Tale of the Tape

Good evening everyone. Nifty hit a new high today!! 🚀

Strong buying in the IT sector left the Sensex and Nifty higher by 1.2% each. Midcaps (+0.4%) and Smallcaps (+0.4%) also saw decent gains. The advance-decline ratio was split evenly. ✌️

Most sectors ended in the green. IT (+5.1%), Real Estate (+1.8%) and Oil & Gas (+1.5%) led the rally today. Auto (-0.2%) and Pharma (-0.2%) stocks saw minor cuts. 💸

Infosys (+7%) & TCS (+4%) shrug off Q3 woes. Read our top story below. 📊

What does the future bull case for Zomato look like? More details below. 🔥

Buy buy buy! TCS and Infosys’ strong Q3 results had a positive rub-off on the rest of the IT stocks. Firstsource Solution, Infibeam Avenue and OFSS rallied 8%-10% each. 📈

Tata Consumer (+2%) hit a 52-week-high. Reports said it would acquire Capital Foods and Fab India-backed Organic India. 👍

Nykaa cracked 3% after 0.9% equity changed hands in a big block deal; the buyer and seller were not immediately known. 🤝

Macrotech Developers gained 6% after Jefferies assigned a ‘buy’ rating; the brokerage sees another 7% potential upside. 🤑

Vedanta’s (-1%) parent company was downgraded by S&P Global to ‘selective default’. 👀

