Tale of the Tape

Good evening and welcome back to The Daily Rip! 🤗

Markets closed down for a fourth straight day. Nervousness ahead of the RBI policy meeting, geopolitical tensions and a weak rupee crushed investor sentiment. Midcaps (-3.1%) and Smallcaps (-3.5%) got smoked. 🔥

Except for IT (+0.6%), all the other sectors ended lower. Real Estate (-4.3%) stocks hit the lowest level since July 15. Autos (-3.8%) and PSU Banks (-3.7%) also witnessed deep cuts. ✂️

The rupee closed at a record low of Rs 81.62 against the US dollar. 📉

Britannia appointed ex-Coca-Cola head Rajneet Kohli as executive director and CEO. The stock closed flat. 👨💼

Samvardhana Motherson (-5%) will buy the mirror business of Japan-based Ichikoh Industries for nearly Rs 300 cr.🪞

Rolling in the dough. Harsha Engineers closed at Rs 486.5 p/sh, up 47% from its issue price. 💰

PowerGrid rebounded +6% from day’s lows on reports that they won’t acquire Rural Electrification of India (REC). ✅

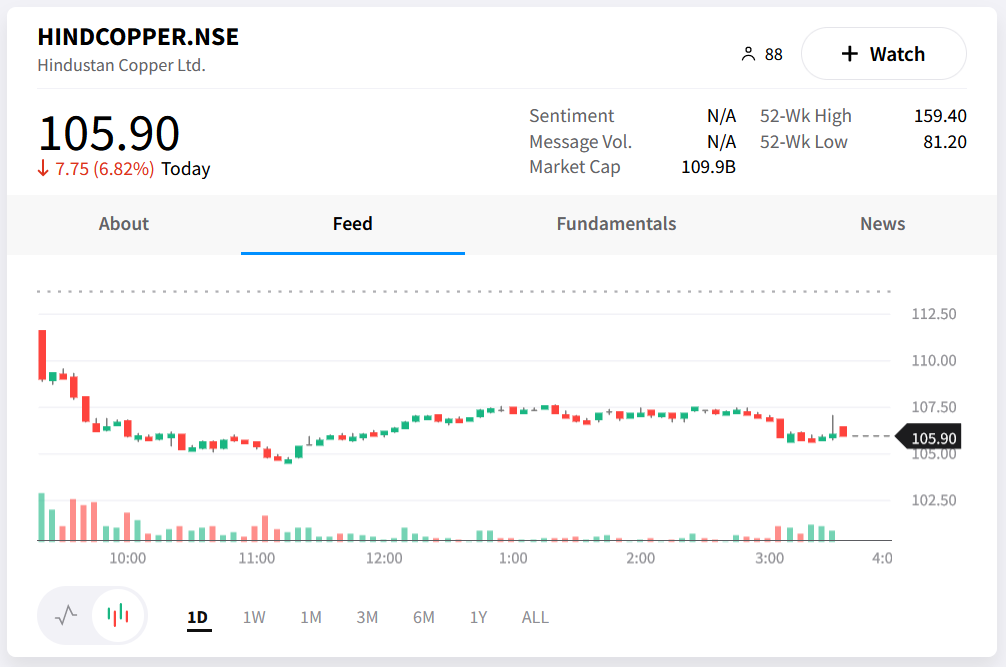

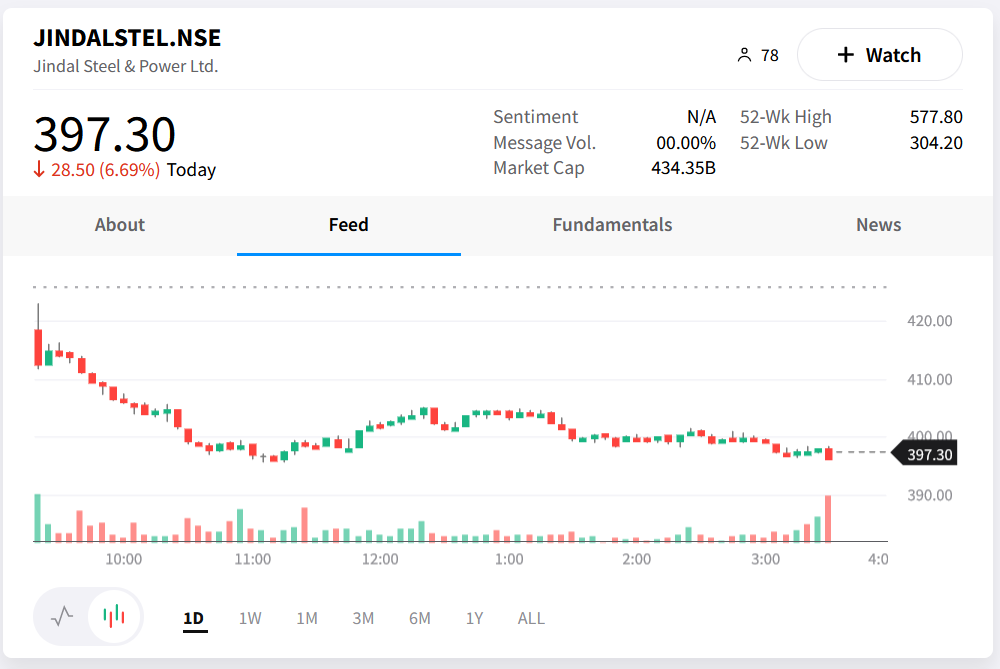

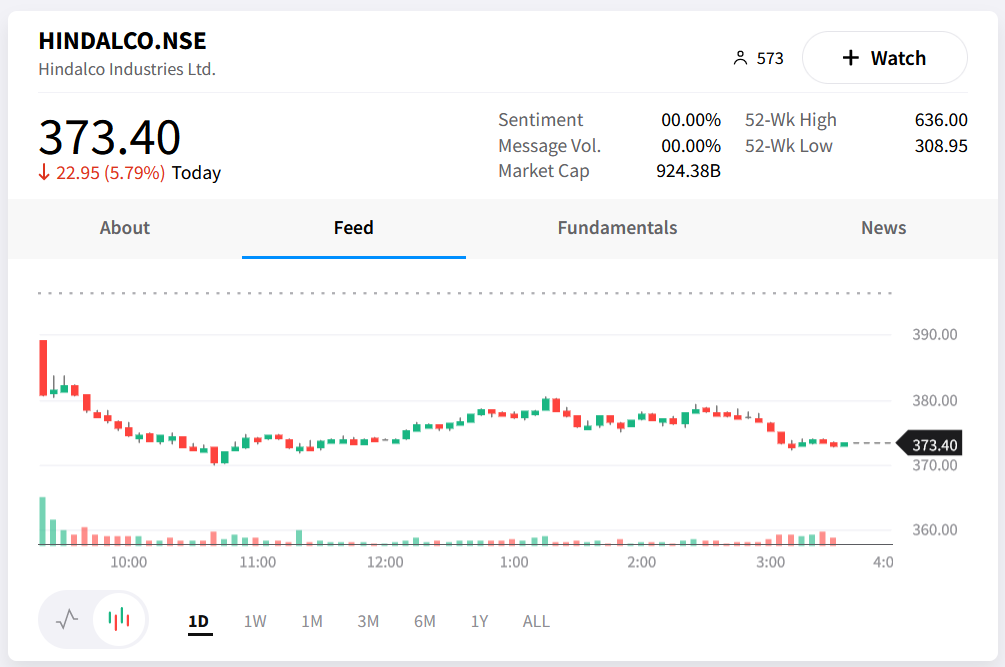

Metal stocks had a rough day. Hindustan Copper, Jindal Steel and Hindalco were down between 6%-7% each. Check out their charts below. 🤕

Suzlon (-7%) will raise Rs 1,200 cr via a right issue. The company will issue 2.4 billion shares at a price of Rs 5 each, down 45% from Friday’s closing price. 👎

