It’s the last week of summer, which means lighter trading volumes and a lot of “pretend working” — here’s what you missed.

Most key economic updates come later in the week, so today’s issue covers several earnings movers, Fed official Neel Kashkari’s hawkish comments, and other relevant news from the day! 📰

Check out today’s heat map:

2 of 11 sectors were green, with energy (+1.53%) leading and technology (-1.32%) lagging. 🔻

In international news, massive flooding in Pakistan has left over 1,000 people dead and a third of the country under water. Fighting in Libya escalated over the weekend, and clashes erupted in Iraq after an influential Iraqi Shiite cleric resigned. And lastly, a UN agency is on an urgent mission to inspect the Ukraine nuclear plant caught in the crossfire of the Russia/Ukraine war. 🌍

In individual stock news, Cameco and other uranium stocks continue to rally following last week’s news that Japan and other countries are reconsidering nuclear power. ☢️

Bed Bath & Beyond continues to rally ahead of the company’s August 31st investor update. 📈

India’s Reliance Industries is partnering with Google to develop a new smartphone in its $25 billion 5G push. Also, Meta and Jio launched grocery shopping on Whatsapp. 🇮🇳

In crypto news, FTX’s Sam Bankman-Fried denied rumors that it’s planning to acquire crypto exchange Huobi. Crypto Coin AVAX fell 11% after a self-described whistleblower says Avalanche weaponized litigation against rivals. Mt. Gox creditors dismissed rumors of a massive Bitcoin dump. And Bitcoin prices continue to bounce around $20,000. ₿

Other symbols active on the streams included: $MYOV (+6.95%), $CFVI (+16.96%), $PSNY (-4.30%), $APE (-6.77%), $AMC (+3.27%), $OLB (+18.34%), $AVCT (+156.32%), and $DWAC (-7.99%). 🔥

Here are the closing prices:

| S&P 500 | 4,031 | -0.67% |

| Nasdaq | 12,018 | -1.02% |

| Russell 2000 | 1,883 | -0.89% |

| Dow Jones | 32,099 | -0.57% |

Earnings

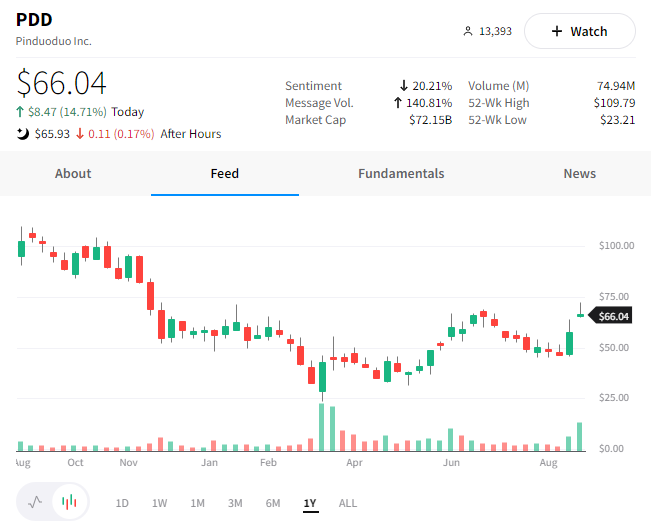

Pinduoduo Pops On Earnings Beat

Chinese e-commerce company Pinduoduo continued its rally after reporting better-than-expected earnings and revenue. 👍

The company reported $4.69 billion in revenue, marking a 36% YoY rise, driven by strong sales during China’s midyear shopping festival. In addition, pent-up demand as Covid-19 restrictions loosened helped drive sales and proved the resilience of China’s consumers. 🛒

Profits surged 268%, but the company cautioned that it was related to the delay of several projects and reduced costs due to Covid restrictions. Executives noted that the company would continue to prioritize R&D to stay competitive and confirmed rumors that it is considering expanding overseas.

This isn’t much of a surprise to anyone paying attention. As China’s consumers get pinched by inflation and slowing wage growth, many Chinese companies are turning to international markets to reaccelerate growth. 🗺️

Additionally, on Friday, The Public Company Accounting Oversight Board (PAOB) said it signed an agreement with Chinese regulators which allows it to audit U.S.-listed Chinese companies without consultation or input from Chinese authorities. The delisting threat was a significant concern for many of these stocks, so the agreement should help decrease their overall volatility.

