Tale of the Tape

Hey, guys. Markets were down again. 📉

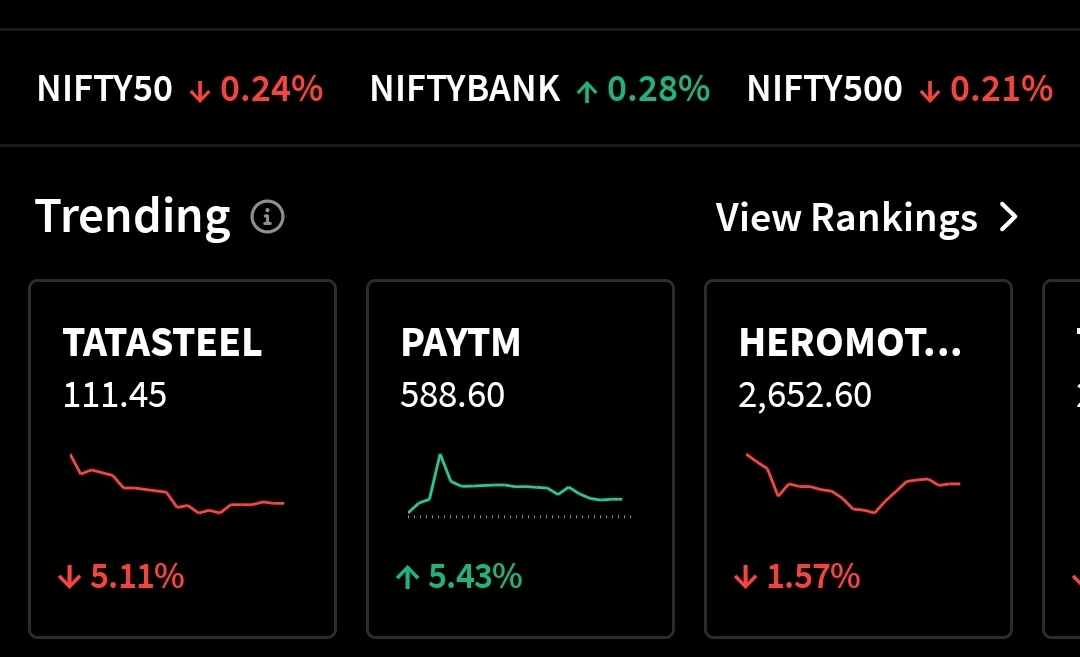

Nifty and Sensex rebounded from intraday lows to end with minor cuts as investors remained on the sidelines ahead of the RBI policy outcome. Midcaps (-0.1%) and Smallcaps (-0.7%) traded mixed. The market breadth remained in the favor of bears. 🐻

Most sectors ended lower. FMCG and Autos declined over -1% each. Real Estate (+0.6%) stocks closed up for a second straight day. ✌️

Tata Steel (-5%) was trending #1 on Stocktwits on weak Q3 results. Read more below. 🔥

Paytm (+6%) posted its highest single-day gain since April 2022. Find out why the stock is buzzing below. 🚀

Adani Group stocks were up big! Adani Enterprises rallied +15% intraday. Adani Wilmar was locked in a 5% upper circuit. 💯

ITC dropped 3% on reports that the Govt may trim its stake. 🙈

Apollo Tyres (-3%) lowered their capex guidance to Rs 700 cr. 🚫

Earnings Reaction. Balaji Amines (-4%) hit a new 52-week low. Muthoot Finance (-3%) snapped its three-day gaining streak. 📊

Here are the closing prints:

| Nifty | 17,721 | -0.3% |

| Sensex | 60,286 | -0.4% |

| Bank Nifty | 41,490 | +0.3% |

Earnings Roundup

Tata Steel (-5%) was the top loser on Nifty on disappointing Q3 results. The main reason behind this underperformance was the slowdown in their European business. Weak demand amidst recession concerns plus elevated energy prices hurt earnings. 👎

This, coupled with a one-time deferred tax expense of Rs 2,500 cr, left the Tata Group company with its second-highest quarterly net loss since the start of the pandemic. Yikes! Here’s its report card: 💰

- Revenue: Rs 57,084 cr; -6% YoY (vs Est: Rs 55,500 cr)

- EBITDA: Rs 4,048 cr; -75% YoY (vs Est: Rs 5,000 cr)

- EBITDA Margin: 7.1% (vs Est: 9%)

- Net Loss: Rs 2,500 cr (vs Net Profit Est: Rs 1,200 cr)

Going forward, experts are hopeful that Q4 (seasonally strong quarter) will be better. Pickup in construction plus GOI’s thrust on infrastructure development in the budget are key positives. Gradual reopening in China, the world’s largest metals consumer, and an improvement in prices also bodes well. ✅

Tata Steel is down 4% in the past year. 📉

Has Paytm Bottomed?

