Stocks and bonds are flirting with their lows ahead of the Federal Reserve’s interest rate decision — here’s what you missed today. 👀

Today’s issue covers Ford’s cost inflation, a housing update, Stitch Fix earnings (or lack thereof), and other news from the day! 📰

Check out today’s heat map:

Every sector was red, with real estate (-2.61%) and materials (-1.87%) leading lower. 🟥

In international news, Sweden’s central bank raised rates by 100 basis points and warned that “inflation is too high.” ECB president Christine Lagarde raised the prospect of rate hikes beyond the “neutral level.” And hurricane Fiona is hitting Turks and Caicos after devastating Puerto Rico and the Dominican Republic. 🗺️

Microsoft raised its quarterly dividend by 10% as the stock tries to stay above its June lows. 📈

Peloton continues its turnaround, launching a new line of rowing machines starting at $3,195. 🚣

Spotify is launching audiobooks, allowing U.S. listeners to purchase more than 300,000 titles. 🎧

In a sign of these trying times, “SPAC King” Chamath Palihapitiya is shuttering two tech SPACs after failing to find a target. 👑

YouTube made headlines after announcing changes to make its Partner Program more friendly to short-form video content creators. Additionally, it introduced “Creator Music,” which will give creators an easier way to use music in their videos. 🖥️

In crypto news, Nasdaq is reportedly preparing crypto custody services for institutions. The U.S. Treasury has begun its public consultation on how to regulate crypto. And crypto market maker Wintermute lost $160 million to a hack. ₿

Other symbols active on the streams included: $RUM (-23.91%), $MGAM (+26.45%), $AVCT (-10.08%), $MULN (-5.01%), $HKD (-21.20%), $VRAX (+41.30%), $VIRI (-75.50%), and $VTAQ (-13.33%). 🔥

Here are the closing prices:

| S&P 500 | 3,856 | -1.13% |

| Nasdaq | 11,425 | -0.95% |

| Russell 2000 | 1,788 | -1.40% |

| Dow Jones | 30,706 | -1.01% |

Company News

Ford Flops On Supply Chain Warning

After yesterday’s close, Ford warned investors that inflation and supply chain issues would cost it an extra $1 billion during the third quarter. 🔺

Parts shortages have prevented 40,000-45,000 vehicles from reaching its dealers, mainly high-margin trucks and SUVs. However, it expects to be able to ship those vehicles during Q4.

Executives reiterated their full-year guidance, projecting 2022 adjusted EBITDA of $11.5-$12.5 billion. They also said they’d “provide more dimension about expectations for full-year performance” at its third-quarter earnings release on October 26th. 📅

Supply chain issues have affected most industries throughout the pandemic, hitting automakers particularly hard. In July, General Motors warned investors that it had about 95,000 vehicles lacking some components. ⚠️

Overall, while the company remains optimistic, investors appear less so. $F shares were down 5% after hours and are down 11% so far in today’s session. 👎

Economy

Unexpected Housing Data

While fourteen-year highs in mortgage rates and record-high prices keep a lid on the overall housing market, rising rents pushed the construction of multi-family housing to 36-year highs in August. Starts for housing projects with five units or more soared 28.6% to 621,000 units. Meanwhile, single-family housing starts rose 3.4% to a rate of 935,000 units. 🏘️

This strength pushed the seasonally adjusted annual rate of housing starts up 12.2% to 1.575 million in August. However, the report revised July’s data down from 1.446 to 1.404 million.

Although housing starts were strong, building permits dropped 10.0% to the lowest level since 2020. Single-family building permits dropped 3.5%, and multi-family permits fell 18.5%. 📉

Overall though, the housing market remains in rough shape.

Homebuilder sentiment has dropped for nine straight months, with a quarter of builders dropping prices to attract buyers. With the Fed expected to continue hiking rates tomorrow and into 2023, affordability isn’t likely to get better anytime soon. That means prices will have to come down to meet demand. Or so the Fed hopes. 🤷

Tomorrow’s reports from $LEN and $KBH should provide additional color on housing. Though a quick look at stocks like $OPEN, $Z, and $RDFN paint a pretty bleak picture… 🙀

