It’s all quiet on the market front as investors brace for Wednesday’s Fed decision — here’s what you missed today. 👀

Today’s issue covers Rumble’s first trading day, Nvidia’s breakup, Autozone earnings, and other news from the day! 📰

Check out today’s heat map:

8 of 11 sectors were green, with consumer discretionary (+1.20%) leading and real estate (-1.12%) lagging. 💚

In U.S. economic news, the NAHB index showed homebuilder sentiment falling for the ninth straight month. More than 25% of builders have lowered prices as rates surged. Additionally, home-flipper Opendoor lost money on 42% of its August resales as demand slumped. And Zillow said home values declined for the second straight month in August. 🏘️

The Federal Aviation Administration rejected a proposal to halve the hours required to become a co-pilot. While flight delays are an issue, I think we’d all agree more training is better. 🧑✈️

In individual stock news, Bluebird Bio’s Skysona received FDA approval. The new $3m gene therapy broke the company’s previous pricing record, though the stock price fell 10% today. 😮

Ford shares fell 5% after hours following a warning that it will incur an extra $1 billion in supply chain costs during the third quarter.

In crypto news, The European Central Bank has chosen Amazon and four other companies to assist in developing user interfaces intended for a digital Euro. The British Financial Conduct Authority listed FTX crypto exchange as an ‘unauthorized’ firm. And South Korean prosecutors asked Interpol to issue a red notice for Do Kwon. ₿

Other symbols active on the streams included: $FOXO (-37.81%), $VTAQ (+54.60%), $BYND (-6.72%), $NKLA (-10.55%), $BCTX (-22.97%), $MULN (-8.22%), $AVCT (+28.11%), and $HKD (-14.81%). 🔥

P.S. It’s “Stocktwits Community Week,” with in-person events all around the country. RSVP for an event near you and connect with fellow Stocktwits traders and investors. We’ll see you there! 🍻

Here are the closing prices:

| S&P 500 | 3,900 | +0.69% |

| Nasdaq | 11,535 | +0.76% |

| Russell 2000 | 1,813 | +0.81% |

| Dow Jones | 31,020 | +1.19% |

Company News

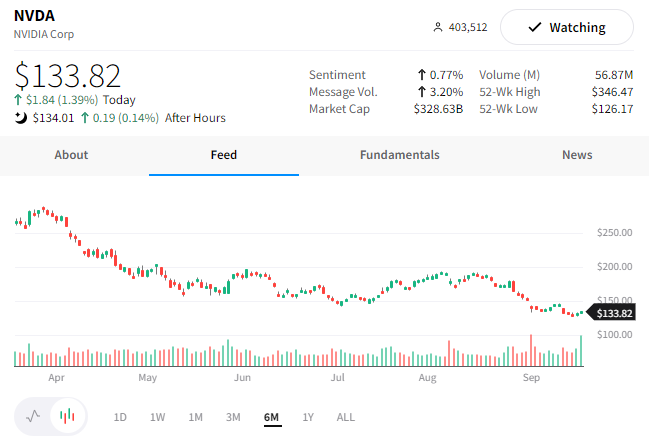

Breaking Up With Nvidia

EVGA, one of the largest manufacturers of graphics card add-in boards, is quitting the board business for two reasons.

Its first reason is the sector’s financial outlook turned bleak after the Ethereum Merge, which moved the cryptocurrency from proof-of-work to proof-of-stake. ⚒️

Second, it stated “mistreatment” from its partner Nvidia. Despite holding 40% of the North American market share of Nvidia cards, it says Nvidia kept it in the dark on prices until the last minute and undercut it by selling its own first-party branded cards.

On top of that breakup news, America’s favorite pundit is now short Nvidia, calling it “a loser.” Cramer stated that higher-end products needed for machine learning are too far out to produce earnings. Meanwhile, the company’s lower-end products are being hurt by the Ethereum merge, the overall decline in the crypto space, and the steep drop in gaming demand.

With $NVDA shares already down 65% from their all-time high, we’ll have to see if the bearish bets pay off. Or if the “inverse Cramer” indicator continues its hot streak. 😂

Company News

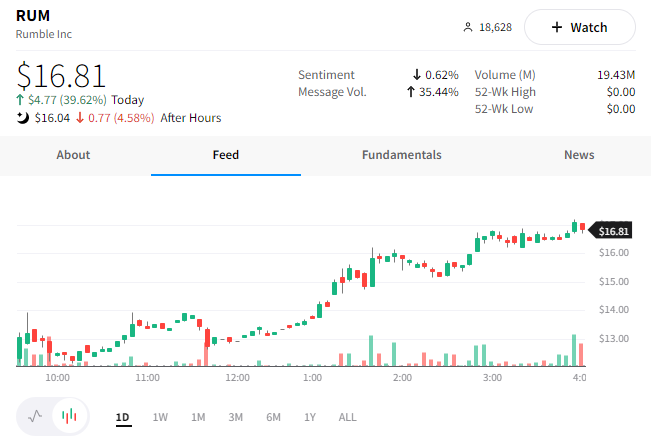

Let’s Get Ready To $RUM-ble

After months of anticipation, blank check company CF Acquisition Corp. VI ($CFVI) completed its business combination with the video-sharing platform “Rumble.” The combined company’s shares began trading on the NASDAQ today under the ticker symbol $RUM.

