The finish line for 2022 looked a lot like the rest of the year, red and falling — let’s see what you missed on the year’s final trading day. 👀

Today’s issue recaps year-to-date returns for the major asset classes, China’s brokerage crackdown, and more! 📰

Check out today’s heat map:

Only one sector closed green. Energy (+0.68%) led, and utilities (-0.94%) lagged. 💚

In crypto news, the Securities Commission of The Bahamas said it moved $3.5 billion from FTX’s Bahamian subsidiary into its own digital wallets. Former MicroStrategy CEO Michael Saylor sold Bitcoin and then bought it back to take advantage of a U.S. tax loophole known as a ‘wash sale.’ And the FBI is investigating the 3Commas data breach that resulted in the leaking of 100,000 API keys connected to the service. ₿

Several micro-cap biotech companies were trending heavily on Stocktwits, including $KALA, $HOTH, $PALI, $DRMA, and mid-cap $TGTX. Other symbols active on the streams included: $AMC (-1.69%), $TSLA (+1.12%), $DBGI (-4.09%), $MULN (+8.41%), and $COSM (+3.64%). 🔥

Here are the closing prices:

| S&P 500 | 3,840 | -0.25% |

| Nasdaq | 10,466 | -0.11% |

| Russell 2000 | 1,761 | -0.28% |

| Dow Jones | 33,147 | -0.22% |

This year was certainly one to remember, particularly for new investors who haven’t seen this type of market environment before. But before we all ride off into the sunset and drink away the pain of 2022, let’s review how some of the major asset classes and sectors performed. 🍸

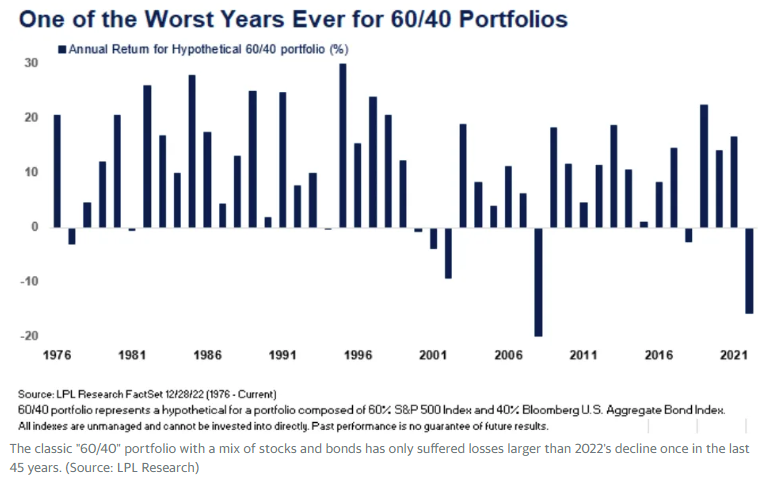

First, let’s start with the traditional 60/40 stock/bond portfolio.

The chart above from LPL Research shows that this was one of the worst years for this ‘conservative’ portfolio approach, as stocks and bonds suffered significant losses. With that said, it also shows that there are far more positive than negative years and falling prices tend to improve forward returns.

However, we’ll have to wait and see if the end of the four-decade-long bond bull market impacts that historical tendency. 🤷