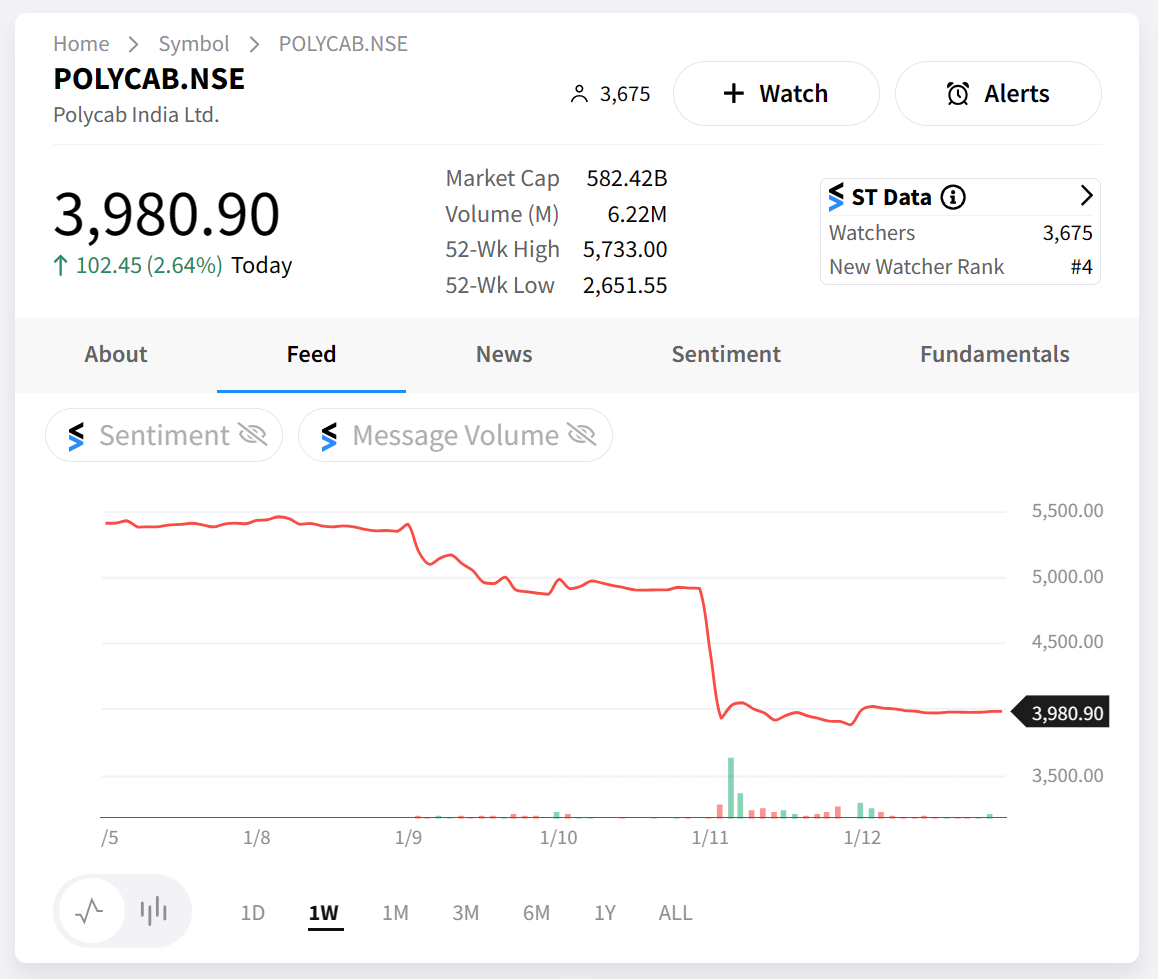

Polycab India gained 2%. The company said it hasn’t received any formal communication from the I-T department about the outcome of its search operations. 🚨

Here are the closing prints:

| Nifty | 21,894 | +1.1% |

| Sensex | 72,568 | +1.2% |

| Bank Nifty | 47,709 | +0.6% |

TCS + Infosys Q3 Earnings

Indian IT’s Q3 earnings season kicked off on a surprisingly okay-ish note! Both companies had a muted performance, but ended up beating Street estimates on some counts; there were also a few silver linings. This is why Infosys was up 7% intraday, while Tata Consultancy Services gained 4%. Here’s a quick look at their Q3 report card: 📊

TCS: The company reported its LOWEST YoY jump in revenue growth (+4%) in nearly two years. Its profit (+2% YoY) also took a hit over the $125-million Epic lawsuit issue. But on the positive side, US dollar revenue was up 1% QoQ to $7.28 billion vs an estimated decline of 0.2% from the Sept quarter. Its EBIT also came in at Rs 15, 155 cr (+4.6% QoQ), beating estimates of Rs 14,600 cr. EBIT margin also came in at 25% (+70 bps) vs an Est: 24.4%. 📈

Infosys: The firm narrowed its FY24 revenue growth guidance, by cutting the upper end but also raising the lower end. It now stands at 1.5%-2% in constant currency terms vs an earlier 1%-2.5%. CEO Salil Parekh said that the “outlook, in essence, is quite similar”. Also, deal wins stood at $3.2 billion in Q3, 71% of which were net new. Yes, it’s a lot less than Q2’s deal wins, but analysts were worried because Q3 saw a big client (revenue potential: $1.5 billion) cancel its MoU with Infosys. 💰

FYI – The Dec quarter is typically a weak one, but analysts had expected a stronger winter chill this time around. So even slightly better than estimates has left people optimistic. Most analysts believe the sector’s issues will bottom out by the end of FY24 and are already looking ahead only to FY25. ✅

Stocktwits Specials

How disciplined are you as F&O traders? Check out the results of a recent survey conducted by Kantar India in partnership with Sharekhan.

Everyone ❤ Zomato

Zomato has been on a ROLLER COASTER of a market ride. The stock is up a whopping 158% over the last year. But more importantly, the party’s not over. In the last two days, it got three brokerage upgrades: from Jefferies, HSBC and now Goldman Sachs today. What explains this newfound love? 🤔

The Past: In 2020, rival Swiggy was the big boss, with a 52% market share. Reports say that since then, Swiggy’s market share dropped to 45%, while Zomato sits at 54%. FYI – this happened even as Zomato turned profitable in Q1FY23. So it was able to win back market share without huge discounts. This has been a HUGE positive and a major driver of its stock price. 🚀

The Present: Analysts say Zomato won’t see too much-increased competition because Swiggy is looking to turn profitable this year. Discounts are likely to be less across both food delivery + quick commerce verticals. This, in turn, will help Zomato’s continued profitability. That said, most brokerages advise a dose of caution. They say 2024 will be more muted compared to explosive 2023. 👌

The Future: Most experts agree that online grocery + online food delivery are the largest total addressable markets within the Indian internet ecosystem. Zomato currently has a dominant market share in food delivery. Where it requires more work is Blinkit, its instant commerce biz, which has potential but has been a drag on the bottom line. Goldman Sachs sees Blinkit hitting “adjusted EBITDA” break-even by mid-2024. 🤑