Anupam Rasayan fell ~4% intraday after a fire broke out at its Surat plant. 🏭

Cryptos were quiet. Bitcoin traded flat. Ethereum was down 1%. Ripple slipped over 3%. 😶

Here are the closing prints:

| Nifty | 17,016 | -1.8% |

| Sensex | 57,145 | -1.6% |

| Bank Nifty | 38,616 | -2.4% |

Apple of My Eye

Apple has begun manufacturing the brand new iPhone 14 in India. Woohoo 🎉🥳

What’s the deal bro? For starters, Apple did not waste any time switching its manufacturing base. They literally launched the expensive, shiny piece of metal 10 days back. That’s a pretty big deal because Apple historically has only assembled older versions of the iPhone in India. The latest move is a clear indication of the Cupertino-based company’s efforts to reduce its dependence on China. 👍

Apple through its vendors Foxconn and Wistron aims to transform India into a global manufacturing hub for iPhones. If things go as per plan, nearly 20% of all iPhones will be “Made in India” by 2025. Currently, China accounts for +95% of its global iPhone production. In your face, Xi. 😎

Big Picture: iPhones are still the bread and butter for Apple. In Q2, Apple’s sales rose 9% over the previous year to $97.3 billion. iPhones pulled in a massive $50.6 billion (52% of its overall sales). This year Apple expects to sell 90 million iPhones, despite concerns over weak consumer sentiment. 💸

