Stocks are down three days in a row — here’s what you missed. 👀

Today’s issue covers retailers’ Best Buy & Big Lots reports, some shocking tech earnings, and the one chart every technical analyst is watching! 📰

Check out today’s heat map:

Every sector closed red, with energy (-3.39%), materials (-1.67%), and utilities (-1.46%) leading to the downside. 🔻

In economic news, the Conference Board consumer confidence index rose to 103.2 in August, its first uptick in four months. JOLTs data showed job openings totaled 11.24 million, well above the 10.3 million estimated by Wall Street. It remains nearly double the pool of available workers, which was 5.67 million. Lastly, the S&P Cash-Shiller data showed that home price growth slowed for the second straight month to 18% YoY. 🗞️

After the landmark U.S.-China audit deal, regulators are wasting no time, notifying Alibaba of a U.S. audit inspection just days after the agreement. 🕵️

In individual stock news, Lucid and Nikola fell after both electric vehicle companies filed to raise additional funds. 💵

Snapchat shares fell nearly 3% after announcing it will lay off another 20% of its staff. 📉

The volatility among new issues continued, with Hempacco offering a million shares for $6.00 each. The price opened at 38 and rose to 41.80 before closing at 7.78. 🤷

And in Twitter news, Elon Musk filed another notice to cancel the Twitter takeover, this time citing the whistleblower’s data privacy concerns. Meanwhile, on the product side, Twitter is launching its ‘Close Friends’ feature, Circle, globally. Lastly, its competitor Facebook is shutting down its standalone Gaming app after failing to challenge Amazon’s Twitch. 💬

On the crypto front, OpenSea’s daily trading volumes have fallen 99% from their peak. Crypto.com accidentally transferred $10.5 million to a client instead of a $100 refund. And pressure from federal agencies is heating up as they inquire about what crypto exchanges are doing to safeguard consumers against scams. ₿

Other symbols active on the streams included: $MYOV (-4.11%), $CFVI (-7.12%), $MGAM (+103.85%), $APE (-14.19%), $AVCT (-14.45%), $BBBY (-9.29%), $WEBR (-16.84%), and $PSNY (-4.36%). 🔥

Here are the closing prices:

| S&P 500 | 3,986 | -1.10% |

| Nasdaq | 11,883 | -1.12% |

| Russell 2000 | 1,856 | -1.45% |

| Dow Jones | 31,791 | -0.96% |

Earnings

A Big Box Surprise

Traditional retailers continue to battle the macro environment, changing consumer behavior, and a struggling business model.

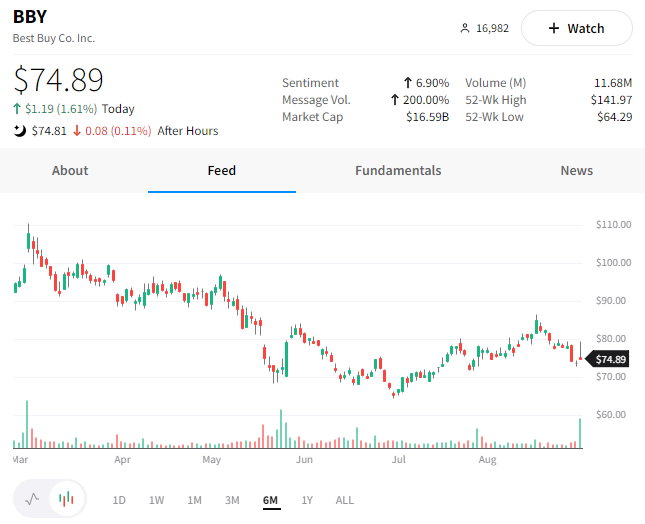

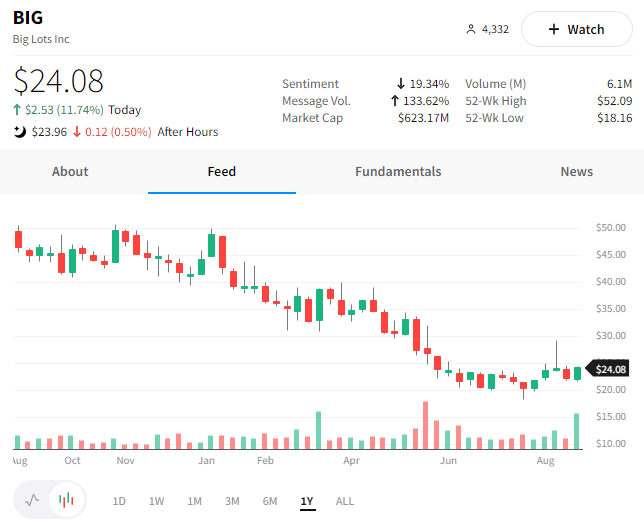

Today before the market opened, we heard from two of them, Best Buy and Big Lots. 🛍️

Best Buy, like many others, cut its outlook ahead of the report and was able to save face. Its earnings and revenue exceeded expectations, and the company reaffirmed its full-year guidance.

