Tale of the Tape

Sup guys? Markets continued to edge lower. 📉

Nifty and Sensex cooled off from the day’s high to end with minor cuts. Midcaps (+0.2%) and Small Caps (+0.3%) fared slightly better. The advance-decline ratio was split evenly. 🤼

Most sectors ended lower. Metals (-0.9%) and Banks (-0.7%) extended their losing streak. IT stocks (+1%) closed up for a second straight day. 🚀

It’s a deal. Mahindra Logistics (+4%) will buy Rivigo’s B2B express delivery business for Rs 225 cr. More details below. 🚚

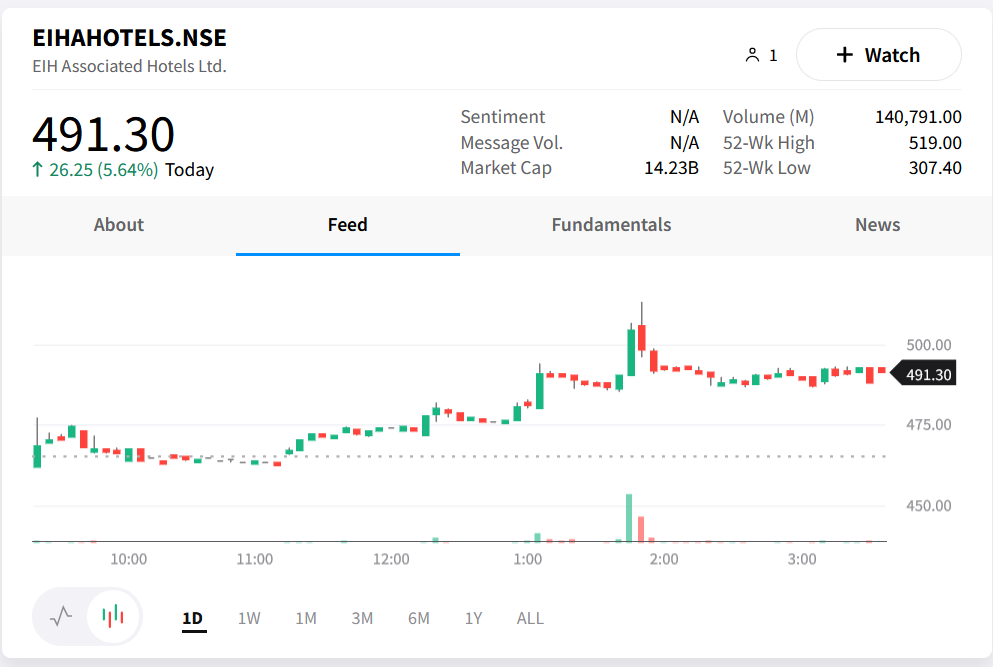

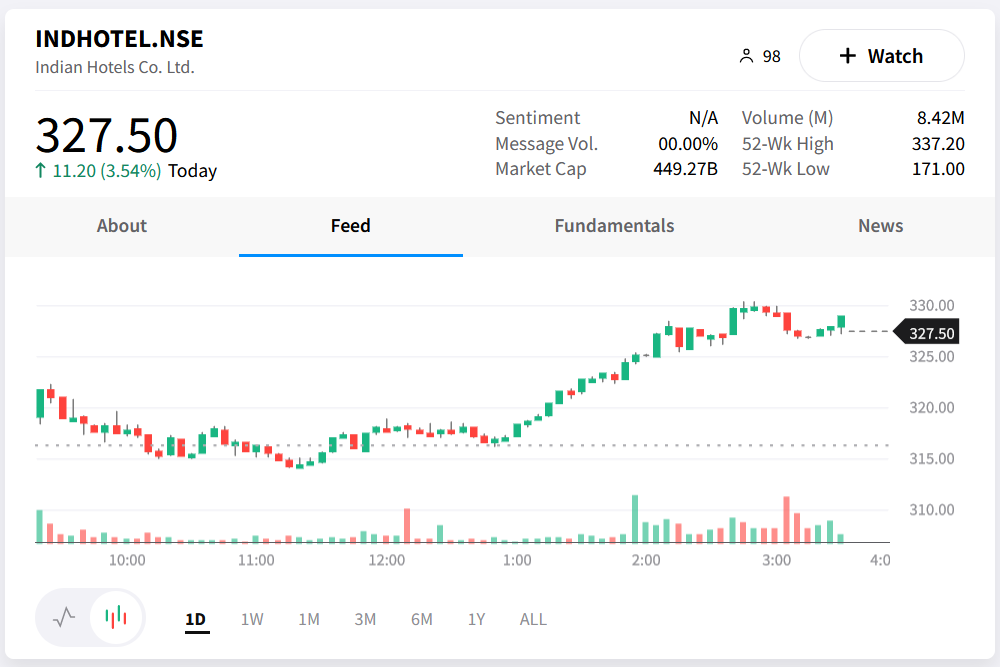

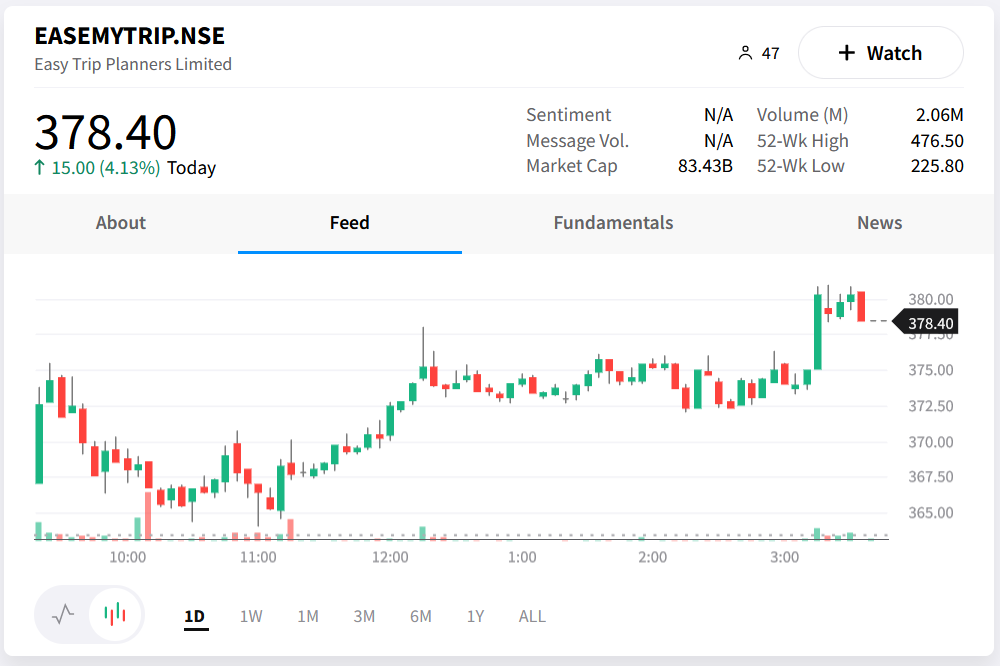

Travel and Hospitality stocks were in high demand. EIH Associated Hotels, Indian Hotels and Easy Trip Planners jumped 3%-6%. Check out their charts below. 🔥

SBI Cards’ (+3%) market share of credit card spends stood at 17.4% in August vs 16.7% in the previous month. 💸

Route Mobile (+3%) upped its FY23 revenue growth guidance to 60% (vs 50% earlier). 💯

Hindustan Construction Company was locked in a 20% upper circuit after repaying the majority of its outstanding debt. ✂️

Nazara Technologies dropped over 3% intraday after the Tamil Nadu Govt sought to ban online fantasy/gambling platforms. 🚫