Big Picture: There’s a lot that could go wrong. Rider costs could go up, inflation could spike again and regulatory issues with online grocery are always on the horizon. But barring that, Zomato’s roadmap seems clear. FYI – Jefferies has a 12-month price target of Rs 190 p/sh; +37% from current levels! 🔥

Movers and Shakers

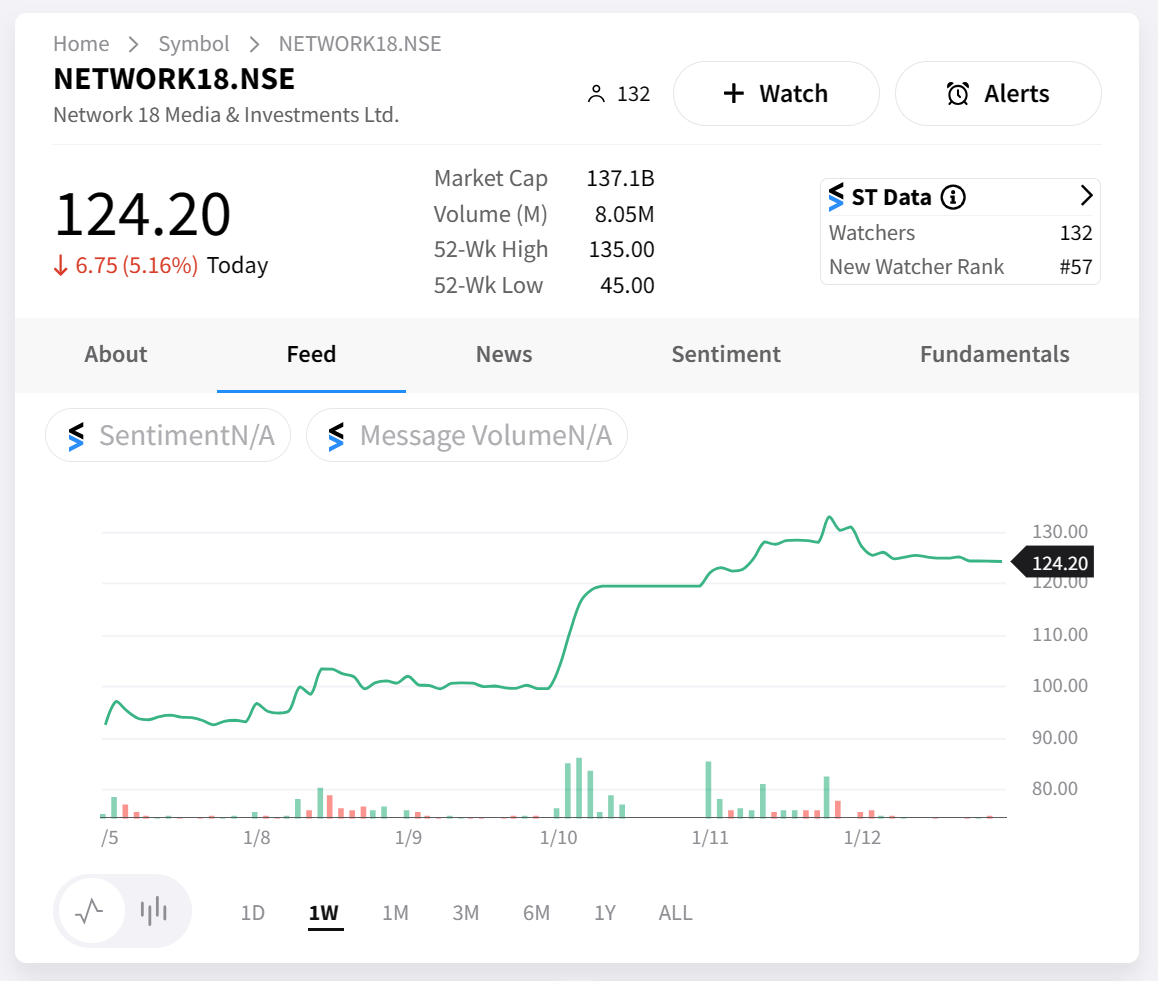

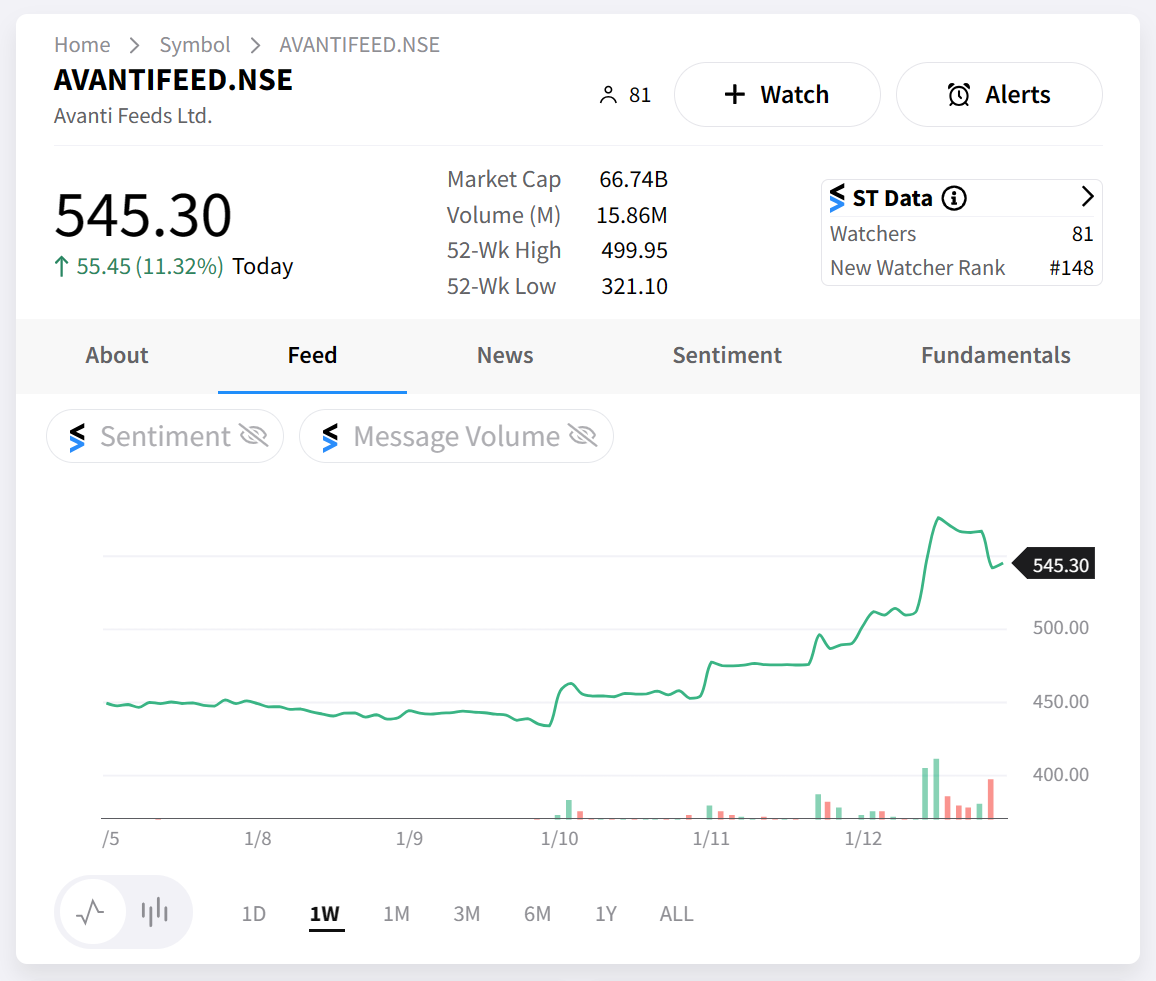

