It’s a new week with a lot happening — here’s what you missed.

The stock market churned in an indecisive trading session, with the major indices closing near the flat line. 🤷♂️

Earnings remain in focus, with over 1,200 companies reporting this week. We cover Pinterest’s earnings surprise below. 👇

Here’s today’s heat map.

4/11 sectors closed green, with consumer staples (+1.25%) leading and energy (-2.07%) lagging. 🟢

In economic news, Euro area unemployment came in at 6.60%, while E.U. unemployment was 6.0%. Meanwhile, U.S. manufacturing activity slowed to a 2-year low as new orders contracted and inventory continued to pile up. The Global PMI report showed a sustained easing of global commodity price and supply pressures in July. 🏭

Revlon shares surged nearly 90% after receiving court approval for a $1.4 billion bankruptcy loan. Despite junior creditor concerns, the court said that the company must be allowed to borrow the cash it needs to continue its operations in bankruptcy. 📈

Speaking of cosmetics, Estee Lauder is reportedly in talks to acquire luxury brand Tom Ford in a nearly $3 billion deal. 💄

Nikola rallied 7.88% on news it will acquire battery pack supplier Romeo Power for $144 million in an all-stock transaction. The move comes as more electric vehicle companies vertically integrate to ensure access to the supplies needed to ramp up production. 🔋

Additionally, Hyundai Motor is looking to acquire a Korean self-driving startup 42dot. Competition on the automobile front has certainly picked up over the last few years… 🚗

SIGA Technologies volatility continues as NYC declares a state of emergency over monkeypox. 💉

And finally, shares of energy drink maker Celsius rallied 11.14% on news that PepsiCo has taken a $550 million stake in the company. 🥤

In crypto news, the SEC has charged eleven individuals in a $300 million crypto pyramid scheme, Coinbase Prime is now offering Ethereum staking to U.S. institutions, and FTX has received full approval to operate a crypto exchange in Dubai. ₿

Lastly, we have to mention this news from jewelry brand Tiffany and Co., which released a $50,000 CryptoPunk Necklace. We could be wrong, but this feels like one of those “we’re still so early…” ironical moments. 😂

Other symbols active on the streams included: $HKD (+85.38%), $FAZE (+8.56%), $GETY (+18.93%), $MAIA (+34.48%), $MGAM (+16.00%), $TBLT (+21.86%), $VRAX (+119.44%), $AEMD (+38.00%), and $MULN (+9.36%). 🔥

Here are the closing prices:

| S&P 500 | 4,119 | -0.28% |

| Nasdaq | 12,369 | -0.18% |

| Russell 2000 | 1,883 | -0.10% |

| Dow Jones | 32,798 | -0.14% |

Earnings

On $PINS And Needles

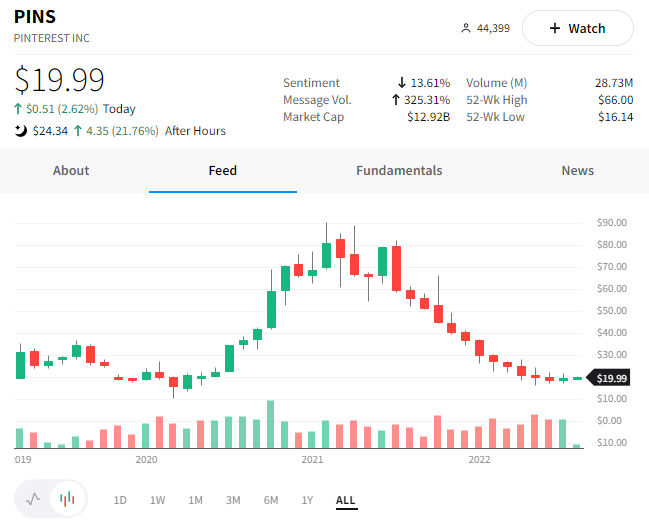

It’s been a rough run for social media companies over the last year, so investors were waiting on $PINS and needles for Pinterest’s earnings report today.

The company reported adjusted EPS of $0.11/share vs. $0.18 expected and revenues of $666 million, $1 million shy of expectations. 👎

Despite the weak results, the stock actually popped 21% after hours! 😮

Investors are focusing on two things.

