Tale of the Tape

Howdy folks. Markets continued to crumble. 📉

Nifty and Sensex reversed after opening higher to end near the day’s low. Midcaps (+0.1%) and Smallcaps (+0.4%) traded with minor gains. The advance-decline ratio was split evenly. ✌️

Most sectors closed down. Metals (+1.8%) and Pharma (+0.3%) stocks held the fort. State-owned Banks (-1.2%) were again hammered. 🔨

Maruti Suzuki promoters bought 3.5 lakh shares worth nearly Rs 300 cr from the open market. 💸

LTIMindtree eyes $1 billion in revenue over the next 4-5 years; expect 19%-20% EBIT margins. 📈

GMR Airports (+5%) will consider raising funds at its Board meeting on March 17. 💯

Page Industries posted its highest single-day gain since Oct 5. Global brokerage firm Morgan Stanley sees a +20% upside from current levels. ✅

Vedanta said it has repaid $150 million of share-backed loans. 💰

PNC Infratech (+3%) won new orders worth Rs 1,260 cr from the National Highway Authority of India (NHAI). 🚧

Cryptos extended their gaining streak. Bitcoin (+2%) hit the highest level in 9 months! Ethereum is up 17% in the past three days. 🚀

Here are the closing prints:

| Nifty | 16,972 | -0.4% |

| Sensex | 57,555 | -0.6% |

| Bank Nifty | 30,051 | -0.9% |

Advantage India?

International oil prices dropped ~10% in the past week after hawkish comments by the US Federal Reserve and the collapse of SVB + Signature Bank increased the odds of a deeper US recession. This MAY play out in India’s favour according to experts! 💯

For those who don’t know, 80% of India’s total oil requirement comes from imports. Higher oil prices tend to stoke up inflation. As prices of day-to-day items increase consumer spending gets adversely affected which in turn hurts corporate profits. Central banks would eventually increase interest rates which by this point we all know sucks! So generally speaking, markets don’t like high crude oil prices. 🚫

Just to be clear, we’re not saying low oil prices are good. It is an indication of weak industrial activity typically seen during a recession/slowdown. Remember when oil prices turned negative in March 2020 as businesses came to a halt due to the pandemic? Yeah, you don’t want that either. Ideally, you’d want oil prices to trade in an acceptable range of $60-$80 per barrel. Unfortunately, we don’t live in an ideal world so that’s that. 🤷♂️

Companies that use oil or its derivatives are set to gain big time from this. These include paints, adhesives and certain speciality chemical makers. Fuel prices and auto demand have an inverse correlation. This means if oil prices decline, demand for cars and especially two-wheelers goes up as it reduces their running cost. Likewise for airlines. Logistics companies also benefit indirectly as it lowers their transport cost. Pick your bets wisely. 🧐

Jio Dhan Dhana Dhan

Reliance Jio launched new postpaid plans as part of its renewed push to attract high-quality postpaid subscribers! 💰

What’s the deal bro? The base Rs 399 plan (plus Rs 99 per add-on connection) is almost 30% cheaper than the competition. They’ve managed to reduce the cost by lowering the data package and excluding OTT (Netflix/Amazon Prime) bundling. 📶

Historically, Jio has struggled to attract postpaid customers. This is mainly because a large number of Jio subscribers use it as an alternative to their main number. Fun Fact: Bharti Airtel and Vi earn 12% and 19% of their wireless revenue from the postpaid segment. Postpaid customers assure recurring revenue, are less price sensitive and generate higher ARPUs, making them highly valuable. 🤑

Big Picture: The share of postpaid customers has nearly doubled in the past 5 years. Even then, they make up just 8% of India’s total subscriber base vs 30% and 55% for peers like Thailand and Brazil! This offers a huge runway for growth, said experts. Having said that, Jio’s latest move may force the competition to cut prices which may dent ARPU, which is a negative. 🚨

