Tale of the Tape

Happy weekend everyone. Markets begin the new year with the best week in four months. 😌

Nifty and Sensex ended with only modest gains despite opening higher. Muted global cues and a steep rise in Covid cases kept investors on the sidelines. Midcaps and Smallcaps continued to outperform, up 0.4% each. The advance-decline ratio was split evenly. 🤝🏼

Most sectors ended in the green. Energy (+0.9%) and Banks (+0.7%) gained the most. Pharma stocks (-0.4%) corrected each day this week. 😔

GM Breweries tanked 10% on weak results. Anand Rathi Wealth’s (-4%) fell despite strong results. More deets below. 👇

Reliance Industries (+0.3%) wrote a big fat cheque to acquire a 26% stake in Dunzo. More detail below. 🚚

Hinduja Global Solutions sank 20% after announcing a super low dividend. 📉

Ujjivan Small Finance Bank rallied 8% after reporting solid Q3 growth. Here’s more details. 📈

Garden Reach Shipbuilders soared 17%. Ace investor Ramesh Damani picked up a 1.1% stake. 🛒

SRF (+4%) hit a new all-time high. UBS sees a 20% upside in the stock from the current price. 📈

TCS (+1%) snapped its two-day losing streak. The Government renewed the company’s contract for the next phase of the Passport Seva Programme. 🛂

Easy Trip Planners (+3%) will consider the proposal of a bonus issue on Jan 12. 🤞

Bharti Airtel (-1%) won’t convert its outstanding AGR-related dues into equity. PS. CLSA upgraded its price target to Rs 910 p/sh, implying a 28% upside. ✌️

Cryptos continued to sulk. Bitcoin was down 1%. Ethereum slipped 3%. Solana was also down 5%. 😟

Here are the closing prints:

| Nifty | 17,812 | +0.4% |

| Sensex | 59,744 | +0.2% |

| Bank Nifty | 37,739 | +0.7% |

Earnings Roundup

GM Breweries’ Q3 results were a major disappointment. Topline saw a healthy boost thanks to strong pent-up demand. But, a lower share of premium products and higher raw material cost hurt the bottom line. 😞 Here are its key stats:

- Revenue: Rs 131 cr; +25% YoY

- Net Profit: Rs Rs 20 cr; -6% YoY

- EBITDA: Rs 27 cr; -2.9% YoY

- EBITDA Margin: 20.6% vs 24.8% (YoY)

Don’t worry bulls, GM Breweries is +67% in the past year. 🤗

Anand Rathi (-4%) posted its first financial results since its December IPO. Growing user base plus strong growth in its flagship wealth business aided its overall performance. 🤗 The company’s assets under management (AUM) rose 28% YoY to Rs 31,348 cr. The stock closed lower as investors booked profits. Here’s its report card:

- Revenue: 109 cr; +55% YoY

- Net Profit: Rs 32 cr; 1.5x YoY

Going forward, Anand Rathi is focused on expanding its HNI customer base and scaling its presence in the mass retail segment. It sees the wealth management space grow 14% annually by FY25. 😎

Anand Rathi is +8% since its listing. 📈

Ambani Adds Dunzo To Cart

Reliance Industries will buy a 26% stake in Dunzo for $200 million. 💸

What’s the deal bro? Dunzo is a leading player in the hyperlocal delivery market. RIL gets direct access to Dunzo’s battle-tested delivery network, rather than building from scratch. 💡 Also, its super quick delivery business is currently restricted only to groceries. But, with Ambani on board the opportunities are endless. 🍾

Isha Ambani, Director at Reliance Retail Ventures Limited said:

We are seeing a shift in consumption patterns to online and have been highly impressed with how Dunzo has disrupted the space. Through our partnership with Dunzo, we will be able to provide increased convenience to Reliance Retail’s consumers and differentiated customer experience through rapid delivery of products from Reliance Retail stores.

Big Picture – Quick commerce, delivery of products in less than 30 minutes, is one of the fastest-growing verticals in India. According to Redseer, the quick commerce market is estimated to grow to a whopping $5 billion by 2025, up from the current $300 million. But, the scene is getting hot with Grofers, BigBasket, and Swiggy all fighting for a bigger share of the pie. 🥧

NFT Boom

NFT marketplace OpenSea raised a whopping $300 million at a $13.3 billion valuation. The Series C funding round was led by Paradigm and Coatue. 🤑

What makes this more special is that OpenSea was founded only in 2017. 🤯 The platform witnessed $15 billion in transaction volumes in 2021 alone, +600x from 2020. It has around 2 million monthly active users. PS: OpenSea was valued at $1.5 billion in July. 😲

NFT’s are digital collectibles like art and digital avatars. British auction house Christie initially raised eyebrows when it sold Beeple’s NFT art for $69 million in March. 💪 NFTs became one of the hottest tech trends in 2021. Several Indian actors, cricketers, and producers also caught the NFT mania. The total NFT trade volume was around $41 billion in 2021. Experts see the trading volume to expand by 10x in 2022. 🚀

Coinbase and others have sights set on NFTs in 2022. Super pumped to bring you guys all the action here. Stay tuned for lots of updates here from the Stocktwits team. 👊

Movers and Shakers

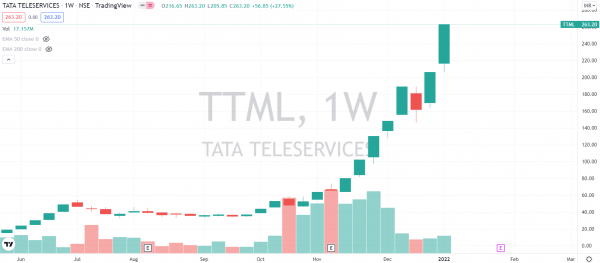

Here’s a look at this week’s top Nifty 500 movers. Tata Teleservices (+28%) took the pole position after advancing for a second straight week. Greaves Cotton (+27% ) posted its highest weekly gain since Feb last year. Hinduja Global Solutions (-14%) posted its worst weekly fall since March 2020. Spandana Sphoorty (-13%) hit a new all-time low. Check out their charts below:

Links That Don’t Suck

🤑 Rupifi Raises $25 Million For Its B2b Payments Platform In India

🚀 Gamestop Shares Surge On Plan To Enter NFT, Crypto Markets

🎸 What India’s First Metaverse Concert Tells Us About The Future Of Virtual Music Events

🔮 Potterheads Assemble! This Harry Potter Spell Turns On Flashlight On Your iPhone

😮 Hairstylist Jawed Habib Spits On Woman’s Head During A Training Session; Watch Viral Video

⚽ January Transfer Window: What Every Premier League Club Needs To Do Before January 31