Earnings

Stitch Fix Needs Fixing

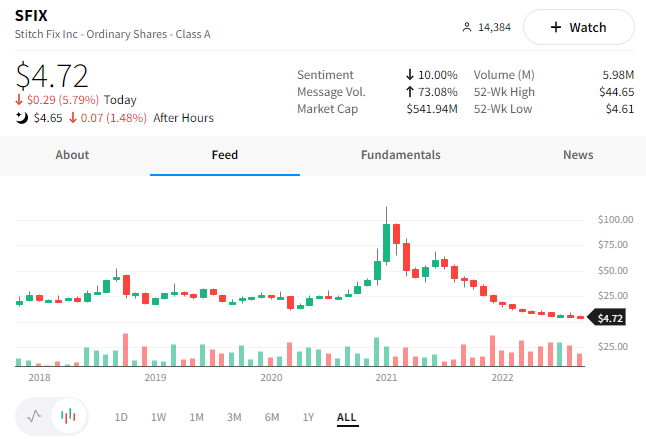

Technology and consumer discretionary companies have been hit hard by rising interest rates and recession fears. Unfortunately for online personal styling service Stitch Fix, its business sits at the intersection of both industries. 📌

The company reached a peak market cap of $11 billion in early 2021 and has been sinking since, reaching $500 million ahead of today’s earnings report. 🔻

Both its diluted loss per share ($0.89 vs. $0.60) and revenues ($481.9 million vs. $488.79 million) missed expectations. Additionally, the company reported a 9% YoY decline in clients (3.795m).

While this quarter’s results disappointed, its guidance for the coming quarter added insult to injury. Management expects revenue of $455-$465 million, a 20-22% YoY decline and well below the $528 million analysts expected.

While the company continues to focus on a return to profitability, it noted: “Today’s macroeconomic environment and its impact on retail spending has been a challenge to navigate…” Sounds very familiar to what we’ve heard from other retailers about the current environment. 😬

$SFIX pared its losses after hours but remains near all-time lows as investors weigh its future. 📉

Bullets

Bullets From The Day:

⚖️ Cancer victims urge the court to end the J&J bankruptcy roadblock. People suing Johnson & Johnson over its talc products urged an appeals court on Monday to revive their claims, saying it should not be allowed to use a bankrupt subsidiary to block lawsuits alleging the products cause cancer. The company spun off its subsidiary in October, assigned its talc liabilities to it, and then placed it into bankruptcy. The commonly used restructuring strategy paused about 38,000 lawsuits J&J was facing and sent the victims into a state of perpetual litigation. More from Reuters.

👎 Judge denies bid to stop UnitedHealth’s acquisition plan. A U.S. judge rejected the Justice Department’s request to stop the company from buying Change Healthcare, which many see as a blow to the current administration’s stricter enforcement of antitrust issues. The DOJ argued that the deal would give the largest U.S. health insurer access to its competitors’ data and ultimately increase healthcare costs. So far, though, the courts have not seen it that way and continue to rule in UnitedHealth’s favor. Reuters has more.

💰 Two veteran sports execs launch Velocity Capital Management. Former private equity professional David Abrams and ex-Sportrader CEO Arne Rees are joining forces to launch the early-stage venture firm. The two plan to invest up to $50 million in companies with enterprise values of up to $2 billion, particularly in the sports, media, and entertainment industries. While they plan to take a non-controlling interest, they want to play an active role in helping the growth-stage companies they invest in. More from CNBC.

🔺 Apple App Store announces international price hikes. The company confirmed it would raise the prices of apps and in-app purchases in all of the eurozone and some Asian and South American countries beginning in October. While some price increases were due to new regulations in certain countries, the primary driver is the declining value of international currencies relative to the U.S. Dollar, which can meaningfully impact the company’s financial results. Reuters has more.

⚡ Hertz to buy up to 175,000 EVs from General Motors. As consumers become more eco-conscious, rental car companies like Hertz are expanding their fleet of electric vehicles to meet demand. The company said today that it plans to order up to 175,000 EVs from General Motors over the next five years, with the first deliveries expected to begin in Q1 2023. Hertz has previously signed deals with Polestar and Tesla to order a combined 165,000 EVs as it moves towards electrifying 25% of its fleet by the end of 2024. More from TechCrunch.

Links

Links That Don’t Suck:

🦉 Night owls at high risk of certain chronic diseases, study says

🤝 Amazon, Pepsi, others agree to hire 20k refugees for U.S. jobs

💊 Amazon loses PillPack founders four years after acquisition of pharmacy startup

💽 Salesforce built a data lake to transform how customer data moves on the platform

🏥 America’s sexually transmitted disease problem is ‘out of control’

❌ Gap eliminating about 500 corporate jobs as sales fall

💾 American Airlines admits data breach

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.