If yesterday was a reversal, today was a reversal of the reversal. Now that you’re as confused as we are — here’s what you missed. 👀

Today’s issue is earnings-heavy, with several retail favorites like Nike, CarMax, and Rite Aid reporting. Meanwhile, investors continued to clean up their portfolios into quarter-end. 🧹

Check out today’s heat map:

Every sector was red, with utilities (-4.01%) and consumer discretionary (-3.45%) leading lower. 🔻

In U.S. economic news, the final Q2 GDP reading was unrevised at -0.60%, and initial jobless claims hit a five-month low. Internationally, things remain tense as many expect Russia to annex more of Ukraine on Friday. 🗺️

In electric vehicle news, Lordstown Motors began production of its Endurance electric pickup truck. Citroen announced an EV concept that uses recycled cardboard with a top speed of 68 mph. Lastly, Chinese EV maker Leapmotor plunged from its offer price amid the market’s volatility. ⚡

Despite the challenging market environment, Porsche pulled off a historic $72 billion public listing in Germany. 💰

In social media news, Mark Zuckerberg says Meta is freezing hiring and cutting costs. Meanwhile, Twitter is adding a new TikTok-like full-screen video feature because there isn’t enough short-form video in the world, right? 🥱

Bed Bath & Beyond shares fell 4% after reporting a 28% decline in quarterly sales and a wider-than-projected loss. 📉

Peloton crashed 15% to new all-time lows after announcing its first brick-and-mortar partnership with Dick’s Sporting Goods. 🤝

Other symbols active on the streams included: $APE (-13.95%), $AMC (-7.43%), $APRN (-10.47%), $MULN (-5.45%), $AVCT (+6.80%), $BBAI (+30.25%), $AMLX (+3.28%), and $ABOS (+9.39%). 🔥

Here are the closing prices:

| S&P 500 | 3,640 | -2.11% |

| Nasdaq | 10,738 | -2.84% |

| Russell 2000 | 1,675 | -2.35% |

| Dow Jones | 29,226 | -1.54% |

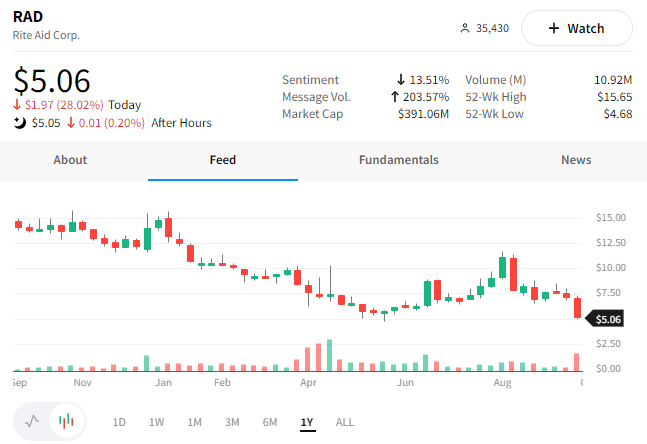

Rite Aid, yes, it’s still a publicly traded company (for now), tumbled nearly 30% today after a big earnings miss. 😮

The drugstore chain reported adjusted earnings per share loss of $0.63, below the $0.50 expected. Meanwhile, revenue fell about $200 million YoY to $5.901 billion.

Where the company faced trouble was its outlook. It stuck with its fiscal 2023 revenue guidance but forecasted a larger-than-expected loss of $477.30-$520.30 million. Additionally, its same-store sales disappointed, growing just 0.3% on an inflation-adjusted basis. 👎

As is usually the case, a business struggling during the good times is likely to perform poorly in the bad times. And that’s what we’re seeing here as it faces continued pressure on consumer spending and supply chain challenges.

Who knows what can save the company, but it’s certainly in need of some aid as its stock approaches a new all-time low. 📉

Sponsored

Hidden Wealth’s “Pick of the Year” Isn’t What You Expect

According to a recent ground-breaking Goldman Sachs report, a US recession could cause the S&P 500 to freefall an additional 14% by year-end.

That’s why the financial experts at Hidden Wealth are focused on finding “hidden gems” outside of traditional markets.

Their latest find could be totally different from anything you’ve seen before.

Because the doors to one exclusive market have been thrown wide open…

By a platform that’s averaging a net return of 29%*, across six separate exits.

*Past returns are no guarantee of future results. See important Regulation A disclosures.

**3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

Nike: “Just Don’t It?”

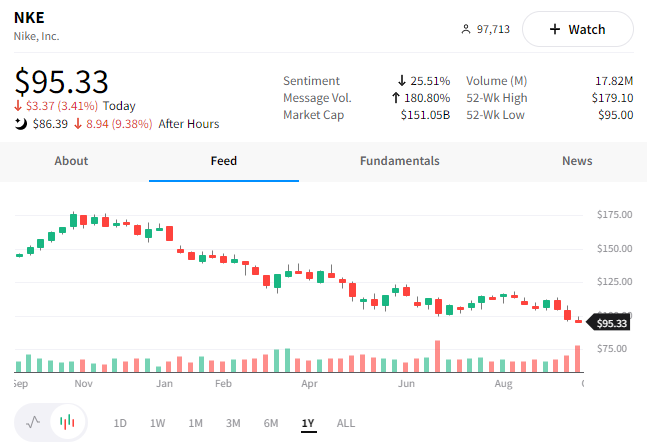

With bellwether companies like FedEx and Target missing earnings, investors can add Nike to their list of disappointments.