Paytm’s third-quarter results will go down in the company’s history books after they turned EBITDA positive for the first time EVER! Importantly, Paytm achieved this milestone 9 months before their own forecast of Q2FY24. That’s legit insane! 💯

This was made possible thanks to the outstanding growth in their high-margin lending business. Paytm gave out fresh loans to over 1 cr users; +137% YoY. For comparison, Bajaj Finance issued 78 lakh loans in Q3. The total number of unique borrowers increased by 20% over the previous quarter to 81 lakhs. 📊

This growing borrower base provides huge scope for cross-selling products. Higher merchant subscriptions and lower payment processing + promotional charges also boosted the overall performance. Going forward, experts are bullish about the company’s fundamentals and are confident of an aggressive scale-up without taking a hit on profitability, which is a huge W. 💸

The recent cool-off in valuations plus the completion of the buyback has also boosted sentiment. But, stiff competition and regulatory headwinds pose key risks. FYI – CLSA sees a further +27% upside from current levels. 👍

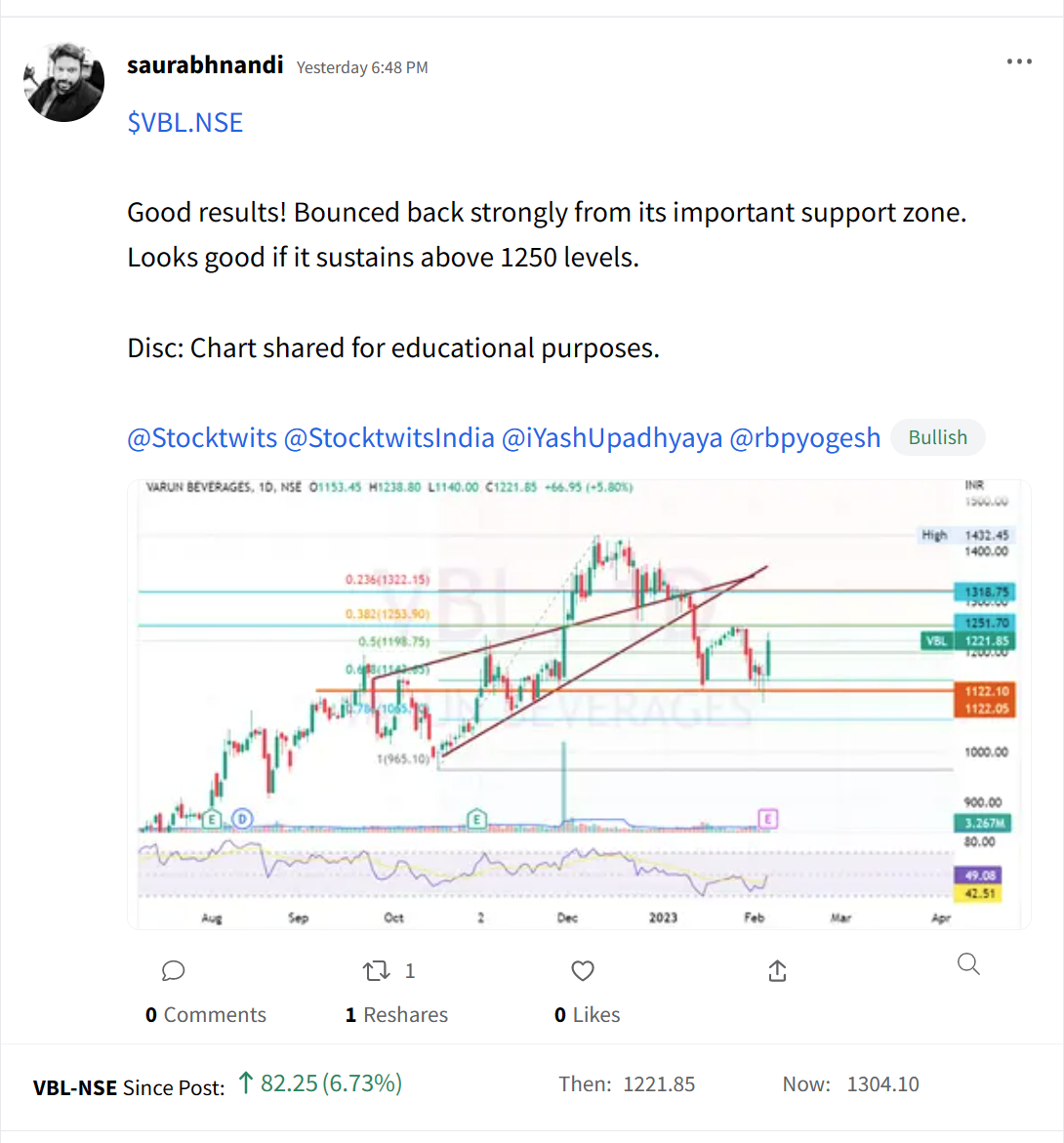

Stocktwits Spotlight

Varun Beverages hit a new all-time high. Our January community star of the month Saurabh Nandi believes it can go higher! Add $VBL.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3Yx8pNd.

Disclaimer: All ideas shared by Saurabh Nandi are for educational purposes. Saurabh Nandi is neither SEBI registered nor an investment advisor.

