We’re running out of summer Fridays, so we’ll keep today’s issue brief. 🩲

Below we analyze the market’s four-week win streak and highlight earnings news from Deere and Foot Locker, which had their stocks moving and grooving. 📰

Here’s today’s heat map.

Only health care (+0.26%) closed green today, with consumer discretionary (-2.09%), financials (-2.02%), and materials (-1.85%) lagging. 🔻

In international news, Germany’s producer prices rose 37.2% YoY and 5.3% MoM…the highest on record. Ukraine’s President Volodymyr Zelenskyy warns the world is on the ‘verge of nuclear disaster’ as fighting continues near its nuclear power plant. And in related doomsday news, scientists believe there’s a one-in-six chance of a massive world-altering volcanic eruption this century. ☢️

China’s GigaCloud went public in the U.S. this week; meanwhile, Chinese carmaker Geely is considering an IPO in Hong Kong for its ride-hailing firm Cao Cao Mobility. 🌏

In individual stock news, Bed Bath and Beyond opened near its after-hours lows from yesterday and traded sideways. The stock’s volume was about twice its outstanding float today as investors cope with the Ryan Cohen dump. 📉

Occidental Petroleum rallied 10% on news that Berkshire has won approval from the Federal Energy Regulatory Commission to buy up to 50% of its shares in the secondary market. 🛢️

MSG shares were up 2% after announcing it’s exploring selling its live entertainment business, including its NYC arena and MSG networks. 🏟️

General Motors rallied nearly 3% after it reinstated its quarterly dividend at $0.09/share and increased the size of its buyback program from $3.3 to $5 billion. 🚗

23andMe shares fell 20% after announcing that its CFO is stepping down. 🧬

Cineworld Group, the owner of Regal Cinemas, fell 46% today on reports that the company is preparing to file for bankruptcy. 📽️

The crypto market snapped a six-week winning streak this week. Additionally, the FDIC ordered FTX U.S. and four others to cease ‘misleading’ claims that their crypto products might be FIDC-insured. Lastly, an independent Tether attestation revealed a 58% decrease in commercial paper holdings. ₿

Other symbols active on the streams included: $GCT (+205.99%), $ENDP (-1.41%), $BBIG (-20.00%), $PH (-1.66%), $XM (-4.89%), $KDP (-0.17%), $AXSM (+40.35%), $NKLA (-9.09%), and $ROOT (-14.13%).

Here are the closing prices:

| S&P 500 | 4,228 | -1.29% |

| Nasdaq | 12,705 | -2.01% |

| Russell 2000 | 1,957 | -2.17% |

| Dow Jones | 33,707 | -0.86% |

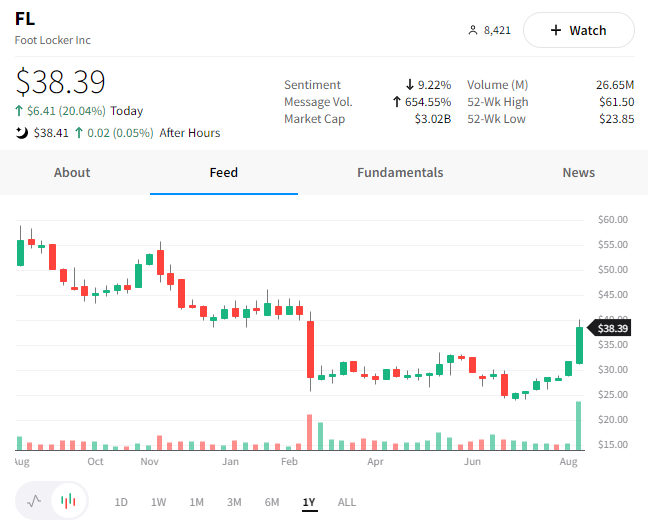

It’s been a rough year for retailers, but sentiment has gotten bad enough for some of them to beat expectations. That seems to be the case for Foot Locker, which rallied heavily after reporting better-than-expected earnings.

Though the $1.10 per share it earned was down 50% YoY, it was still ahead of the $0.81 Wall Street expected. On the other hand, revenues were just shy of expectations, down 9%, while same-store sales fell 10.3%. 🔻

Despite beating expectations this quarter, the company updated its 2022 profit forecast to $4.25-$4.45 per share, down $0.15 from the higher end of its guidance. 📉

Most notable was the company’s announcement that CEO Richard Johnson will retire on September 1st. Mary Dillon, a former Ulta Beauty executive and e-commerce expert, will take over.