The first is global monthly active users, which declined 5% YoY to 433 million. While that decline isn’t great news, it was less severe than analyst expectations of 431 million. 🔻

The second is that activist investor Elliott Management confirmed that it is the company’s top investor and said it has “conviction in the value-creation opportunity” at the company. 👍

Maybe investor expectations have gotten low enough where bad news is okay, as long as it’s less lousy than expectations.

With that said, what is clear is that the online advertising market is weakening. Results from Meta, Twitter, Snap, Google, and other major players all cited a challenging macroeconomic environment in their reports. And uncertainty means less advertising spending until their ad customers get a better handle on their own businesses.

Pinterest furthered that narrative, stating, “The macroeconomic environment has created meaningful uncertainty for our advertiser partners…” and “…lower than expected demand from U.S. big box retailers and mid-market advertisers, who pulled back ad spend due to concerns about weakening consumer demand.”

The Federal Reserve is doing all it can to bring demand (and prices) down, so maybe we shouldn’t be surprised when it shows up in the stock market’s earnings. 🤷♂️

We’ll have to wait and see if this after-hours move holds or if this is another fake-out.

In the meantime, hop on the $PINS stream and share your view with us! 💭

Bullets

Bullets From The Day:

🚚 Amazon launches same-day delivery for some brick-and-mortar retailers. The company continues to invest in making one-day (or same-day) delivery the default for its members across the country. Today, Amazon Prime members in select cities can now get items from several retailers like PacSun and Superdry delivered to their homes in just a few hours. CNBC has more.

☕ Did unionizing backfire for Starbucks workers? In May, Starbucks announced it would raise wages for workers at nonunionized stores, but now Starbucks Workers United is pressing the company to extend those hikes to workers at its unionized stores. As for Starbucks’ reasoning, the company says that it cannot change benefits for union workers without a good faith collective bargaining agreement. The union, however, argues that it has the power to greenlight the changes without bargaining and that these actions are part of an effort to discourage other stores from unionizing. More from CNBC.

🚢 The first ship of Ukrainian grain leaves Odesa port. Imports and exports are finally resuming, at least in a limited capacity, from the Ukrainian port of Odesa. Activity shuttered when Russia’s aggression began five months ago, leaving grain and other agricultural products stuck at port. But under a new deal brokered by Turkey and the U.N., Ukraine and Russia can start shipping these products again. This agreement is hopefully a first step towards restoring the “breadbasket of Europe” and bringing down food prices in the region/worldwide. AP News has more.

🔌 Bolt network of e-bikes becomes immobile. Bolt Mobility, the Miami-based micro-mobility startup co-founded by Usain Bolt, has disappeared from several of its U.S. markets. The company has stopped operating in at least six U.S. cities, leaving equipment abandoned, unanswered calls and emails, and even more questions. Despite a hot start for the company, its leaders have seemingly bolted away from their responsibilities, leaving cities to clean up their mess and everyone else to wonder what happened. TechCrunch has more.

🎵 Is TikTok gearing up to challenge Spotify and Apple? ByteDance filed for a ‘TikTok Music’ trademark in May, sparking speculation that the company may be launching a music streaming app of its own. Given how integral music has become to the TikTok experience and the company’s experience launching music streaming services in other countries, this wouldn’t be that surprising of a move. It’s unclear what the company’s plans are, but since it shook up the short-form video game pretty quickly…music streaming services should watch their backs. The Verge has more.

Links

Links That Don’t Suck:

📚 Stephen King going to bat for U.S. gov’t in case against book publishing mega-merger

☣️ UN chief warns world is one step from ‘nuclear annihilation’

🌎 Oh my days! Midnight comes a fraction sooner as Earth spins faster

📝 Bank of America memo, revealed: “we hope” conditions for American workers will get worse

🌕 Parts of the moon have stable temperatures fit for humans, researchers find

🚫 Indonesian government blocks Steam, Epic, & Nintendo for 270 million people

💸 Boston Chinatown restaurant served as front for global money laundering scheme, DOJ says

🏀 Boston Celtics great Bill Russell, 11-time NBA champion, dies at 88

💪 The 2023 Ford Maverick Tremor is a little truck with a little lift

🍬 This company wants to pay you $100,000 a year to eat candy – here’s how to apply