Consumers are spending more on essentials than discretionary items, forcing the company to increase promotional offers to bring in customers. Still, the change in consumer spending habits has caused same-store sales to drop 12.1% YoY, and the company expects a full-year decline of 11%. 📉

Overall, the news was less bad than expected, but investors expect more of the same from the company as it tries to cut costs and weather the weak environment. ⛈️

Meanwhile, discount retailer Big Lots managed to beat earnings estimates, reporting a loss of $2.28/share vs. the $2.47/share estimate. Additionally, revenue was in line with expectations. 👍

As we learned from Dollar General, discount stores are doing better in an environment where consumers try to stretch their dollars further.

In another case of “not as bad as expected,” the stock popped nearly 12% despite the mixed results.

If you follow markets somewhat regularly, chances are you’ve heard of the 50 and 200-day moving averages. These are trend-following indicators that technical analysts use to measure the medium and long-term trends in a market. 📈📉

Well, these spooky indicators are back in the news because the S&P 500 is sandwiched right between the two averages, which means…well, that depends who you ask, lol. 🎃

The overall theory is that when prices are below a moving average, it’ll act as “resistance,” and when prices are above a moving average, it’ll act as “support.” However, if you test this theory with any rigor, you’ll notice that it has mixed results at best, meaning sometimes prices react to these moving averages and other times they don’t.

Many point to its significance as a self-fulfilling prophecy, meaning it has importance because many people believe it has importance and therefore factor it into their decision-making process.

We’re not here to debate who is right or wrong, but instead, provide an explanation for the chart you’ll inevitably see in the coming days/weeks if you haven’t seen it already.

Below is the S&P 500 ETF $SPY, which is sitting right at its 50-day moving average after reaching its 200-day moving average three weeks ago before selling off. Technical analysts will watch these two key levels on the upside and downside as an indicator of the market’s next move. 👀

If prices decisively break below the 50-day moving average, bearish analysts believe a test of the June lows is ahead. Meanwhile, if its prices break above the 200-day moving average, bullish analysts say there are blue skies back to all-time highs. 🤷♂️

We’ll have to wait and see what happens, but for now, at least you’ll have some context about what they’re talking about on the streams and in the news. 👍

Earnings

Some Shocking Tech Reports

A few retail favorites in the tech space reported today, so let’s quickly recap them. 📰

First off, Chewy (sort of a tech company) fell nearly 10% after reporting a surprise second-quarter profit. However, its revenues and active customers were slightly below expectations. 😮

The company’s lowered full-year guidance appears to be sending the stock down, with management saying that rising prices have shifted spending from goods to pet medications and food.

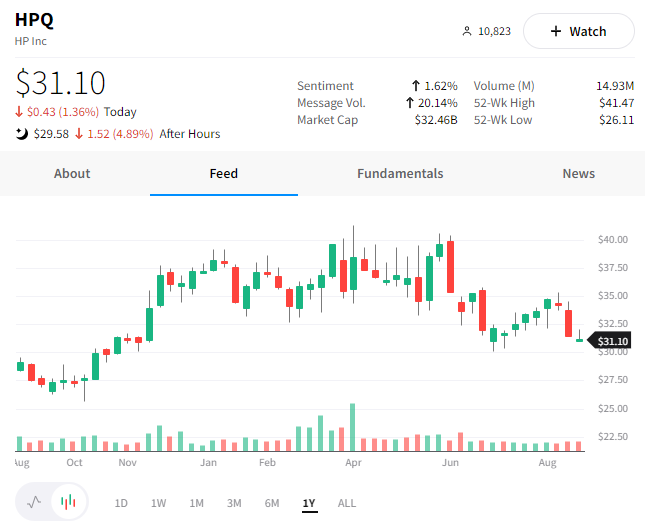

As the pandemic PC binge continues to cool down, HP Inc. missed earnings and revenue estimates. The PC and printer company said the sales decline reflects macroeconomic uncertainty, with operating profit margins falling 150 bps in its personal systems segment.