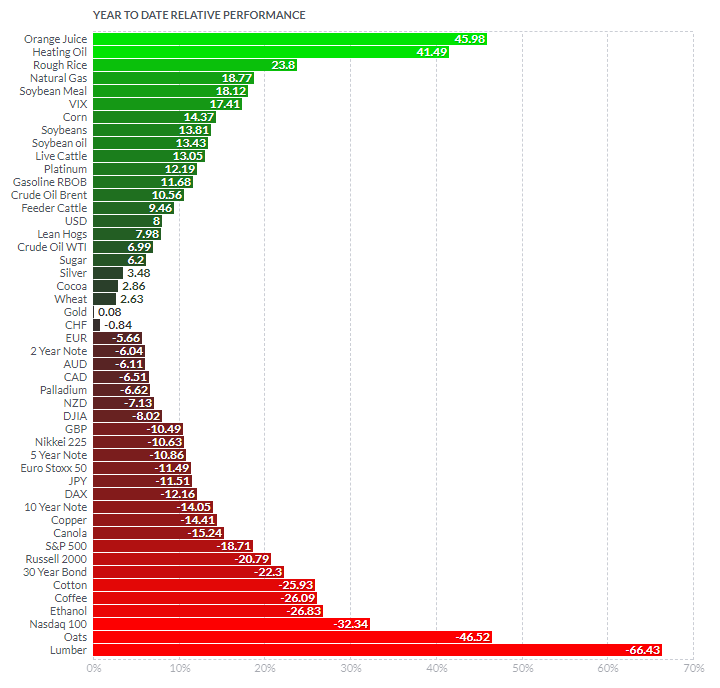

Next, let’s take a look at a list of many significant assets using Finviz’s futures chart.

And the winner for 2022 was…Orange juice. After that, it’s heating oil, rough rice, natural gas, and many other commodities. Oh, and the U.S. Dollar and Volatility Index (VIX).

So, where are stocks on this list? Not a single global equity index is in the green on this list, with the first being the Dow Jones Industrial Average leading the pack by losing just 8.02%. The same goes for bonds, which had a rough year around the globe. 🔻

As we can see, unless you had commodity exposure or sat in U.S. Dollars, chances are you felt some pain in your portfolio in 2022. As for 2023, the multi-multi-billion dollar question remains whether 2022 was the start of a new commodity supercycle. Or if it was an anomaly that investors should bet reverts back to its mean.

We’ll let y’all decide that one for yourself… 👍

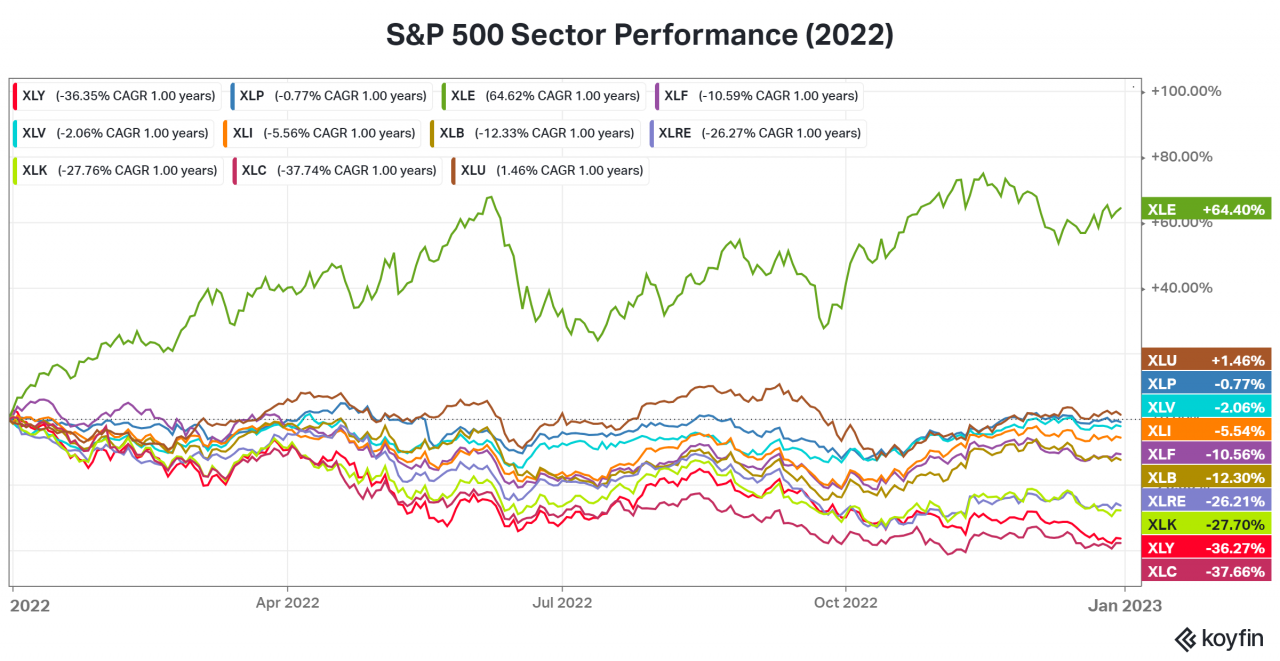

Lastly, let’s check on U.S. sector performance using a chart from Koyfin.

