Tale of the Tape

Good evening, folks. Welcome back to the market of stocks. 🎲

Markets had a rough day. Nifty and Sensex tumbled -1.5% each as the banking crisis in the US dented sentiment. Check out our full coverage below. Midcaps (-2%) and Smallcaps (-2.2%) got absolutely hammered. 🔨

It was a sea of red across the board. Banks (-2.5%) and Autos (-2.2%) got beat up the most. Real Estate (-1.9%) stocks closed down for a 5th straight day. 📉

Tech Mahindra was the top gainer on Nifty after rallying +7% despite overall market weakness. Find out what’s fuelling this optimism below. 💯

Yes Bank cracked 13% intraday after RBI’s compulsory 3-year lock-in period ended today. 👀

Reliance Industries hit a new 52-week low of Rs 2,275 per share. PS – The stock is in a bear market after falling over 20% from its all-time high. 💔

IndusInd Bank (-7%) was the top loser on Nifty after the RBI granted ONLY a two-year extension (vs 3 years) to Sumanth Kathpalia as MD & CEO. 😖

Adani Group stocks continued to climb higher after the Group announced they’ve repaid $2.13 billion of share-backed loans before their Mar 31 deadline. Adani Transmission, Adani Total Gas and Adani Green were locked in a 5% upper circuit. 🔥

Sona BLW fell 5% after promoters Blackstone Group sold their 20.5% stake, according to media reports. 🤔

Nazara Technologies dropped 7% intraday after the company said its two subsidiaries have Rs 64 cr in deposits with Silicon Valley Bank. 💰

The global crypto market cap jumped +8% after the US Federal Reserve’s intervention in the Silicon Valley Bank and Signature Bank crisis. Bitcoin (+9%) rallied past the $22K mark. Ethereum jumped +8%. 🚀

Here are the closing prints:

| Nifty | 17,154 | -1.5% |

| Sensex | 58,237 | -1.5% |

| Bank Nifty | 39,654 | -2.3% |

Crisis Averted?

US regulators announced a set of measures to protect depositor holders after the sudden collapse of two banks – Silicon Valley Bank and Signature Bank in the past week. This comes as a HUGEEE relief as fears of this fallout spreading across the entire financial system caused panic in the US market. 🚨

What’s the deal bro? Regulators took over the failed banks and assured deposit holders that they will have FULL ACCESS to their money from Monday. The Federal Reserve is also creating a new program to help smaller regional banks affected by the market instability. These measures are aimed at protecting the US economy and ensuring people have access to their money, the Fed said in a statement. 😇

Paul Ashworth, an economist, said that the plan should be enough to stop other banks from failing, which can happen quickly in the digital age. However, he also said that fear can cause people to act irrationally, so there is no guarantee that the plan will work. 🙈

In today’s highly interconnected world, a financial occurrence, whether good or bad, in any part of the world can have a domino effect. Fun fact: The US is India’s largest trade partner. Indian exports to the US stood at $76.1 billion in FY22, +47% over the previous year. Several industries like IT, pharma, and chemicals earn a bulk of their revenue from the US. Any slowdown in the US would hurt business back home. That’s why they say – When America Sneezes, the World Catches Cold. 🤧

Aye Aye Captain

Tech Mahindra rallied close to 10% intraday, the highest single day in 7 years, after appointing ex-Infosys President Mohit Joshi as the company’s new Managing Director and CEO!! 👏

What’s popping? Joshi has over two decades of experience in the Enterprise technology software & consulting space. At Infosys, he was the head of the Global Financial Services & Healthcare as well as the Software businesses and the AI/Automation portfolio. He also led Sales Operations and Transformation for Infosys and was pivotal in securing large deal wins. 💯

What’s the big deal? Tech Mahindra is strong in communications but lacks scale in the high-margin BFSI and other verticals as compared to larger peers. Mohit, with his deep BFSI client connections, can help correct this anomaly. Joshi’s experience in digital transformation, new technologies and large deals will complement TechM’s strategies, said experts. Focus on organic growth, and margin improvement can be key re-rating triggers. 📈

