We hope you’re enjoying your weekend and the last day of July! 🏖️

Let’s at least recap and look to the week ahead.

What Happened?

💚 Stocks rallied for the second week, and crypto registered its fourth week of gains.

🤩 This week’s Stocktwits Top 25 report showed the top stocks in each index significantly outperformed.

🤖 The tale of two technology sectors continues, with companies like Amazon and Apple rallying on results that weren’t as bad as expected. Meanwhile, broken growth stories like Roku and Teladoc continue to be punished by the market for missing expectations. Then there’s Meta, which reported its first quarterly YoY revenue decline as a public company and warned its revenue would decline again next quarter. Despite the awful report, the stock didn’t make a fresh year-to-date low…though we’ll have to see what happens this week.

🤷♂️ Earnings season remains a mixed bag. Walmart set a gloomy tone for retailers by pre-announcing a weaker-than-expected forecast. On the other hand, oil companies announced record profits. And consumer goods/staples companies saw their earnings dampened by inflation and unfavorable foreign-exchange rates.

📈 The Federal Reserve raised its benchmark rate by another 75 bps to 2.25%-2.50%. Chairman Jerome Powell reiterated his commitment to bringing down prices, even if that means slower growth and softening of the labor market. He also noted that the Fed would be less transparent on its guidance and make decisions meeting by meeting. Given the Fed’s preferred measure of inflation (PCE) reaccelerated in June, it’s clear they will have to remain aggressive in tightening financial conditions to bring down prices meaningfully.

💭 Our first read on U.S. Q2 GDP came in at -0.90%, marking the start of a recession based on the long-standing rule of thumb, which defines it as two consecutive quarters of economic contraction. The debate over whether or not this reading technically qualifies as a recession continues nonetheless. Meanwhile, the Euro Area saw inflation hit a new high, but its economy managed to avoid a recession by growing at +0.70%. Despite the positive news, it’s important to note that both China and the International Monetary Fund (IMF) lowered their growth forecasts.

🥇 Gold and Silver had one of their best weeks of the year as the U.S. Dollar pulled back from its highs. These safe-haven assets haven’t provided the protection many investors expected over the last year, but some see this week’s rally as a potential turning point.

🤝 The Spirit Airlines saga is finally over. The company terminated its merger agreement with Frontier Airlines and accepted JetBlue’s $3.8 billion all-cash offer.

₿ Crypto prices recorded their fourth straight week of gains, with Ethereum Classic rallying another 53.35%. Meanwhile, Coinbase shares tumbled after the SEC announced a probe into whether the platform offers unregistered securities. Despite the recent price improvements, the regulatory and consumer scrutiny of companies operating in this space is here to stay.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $SIGA, $MULN, $TBLT, $GOVX, $FAZE, and $XELA.

Those are the major stories from the week. And here are the final prints:

| S&P 500 | 4,130 | +4.26% |

| Nasdaq | 12,391 | +4.70% |

| Russell 2000 | 1,885 | +4.34% |

| Dow Jones | 32,845 | +2.97% |

Bullets

Bullets From The Weekend

🏭 China’s factory activity unexpectedly contracted. The country’s manufacturing purchasing manager’s index (PMI) fell to 49 (below 50 signals a contraction) in July as fears of a global recession, inflation, and the fear of further covid lockdowns slows the country’s economic recovery. The weak data comes the same week the government said it will likely miss its 5.5% GDP target for the year, though it’s aiming for the ‘best possible result.’ CNBC has more.

🌎 Climate-focused VC targets a $100m fund. Despite the slowdown in the public and private markets, some areas continue to bring in the dough. Climate-focused VCs have been busy lately, raising and deploying funds as climate issues retake center stage. For example, buoyant Ventures has raised $50m for a new fund and is targeting another $50m more to invest in “solutions for the industries contributing the most to carbon emissions.” More from TechCrunch.

💳 U.K. credit card borrowing ramps up. Credit card borrowing in the U.K. grew at 12.5% YoY, its fastest pace since November 2005. With inflation sitting near record highs in many parts of the world, consumers rely on their savings and credit cards to keep pace. Analysts expect this trend to continue as elevated prices and interest rates take a toll on households. BBC News has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

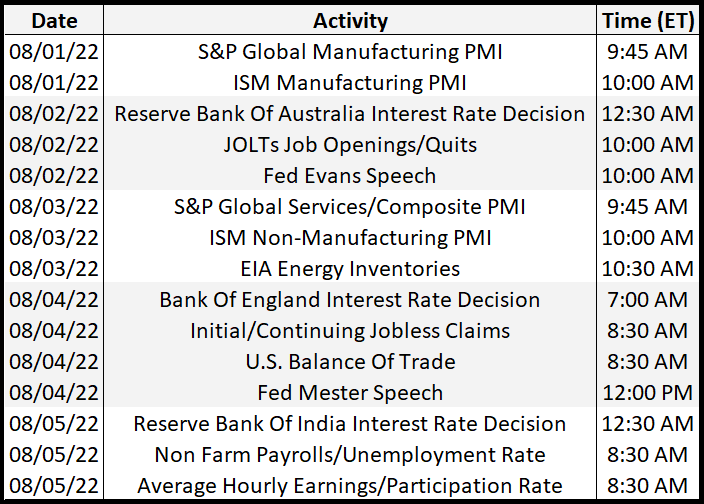

Economic Calendar

All eyes are on the labor market data, with non farm payrolls and average hourly earnings in focus on Friday. In addition to the above, check out this week’s complete list of economic releases.