Amara Raja Batteries (+0.5%) will buy the plastic component business from promoter entity Mangal Industries in an all-stock deal. 🔋

Mahindra CIE jumped +3% after 87 lakh shares (2.3% equity) changed hands in multiple block deals. 🤝

Cryptos were up big. Bitcoin (+4%) was back above the $20,000-mark. Ethereum rose ~5%. 📈

Here are the closing prints:

| Nifty | 17,007 | -0.1% |

| Sensex | 57,107 | -0.1% |

| Bank Nifty | 38,359 | -0.7% |

Delivering the Gains

Mahindra Logistics (+4%) will buy Rivigo’s B2B express delivery business for Rs 225 cr. The deal will also include its customers, teams, tech stack and branding. 💪

Founded in 2014, Rivigo was the first unicorn in the B2B logistics space. The Gurgaon-based startup has a solid pan-India presence covering +19,000 pin codes and has 250+ processing centres. Mahindra is bullish on the B2B business and the acquisition will strengthen its presence in the fast-growing sector. 🚚

Investors are also doubly happy with Mahindra’s deal-making skills. Rivigo’s B2B express business brought in Rs 371 cr in sales in FY21. That means, the business is valued at just 0.6 times its sales, which is a pretty solid deal. One of the main reasons for this steep discount is the trouble in Rivigo’s backyard. 🤕

Rivigo, once hailed as the disruptor in B2B logistics, has found it difficult to operate amidst the VC funding winter. The cash-strapped startup has already sold 80% of its truck fleet in order to raise cash. A change in the business model also failed to improve matters. PS – they reported a net loss of Rs 320 cr in FY21. Yikes! 👀

Big Picture: The Indian logistics market is estimated to grow to $365 billion by FY26, according to RedSeer Consulting. Sustained economic growth, improvement in transport infrastructure, and the rapid rise of e-commerce firms are key positives. ✅

Recently, the GOI announced the National Logistics Policy. It aims to boost the seamless movement of goods & services, reduce logistics costs and improve warehousing infrastructure. Watch out for this space. 🔥

Bags Packed With Cash

Travel and hospitality stocks broke out in trade on the occasion of World Tourism Day. 🧳

As we all know, travel demand has witnessed a V-shaped recovery after the 3rd wave. We all have that one friend posting endless Instagram stories about his/her Goa trip. Turns out, their quota for the year is not over. People are busy planning their next holiday ahead of the upcoming festive season. Bookings are going through the roof and prices are rising with every passing day. PS – leisure tourism is up 62% YoY in the first 9 months of 2022. ✈️

Shreerang Godbole, Chief Service Officer and SVP Produc, at Oyo said:

There’s a major shift in travel habits and sentiments. Unplanned vacations, shorter stays at the very last minute, and exploring nearby and offbeat destinations are all very relevant trends today. Flexibility tops the list.

EIH Associated Hotels, Indian Hotels and Easy Trip Planners jumped 3%-6%. Check out their charts below: 📈

