Tale of the Tape

Hey guys. Markets closed up for a third straight day. 📈

Nifty and Sensex closed barely in the green following a late bout of profit booking. Midcaps (+0.6%) and Smallcaps (-0.1%) traded mixed. The advance-decline ratio was split evenly. ⚔️

Most sectors closed higher. Metals (+2.5%) stocks hit the highest level since Feb 8. Auto (+0.6%) and Pharma (+0.5%) also supported markets. IT (-0.5%) stocks pulled back after yesterday’s big up move. 💸

What does the change in GOI’s EV policy mean for the auto sector? Find out in our top story below. ⚡️

Westlife Foodworks is +60% in the past year. Find out what’s fuelling the rally in this QSR chain operator below. 🍔

RIL subsidiary JioMart will lay off 1,000 employees. 👀

Adani Group stocks extended their rally to day 2. Reports indicate that US-based investment firm GQG Partners picked up an additional 10% stake in Adani firms. Adani Enterprises (+15%) was the top gainer on Nifty. Adani Wilmar was locked in a 10% upper circuit. 💰

Vedanta (+1%) approved the 1st interim dividend of Rs 18.5 p/sh. 👍

Escorts Kubota will increase tractor prices from June 1. 🚜

Kokuyo Camlin (+4%) hit a new all-time high. Ace investor Porinju Veliyath bought 5.4 lakh shares. 🚀

Samvardhana Motherson rose +3% intraday. Global brokerage firm JP Morgan sees an +18% upside from current levels. 💯

JSW Steel will acquire National Steel and Agro Industries for Rs 621 cr. 🏭

ITI Ltd (+5%) won a 3,889 cr order from BSNL for 4G deployment. 🛜

Here are the closing prints:

| Nifty | 18,348 | +0.2% |

| Sensex | 61,981 | +0.1% |

| Bank Nifty | 43,954 | +0.2% |

Power Cut?

From June 1, your electric two-wheeler is going to get more EXPENSIVE. That’s right. The GOI is slashing subsidies given under its FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme. 🏍️

What’s the deal bro? The GOI originally gave subsidies that were capped at 40% of the motorcycle’s cost or Rs 15,000 per KW (whichever is lower). That’s been cut to 15% of vehicle cost or Rs 10,000 per KW (whichever is lower). For example, if you bought a Rs 1 lakh EV, you would earlier get Rs 33,000 as a subsidized discount. Now, it may drop to just Rs 15,000. 💸

Not all manufacturers will pass on the full impact of the subsidy loss, but it’s still a pretty big YIKES. Why is GOI doing this? Firstly because subsidies can’t last forever. The FAME scheme has worked GREAT. In March 2020, 13k electric 2-wheelers were sold per month. That jumped to over 100k as of February 2023. The programme was set to wind down FULLY from April 2024, so this is the start of the weaning-off process. 👋

But secondly, there’s some evidence to show many companies cut corners to secure that subsidy money. This included lying about where some parts came from *cough* China *cough & creatively pricing their bikes so they qualified for the subsidy. 🚨

Bottomline: Which motorcycle companies are going to be hit the most? The top 10 sellers include Ola Electric, Ather Energy, Hero Electric, TVS Motors and Bajaj Auto. 😣

FYI – The GOI already hit a pause on some subsidy payments months ago during its fraud investigation. The sales drop was immediate. After hitting an all-time high in Nov 2022, new EV registrations fell 14% in December and 16% in January. Can India’s bike companies continue to invest and sell without taxpayer money? We’ll have to wait and watch. 🛵

I’m Lovin It

Westlife Foodworld has been KILLING it. The stock is up 59% over the last year. It has easily beaten quick service restaurant (QSR) peers like Jubilant Foodworks (-2%), Devyani International (+16%), Restaurant Brands Asia (17%) or Sapphire Foods India (+28%). What’s popping? 🔥

About the company: Founded in 1986, Westlife runs over 350 McDonald and McCafe restaurants across Western and Southern India. The company’s top line grew at a healthy 16% CAGR from FY16 to FY22. FYI – it is the ONLY third-party McDonald’s master franchise since 2019 after McDonald’s bought out its other partner. 🍔

What’s fuelling this outperformance? Simply put, business is red hot. In FY23, net sales hit an all-time high of Rs 2,270 cr, a 36% growth in ‘same-store sales growth’. Consequently, the company reported a first net profit (Rs 112 cr) in 4 years!!! Westlife also managed to weather the high inflation storm far better than peers like Jubilant Foodworks. Fun Fact: Westlife has 2x longer leases per store compared to the industry average. This helps keeps costs down, boosting operating margins. 📈

With the Covid disruption over, it plans to open 300 new stores by FY27. The QSR industry has an enormous growth runway in India; on all metrics, from average customer spend to eating frequency per week. Key positives include the company’s aggressive expansion plans & and a steady royalty rate until FY26. FYI – Brokerage firm Motilal Oswal has a target price of Rs 800, +9% from current levels. ✅

