Tale of the Tape

Good evening everyone and Happy Friday Jr. 🤗

Nifty and Sensex snapped their six-day gaining streak. Rising China-Taiwan tensions, nervousness ahead of RBI policy meeting, and weekly F&O expiry added pressure. Midcaps (+0.6%) and Smallcaps (-0.4%) moved in opposite direction. The advance-decline ratio was split evenly. ⚔️

Most sectors ended lower. State-owned Banks (-1.8%) and Real Estate (-1.1%) stocks dropped the most. Pharma (+2.4%) had a rare green day. 💊

Vodafone Idea’s (-4%) struggles are far from over after another disappointing quarter. More details below. 📊

InterGlobe Aviation is up ~25% in the past month. What’s fueling this rally and outlook going forward? Read more below. 🛫

Zomato gained 4% after large global and domestic institutions like Fidelity, Franklin Templeton, and ICICI Prudential picked up a stake in the startup. 💸

Fineotex Chemicals (+8%) hit a new all-time high after renowned investor Ashish Kacholia bought a 0.5% stake. 💪

Gujarat Gas dropped 4%. Foreign brokerage firm CLSA sees a 12% downside from current levels. 📉

Macrotech Developers crashed over 8% intraday after 74 lakh shares (1.5% equity) changed hands in multiple block deals. 🔻

DCM Shriram (+4%) will set up a 50MW hybrid solar/wind power plant in Gujarat. ⚡

Cryptos trended lower. Bitcoin and Ethereum fell over 1% each. 😓

Here are the closing prints:

| Nifty | 17,382 | -0.1% |

| Sensex | 58,298 | -0.1% |

| Bank Nifty | 37,755 | -0.6% |

Earnings Roundup

Vodafone Idea dropped over 4% on weak Q1 results. The top line was flat as the telecom operator continued to lose active subscribers. In Q1, Vodafone Idea lost a staggering 34 lakh paying customers. Experts said the pace of subscriber loss was stable QoQ meaning they’re only doing as bad as they were earlier. Pfft! 🤦♂️

Losses widened further led by higher marketing and other expenses. The only silver lining was the improvement in Average Revenue Per User (ARPU) by 4% to Rs 128. Here are its key stats: 📊

- Revenue: Rs 10,410 cr; +1.5% QoQ

- Net Loss: Rs 7,297 cr (vs Net Loss of Rs 6,563 cr QoQ)

Vodafone Idea recently placed bids worth Rs 18,800 cr for 5G spectrum. Experts believe this would increase their total debt by 10%, which is a huge negative. Vodafone Idea’s inability to secure funding, continued market share loss, and towering debt are major red flags. 🚨

Vodafone Idea is -44% YTD.

Stocktwits India Update!

We are hosting a webinar with market guru Shankar Sharma this Sunday i.e. 7th of August. Shankar will discuss how to invest during bear markets, investing dos and don’ts, identifying multi-baggers, and tons more. We’ve already received 4,000 sign-ups so hurry up and register now! Here’s the link: https://bit.ly/3JwE5M4.

Flying High!

InterGlobe Aviation is red hot. The stock has rallied ~25% in the past month vs a 10% gain for the Nifty 50 Index. ✈️

What’s the deal bro? Travel demand has rebounded sharply after the 3rd wave and is expected to continue well beyond the holiday season. Higher ticket prices and strong pent-up demand is expected to boost topline growth. Fun Fact: In Q1, the airline reported its highest-ever quarterly revenue. IndiGo is also upgrading its aging aircraft fleet which should help save fuel costs. Focus on scaling up corporate and international travel are key positives, said experts. ✅

What next? Q2 is a seasonally weak quarter so we can expect moderation in air travel. Additionally, steep oil prices and a weak rupee may dent profits going forward, warned experts. But, the biggest concern for the Street is competition. Jhunjhunwala-backed Akasa Air takes flight in mid-September. Jet Airways is back with a fresh lease of life and then we have Air India under the strong leadership of Tata Group! 🤼♂️

Reports of pilots, cabin crew, and other staff members calling in sick to apply for jobs at competitors made headlines last month. IndiGo will need to take steps to retain talent which in turn may drive up costs further. PS – they will reinstate salaries of pilots to pre-Covid level from November. FYI – JM Financial sees a 17% downside from current levels. 🙈

