We’re a day away from a five-week win streak — let’s see what you missed.

Today’s issue covers a global central bank’s surprise action, pertinent economic updates, the biggest earnings movers, and analysis of the public and private funding markets. 📰

Here’s today’s heat map.

7 of 11 sectors closed green, with energy (+2.69%) leading and real estate (-0.68%) lagging. 💚

U.S. natural gas prices rose to a 14-year high as scorching temperatures across the country raise energy demands. Additionally, Crude Oil prices pushed higher after the weekly EIA report showed inventories fell more than expected. ⛽

In individual stock news, Bed Bath & Beyond was down 20% today and plummeted another 35% after hours on news that Ryan Cohen liquidated his entire position. 📉

Meanwhile, retail continues to target other beaten-down stocks to rally behind, like Weber (+26%). 🚀

Penn National Gaming shares were down marginally on news that it purchased the rest of Barstool Sports for $387 million. 🎰

In crypto news, Canadian pension giant Caisse wrote off a $150 million bet on now bankrupt crypto lender Celsius. Additionally, the CME Group is adding Ether options to its crypto offerings ahead of the Ethereum Merge. ₿

Other symbols active on the streams included: $SST (+9.21%), $GCT(+6.05%), $MEGL (+6.74%), $PSTV (-53.90%), $BLUE (-14.31%), $BBIG (+4.32%), $INDO (+34.02%), and $MVIS (+3.91%). 🔥

Here are the closing prices:

| S&P 500 | 4,284 | +0.23% |

| Nasdaq | 12,965 | +0.21% |

| Russell 2000 | 2,001 | +0.68% |

| Dow Jones | 33,999 | +0.06% |

Another busy day of economic data; let’s talk about it. 💬

First up was existing home sales, which fell for the sixth straight month to the lowest level since May 2020. They fell 5.9% MoM and a whopping 20.2% YoY. 😬

The weakness more or less confirms yesterday’s data which showed new home sales fell 9.6% MoM and 8.1% YoY. Despite mortgage rates pulling back slightly, prices of new and existing homes remain elevated, pricing many out of the market. 🏘️

In other news, the Philadelphia Fed Index rose unexpectedly in August, as volatility in this data type continues. Given these are regional surveys, it’s been hard to get a clear read on manufacturing activity which had been showing signs of softening lately. 🏭

On the positive side, the report’s inflation component showed that the extreme input prices are beginning to moderate. 👍

Overseas we received Eurozone inflation numbers for July. The headline reading came in at 8.9% YoY, a new record, and its core reading came in at 5.1%. The ECB began its tightening cycle last month but still has a long way to go before inflation is back down towards its 2% long-run target.

Finally, in other central bank news, Norway hiked rates by another 50 bps. Meanwhile, Turkey surprised the world with a rate cut (from 14% to 13%) despite inflation nearing 80% in the country and other global banks continuing their tightening efforts. 😮

Overall, the battle against inflation continues around the globe. As we’ve discussed in this newsletter, many structural issues are at play here, which suggests the struggle between central banks and price stability will be long. 😫

Private Markets

Just How Cool Have Funding Markets Gotten?

Last week Pitchbook released its Q2 2022 U.S. VC Valuations Report, which had some interesting stats about the current environment. 📝

Early-stage valuations are beginning to reflect broader economic uncertainty, as quarter-over-quarter median pre-money valuations saw their first decline in ten quarters. The median pre-money valuation for early-stage VC was $52 million, down 16.1% YoY.

Earnings

Earnings Highlights (08/18/22)

There were a bunch of names moving today; let’s see what caught investors’ attention. 👀

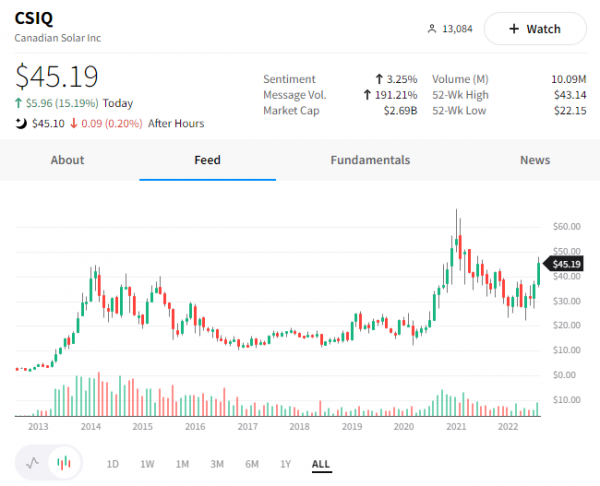

First up is Canadian Solar, which rallied 15% after the company beat earnings and revenue expectations.