Earnings Highlights

- Adani Ports & Special Economic Zone: Revenue: Rs 4,786 cr; (+18% YoY) | Net Profit: Rs 1,315 cr; (-16% YoY)

- Balaji Amines: Revenue: Rs 586 cr; (+4% YoY) | Net Profit: Rs 63 cr; (-30% YoY)

- Muthoot Finance: Net Interest Income: Rs 1,704 cr; (-10% YoY) | Net Profit: Rs 902 cr; (-12% YoY)

- Bharat Dynamics: Revenue: Rs 462 cr; (-43% YoY) | Net Profit: Rs 84 cr; (-60% YoY)

- Gujarat Fluorochemicals: Revenue: Rs 1,418 cr; (+41% YoY) | Net Profit: Rs 329 cr; (+61% YoY)

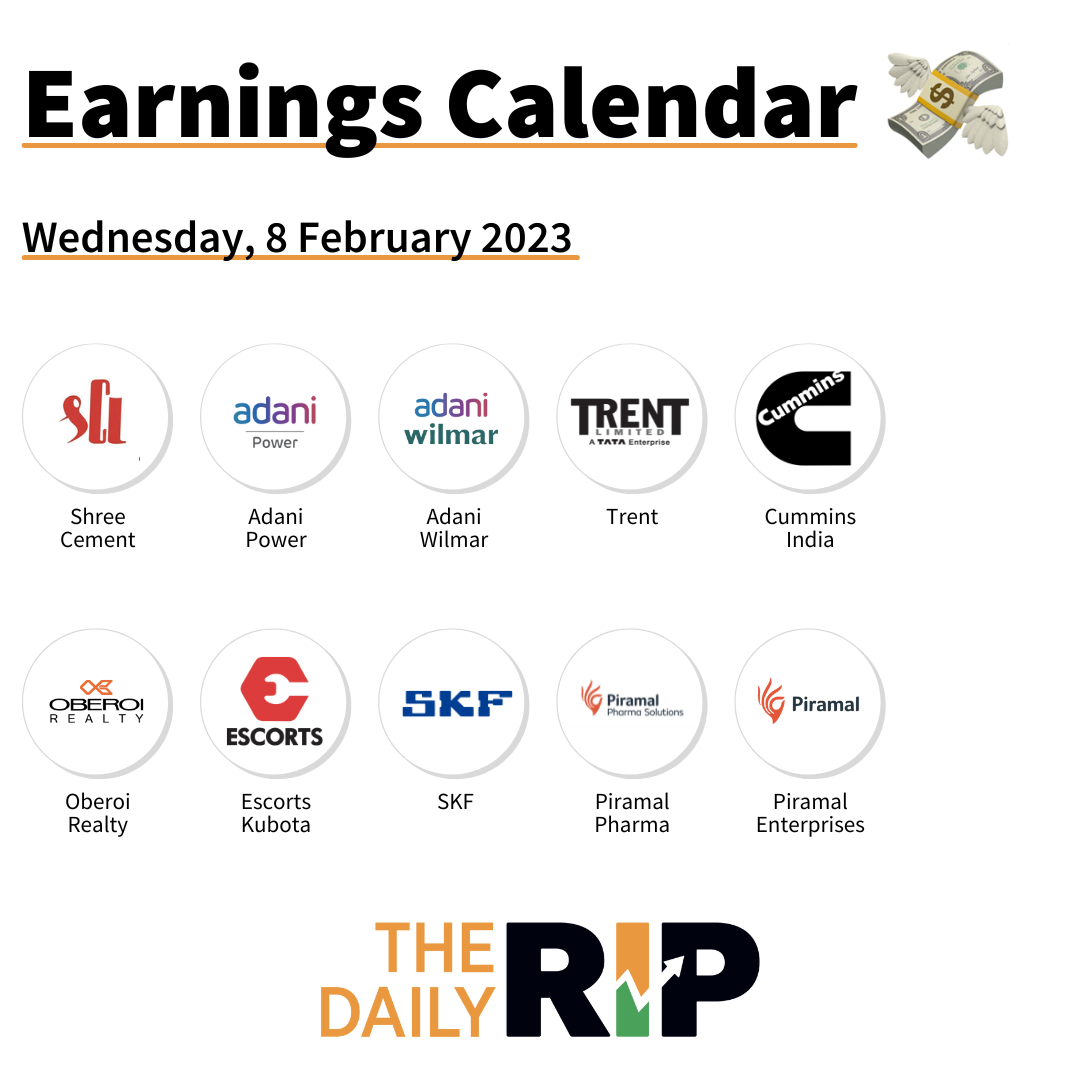

Calendar

Be sure to know when your stocks report earnings. Here’s the results calendar:

Links That Don’t Suck

🤖 Google announces ChatGPT rival Bard, with wider availability in ‘coming weeks’

🚫 Crypto Exchange Binance Will Suspend U.S. Dollar Transfers

🙏 This May Be RBI’s Last Rate Hike: Morgan Stanley

⚡Techie Turns Son’s School Project Into Startup, Builds Affordable Electric Bikes

🤯 Scientists Just Found A Planet That’s Stranger Than You Can Imagine

👨⚖️ Man City charged by Premier League for numerous alleged breaches of financial rules