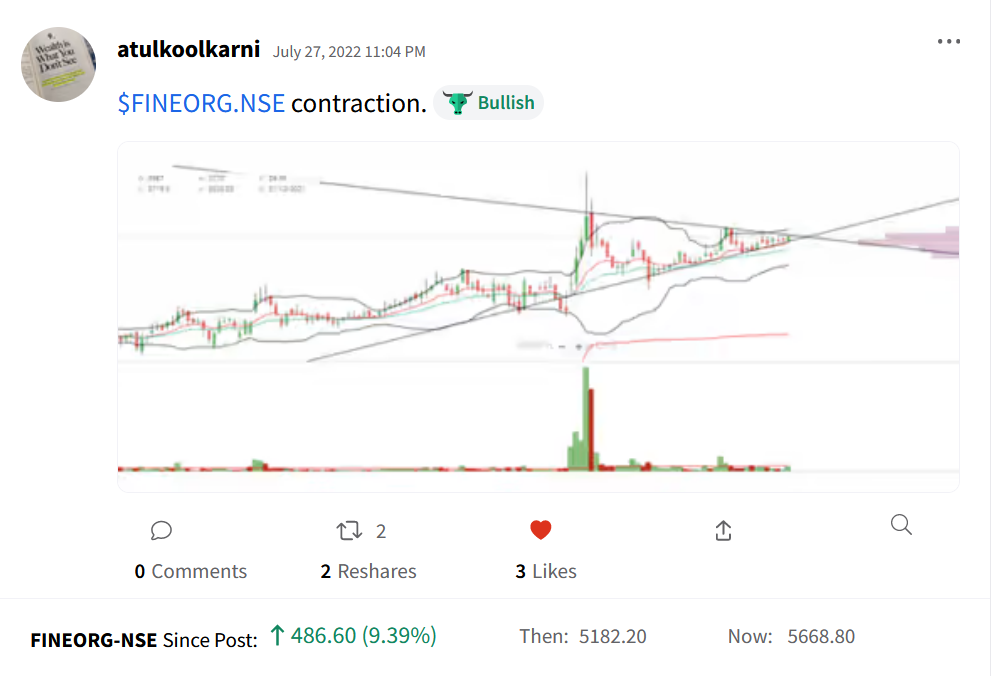

Stocktwits Spotlight

Fine Organics hit a new all-time high of Rs 5,755 on Wednesday. Huge shoutout to Atul Kulkarni for spotting the trade. Follow him for more awesome trade ideas and add $FINEORG.NSE to your watchlist and track its performance. Here’s the link: https://bit.ly/3zVqT08.

Earnings Highlights

- Lupin: Revenue: Rs 3,749 cr; (-13% YoY) | Net Loss: Rs 89 cr;

- GAIL: Revenue: Rs 38,033 cr; (+1.1X YoY) | Net Profit: Rs 3,253 cr; (+52% YoY)

- Dabur India: Revenue: Rs 2,822 cr; (+8% YoY) | Net Profit: Rs 441 cr; (+1% YoY)

- Balrampur Chini Mills: Revenue: Rs 1,080 cr; (-5% YoY) | Net Profit: Rs 12 cr; (-84% YoY)

- Redington India: Revenue: Rs 16,828 cr; (+25% YoY) | Net Profit: Rs 316 cr; (+33% YoY)

- Gujarat Gas: Revenue: Rs 5,322 cr; (+72% YoY) | Net Profit: Rs 382 cr; (-19% YoY)

Calendar

A ton of companies will report their Q1 results tomorrow… Here are all the important earnings you don’t want to miss:

Links That Don’t Suck

🚀 The $300 billion meme stock that makes GameStop look like child’s play

👨💻 Solana Wallet Hack: Here’s What We Know So Far

📱 Samsung To Unfold Something ‘Greater Than’ Before At Galaxy Unpacked Event on August 10

🤑 Meet Muhammed Awal Mustapha, World’s Youngest Billionaire Who Owns A Private Jet & Mansion At 10

🎵 How Instagram Is Changing Bollywood Music

🧠 These 5 Mental Habits Are Key To Becoming Successful Like Elon Musk and Bill Gates