Happy Sunday, y’all.

That said, every major index closed in the red again. The Russell 2000 fell the greatest, booking a –7.88% loss this week. It marks even more pain for the growth name index, which is only up 10.7% over the last year.

The tech-heavy Nasdaq Composite fell -6.38% this week, joined at the hip by the S&P 500, -5.18%. The Dow Jones was the best off, but that’s not saying much. It was down -4.81%.

As you probably estimated, crypto wasn’t much better off than the equities. $BTC.X fell –17% this week, dipping into the mid-$30,000s. $ETH.X was down -26% to $2,476.

And, as you guessed, other large-cap cryptos continued their declines from last week in sympathy. $SOL.X (-33%) struggled amidst network congestion, $AVAX.X (-32%) fell out of the top-10 crypto list, and $LUNA.X (-21%) fought back some of its losses to remain above $DOGE.X (-21%).

Some cryptos made their best effort to claw back losses today, with a number of top-100 cryptos trading up double-digits on the 24hr chart.

That all said, let’s take a look at this week’s drama in the markets:

| S&P 500 | 4,397 | -5.18% |

| Nasdaq | 14,768 | -6.38% |

| Russell 2000 | 1,987 | -7.88% |

| Dow Jones | 34,265 | -4.81% |

Bullets

Bullets from the Week

Netflix struggles in Q4. Netflix is struggling to remain a “FAANG” namesake, even with star-studded casts and award-winning programming. The company’s stock fell 23% in the last week after downgrading its forward subscriber outlook. The news comes in tandem with the company’s decision to raise prices later this month. The standard plan for the company will now cost $15.50/mo. Read more about the Netflix FUD on Stocktwits News.

Crypto enters bear market. It’s no secret: crypto isn’t doing too hot. Major cryptos are in serious decline, with pullbacks pointing to increased odds of a Crypto Winter. We cover some of the pullbacks in the top story of the Friday edition of The Daily Rip.

Peloton’s momentum is Pelo-Gone. When Peloton decided to halt hiring late last year, we thought it would put the troubled gymtech company on the right path. Unfortunately, things keep getting worse. The company was reportedly preparing to lay off more than 40% of its sales and marketing hires, but now looks to be halting production of its smart bikes and treadmills given reduced demand. The stock fell 24% on the news. Read more about the implications for the company on Stocktwits News.

Activists invade Kohls, Unilever. Activist investors are taking advantage of the dip to pick up in stakes in consumer names such as Kohl’s and Unilever. Activist investor Nelson Peltz took a stake in Unilever after its failed bid for GlaxoSmithKline‘s consumer-health business and Kohl’s (which has faced a number of tests by activists in the last year) saw renewed investor pressure from activists.

crypto.com hosed by hackers. Crypto exchange crypto.com users reportedly lost $33 million in a hack. The exchange originally denied any breach and insisted that no customer funds were lost, but still refunded users which indicated they lost money. Read more about the hack in the top story of our crypto newsletter, The Litepaper.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s your brief for the trading week starting Jan. 23.

Economic Calendar

1/25 Consumer Confidence (10:00 AM ET)

1/26 New Home Sales (10:00 AM ET)

1/26 EIA Crude Oil Inventories (10:30 AM ET)

1/26 FOMC Rate Decision (2:00 PM ET)

1/27 GDP-Adv (8:30 AM ET)

1/27 Initial & Continuing Claims (8:30 AM ET)

1/28 Personal Income & Spending (8:30 AM ET)

1/28 Personal Consumption Expenditures (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

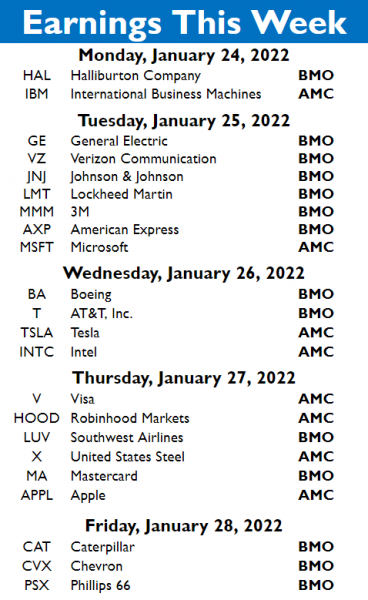

Earnings this Week

Now that Big Bank earnings have tipped off, the earnings are gonna come at us quick. We’ll be covering them in the Rip, but in case you want to keep an eye for yourself, here’s what’s on our radar this week:

We couldn’t possibly fit all the bank & financials companies reporting this week on this list, so feel free to check all the companies reporting this week Stocktwits earnings calendar.

Links

Links That Don’t Suck:

💥 Perfect Storm Brewing for Extreme Politicians In Hyperpartisan Districts

🕵️ Inflation Poses Risk of Unexpected Fed Rate Increases

💻 Solana Suffers Network Instability During Brutal Week for Crypto

🍫 M&M Characters Redesigned For A “More Dynamic, Progressive World”