Stocktwits Spotlight

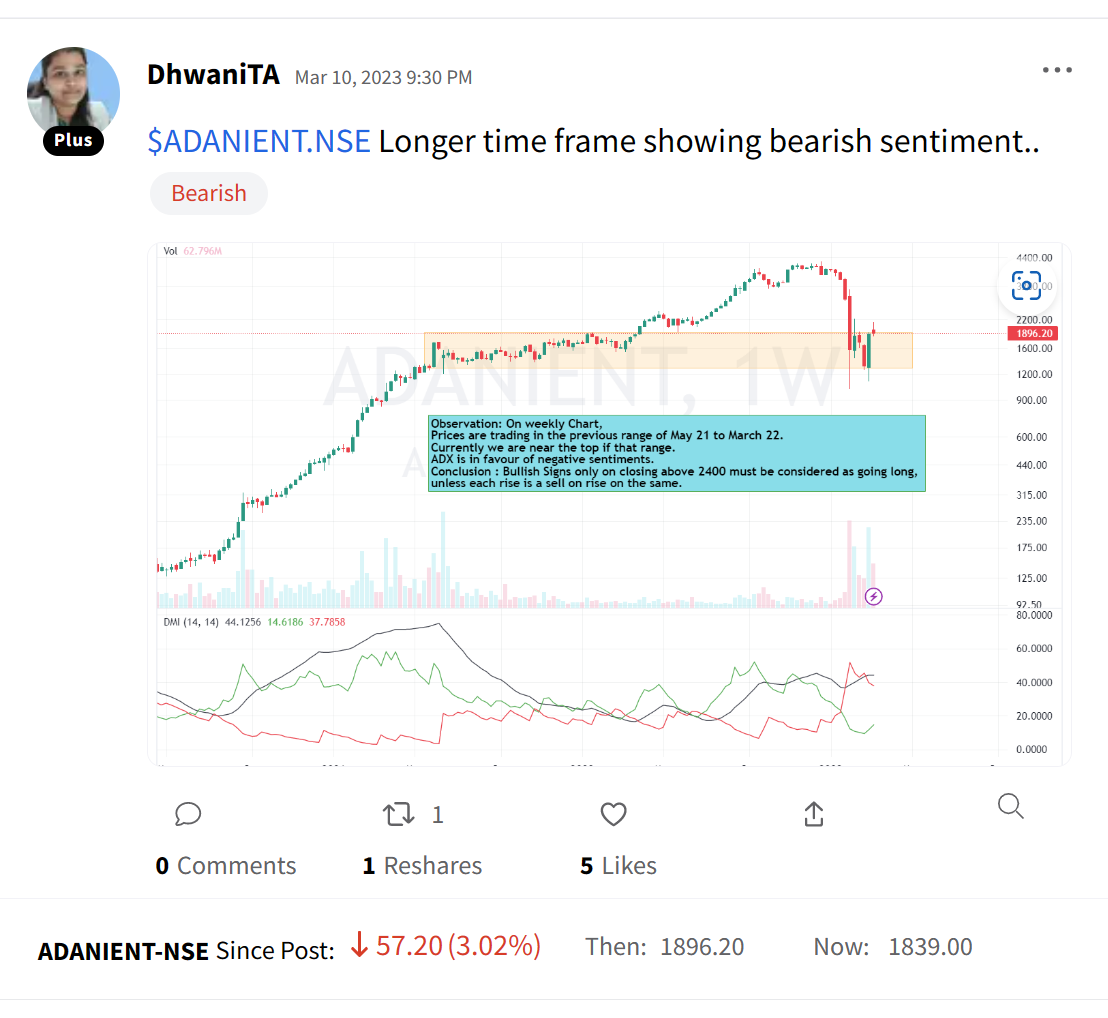

Adani Group stocks saw a big move last week but Dhwani Patel has a contra view on Adani Enterprises. PS – the stock is down -7% in just 3 days!!! Follow her for more awesome trading insights and add $ADANIENT.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3yBRaiP.

Links That Don’t Suck

✅ We Are Hiring!!! Stocktwits Is Looking For Freelance Writers. Apply Via This Link

😵💫 Meta To Lay Off 10,000 More Workers After Initial Cuts In November

🔥 OpenAI announces GPT-4 — the next generation of its AI language model

🙏 Meet Nikh Jasmine, Arunachal’s Frist Female Drone Operator, Delivering Medicines In Remote NE

💪 Harvard Career Expert: The ‘Highly Desirable’ Skill Successful People Have—It Is ‘Surprisingly Rare’

⚽ Erling Haaland Hits ‘Record’ Five To Ease Man City Into Champions League Quarters