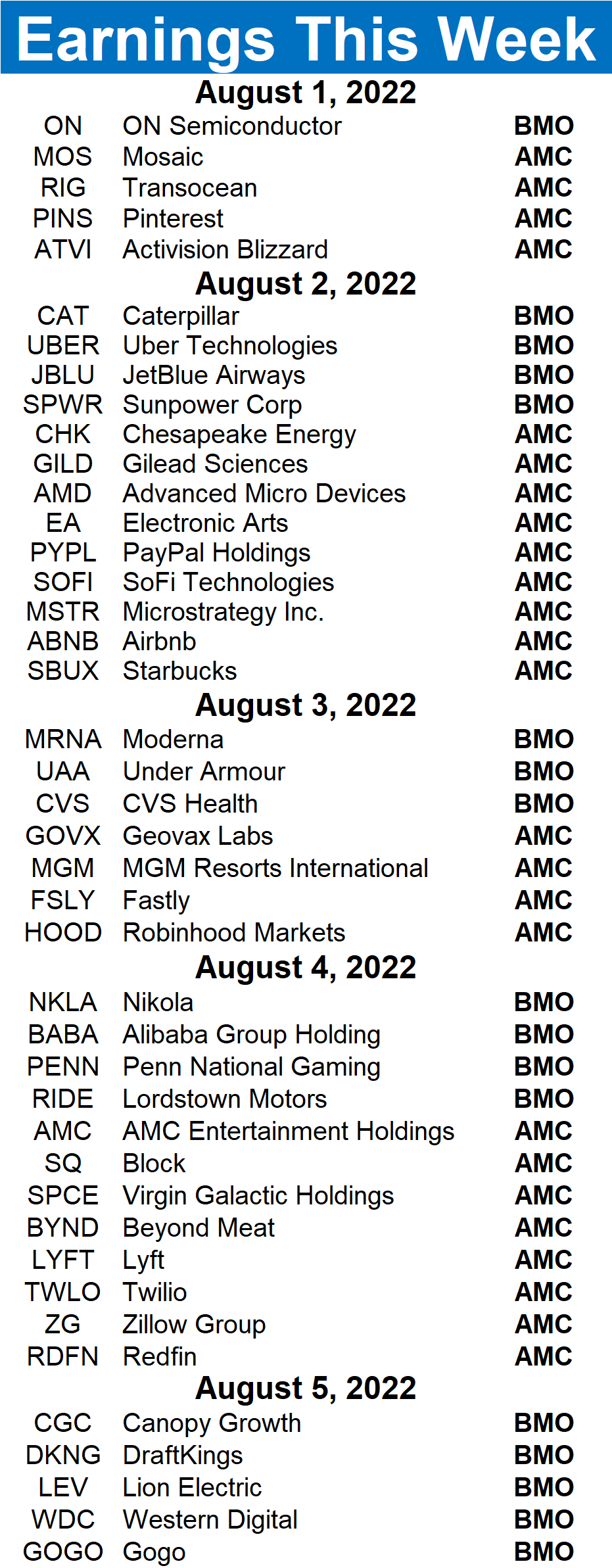

Earnings This Week

Earnings season is in full swing, with 1255 companies reporting this week. Several tickers you may recognize are $PINS, $CAT, $UBER, $SOFI, $AMD, $HOOD, $BABA, $PENN, and $AMC.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

🦈 Reach market shark status with 4 weeks of MarketSmith for just $29.95 (that saves you $120)*

🎫 Ticket bought in Illinois wins $1.337 billion mega millions jackpot

🎥 Amazon-owned MGM lost the movie rights to Tomb Raider

🧹 Kentucky cleans the debris and assesses the damage after deadly floods hit the state

🚀 Chinese rocket falls to Earth, NASA says Beijing did not share information

🔥 California wildfire explodes in size amid “critical” risk

🏢 Google CEO tells employees productivity and focus must improve

✈️ Air Canada revoked a worker’s flying privileges after her daughter complained about poor service

🗑️ ‘A mountain that just keeps growing.’ What to know about the e-waste left behind by your gadgets

*this is a sponsored post