Chartbusters

Metal stocks got hammered. The Nifty Metals Index dumped over 4% to hit a one-month low. Why so? 🤔

Prices of key industrial metals like steel, aluminium, and copper are down 25%-30% from their recent peaks. Fears of a global slowdown and muted demand from China – the world’s largest metal consumer – are key reasons. The GOI recently taxed exports of steel and steel products. This has resulted in a supply glut adding further pricing pressure. Lower prices in turn may impact profitability, which is a huge negative. 🚨

Global brokerage firm Jefferies believes operating margins for these companies have “topped out” in the medium term and expect operating profit to halve by FY24. Yikes! 📊

Hindustan Copper, Jindal Steel and Hindalco were down between 6%-7% each. Check out their (horrifying) charts below: 📉

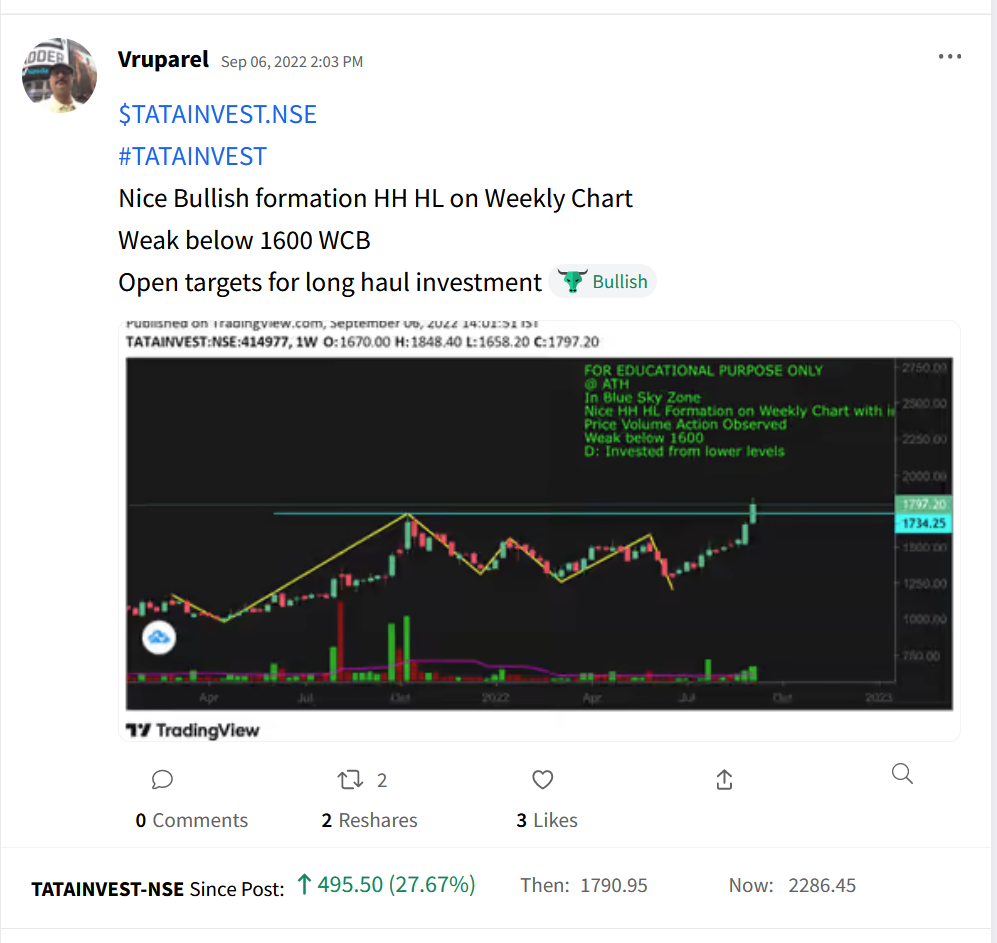

Stocktwits Spotlight

Tata Investment has come out on top amidst the recent spike in volatility. The stock is up ~30% since Vivek Ruparel shared his view on Stocktwits. That deserves a big round of applause. Follow Vivek for more amazing trade ideas and add $TATAINVEST.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3xV6Pd8.

Links That Don’t Suck

💯 Paper Industry Analysis | Stocks To Buy Now | Stock Room Sunday

🙏🏻 At 65, Kerala’s Narayani Teacher Walks 25 Km Everyday For Her Students

😍 15 Of The Most Exquisite Durga Pujo Pandals From West Bengal Over The Years

🤷♂️ Google CEO Sundar Pichai Tells Employees They Don’t Need Money To Have Fun Amid Cost Cuts