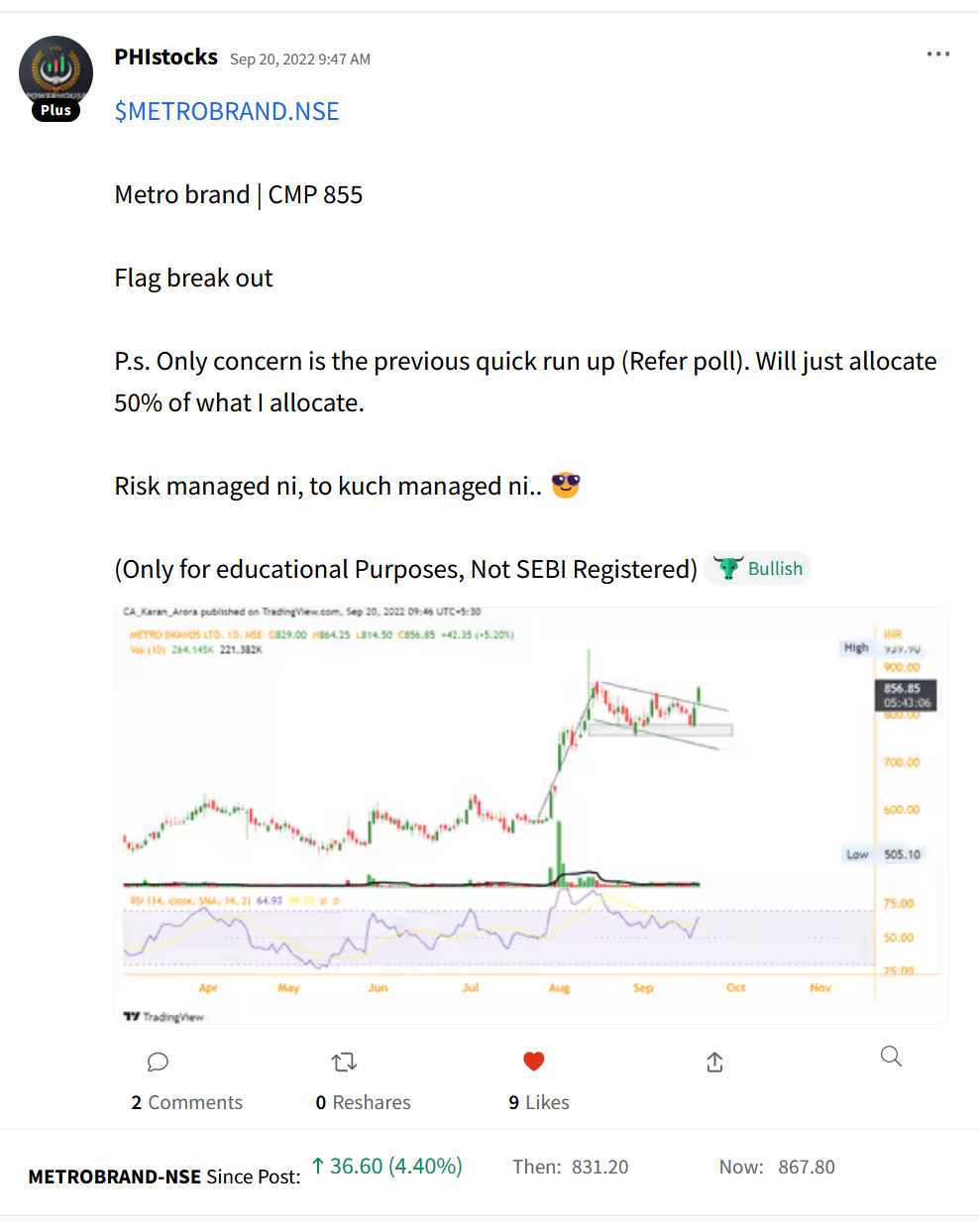

Stocktwits Spotlight

Metro Brands hit a new all-time high. Thank you PHIstocks or The Powerhouse Ideas for the superb call. Follow him for more amazing trade ideas and add $METROBRAND.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3SjGs8E.

Links That Don’t Suck

🌎 World Tourism Day 2022: Discover India’s top tourist destinations this year

👾 Walmart Debuts Roblox Worlds As ‘Testing Ground’ For The Metaverse

🛰️ NASA Just Crashed A Spacecraft Into An Asteroid To See What Would Happen

🙏🏻 ‘600 Emails And 80 Cold Calls’: How This 23-Year-Old Landed A Gig At The World Bank In The Pandemic

🐘 Only 1% Of People Can Spot The Hidden Elephant In This Mind-Bending Optical Illusion. Try Your Luck!

🤔 Putin Grants Russian Citizenship To Former NSA Contractor Turned Whistleblower Edward Snowden