Stocks trended lower and notched their third straight down day as the safe-haven U.S. dollar caught a bid — let’s see what you missed. 👀

Today’s issue covers an $80 trillion blind spot, updates from China and Foxconn, and VF Corp.’s earnings report. 📰

Check out today’s heat map:

Every sector closed red. Utilities (-0.56%) led, and energy (-2.97%) lagged. 🟥

The U.S. economy saw services activity pick up in November, with employment and delivery times improving. Meanwhile, factory orders surprised analysts by rising 1% in October. 🏭

Trending stock TOP Ships fell 50% after announcing a secondary offering. 📉

PepsiCo announced after hours that it plans to cut hundreds of corporate jobs. ✂️

Tesla fell 7% on rumors that it’s cutting production at its Shanghai plant, leading investors to question if demand is faltering. 🤔

Chinese stocks remain in focus, as EHang and Digital Brands Group Inc. rose sharply. 🔎

In crypto news, Circle pulls the plug on a SPAC as the stablecoin giant announces it is profitable. Crypto exchange Bybit is laying off 30% of its staff. Sam Bankman-Fried wants to testify before Congress, but only on his terms. And Ripple filed its last submission against the SEC as its landmark case nears completion. ₿

Other symbols active on the streams included: $LPTV (+47.50%), $MMAT (-7.57%), $MMTLP (-13.82%), $MULN (-4.64%), $COSM (+6.54%), $CGRA (+35.68%), $IOVA (+17.40%), and $GTLB (-7.12%). 🔥

Here are the closing prices:

| S&P 500 | 3,999 | -1.79% |

| Nasdaq | 11,240 | -1.93% |

| Russell 2000 | 1,840 | -2.78% |

| Dow Jones | 33,947 | -1.40% |

Final week to secure your chance to win $100. 💰

Answer a short survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the newsletter experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation!

The Bank for International Settlements (BIS) is sounding the alarm over off-balance sheet dollar debt. The global regulator, known as the central bank to the world’s central banks, released its latest quarterly report today, which included a major warning. ⚠️

On a positive note, it says that this year’s market volatility has not caused significant market issues. It’s also taken a more moderate tone toward inflation after telling central banks to act swiftly to bring it down last year.

However, its primary concern this year is the FX swap debt ballooning to concerning levels. They describe it as a “blind spot” that risks leaving policymakers in a “fog.” 😶🌫️

It estimates that the $80 trillion debt exceeds the amount of dollar Treasury bills, repo, and commercial paper combined. And much of it is owned by pension funds and other ‘non-bank’ financial firms where there’s reduced visibility and regulation. The churn of FX swap deals was almost $5 trillion a day in April, representing two-thirds of the daily global FX turnover. That’s a lot of volume.

In English, the concern is that if issues arose and liquidity dried up, settlement of these swaps could cause instability in other areas of the global financial system.

This wouldn’t be the first time this asset class experienced problems. During the financial crisis and the COVID-19 pandemic, central banks had to intervene with dollar swap lines to keep the market liquid and prevent contagion. 📆

More broadly, they’re concerned that FX trading continues to move into “less visible” venues, which prevents policymakers from monitoring FX market conditions and risk. And while things are functioning well now, the notional value of these swaps sets the table for problems to occur.

On another gloomy note, Britain’s Confederation of Business Industry warned that the country’s economy is set to shrink by 0.4% next year. Inflation remains too high, and companies have put investments on hold given the macroeconomic uncertainty.

In other words, they believe stagflation has arrived in Britain, setting the country for a ‘lost decade.’ 🙃

Earnings

Foxconn Slumps Amid China Unrest

The China news continues today, with iPhone maker Foxconn reporting a significant drop in revenue. 🔻

Its November revenue was down 29% MoM and 11% YoY to $14.7 billion. The Taiwanese manufacturer said production is entering off-peak seasonality. But the major driver was part of its shipments being impacted by the unrest in Zhengzhou, where the world’s largest iPhone assembly plant is located.

The world’s largest contract electronic maker tried to calm investors by saying the overall epidemic situation is under control. With that said, November was its most affected period. As a result, it’s making efforts to diversify its operations and get production at the Zhengzhou factory back up to adequate levels.

