Tale of the Tape

Hey everyone. The weekend is here! 😀

Markets closed down as investors booked profits. Rising cases of the Omicron variant plus weak global cues hurt sentiment. Midcaps (-0.1%) and Smallcaps (+0.8%) traded mixed. The advance-decline ratio was split evenly. 🥱

Except for Media (+1.7%), all the other sectors ended in red. Banks and NBFCs dragged markets lower, down over 1% each. 👎

IEX rallied +5% after going ex-bonus. Shareholders of the company will receive two bonus shares for every one share held. ✌

Zee Entertainment (+2%) is all set to close its deal with Sony. The stock bounced over 3% intraday before cooling off. Read more below. 🤝

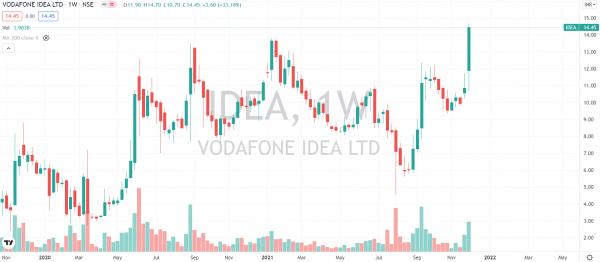

Vodafone Idea rallied +13%. The telecom department has started returning bank guarantees to telcos, as per media reports. Vodafone Idea will get back Rs 12,000 crore which is a big relief for the debt laden company. 💸

Paytm (+3%) snapped its three-day losing streak. Dolat Capital sees a 47% upside in the stock. More details are below. 🤑

Unichem Lab (+14%) received US Food and Drug Administration (USFDA) approval for its new drug used in the treatment of schizophrenia. 💊

Tata Teleservices was locked in a 5% upper circuit for a 14th straight day. The stock is +16x in 2021. 📈

Hindustan Zinc (+4%) will consider the proposal of interim dividend on Dec 7. 💰

Tega Industries IPO was oversubscribed 219x on the final day. Anand Rathi Wealth received 3x more bids on day 2. 💪

Cryptos mostly traded higher. Bitcoin and Ethereum were flat. Cardano rose 5%. Terra (+11%) became the fifth largest DeFi project after hitting a new all-time high. 😍

Here are the closing prints:

| Nifty | 17,197 | -1.2% |

| Sensex | 57,697 | -1.3% |

| Bank Nifty | 36,197 | -0.9% |

Bullish AF

Paytm (+3%) has received its first buy rating since its IPO launched. Finally!!! Dolat Capital has a target price of Rs 2,500 on the stock, indicating a 47% upside. 🤑 Here’s the rationale:

Dolat Capital estimates the company’s Monthly Transacting Users (MTUs) to grow 10x to 50 cr over the next decade. Digital payments, its largest source of revenue, will continue to attract users. But, it is the entire suite of financial offerings like lending, and discount broking that will hold them on the platform. 🤗

Currently, the company earns a small fee acting as an agent/distributor of these financial products. This in turn is offset by its higher expenses on promotions aka user acquisition. Profitability will see a huge improvement as Paytm starts offering these services in-house. 📊

Having said that, there are a number of risks to this investment thesis. Intense competition across multiple segments may delay profitability. Any regulatory changes by the Government/RBI pose a threat to Paytm’s business. 👎

Even without factoring in the risk, it would require near-perfect execution by the company to achieve such lofty targets. With sky-high valuations, we’re not sure if there are enough takers. 😕

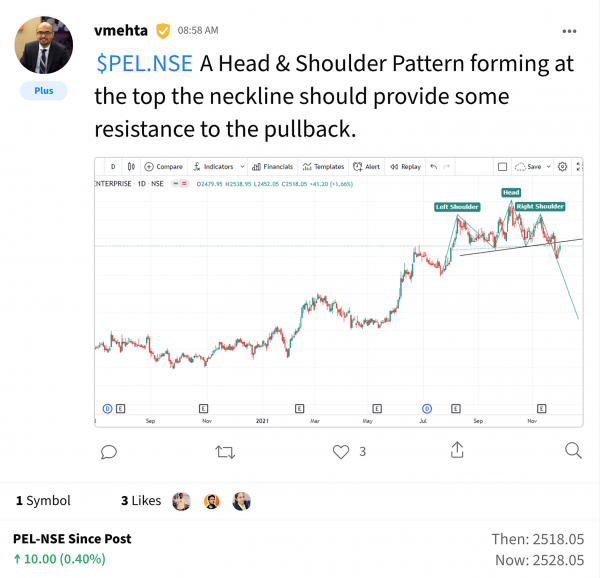

Overheard on Stocktwits

Here’s an interesting chart setup by Vishal Mehta on Stocktwits that you should check out. Add $PEL.NSE to your watchlist and track the latest from our community. Want to know more about Piramal Enterprises’ business and its valuations? Check out our Youtube video here – https://bit.ly/3xXQ3c8