On its surface, the athletic apparel company’s report didn’t seem that bad. EPS of $0.93 beat the $0.92 expected, and revenues of $12.69 billion were above estimates of $12.27 billion. 📈

With that said, its forward guidance is what’s getting it put in the dog house. The company says supply chain headwinds like rising shipping costs and times have caused its inventory levels to swell significantly during the quarter. While this was partially offset by strong demand, concerns over its sales channels remain.

The largest part of Nike’s business is wholesale, which only saw a 1% increase. Meanwhile, its direct sales grew by 8%, and its digital-brand sales rose by 16%.

As expected, shutdowns in the Greater China region caused a sales decline of 16%. So although conditions in China are improving, there’s still a lot of uncertainty around its business there. And with the U.S. economy looking like it’s going to get worse before it gets better, some analysts have concerns over demand in North America. 😬

In the short-term, bearish investors are shipping the stock back, sending shares down another 10% after hours. Meanwhile, the bulls argue that the stock is already down more than 50% and that much of the bad news is already baked in.

Given the current market and economic environment, bears feel like they still have the upper hand. However, we’ll have to see what the rest of the week and next quarter bring for $NKE. 🤷

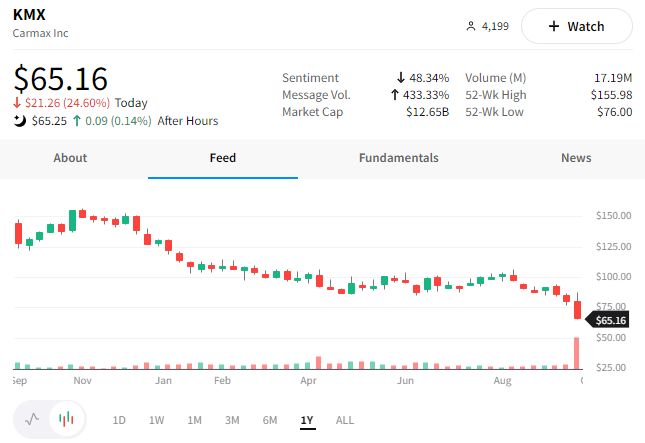

The used car market has been bonkers over the last few years, but as of now, it remains on the downswing. For example, shares of CarMax fell 25% today to a 2-year low after reporting a second-quarter profit well below expectations.

Its earnings per share was $0.79 vs. the $1.39 expected. Additionally, revenues of $8.14 billion fell short of the $8.54 billion expected. 🔻

Like in housing, the used car market faces an affordability crunch. Record-high prices, rising interest rates, and an uncertain economy have led to a steep decline in demand.

CarMax saw vehicle unit sales fall 10.30%. Meanwhile, the average price of a used vehicle sold was up 9.60%, and average wholesale vehicle prices were up 17%. Comparable-store used vehicle unit sales fell 8.30%, way higher than the consensus estimate for a 3.60% decline. 😱

With the Federal Reserve waging war on demand and prices, things don’t look great for CarMax and the used car industry. As a result, competitors like Carvana (-19.73%) and Penske (-9.16%) fell in sympathy throughout the day. 📉

Bullets

Bullets From The Day:

💵 China Yuan-ts its state banks to sell Dollars. The country has asked major state-owned banks to be prepared to sell dollars for the local unit in offshore markets to help stem the yuan’s decline. In addition, state banks were told to ask their offshore branches to review their offshore yuan holdings and ensure they have enough U.S. dollar reserves to deploy. The Chinese currency is down 11% vs. the Dollar, its biggest annual loss since 1994 when China unified its official and market rates. It hopes that selling dollars and buying yuan can help form a floor under the currency. Reuters has more.

🔋 Brookfield buys U.S. renewable developers. The Canadian Asset Manager’s renewable power unit is acquiring wind and solar firm Scout Clean Energy LLC for $1 billion. It’s also buying Standard Solar Inc. for $540 million, saying it could invest more than $4500 million across both to help them grow. The move represents a major global trend of large investors pouring money into clean-energy firms, specifically as Europe and other parts of the world struggle with Russian energy dependency. More from Fox Business.

🚫 Instagram sparks controversy by permanently disabling Pornhub’s account. The suspension raises an issue of how social media companies apply their rules and standards across their platforms. Pornhub wrote an open letter to Meta, claiming that Instagram’s enforcement of its platform rules is “opaque, discriminatory and hypocritical.” As the adult entertainment industry grows, these platforms will have to figure out how to manage that type of content fairly. TechCrunch has more.

🤔 What the fund is going on in the U.K.? Pension funds were in a panic after losing a significant portion of their value when U.K. government bond yields soared. Rumors are this panic was a primary reason for the Bank of England to step in and try to stabilize the market. While the connection is a bit confusing, essentially, the pension funds hold a lot of their assets in liquid long-dated bonds. But when the prices of those bonds become unstable, there’s a risk that the funds themselves can become insolvent (unable to meet their liabilities). More from CNBC.

⚔️ The executives of top companies are fighting back against ESG. There’s not a lot of love for the Securities and Exchange Commission’s environmental, social, and governance standards disclosure proposal. Only 25% of CFOs surveyed by CNBC say they support it, while those surveys are more likely than not to support the moves by Texas and Florida to ban pension funds from investing based on ESG factors. CNBC has more.

Links

Links That Don’t Suck:

📈 Join IBD for a free online workshop and learn the fundamentals of smart investing. Sign up today!*

❌ SoftBank plans at least 30% staff cuts to Vision Fund

⛽ New York expedites efforts to ban the sale of new gas cars by 2035

🩹 Band-Aids and Tylenol will have a new name on their packages

🥗 FDA proposes updates to ‘healthy’ claim on food packages

⚖️ Chamber sues CFPB over its anti-discrimination policy

🔭 Webb, Hubble space telescopes share images of DART slamming into an asteroid

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.