Investors appear optimistic about the move and the company’s turnaround story, since the stock rallied 20% today. 👍

Here’s to hoping Richard enjoys his retirement as much as investors are… 😂

Stocks

Recapping The Rally

While the market’s four-week win streak ended, the good news is we’ve gotten some interesting data to consider. 🕵️

Let’s make lemons out of lemonade — or whatever the saying is… 🍋

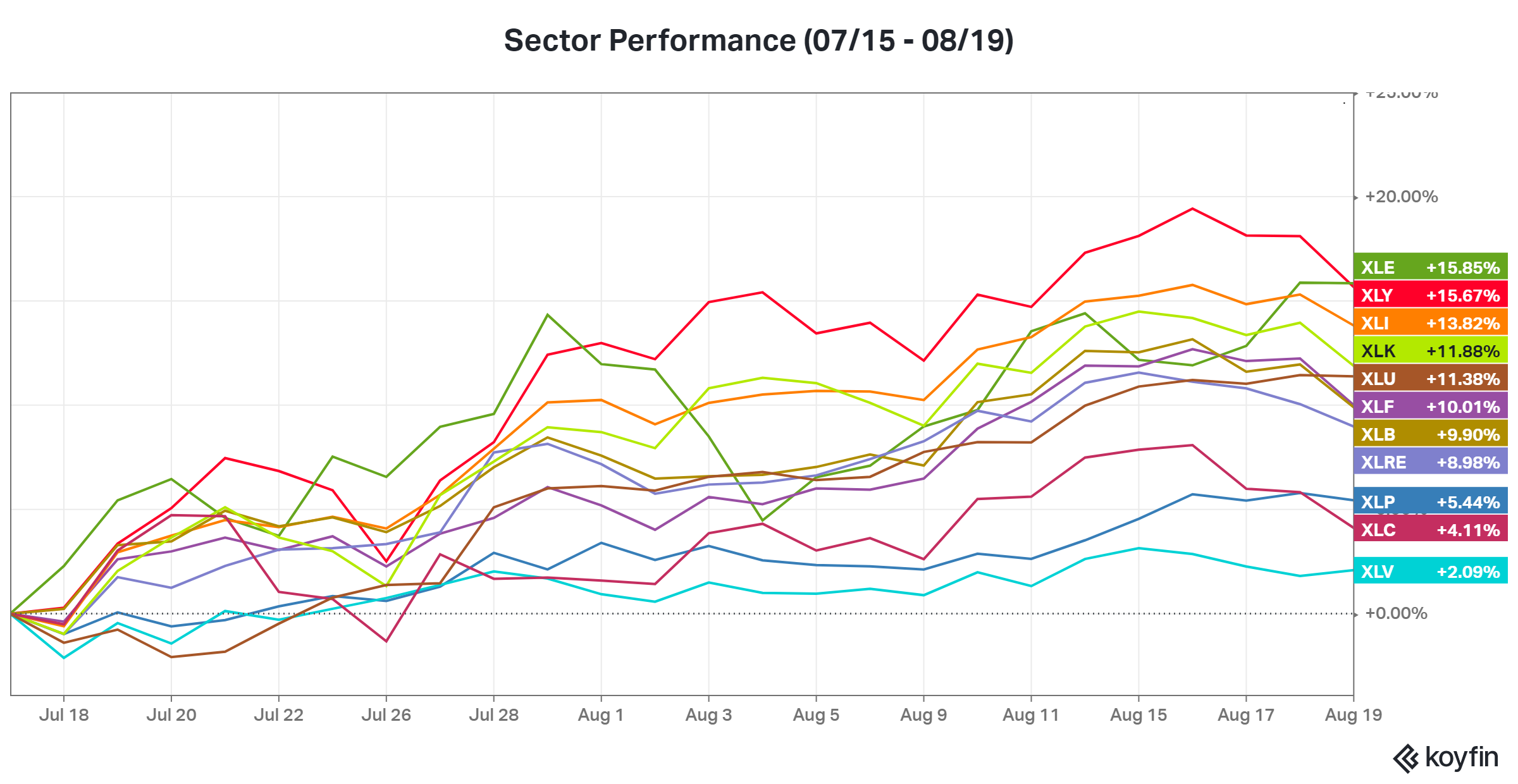

First, let’s start by looking at the eleven U.S. sector SPDR ETFs’ performance from July 15th through today, which includes four up weeks and one down. In terms of major winners, we had energy (XLE), consumer discretionary (XLY), industrials ($XLI), and technology (XLK). And the losers were health care (XLV), communication services (XLC), and consumer staples (XLP).

