The stock advanced +2%. 💸

Aavas Financiers dropped 6% after 3 million shares changed hands in multiple block deals. 📉

Kaveri Seed gained +1%. The company will consider a share buyback on Aug 25. 😊

Bharat Forge (-1%) announced that it will manufacture electric two-wheelers. 🛵

Vodafone-Idea rallied +12%. Rumors of the Government announcing some relief in the AGR issue triggered the sharp spike.

The global crypto market cap fell ~4%. Bitcoin slipped 2.5%. Ethereum flopped 4%. XRP (-7%), ADA (-3%) and Doge (-10%) also declined. 👎

Here are the closing prints:

| Nifty | 16,569 | -0.3% |

| Sensex | 55,629 | -0.3% |

| Bank Nifty | 35,554 | -0.9% |

Go Ahead Son

The Reserve Bank of India (RBI) lifted its ban on HDFC Bank from issuing new credit cards. That’s good news for the private lender. ✅

HDFC Bank is the largest credit card player (1.5 cr outstanding cards) and controls over a third of the market. However, the bank lost market share to peers like SBI (1.2 cr) and ICICI Bank (1.1 cr) because of the ban. Consequently, income from the credit card business (~30% of non-lending portfolio) fell 11% over the previous year. 📊 What’s delighted the Street, even more, is the timing of the announcement.

Banks are hoping for a revival in retail credit growth ahead of the all-important festive season. 🎆 Credit cards and unsecured personal loans see the highest growth during this period. An area where HDFC Bank is very aggressive. ✌

HDFC Bank has been one of the top laggards of 2021. The stock is up only 6% YTD vs 13% gain for Nifty Bank. 📉 Developing its tech infrastructure will be crucial for the stock going forward.

Cheers Everyone!

Liquor stocks were in high demand today. Hopes of strong demand as more States ease restrictions cheered investors. 😇 The long-term outlook for the Indian Alco-Bev industry, too, remains positive. Low per capita alcohol consumption, a young population, and rising income levels are the key driving factors. 🥂

United Spirits, United Breweries, and GM Breweries rallied between 6%-10%. Check out their charts below: 📈

Red Carpet Entry

Amazon’s expanding its wings in the Indian financial markets. And its latest bet is Smallcase. 💰

Amazon invested in Smallcase’s recent $40 million Series C fundraise. The round was led by Faering Capital and Premji Invest. Existing investors Sequoia Capital, Blume Ventures, DSP Group, and more also participated. 💸 FYI – Zerodha’s incubator Rainmatter is an early investor in the company.

Bengaluru-based Smallcase offers portfolios of stocks and exchange-traded funds from in-house licensed professionals. 📈 It also provides its users access to independent investment managers, brokerages, and wealth platforms. India’s retail trading boom has helped the company double its user base to 3 million in the past year. 📊 Smallcase said it will utilize the cash to expand its product offering, and win more customers.

This isn’t the first time Amazon has backed an Indian startup. 😎 The e-commerce giant is an investor in insurance player Acko General Insurance Ltd., as well credit provider Capital Float.

But, its foray into the wealth management business is a classic example of “in the right place at the right time”. The Indian wealth-tech market is expected to 3x to $63 billion by FY25, according to RedSeer Consulting. 🤑 Rising financial awareness and digitization boom are set to drive growth.