Tale of the Tape

Good evening everyone and welcome to the new trading week. 🎲

Markets were back in the red. Nifty and Sensex tumbled over 1% each. Midcaps (-1.2%) and Smallcaps (-0.7%) also edged lower. Nearly two stocks fell for every one loser. 📉

Except for Pharma (+1.1%), all the other sectors ended down. Metals (-3%) and PSU Banks (-2.7%) got beat up the most. 🤕

ONGC (+4.5%) was the top gainer on Nifty after GOI reduced the windfall tax on fuel exports. Also, MRPL rallied by +3%. ✌️

Nykaa approved a 5:1 bonus issue. Shareholders will receive 5 bonus shares for every 1 share held. 🚀

Eicher Motors tanked 5% as investors booked profits after record September sales. Here’s the full lowdown. 🚗

City gas distribution companies extended their losing streak after GOI increased natural gas prices by a record 40%. IGL and MGL fell over 3% each. 🚨

Telecom stocks were in focus after launching 5G services on Oct 1. Bharti Airtel (+1%) closed up for a fifth straight day. Vodafone Idea rose ~3%. 📶

Kernex Microsystems was locked in a 5% upper circuit after winning a Rs 255 cr order from Indian Railways. 💰

Cryptos traded lower. Bitcoin and Ethereum were down 1%. Solana declined by 2%. 🙈

Here are the closing prints:

| Nifty | 16,887 | -1.2% |

| Sensex | 56,788 | -1.1% |

| Bank Nifty | 38,029 | -1.6% |

Credit “Sus”?

Fears of Swiss banking giant Credit Suisse going bust is spooking investors globally. Some are even calling it a repeat of the Lehman Brothers crisis. As if we haven’t had enough this year! 😖

Speculation about the future of the bank started after the spread on its Credit Default Swap (CDS) jumped +15% last week to hit the highest level since 2009. If the previous sentence went like a bouncer over your head then don’t worry, here’s a simple explanation. 💯

A Credit Default Swap is a financial instrument, kinda like insurance (but not exactly), used to hedge against default. The price of a CDS is referred to as a “spread” and is expressed in basis points. Spreads are a function of risk – the higher the risk of default, the higher the CDS spread and vice versa. A sharp jump in CDS spreads indicates the higher odds of a default, which has caused panic amongst investors. 😱

Credit Suisse has been marred by numerous scandals, high-level exits and massive treasury losses in recent years. FYI – Credit Suisse shares hit a new all-time low after falling ~60% in 2022. 📉

Switzerland’s second-largest bank appointed a new head in July to fix the mess and steer them towards profitability. Various measures like selling off profitable businesses, cost cutting/layoffs and a multi-billion dollar fund raise are being considered. 👀

Bottomline: Fears of Credit Suisse going belly up are slightly exaggerated, but not entirely unwarranted, say experts. The fallout of a bank this big in size can have a ripple effect across the global economy. Let’s hope for the best. 👍

IPO Alert!!

Electronics Mart India IPO opens for subscription tomorrow. The price band is fixed at Rs 56-59 per share. The company plans to raise Rs 500 cr from the markets.💰

Founded in 1980, Electronics Mart is India’s fourth largest consumer durable and electronics retailer. They have a total of 112 stores in 36 cities which they mainly operate under the “Bajaj Electronics” brand name. They offer a diverse range of products like ACs, Refrigerators, and TVs from over 70 brands. Electronic Mart will use the IPO to expand operations, pay off debt, and fund working capital requirements. 💯

Financial Snapshot: (FY22)

- Revenue: Rs 4,349 cr; +36% YoY

- EBITDA: Rs 292 cr; +43% YoY

- EBITDA Margin: 6.7% (flat YoY)

- Net Profit: Rs 104 cr; +76% YoY

Electronics Mart is one of the fastest-growing electronics retailers in India. They already have a strong foothold in the South and are focusing on expanding to newer markets. Electronics Mart has the best-operating margins in the industry driven by its best-in-class inventory management and cost control measures. 📊

At 22x Price-To-Earnings (P/E), the IPO is priced attractively, said experts. But, stiff competition (offline + online) and high dependence on the top 5 brands are key concerns. ✅