One Step Closer

Zee Entertainment and Sony may close their merger deal before the end of the year, as per media reports.🤝

To recap, Sony and Zee announced a surprise merger deal in September. The combined entity will own over 75 channels, two streaming services, and two film studios. We discussed this in detail here. 🥇

FYI, Zee is still locked in a legal tussle with its largest shareholder, Invesco. The latter has given his blessings to the merger. But, there is a catch. Invesco wants to remove Punit Goenka from his role as a Managing Director & CEO and set up a new board. The matter is still under hearing at the Bombay High Court. ⚖️

The deal with Sony will be a key trigger for the stock’s re-rating, according to CLSA. The brokerage estimates the company’s profits to jump 2.5X by FY24. That’s not all! Business is firing on all cylinders. Industry-wide ad spends have seen a sharp pickup which is positive for Zee. ✅

CLSA is also bullish on the company’s over-the-top (OTT) business. They expect India’s OTT market to grow 34% compounded annually over the next three years. Zee5 is already among the top five in India. 📺

FWIW, Goenka is reportedly in Los Angeles to nail down the merger details with Sony. That’s what you call a Merry Christmas 🎄

Add To Cart

Swiggy will invest a whopping $700 million more into Instamart. The company will use these funds to scale up distribution, marketing, and tech. 👍

Big picture: Quick commerce is one of the fastest-growing e-commerce segments in India. The Covid-19 pandemic turbocharged the industry’s growth. Besides that, rising smartphone penetration and cheap data costs are set to drive growth. According to RedSeer, The online grocery market in India is expected to touch $24 billion by 2025. 💰

Instamart claims to deliver +1 million orders per week and will start 15-minute deliveries to top cities by January 2022. Going forward, The company estimates its gross merchandise value (GMV) to touch $1 billion by Q1FY23. But, it will be faced with stiff competition from the likes of Zomato, Flipkart, BigBasket, and JioMart to do so. 🤼♂️

Swiggy has witnessed a fair bit of success despite cut throat competition. The fresh investments will help solidify its lead over its rivals. Meanwhile, users can continue to enjoy as companies go all out to grab market share. 😇

Movers and Shakers

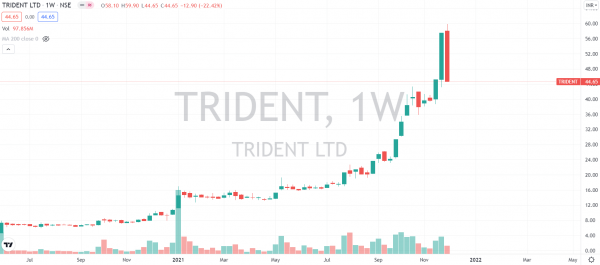

Here’s a look at this week’s top movers from the Nifty 500. Vodafone Idea (+33.2%) posted its best weekly gain in seven months. 📈 Tata Teleservices (+28%) was locked in the upper circuit all five days of the week. Trident (-22%) snapped its two-week gaining streak. IFB Industries (-9%) posted its worst single-week fall since June 14. 🛑 Check out their charts below:

Links That Don’t Suck

💸 Falcon Edge Capital eyes raising a fund of over $10 billion

🙃 Grab Plunges 21% After Altimeter Deal Caps Biggest SPAC Merger

👨💻 Facebook’s Metaverse Play Is a ‘Battle for Future of the Internet’: Axie Infinity Co-Founder

💄 Are anti-aging products actually worth the high price tags?

💍 Looks Like Vicky & Katrina Are Getting Married In Rajasthan On The 9th Of Dec. What We Know So Far

🍿 ‘Spider-Man: No Way Home’, ‘Money Heist’, ‘Aarya’ and More; What To Watch December 2021

💯 Story of Kapil Dev: India’s All-Rounder Who Lead the Team to Victory in 1983