Tale of the Tape

Hey, guys. Markets extended their unbeaten run to day 6. 🔥

Nifty and Sensex pulled back after opening lower as investors bought the morning dip. On the other hand, Midcaps (-0.8%) and Smallcaps (-0.5%) witnessed profit booking. Nearly 2 stocks fell for every 1 gainer. 👎

Except for IT (+1.4%), all the other sectors ended in the red. Autos and Pharma dropped the most, down 0.8% each. 😓

Devyani International rallied +8% on strong Q1 results. Read more below. 💰

Two bank stocks that can give up to 25% return. More details below. 📈

Zomato slipped over 4%. Reports indicate that Uber Eats sold its entire 7.8% stake in the startup. 🙈

e-Clerx Services (+6%) will consider the proposal of a share buyback on Aug 9. ✌️

SpiceJet rallied +13% on the buzz that the debt-laden airline may sell up to 24% stake to a foreign carrier. 🚀

Bharat Forge dropped 4% after North America Class 8 truck sales fell 60% YoY in July. 📊

Cryptos were back in the green. Bitcoin rose 1.5%. Ethereum jumped +4%. Uniswap rallied +9% driven by large institutional buying. 🪙

Here are the closing prints:

| Nifty | 17,388 | +0.3% |

| Sensex | 58,350 | +0.4% |

| Bank Nifty | 37,989 | -0.1% |

Earnings Roundup

Devyani International (+8%) hit a new all-time high on delicious Q1 results. Aggressive store expansion and healthy all-round demand drove the outperformance. 💸

Devyani added a record 70 new retail outlets surpassing the 1,000 store mark for the first time ever. KFC posted the highest average daily sales per store (ADS), surpassing pre-pandemic levels! Investors were also impressed by the steady operating margins despite increased cost pressure in Q1. Here’s its report card: 📊

- Revenue: Rs 705 cr; +2x YoY

- EBITDA: Rs 165 cr; +3x YoY

- EBITDA Margin: 23.4% vs 16.1% YoY

- Net Profit: Rs 75 cr vs net loss of Rs 33 cr YoY

Ravi Jaipuria, Chairman at Devyani International Limited said:

On the economic front, we are seeing early signs of recovery in consumer sentiment. We ended Q1 FY 22-23 with growth across all our brands. As a result, we witnessed good recovery in overall sales in the quarter with strong traction in the dine-in channel.

Going forward, Devyani International aims to add another 1,000 stores (+2x) in the next 4-5 years. PS – It took them +25 years to open the first 1,000 stores! They are also confident of maintaining +20% operating margins which is a huge positive. ✅

Devyani International is +9% YTD.

Stocktwits India Update!

We are hosting a webinar with market guru Shankar Sharma this Sunday i.e. 7th of August. Shankar will discuss how to invest during bear markets, investing dos and don’ts, identifying multibaggers and tons more. So go ahead and register for the event now, here’s the link: https://bit.ly/3oFcj6R.

Bank-ing for Gains

Banking stocks are at the top of every market expert’s buying list. The Nifty Bank Index has rallied +13% in the past month outpacing the ~10% rise in Nifty50 Index. 📈

What’s the deal bro? Banks are the backbone of any economy. Banks lend money to businesses which boosts production, generates employment, and in turn drives economic growth. So, naturally when the economy is in a good shape banks tend to outperform and vice versa. 💰

Credit growth has witnessed a significant rebound in recent months, according to the latest quarterly results of top banks. Recent GST data (2nd highest monthly collection) and manufacturing data (8-month high) have sparked hopes of robust growth despite steep inflation and geopolitical tensions. Bad loan (NPA) pressure has eased considerably from the Covid peak, another indication of solid economic health. 💪

SBI and ICICI Bank are amongst the top picks. Higher loan growth, improving operating profits, and a strong provision buffer may drive ROE expansion for ICICI Bank, said experts. Similarly, SBI’s improving asset quality, unparalleled distribution network, and healthy business outlook are key positives. FYI – Axis Securities sees up to 25% in the stock from current levels. 🤑