The risk-on sectors rallied significantly during this period, while defensive sectors lagged. 🤔

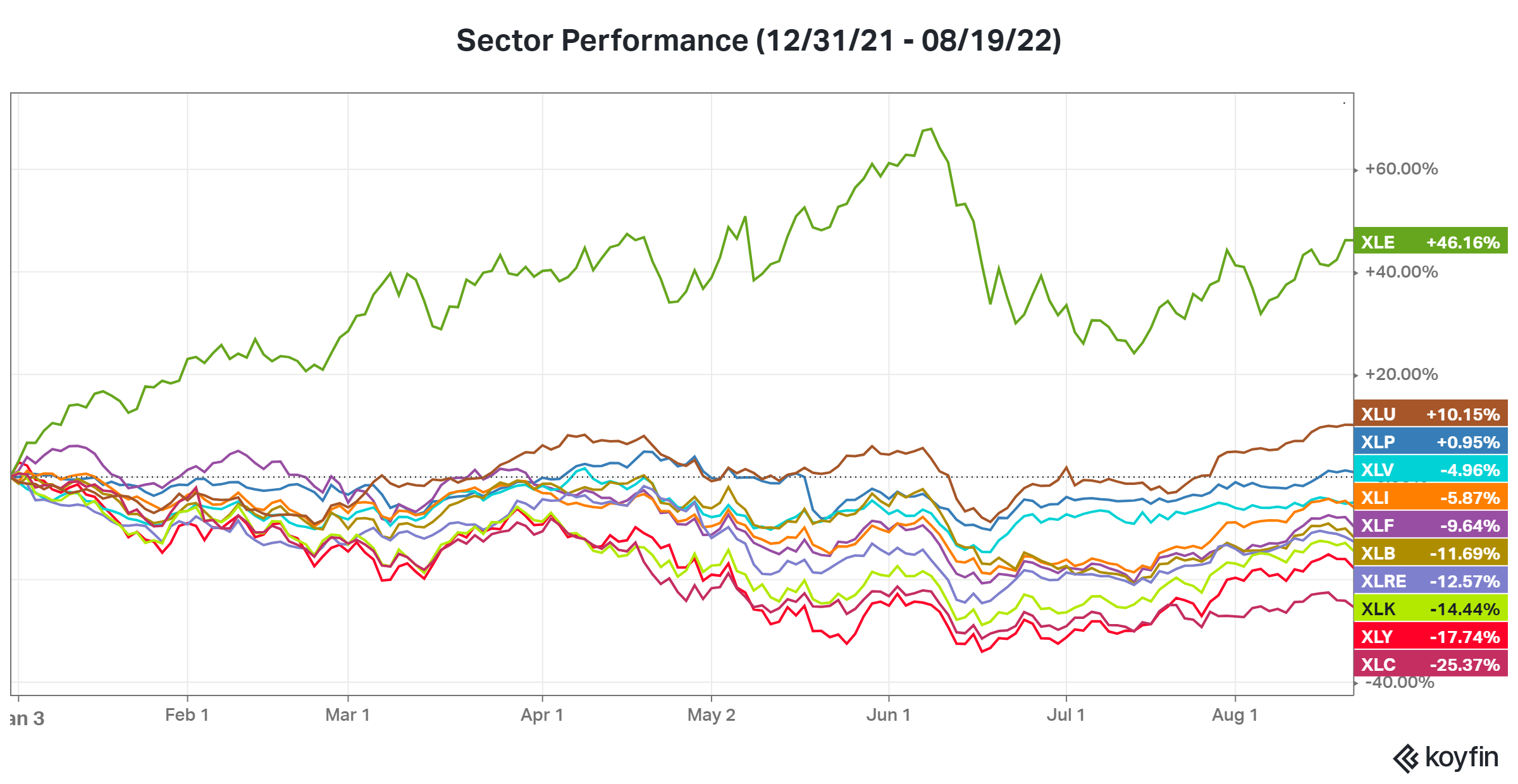

Meanwhile, if we look at the year-to-date performance of these sectors, we see a very different picture. Some of the top winners (excluding energy) were the defensive sectors like utilities, consumer staples, and health care. And some of the biggest losers were the risk-on sectors of the market like communication services, consumer discretionary, and technology. 👀

Some technical analysts point to this data as evidence that the recent rally was nothing more than a bear-market rally. 💭

They argue that the risk-on areas only rallied the most over the last five weeks because they were hit hardest year-to-date. They also suggest that the defensive sectors holding up best throughout the year is continued evidence that institutions are positioned for more downside.

Because if you’re bearish on the market and the economy, you’d probably be investing in toothpaste and utility companies, not high-flying growth names, right?