HPQ shares were down nearly 5% after hours, trading at fresh year-to-date lows. 📉

Meanwhile, Hewlett Packard Enterprises, which focuses on enterprise-computing hardware, reported better-than-expected earnings and revenue. While it slightly adjusted the top end of its earnings forecast down, the enterprise business appears to be holding up better than personal computers/printers. $HPE shares were up roughly 2.50% after hours. 📈

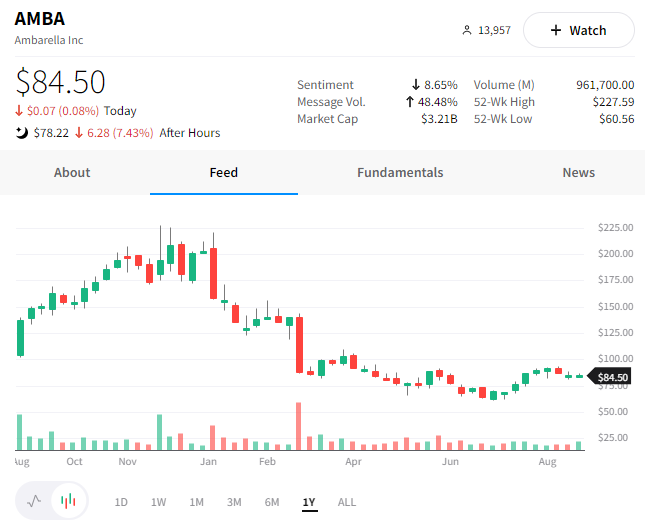

Lastly, the mid-cap semiconductor company Ambarella reported better-than-expected earnings and revenue for the quarter. However, it lowered its sales outlook, which is why its shares are likely down over 7% after hours. 🔻

Keep track of all the companies reporting earnings with the Stocktwits earnings calendar. 📅

Bullets

Bullets From The Day:

🌿 Beverage companies bet big on cannabis drinks. As the market for legal marijuana expands, companies are betting people will want cannabis drinks as an alternative to alcohol. One concern is the dosing and a lack of research about the drinks. Still, cannabis research agency Brightfield Group estimates that the industry will grow to roughly $1 billion in U.S. sales by 2025. More from CNBC.

🏭 First Solar announces new U.S. panel factory. The U.S. has passed legislation to spur the domestic production of solar and other alternative energy sources, giving companies the final push they needed. For example, First Solar announced it would invest up to $1 billion in a new solar panel manufacturing facility in the southeast U.S. and spend another $185 million upgrading and expanding its existing Ohio facilities. The CEO noted that current legislation had incentivized the entire supply chain, which is a significant tailwind for the industry. CNBC has more.

💽 Another huge Chinese database has leaked. Over 800 million faces and vehicle license plates were exposed on the internet for months in one of China’s most extensive data security lapses this year. The exposed data is from a company that builds systems for controlling access for people and vehicles to workplaces, schools, and other secure sites across China. Data breaches like this continue to highlight a vital concern of the technology age, where data is currency. More from TechCrunch.

🛍️ Several retailers unveil an unconventional inventory strategy. While major retailers like Target aggressively discount merchandise to eliminate excess inventory ahead of the holiday season, Kohl’s and Gap are taking a different approach. They’ve opted to hold some unsold merchandise in their warehouses and put it back on shelves later this year and next in a strategy called “pack and hold.” We’ll have to see if the strategy pays off for these struggling retailers or if they’re left holding a literal bag. CNN Business has more.

✋ American credit scores halt their upward progress. As Americans reach for their credit cards in this highly inflationary environment, their credit scores are beginning to suffer as utilization and late/missed payments tick up from historic lows. Additionally, much of the savings resulting from lower pandemic spending and stimulus payments have largely run out, meaning consumers have less cushion than before. FICO scores remain above pre-pandemic levels but will be monitored closely as the current economic recession develops. More from Fortune.

Links

Links That Don’t Suck:

📈 Labor Day Sale: Level up your investing game with 1 month of IBD Digital access for only $1*

🧑💻 Meta loses key metaverse official shortly after criticism over Chief Mark Zuckerberg’s Avatar

📽️ Megan Thee Stallion joins She-Hulk and the Marvel Cinematic Multiverse

👕 Tesla must allow workers to wear clothing supporting union

💊 Drug typically used in cancer therapy emerges as powerful anti-aging remedy

🚚 Amazon facing ‘unfavorable regulatory environment’ in India, struggles to expand

💳 The Fed gives a timeline for FedNow, its payments platform

🛢️ France accuses Russia over gas supply as Nord Stream shutdown looms

🏥 Texas reports what may be the first U.S. death from monkeypox

📰 Mikhail Gorbachev, ex-Soviet leader who ended the Cold War, dies aged 91, report says

*this is a sponsored post