Additionally, the company raised its revenue estimates for the coming quarter and full year. Given all the focus on energy and alternatives in the U.S. and around the globe, investors appear optimistic about the company’s ability to grow as the stock hits its highest level in 18 months. 🌞

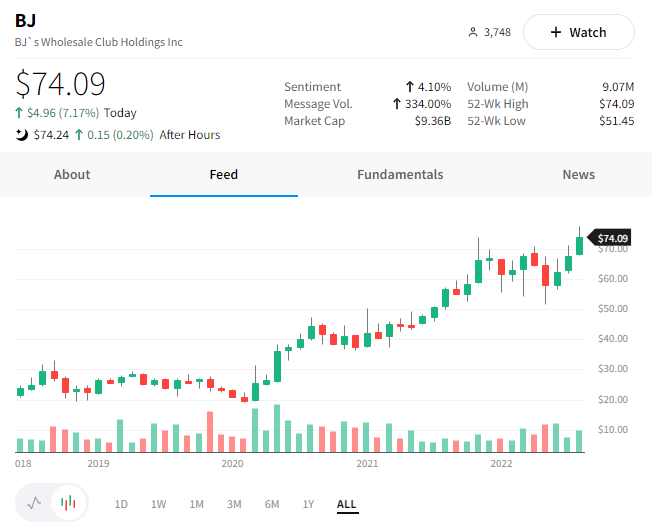

Next up, we heard from BJ’s Wholesale Club, which reported better-than-expected earnings and revenue. The company’s comparable store sales rose 7.6% YoY (ex-gas), and Bank of America also upgraded the stock from neutral to buy today.

The stock rose 7% to a new all-time high, given the positive news. 📈

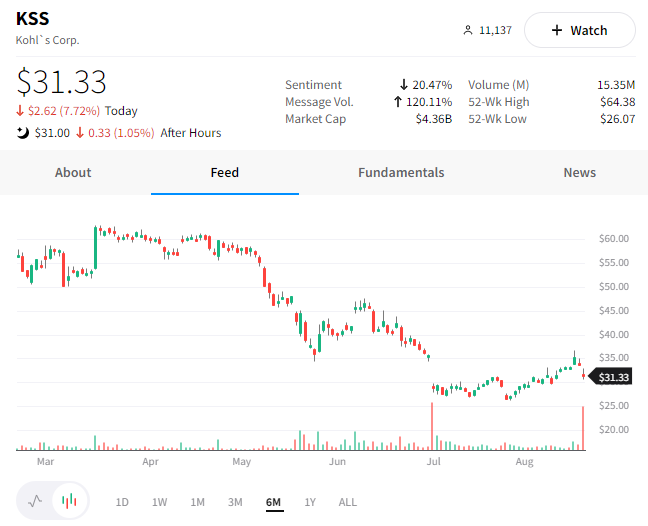

Retailer Kohl’s fell 7% despite earnings and revenue coming in above analysts’ lowered expectations. Investors are looking ahead to the future, which remains rough, with the company saying inflation has pressured its middle-income customers. As a result, it cut its full-year sales and profit forecasts, which weighed on the stock. 🔻

And finally, semiconductor companies Wolfspeed (+32%) and Applied Materials (+4%) rallied today after both beat expectations and offered upbeat guidance. Semiconductor earnings have been mixed at best this quarter, but the commentary from these two firms suggests their management thinks they’re well prepared for the future.

I guess we’ll just have to wait and see. 🤷♂️

Bullets

Bullets From The Day:

👎 Snapchat’s hardware efforts take another blow. Those who were excited about Snap’s $230 flying camera drone will be disappointed to know that the company has stopped the development of this product just four months after announcing it. The Pixy was introduced as a new way for users to capture photos from unique angles but is now just another failed attempt by the company to break into the hardware space. CNBC has more.

🏦 BofA’s overdraft fee revenues are down over 90%. The nation’s largest banks are moving away from charging exorbitant fees to their customers, though it’s coming at a significant cost. Bank of America’s new overdraft policy was implemented in June, reducing overdraft fees from $35 to $10 and eliminating fees for bounced checks. The first two months of the policy have resulted in overdraft fee revenue falling 90%. Still, consumer advocates say the banking industry has a long way to go in reforming its general business practices. AP News has more.

📱 A 10-minute live call with your favorite celebs? The popular website Cameo, where fans can request a brief message from their favorite celebrities, is expanding its service to offer longer calls via Cameo Live. While it’s not a cheap service, the company hopes its expanded offering of services can help accelerate its growth and help it push through the weaker environment for consumer technology companies. More from TechCrunch.

🥵 Record heatwave hits China’s factories. Just months after covid lockdowns disrupted supply chains in China, factories now face a new issue. An intense heatwave and drought have left the Yangtze river basin levels dwindling, curbing electricity generating at hydropower plants and putting a strain on the country’s infrastructure. As a result, some provinces have ordered factories to suspend their operations to save power and prevent a further crisis, which could further pressure global supply chains. Quartz has more.

Links

Links That Don’t Suck:

✈️ Airline unions urge carriers not to resume buybacks when bailout ban ends this fall

🍔 Here’s what the Wendy’s of the future looks like

🌮 Taco Bell tests its own meat substitute ahead of Beyond Meat launch later this year

🍺 Japan launches a contest to urge young people to drink more alcohol

😬 ‘$70,000 CEO’ Dan Price resigns as chief of Gravity Payments after assault allegations

👶 Russia is offering a hero’s medal and $16,000 to women who have 10 kids