Whether or not they’re reading too much into this data remains to be seen, but we wanted to pass it along so you could draw your own conclusions. 🤷♂️

Earnings

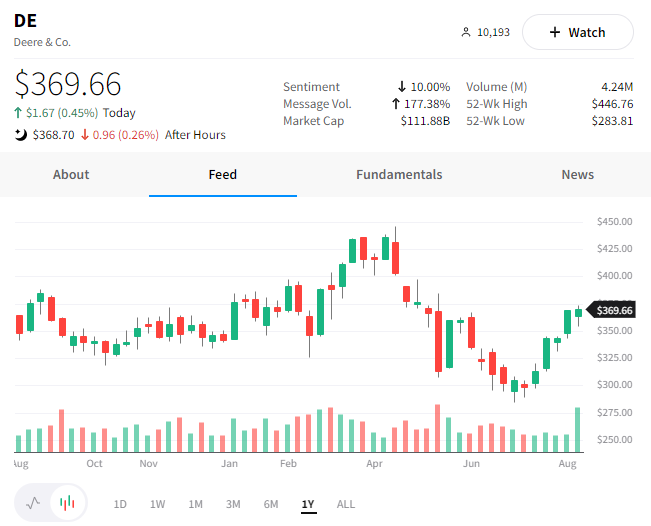

Deere’s Earnings Drought

While a good portion of the world deals with a major heatwave, Deere’s earnings report shows it’s facing a drought of its own. 🥵

The world’s largest farm equipment manufacturer lowered its full-year profit outlook and said it has sold out of its large tractors. The overarching sentiment is similar to what it expressed last quarter, that it’s unable to fulfill strong demand because of supply chain issues. 🏭

While it struggles to keep up with demand, those supply chain issues are eating into its profits. Total costs and expenses rose 24.4% YoY, resulting in an earnings miss but a revenue beat. 🔻

Despite another mixed quarter, the stock was more or less flat on the day. Investors appear to be focusing on its backlog of orders through early 2023 and hoping the company’s supply chain issues will ease in the year’s second half. 📆

Although commodity prices have come down as of late, but are still above pre-pandemic levels in many cases. Investors and analysts alike believe that will continue to buoy demand for Deere’s products in the coming quarters. 💪

Bullets

Bullets From The Day:

🚗 DoorDash ends a 4-year partnership with Walmart. Sources familiar with the matter say that DoorDash ended the partnership because it was no longer mutually beneficial and that they’re focusing on its long-term customer relationships. Where one partnership door closes, another one opens, though. Reports are that DoorDash is gearing up to collaborate with Facebook parent Meta, testing a service that will allow drivers to pick up and drop off Facebook Marketplace items. TechCrunch has more.

👀 Working from home? Prepare to be tracked. Physical rubbernecking has been replaced by digital surveillance, with eight out of ten of the largest private employers in the U.S. tracking productivity metrics for their employees. Companies are taking measures to track everything from active time, keyboard pauses, and keystroke counts, giving employers back their ‘sense of control’ over their remote workers. Early research has suggested hybrid workers are the most productive, but work still needs to be done to bridge the expectations gap between employers and their employees. More from Fortune.

💸 U.S. mortgage lenders are starting to go broke. After a sharp spike in lending rates and a meltdown in purchasing and refinancing activity, the U.S. mortgage industry is seeing its first lenders go out of business. Independent lenders handle more of the mortgage business than in previous decades, and they’re struggling to stay afloat given the sharp drop in business volume. These ‘shadow banks’ are not as well capitalized as the money-center or regional banks and remain the most vulnerable to the recent housing downturn. Financial Advisor Magazine has more.

❌ Wayfair lays off 5% of its workforce. The online home goods retailer cuts close to 900 employees just months after implementing a hiring freeze. The pandemic e-commerce shopping trends have slowed meaningfully, leaving the company overstaffed and needing to reprioritize its investment needs. Investors weren’t thrilled with the news, as the stock fell roughly 20% and remains nearly 85% off its pandemic-fueled highs. More from TechCrunch.

💰 Apollo Global Management makes a monster investment. The private equity giant invested $785 million in GI Alliance, a gastroenterology-care platform that now boasts a $2.2 billion valuation. Given the current environment, deal-making has picked up across the health care space and other industries as cash-rich firms take advantage of the discounts. Reuters has more.

Links

Links That Don’t Suck:

📈 See why so many investors choose MarketSmith over free chart services—try 3 weeks for just $19.95*

🪃 ‘Boomerang employees’ are going back to the old jobs they quit

🚀 Watch SpaceX launch 53 Starlink satellites, land a rocket at sea today

🪐 Astrophotographer captures incredible shot of Saturn from garage roof

😴 Plane fails to descend as pilots reportedly fell asleep during flight

🍔 McDonald’s is bringing a British hit to the US

✈️ New DOT dashboard shows what airlines owe you for flight delays & cancellations

⚖️ Tesla wins order to arbitrate trade-secret case against former engineer

*this is a sponsored post