Stocktwits Spotlight

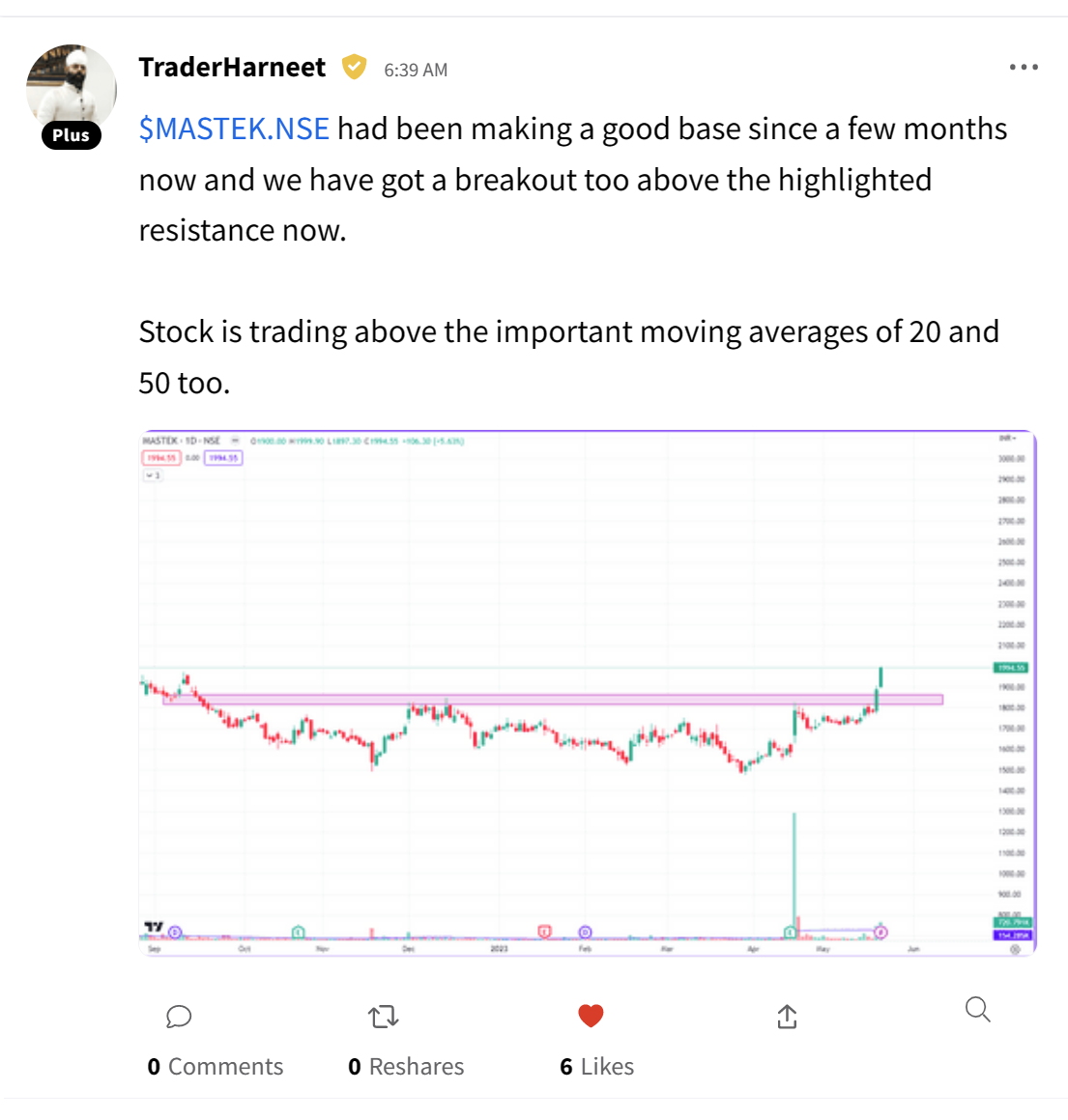

Mastek saw a hugeee breakout in yesterday’s day of trade. Here’s an interesting chart setup by Trader Harneet on the midcap IT stock. Follow him now for awesome trade ideas and add $MASTEK.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3BMeufk.

Earnings Highlights

- BPCL: Revenue: Rs 1.18 lakh cr; -1% QoQ | Net Profit: Rs 6,478 cr; +3x YoY

- Policybazaar: Revenue: Rs 869 cr; +61% YoY | Net Loss: Rs 9 cr; (Net loss: Rs 220 cr YoY)

- HEG: Revenue: Rs 617 cr; -8% YoY | Net Profit: Rs 100 cr; -23% YoY

- Finolex Industries: Revenue: Rs 1,141 cr -28% YoY | Net Profit: Rs 167 cr; -66% YoY

- Dreamfolks Services: Revenue: Rs 238 cr; +2.4x YoY | Net Profit: Rs 25 cr; +2.5x YoY

Calendar

Here are all the companies that will announce their Q4 results tomorrow:

Links That Don’t Suck

👾 Apple Is Building Its Own AI After Banning Workers From Using ChatGPT At Workplace

🍿 Netflix Might Need Some Freeloaders to Stick Around

🗣️ The Human Brain Shows a Weird Preference For Sounds From The Left

👨🍳 Meet the 1st Indian Chef Who Broke a Global Stereotype That Desi Food Can’t be High-End

💯 America’s Got Talent judge Simon Cowell says this advice from his dad inspired his success

😡 Vinicius Jr, Spain and racism – What’s been said? Will he leave Real?