Tale of the Tape

Happy Thursday everyone! One more day to go for the weekend. 😀

Markets slip for a third straight day amidst global weakness. Midcaps (+0.4%) and Smallcaps (+0.8%) continue their outperformance. ✌

Most sectors ended in the red. Media (-1%) and Metals (-0.9%) topped the list of losers. On the other hand, State-owned Banks (+0.8%) saw decent gains. 💪

Zee Entertainment (-2%) is in the headlines (again!). Invesco approached the National Company Law Tribunal (NCLT) over the company’s failure to announce its extraordinary general meeting (EGM). 😵 Read more below.

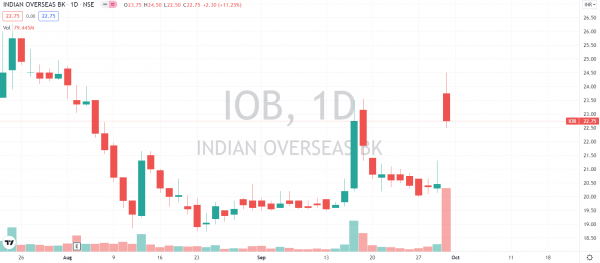

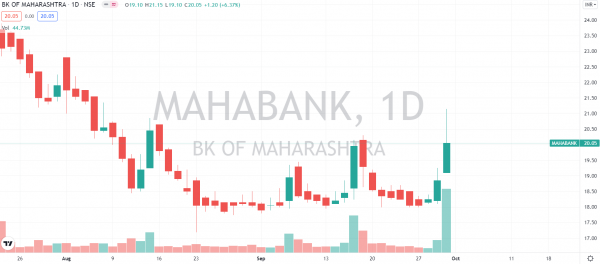

Indian Overseas Bank rallied +11% after the Reserve Bank of India (RBI) lifted restrictions. ✅ Bank of Maharashtra and Central Bank of India also jumped 4%-6%. Check out their charts below.

Persistent Systems (+5%) dropped $53 million to acquire US-based Software Corporation International and its subsidiary. Here’s more. 💸

BlueDart (+2%) will increase shipping prices by ~10% from next year. 🚚

Sterling & Wilson Solar’s (-3.5%) promoters Shapoorji Pallonji and Khurshed Daruvala repaid all of their outstanding dues to the company. 💰 Separately, it also won fresh orders worth Rs 1,500 cr.

M&M (-1%) said bookings for the all-new XUV700 will open from October 7. 🚘

Bharti Airtel (-1%) will invest Rs 5,000 cr to triple its data centers by 2025. 📈

Aditya Birla Sun Life AMC IPO was subscribed 0.9x on Day 2. 👍

Cryptos were mixed. Bitcoin and Ethereum rose 2%. Cardano and Solana slipped ~3% each. Doge was up 1%. 😑

Here are the closing prints:

| Nifty | 17,618 | -0.5% |

| Sensex | 59,126 | -0.5% |

| Bank Nifty | 37,425 | -0.8% |

Invesco’s Mad Bruh

The Zee-Invesco tussle took a new turn today. Invesco hit up the National Company Law Tribunal (NCLT) today as they were frustrated by Zee’s lack of urgency to hold the Extraordinary General Meeting (EGM). 🙋♂️

Invesco called out the company’s top management for intentionally delaying. They remain firm in their demand for Punit Goenka’s resignation. Invesco also clarified that they’re not opposed to the deal with Sony. But, they feel new directors should come on board to protect investor interest. Boom! 🧨

As per law, an EGM should have been called 21 days post shareholder notice. Tomorrow is the last day and there has been no communication yet. Clearly, Zee is in the wrong here and NCLT ordered the company to fix a date ASAP. 👩⚖️

Ah, the plot thickens. 🍿

Breakout Trades

State-owned Banks were on top of our watchlist. Indian Overseas Bank rallied +11% after the Reserve Bank of India (RBI) lifted restrictions. ✅ Reports of the Government shortlisting some banks for privatization further boosted sentiment. Bank of Maharashtra and Central Bank of India jumped 4%-6%. Check out their charts below: 📈

Stopped In The Tracks?

Oyo’s IPO plans may get delayed. 🤔We know it sucks but here’s why.

A friend turned foe, Zo Rooms approached the Delhi High Court seeking to stop Oyo from filing its IPO papers. Zo Rooms claims to hold a 7% stake in Oyo following a failed buyout attempt six years ago. Oyo, on the other hand, denies any wrongdoing and accused the company of misrepresenting the facts. ⚖

How did we get here? Back in 2015, Oyo had agreed to buy Zo Rooms. The all-stock deal would give ZoRoom’s seven founders and investors, including Tiger Global, a 7% stake in Oyo. But, for some reason, the deal didn’t go through. 👎

Zo Rooms claims that the deal’s terms are binding, but Oyo refuses to cede. In March 2021, a Supreme Court-appointed arbitrator sided with Zo Rooms. The arbitrator said that Zoo Rooms is entitled to claim relief in the form of allotment of shares, but struck down its appeal for millions of $ in damages. 💰

Let’s see how this one goes. 😎

Links That Don’t Suck

💰 Cabinet Approves ECGC IPO; Govt To Infuse ₹4,400 Cr Capital

✌ Facebook Launches Largest Creator Education, Enablement Programme In India

🤭 World’s Second-Richest Man Is On The Wrong Indian Magazine Cover

🤯 Martian Soil Will Cost Over $9 Billion To Bring Back To Earth

💯 ‘No Time To Die’ Is An Epic Last Chance To Fall For Daniel Craig’s Bond