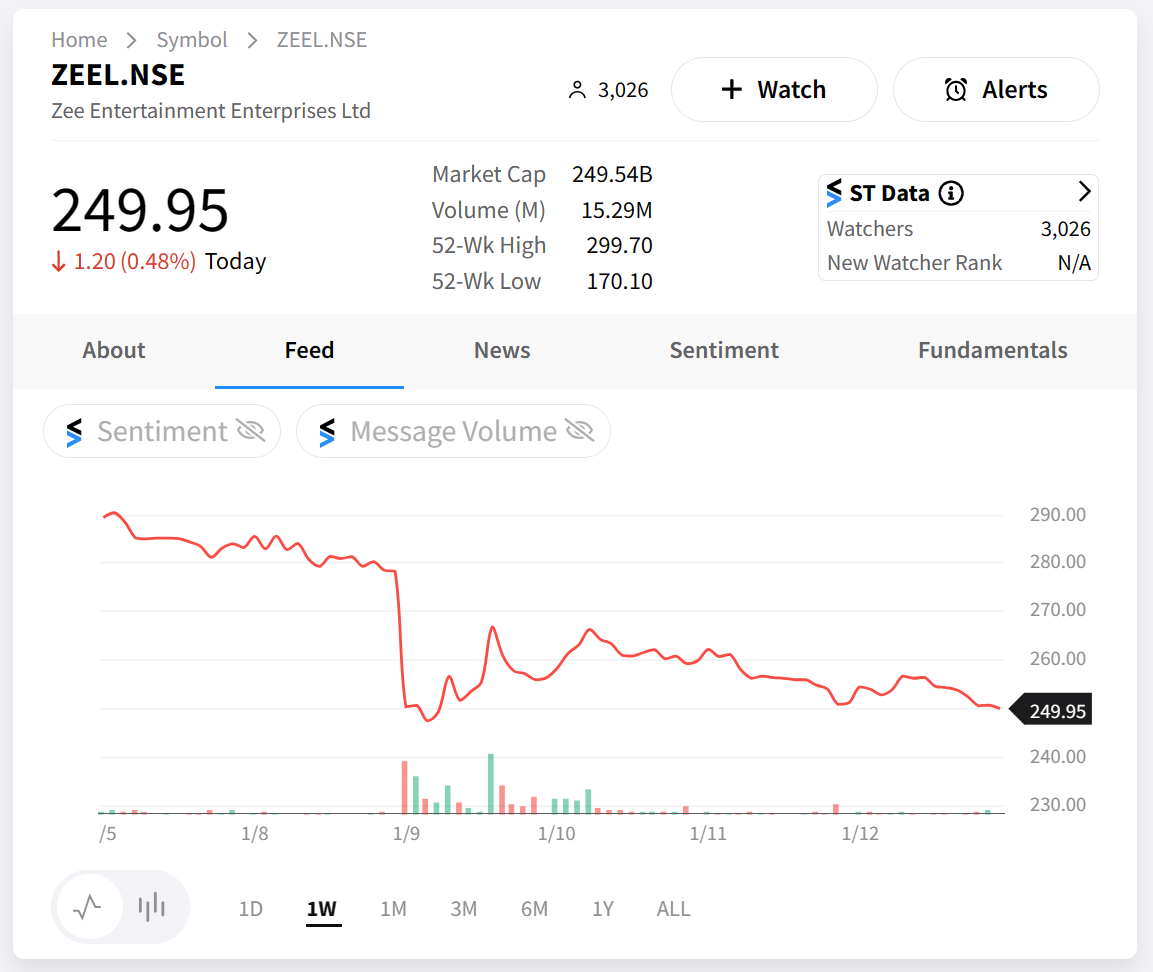

Here’s a look at this week’s NSE500 movers. Network18 Media took the pole position after rallying +34% 🥇 Avanti Feed (+20%) closed up for a 3rd straight week. Polycab sank -26% amidst concerns over financial irregularities and corporate governance. Zee Entertainment dropped 12% on fears of the Sony deal collapsing. 📉 Check out their charts below :

Links That Don’t Suck

📈 How disciplined are F&O traders? Let’s find out.

🔥Top stock ideas by brokerages for 2024

✂️ BlackRock slashes Byju’s valuation by 95% to $1 billion

🛒 Amazon, Flipkart Announce Republic Day Sales; What’s In Store For You?

👨❤️👨 OpenAI CEO Sam Altman Marries Long-Time Partner Oliver Mulherin: Report

⚽ City’s season starts now! KDB return can spark treble repeat