Tale of the Tape

Hello everyone. The stock market had a rough day! 🤕

Nifty and Sensex crashed ~3% as record US inflation stoked fears of increased rate hikes. Midcaps (-2.8%) and Smallcaps (-3.8%) got absolutely hammered. 🔨

It was a sea of red across the board. IT (-4%) and Metals (-3.7%) were the biggest casualties. 📉

RBL Bank got KO-ed. The stock fell 23%, the worst single-day fall since Dec 2021. Read more below. 💀

LIC tanked 6% after the 30-day lock-in period for anchor investors expired today. 🔻

G R Infraprojects slipped 10% after the Central Bureau of Investigation (CBI) raided its offices, according to media reports. 🕵️♂️

GSK Pharma (-1%) approved a dividend of Rs 90 p/sh. 💸

Spring in its step. Bank of America sees a 12% upside from current levels in Campus Activewear. The stock closed down 2% tracking overall market weakness. 👟

Cryptos extended their weekend losses. Bitcoin and Ethereum were down 9%. Solana and Matic dropped over 12%. 👎

Here are the closing prints:

| Nifty | 15,774 | -2.6% |

| Sensex | 52,846 | -2.7% |

| Bank Nifty | 33,405 | -3.1% |

RBL Bank, WTF!?

RBL Bank crashed 23% amidst speculation over the private lender’s future. 😓

What’s the matter, bro? Over the weekend, RBL bank appointed veteran banker R Subramaniakumar as its new MD & CEO for a period of three years. Subramaniakumar has nearly four decades of experience in the banking industry. He was the ex-head of state-owned banks like Indian Overseas Bank and Punjab National Bank during that time. He also played a key role in the DHFL resolution. 😎

What’s the big deal? The appointment of an ex-PSU bank head as the MD & CEO is a bit odd. You see, the RBI generally does not interfere with the management decisions of financial institutions. Unless, of course, the bank or NBFC is financially weak, and has poor corporate governance. 🚨

Concerns over changes in the portfolio mix and management rejig under the new leadership added to the uncertainty. This set the alarm bells ringing and investors pressed the sell button immediately as the markets opened. 📉

RBL Bank is down 60% in the past year. ✂️

Dollar Dollar $$$

Chinese tech and entertainment giant Tencent Group just wrote a huge $264 million cheque for Flipkart! 💰

Tencent will buy the 0.7% stake from Flipkart co-founder Binny Bansal. The deal values the e-commerce giant at a whopping $37.6 billion. FYI – this group valuation also includes, Myntra, PhonePe, and EKart. 🛒

Several Indian startups like Paytm, Zomato, and Byju’s are funded by Chinese companies. But, Govt crackdown post the recent border tensions slowed the pace of Chinese investments. Many apps and games including the famous PUBG-Mobile, developed by Tencent Group are banned in India. 👀

Zooming out: As we all know, the Covid-19 pandemic has been a blessing in disguise for the Indian e-commerce sector. The industry grew 25% YoY to $38 billion in FY21. Since March 2020, 3 cr+ new customers have come online to meet their shopping requirements. And the numbers keep on rising. Flipkart raised a massive $3.6 billion in July last year from Walmart, Softbank, and Qatar Investment Authority. 📊

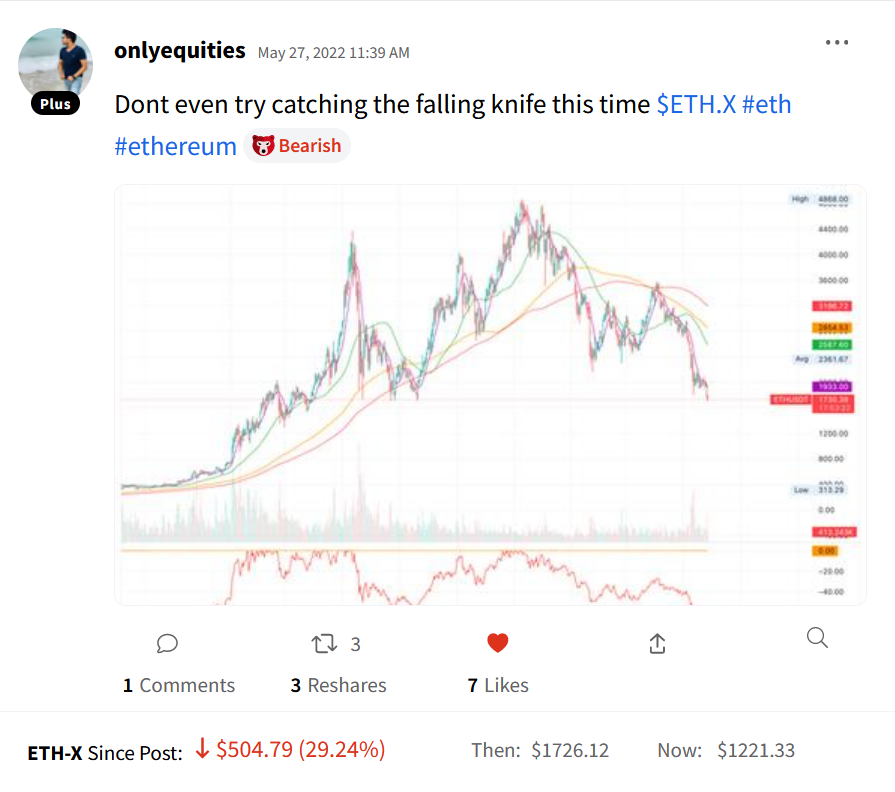

Stocktwits Spotlight

It wasn’t a pleasant weekend for crypto investors! The writing was on the chart, according to Ashutosh Shah aka onlyequities. Follow him for all the latest market updates, awesome trading ideas, and more only on Stocktwits. Here’s the link: https://bit.ly/3xIWKQE.

Links That Don’t Suck

🎯 Watch: Keep An Eye On This Sector | Stock Room Sunday

📈 How To Read Market Direction? (Marketsmith India)

🦮 Dogecoin Down Over 90% Since Elon Musk’s SNL Appearance

🏏 IPL Media Rights: IPL Overtakes EPL In Per Match Valuation At Rs 104 Crore, Behind Only NFL

🚆 10 Places You Can Travel To In The Indian Railways’ Magnificent Vistadome Coaches

🎮 Overwatch 2 Will Be Free To Play And Has An Early Access Release Date