Winner Winner Chicken Dinner

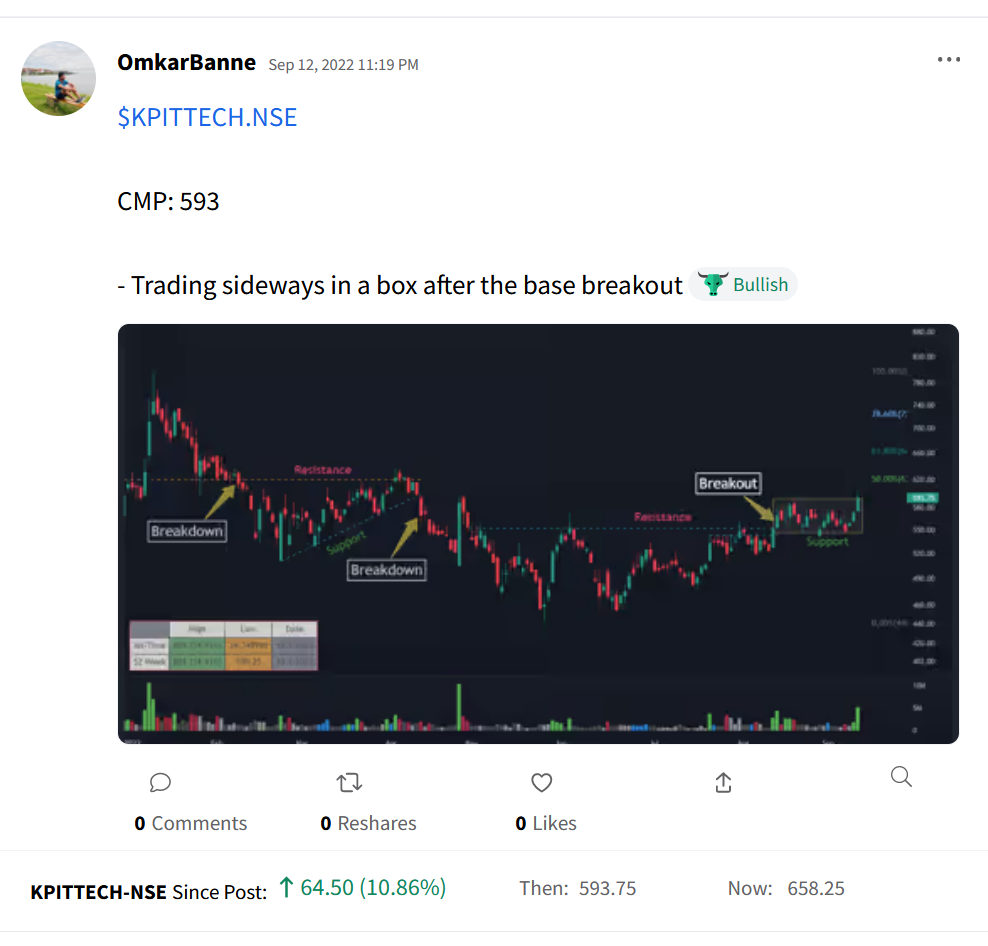

Congratulations Omkar Banne for winning the Community Star of the Month! ⭐

Omkar’s top trading call, KPIT Tech, is up +12% in the past month. Here are a few trade ideas shared by him on Stocktwits that you must check out: 😎

$MANYAVAR.NSE: https://stocktwits.com/OmkarBanne/message/483120684

$WELCORP.NSE: https://stocktwits.com/OmkarBanne/message/482966298

Omkar is a part-time trader and specializes in catching breakouts in momentum stocks. He also trades in Index futures & options. Follow him for more awesome trade ideas like these. Here’s the link: http://www.stocktwits.com/OmkarBanne.

Links That Don’t Suck

🔥 Should You Buy FMCG & Pharma Stocks? | Stock Room Sunday

😬 Credit Suisse Is At ‘Critical Moment’ As Bank Prepares For Latest Overhaul, Ceo Says

💻 Reuters: Mukesh Ambani-Led Reliance Jio To Launch 4G Enabled Low-Cost Laptop At Rs 15,000

🌊 Scientists Have Uncovered A 6th Ocean That Is Not On Earth’s Surface

👮♂️ Ever Heard Of Jail Tourism? Uttrakhand Prison Reportedly Offering ‘Real Jail Experience’ For ₹500

🤕 Man Utd Destroyed On Derby Day

🍿 Ponniyin Selvan Part 1 Review: Mani Ratnam Fixes And Nails The Adaptation