In an age where most social media platforms like YouTube have to choose between censorship and hosting a free-for-all, Rumble is stepping in as a high-growth neutral video platform. It says its goal is to create rails and independent infrastructure designed to be immune to cancel culture, hence its mission to restore the Internet to its roots by making it free and open again.

In today’s highly polarized environment, it will be interesting to see if the platform can gain enough traction to compete with the largest players in the space. 🤔

At the very least, some investors may invest in the company to support the idea of “free speech” that they think is lacking on other platforms, the same way people bought Gamestop to fight against Wall Street. They’re buying the idea, maybe not the execution (yet).

$RUM shares rose 40% on their first trading day, and one many are watching in the coming weeks. 👀

Earnings

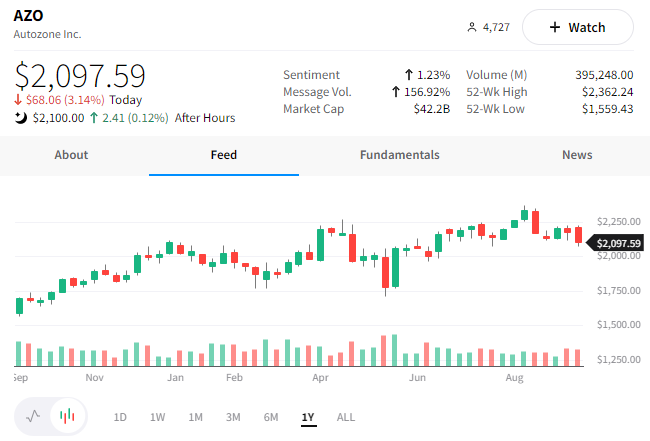

In The Zone…AutoZone

When money is tight, people are more likely to repair their cars than buy new ones. That’s why people watch retailers like AutoZone for hints on the health of the economy. Unfortunately, today’s report didn’t tell us all that much. 👎

The company reported EPS of $40.51 vs. $38.51 expected and revenue of $5.3 billion vs. $5.2 billion expected.

The company had positive same-store sales but noted that revenue gains this quarter came from inflation. The price increases passed along to consumers matched the increase in the cost of goods, which was about 10%. 🔺

The company expects inflation to be similar in the first quarter of fiscal 2023 and did not provide an earnings forecast, citing the uncertain environment.

Despite the current-quarter beat, investors don’t seem thrilled with the company’s outlook (or lack thereof). After an initial pre-market pop of 4%, $AZO shares trended lower and closed down 3%. 📉

Bullets

Bullets From The Day:

💳 Tech talent finds soft landing at AMEX. Tech layoffs continue, allowing other industries to pick up talent on the cheap(er). For example, American Express plans to hire about 1,500 people for technology roles by the end of the year, adding to the 3,600 it’s already employed so far this year. While other financial giants like Goldman cut costs, some use the downturn as an opportunity to expand their teams and beef up their technology/cybersecurity departments. More from Reuters.

🔋 A hydrogen fuel cell more efficient than a diesel engine? The Hydrogen fuel cell maker Loop Energy said its latest cell system can now deliver better fuel economy than a diesel engine at current price levels. However, this fuel method has faced two challenges so far for widespread adoption, including being far less efficient than diesel, and there’s a lack of fuelling infrastructure in Europe. The new system addresses the first issue and moves us closer to a green future. Reuters has more.

💰 Porsche sets lofty target valuation for planned IPO. Volkswagen is targeting a $70.1-$75.1 billion valuation for its luxury sportscar maker. The valuation is slightly below some estimates of up to 85 billion euros but still outpaces the valuation of other German carmakers like BMW’s 49 billion euros or Mercedes-Benz’s 61 billion. The IPO will begin trading on September 29th, though it could be postponed or canceled in the event of new “severe geopolitical problems.” More from CNBC.

⚡ Mercedes-Benz unveils its longest-range electric truck yet. The eActros Longhaul has three battery packs for a total capacity of “over 600 kWh.” The company also notes that the truck’s battery pack can be charged from 20 to 80% in “well under 30 minutes” when using a charging station with an output of “about one megawatt.” Volume production will begin in 2024. Electrek has more.

🤖 1MRobotics raises $25m for ‘nano-fulfillment’ centers. On-demand delivery is a challenging space, but brands, retailers, and operators continue to push for delivery methods that maximize efficiency. This trend has given way to micro-fulfillment centers that don’t serve in-person customers but instead have employees pack orders for online delivery orders. 1MRobotics is looking to take an automation-first approach to deploy these types of stores for rapid delivery, raising a $16.5 million Series A round to do so. More from TechCrunch.

Links

Links That Don’t Suck:

🪦 Mass graves unearthed in Ukraine’s Izyum after Russian retreat

🦿 A man borrowed $75,000 for leg-lengthening surgery to make him 3 inches taller, report says

💸 Instacart plans to focus on selling employee’s shares in IPO, WSJ reports

🤑 Frugal is the new cool for young Chinese as economy falters

🌪️ Hurricane Fiona makes landfall in Dominican Republic as most of Puerto Rico remains without power

🚀 How billionaire Jared Isaacman is using fighter jets to prepare his crew for private SpaceX missions