Investors seem happy with the news, given the stock added to last week’s 25% gain and reached its highest level of 2022 intraday. 📈

Jerome Powell’s Jackson Hole speech sent stocks into a tailspin on Friday, and several Fed officials are speaking publicly this week. 🎤

So the big question is, will they deliver the same messaging as Powell did last week?

Today, Bloomberg interviewed Federal Reserve Bank of Minneapolis President Neel Kashkari, who didn’t mince words. 💬

Conor Sen has a tweet thread with his thoughts on the article, but in essence, Kashkari said that he was happy to see the stock market sell-off on Friday.

Kashkari not holding back: pic.twitter.com/k0rZQIHqdU

— Conor Sen (@conorsen) August 29, 2022

His view is that the market was rallying in anticipation of a Fed pivot towards a ‘looser policy’ that isn’t coming. So the fact that stocks are selling off means investors may be finally accepting that the Fed will stay aggressive until inflation shows meaningful progress towards the 2% goal.

We’ll have to see if the other Fed members use the explicit language that Powell and Kashkari have. If they do, that might not be great for stocks in the short-term, but clearer messaging on the Fed’s next moves could prove to be a longer-term net positive. 🤷♂️

Health care remains one of the best-performing sectors year-to-date, down just 9.62%, but it’s a broad sector that includes a lot of subindustries. As a result, performance can vary widely depending on the industry and market-cap segment.

Today we head from the $16 billion pharmaceuticals company Catalent, which reported better-than-expected earnings, but revenues fell short of expectations. Additionally, its revenue and full-year outlook came in below estimates.

Overall, investors did not appear thrilled with what they heard from the company, sending the stock down 7.44% towards its YTD lows. 📉

Bullets

Bullets From The Day:

🤖 Panera bread tests AI drive-thru lanes. Two locations in upstate New York are testing artificial intelligence technology to take drive-thru orders. A surge in drive-thru sales during Covid has led to many companies investing heavily in the drive-thru experience to improve their customer experience and streamline operations. Panera is using voice-ordering technology called Tori from tech startup OpenCity. More from CNBC.

🌬️ Indian government unveils new ‘fresh air’ helmet in the battle against smog. The capital of India, New Delhi, is preparing for winter and the accompanying acrid smog that comes with it. This year, they’ll be taking on the pollution issue with a motorcycle helmet fitted with filters and a fan at the back that says it can remove 80% of pollutants. State agencies have invested heavily into the startup Technolabs, that’s been developing the helmet since 2016. It hopes to be a solution for motorcyclists who typically have no protection from poor air quality. Reuters has more.

💸 Y Combinator announces next president and CEO. Geoff Ralston, who has been with the accelerator since 2011, will leave next year and pass the baton to Garry Tan. Tan was the tenth employee at Palantir, co-founded Posterous (acquired by Twitter in 2012), and co-founded an early-stage VC firm with more than $1 billion in assets under management. Additionally, he was a YC founder in the summer of 2008 and served as a partner for roughly five years. More from TechCrunch.

🛍️ Walmart looks to buy out South African retailer Massmart. The company has offered $377.6 million for the remaining 47% of Massmart it doesn’t already own, representing a premium of over 50% from its last trading price. Walmart initially took a 51% stake in Massmart in 2010 for $2.3 billion, but it’s struggled to deal with a competitive landscape of local retailers. So this is essentially Walmart furthering its bet on the South African retail market, though at a much lower price. Reuters has more.

⚡ Another U.S. EV battery plant is coming shortly. The electric vehicle investment boom continues, with Honda Motor and LG energy Solution announcing a $4.4 billion joint venture to build a U.S. battery plant. They expect the facility to mass-produce advanced lithium-ion battery cells by the end of 2025. And although they did not specify a location, speculation is that it will be near one of Honda’s manufacturing facilities in Ohio, Alabama, or Indiana. More from CNBC.

Links

Links That Don’t Suck:

🎃 Starbucks’ Pumpkin Spice Latte is coming back at a higher price

🧪 Biden administration to stop sending free at-home Covid tests Friday

🚗 St. Louis threatens to sue Hyundai and Kia over theft epidemic

🚫 Dell ceases all Russian operations after August offices closure

🚀 SpaceX Falcon 9 rocket breaks payload mass record with repaired booster

🧑🚀 NASA’s Artemis I launch scrubbed after engine issue

🧑💼 Singapore introduces new work visa rules to woo foreign talent