Stocktwits Spotlight

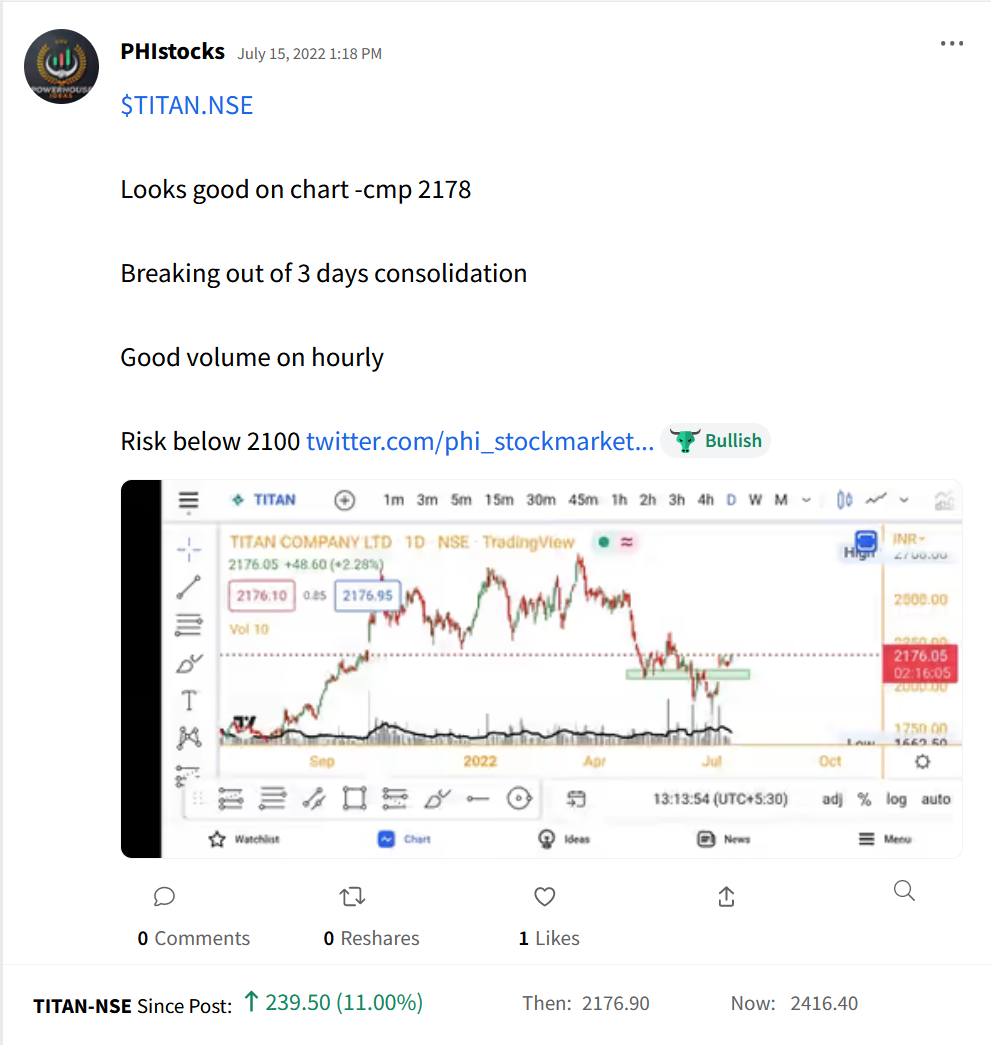

Titan is up 11% since Powerhouse Ideas aka PHIstocks shares his view on Stocktwits. Follow him for more amazing trade ideas and add $TITAN.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3bmJEjW.

Earnings Highlights

- Indus Towers: Revenue: Rs 6,990 cr; (+2% YoY) | Net Profit: Rs 477 cr; (-66% YoY)

- Siemens: Revenue: Rs 4,258 cr; (+50% YoY) | Net Profit: Rs 301 cr; (+1.1X YoY)

- Voltas: Revenue: Rs 2,795 cr; (+50% YoY) | Net Profit: Rs 109 cr; (-11% YoY)

- Navneet Education: Revenue: Rs 698 cr; (+1.1X YoY) | Net Profit: Rs 139 cr; (+3.3X YoY)

- Godrej Consumer Products: Revenue: Rs 3,152 cr; (+8% YoY) | Net Profit: Rs 345 cr; (-17% YoY)

Calendar

We’re in the thick of the earnings season. Here’s all the companies that will announce their Q1 results tomorrow:

Links That Don’t Suck

👀 U.S. House Speaker Nancy Pelosi Meets Taiwan’s President Despite China’s Warnings

😇 Fed’s James Bullard Expresses Confidence That The Economy Can Achieve A ‘Soft Landing’

🏃♀️ Kim Kardashian Tries To Escape EthereumMax Lawsuit

😂 Ashneer Grover Reacts To Viral Video Of His Doppelganger Dancing: ‘Ye Kaam Bhi Outsource Ho Gaya’

💯 A Sneak Peek Of All Or Nothing Arsenal: From Arteta’s Crazy Anfield Idea To Ramsdale’s Rage

☕ Afternoon Tea: A Relaxing Ritual

🤨 12 People Reveal Tell-Tale Signs That Your Friend Might Be Jealous Of You