Overall, the uncertainty around China’s reopening remains high, and the situation remains volatile. Investors are watching closely to see how it will impact Apple and other companies’ earnings in the coming quarters. 👀

Earnings

North Face Owner’s Cold Winter

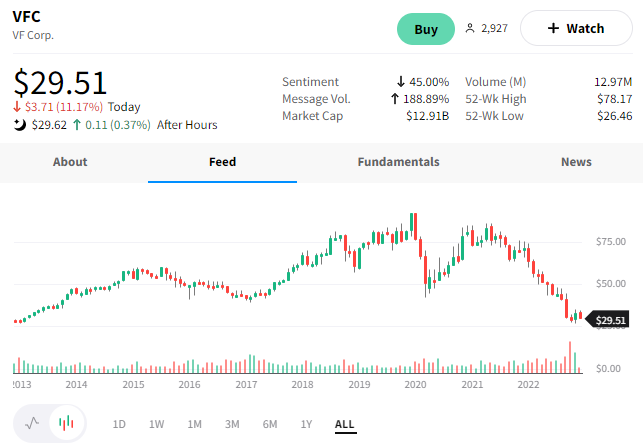

Not even North Face jackets can keep investors warm from the winter VF Corp. is experiencing. 🥶

The owner of North Face and Timberland reduced its revenue and earnings expectations for the second half of its fiscal year. It now expects full-year revenue to rise 3%-4% YoY, down from its previous forecast of 5%-6%. Its full-year earnings will now be $2.00-$2.20 per share vs. previous guidance of $2.40-$2.50 just a few weeks ago. 🔻

Driving the reduced financial outlook is weaker than anticipated demand, especially in North America, where there are fewer sales and more order cancellations. As inflation squeezes consumers, they buy less apparel, especially those on the higher end of the price scale, like VF Corp.’s products.

Additionally, the company announced its chairman and chief executive is retiring. Board member Benno Dorer will serve as interim CEO while they search for a replacement. 🔍

The news sent $VFC shares down 11% today as it hovers near its lowest level since 2013. 📉

Bullets

Bullets From The Day:

📡 SpaceX unveils a military variation of Starlink satellites. Elon Musk’s space company will expand its Starlink technology into military applications under a new business segment called Starshield. The company states on its website that Starlink is designed for consumer and commercial use, but Starshield is intended for government use. However, little is known about the product outside of a few minor details. CNBC has more.

⚡ DHL to buy 2,000 electric Ford E-Transits for delivery vans. Ford will deliver the vans by the end of 2023, with DHL using them in Europe and the Americas for last-mile deliveries. Like other companies, DHL has committed to becoming carbon neutral over the next decade, and electrifying its suite of delivery vehicles is a significant step in reaching its goal. Meanwhile, as deliveries of these vehicles ramp up, the public and private sectors will have to invest heavily in expanding electric charging stations to support them. More from ArsTechnica.

😮 Amazon layoffs are expected to rise above 20,000. Anonymous sources say the company’s layoffs will be larger than initially expected, affecting its distribution center workers, technology staff, and corporate executives. Twenty thousand employees are roughly six percent of the company’s corporate staff but just over one percent of its total 1.5 million person workforce. Internally, managers have been asked to identify employees with performance problems as they’ll likely be the first affected by the layoffs. MoneyControl has more.

👋 Slack CEO to step down in January. The news comes days after Salesforce co-CEO Bret Taylor also announced his resignation. Lidiane Jones will take over for Butterfield, leaving her role as executive VP and GM for the digital experiences clouds at Salesforce. Overall, there have been many high-level departures within the company, whose stock has struggled with the rest of the market. More from TechCrunch.

⚖️ Hertz to pay $168 million for bogus theft claims. The rental car company will settle most of the lawsuits brought by customers wrongly accused of stealing the cars they rented. The company has since fixed a glitch in its systems that led to the false incidents. Meanwhile, the $168 million payment will settle 364 pending claims, leaving less than 5% outstanding. From a financial perspective, the company believes it will recover a “meaningful portion” of the settlement amount from its insurance carriers. Yahoo Finance has more.

Links

Links That Don’t Suck:

😲 The internet is having its midlife crisis

👺 Why ‘Goblin mode’ is Oxford’s 2022 word of the year

🤘 Indonesia wants to make an OPEC for this coveted metal

⚒️ DR Congo: Miner Glencore pays $180m in latest corruption case

🧠 Dementia risk may increase if you’re eating these foods, study finds

😠 Some Meta employees claim they’re not getting promised severance

🎰 Star Power! Jay-Z joins Times Square team bidding for prized NYC casino