Markets were clearly happy with the appointment. PS – domestic brokerage firm Emkay sees a FURTHER +12% upside after today’s big up move. 🤑

Stocktwits Spotlight

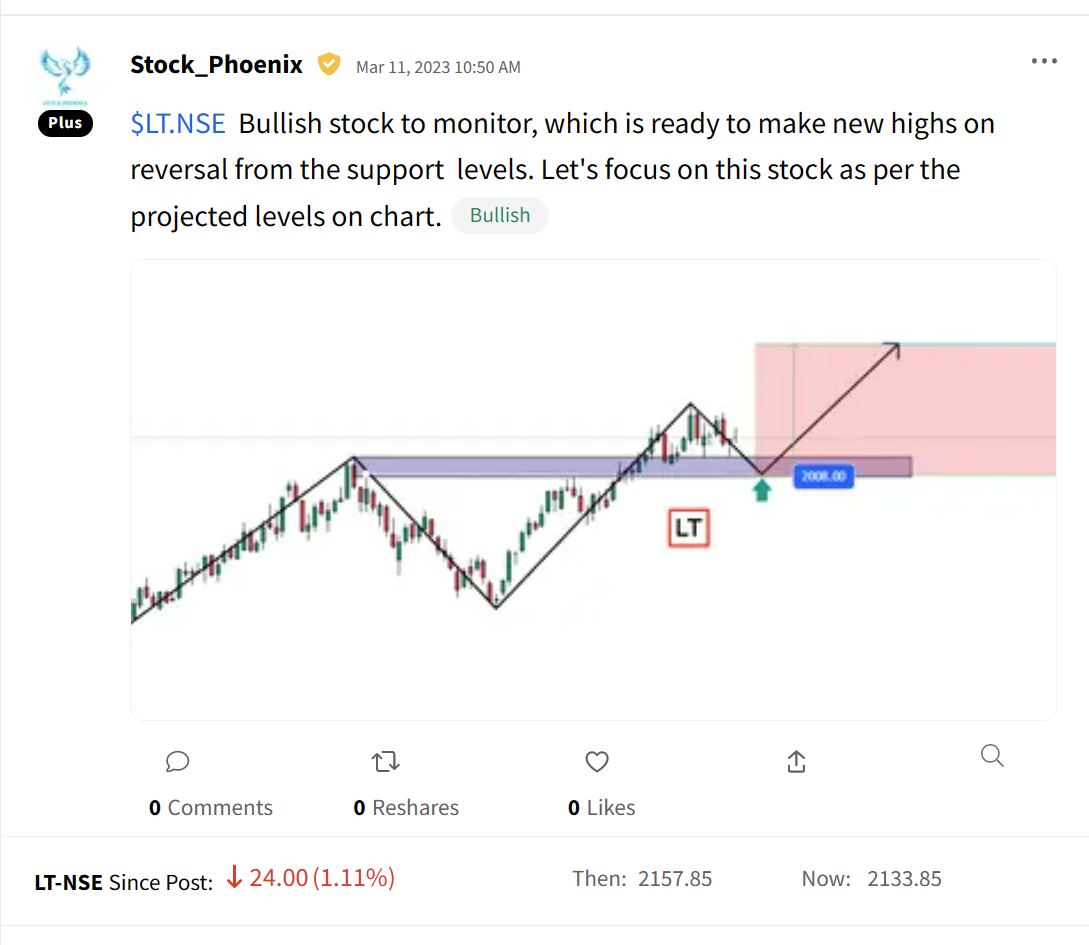

Here’s an interesting chart setup on L&T by StockPhoenix. Follow him for more awesome trading insights and add $LT.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3mL3rPk.

Disclaimer: All ideas shared by StockPhoenix are for educational purposes. StockPhoenix is neither SEBI registered nor an investment advisor.