Tale of the Tape

Happy Monday everyone, and welcome back to The Daily Rip! 🤗

Nifty and Sensex ended higher for the first time in seven days. Midcaps and Smallcaps fared much better; +1% each. The advance-decline ratio (2:1) stood in favor of the bulls. 🐂

Most sectors ended higher. State-owned Banks (+3%) were the top gainers. Real Estate and Auto stocks gained over 2% each. IT (-0.8%) closed down for a fifth straight day. 📉

Adani Group is now the proud owner of Ambuja Cement and ACC Ltd. More details below. 🔥

Eicher Motors (+7%) was the top gainer on Nifty after blockbuster Q4 results. Read more below. 💰

Paytm soared +8%. The fintech startup gave out fresh loans to 26 lakh customers, +5.5x YoY! Here’s the complete lowdown. 📊

Aditya Birla Capital dropped over 6% amidst reports of corruption and mismanagement. 🕵️♂️

Maruti (+2%) will invest Rs 11,000 cr to set up a new manufacturing unit in Haryana. 🏭

Tata Power (+2%) won a Rs 1,731 cr order to set up a 300 MW solar project in Rajasthan. 🌤️

CL Educate was locked in a 5% upper circuit. The company will consider the proposal of a share buyback on May 19. 💸

Cryptos cooled off after a big weekend. Bitcoin was flat. Ethereum fell 1%. Solana rose ~4%. ✌️

Here are the closing prints:

| Nifty | 15,842 | +0.4% |

| Sensex | 52,973 | +0.3% |

| Bank Nifty | 33,597 | +1.4% |

New Cement King?

The Adani Group will buy Ambuja Cements and ACC Ltd for an insane $10.5 billion, making it India’s second-largest cement player! 🔥

Big Picture: The GOI will spend Rs 7.5 lakh crore to build new roads, homes, dams, and other projects. Rapid urbanization, a growing middle class, and affordable housing are expected to drive the cement sector’s growth over the next several decades. Ambuja and ACC have established brands with immense manufacturing depth and a robust pan India distribution network. 💯

FYI – India is the second-largest cement producer in the world. But, the industry is highly competitive with several regional players and limited pricing power. Adani’s foray into the cement business is a pretty big deal and could drive further consolidation, said experts. Let’s see who wins. 🏆

Here are the deal contours for those who care: Adani Group will pay $6.5 billion to buy Holcim’s stake in Ambuja Cement and ACC Ltd. The deal values both companies at ~9% premium to their Friday’s closing price. The transaction will trigger an open offer for a 26% minority stake in the two companies. The deal is expected to be completed in 6-9 months. Going forward, Adani has set an ambitious target of doubling its current manufacturing capacity (~66 million tonnes per annum) over the next five years. 🤑

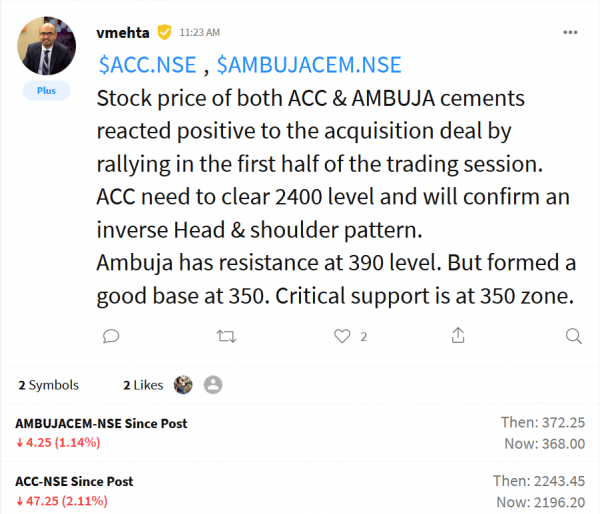

PS – wondering how to trade the news? Here are the key levels to watch out for Ambuja Cement and ACC Ltd from chart guru Vishal Mehta. Follow him for amazing market insights, trading ideas, and more. Here’s the link: https://bit.ly/3zL3xJ9.

Chartbusters

The Adani-Holcim deal had a positive rub-off on the rest of the cement stocks. Birla Corp, Sanghi Industries, and India Cements rallied over 7% each. Check out their charts below: 📈

Earnings Roundup

Eicher Motors (+7%) Q4 results comfortably beat Street expectations. Volumes rose 9% over the previous quarter led by robust demand and market share gains. Operating profit hit a 15-quarter high. Price hikes plus a higher export contribution boosted overall performance. Here’s its report card: 📊

- Revenue: Rs 3,193 cr; +9% YoY (vs Est: Rs 3,050 cr)

- EBITDA: Rs 757 cr; +19% YoY (vs Est: Rs 711 cr)

- EBITDA Margin: 23.7%; (vs Est: 22.3%)

- Net Profit: Rs 610 cr; +16% YoY (vs Est: Rs 575 cr)

Strong demand for Royal Enfield coupled with new launches and easing supply bottlenecks are set to drive volume growth, said experts. Focus on ramping up exports plus better pricing power may boost earnings. 💰

Eicher Motors is -4% YTD.

Calendar

A ton of companies will post their Q4 results tomorrow… Here are all the important earnings you don’t want to miss:

Earnings Highlights

- Avenue Supermarts: Revenue: Rs 8,786 cr ; (+19% YoY) | Net Profit: Rs 427 cr; (+3% YoY)

- Amber Enterprises: Revenue: Rs 1,937 cr; (+21% YoY) | Net Profit: Rs 57 cr; (-24% YoY)

- Bandhan Bank: Net Interest Income: Rs 2,540 cr; (+45% YoY) | Net Profit: Rs 1,902 cr; (+17X YoY)

- JK Paper: Revenue: Rs 1,340 cr; (+31% YoY) | Net Profit: Rs 170 cr; (+13% YoY)

- Bharat Forge: Revenue: Rs 3,573 cr; (+72% YoY) | Net Profit: Rs 232 cr; (+9% YoY)

Links That Don’t Suck

💯 Watch: Markets About To Crash? Should You Buy The Dip? | Stock Room Sunday

🤝 UAE Has Committed To Invest $100b In India: Goyal

🤔 What Happened To Terra’s Bitcoin Reserve As UST And LUNA Crashed

🎮 Netflix Is Reportedly Looking Into Livestreaming