Given the strength in commodities, it’s unsurprising to see energy topping the list with a whopping 64.40% gain. After that, it’s followed by the defensive ‘risk-off’ sectors of utilities, consumer staples, and health care, which all finished marginally on either side of 0% for the year. 🛡️

Not included in the defensive sectors this year is real estate. Typically a higher-yield vehicle, it fell with other rate-sensitive sectors like communication services and consumer discretionary. The Fed aggressively hiking rates and changing work trends pressured the industry’s assets/valuation. 🏢

The theme for 2022 throughout the economy was one of ‘real assets’ over ‘financial assets.’ And that’s reflected in the S&P 500’s sector performance as well.

International stocks and assets are a whole other can of worms, so we’ll leave those for another day. For now, just take our word for it…they didn’t fare much better. 😂

Company News

China Puts $FUTU’s Future On Hold

Last year, Chinese officials began looking to crack down on mainland clients using offshore trading services. Many believed New York-listed Futu Holdings and UP Fintech Holdings would face regulatory risks because they lack licenses in China. 🚨

Unfortunately for investors, that risk has come to fruition. Today, China’s securities regulator banned the companies from opening new accounts with mainland Chinese investors.

The new rules will allow existing customers to continue trading. However, brokerages will have to take corrective measures to prevent money from mainland clients from entering their platforms. In short, no new money can unlawfully flow into their accounts.

The news comes just a day after Futu delayed its listing plan in Hong Kong, stating it was “clarifying certain matters” with the Hong Kong Stock Exchange.

Today’s ban hits $FUTU‘s business particularly hard, given its 2020 annual report said that a large number of its clients were mainland Chinese citizens. The company’s shares are down roughly 31% today, erasing all their year-to-date gains. 📉

Meanwhile, shares of UP Fintech Holdings ($TIGR) are down 28%. 🔻

Bullets

Bullets From The Day:

🧑💼 Startups pick up talent after significant tech layoffs. This year has been challenging for big tech companies and their employees, with over 150,000 jobs being cut according to Layoffs.fyi. However, the layoffs give startups and small businesses a chance to finally compete for talent in the tight labor market. Moreover, with a recession looking likely in the year ahead, companies and potential employees will need to continue adapting to the changing environment to find new opportunities. CNBC has more.

🏭 Taiwan Semiconductor begins volume production of Taiwan’s most advanced chips. The semiconductor manufacturer finally launched the long-awaited mass production of its chips with 3-nanometre technology. Despite the tech and broader economic slowdown, the world’s largest contractor chipmaker continues to ramp up its investment plans within Taiwan and abroad, taking advantage of programs like the U.S. Chips and Science Act. More from Reuters.

🛢️ Keystone Pipeline is back online after its 600,000-gallon leak. This marks the first time the 2,687-mile pipeline has been fully operational in over three weeks. With that said, TC Energy executives and regulators are investigating the incident that caused the leak and cleaning up the spill’s impact, especially given how many eyeballs are watching. Energy sustainability has been a major topic in 2022 and will remain so in the years ahead as the world continues to cope with the Russia-Ukraine war’s impact on global supplies. ABC News has more.

📝 New York signs modified right-to-repair bill. While on its surface, the signing of this bill looks like welcome progress for the movement, proponents argue the final-hour changes to its content were small but dramatic. Moreover, they say the new language gives manufacturers an easy way to skirt the requirements and excludes major industries like medical devices and home appliances. This remains a hot-button issue in the U.S. and globally, with advocacy groups like iFixit pushing for the law to require companies to provide the same diagnostic tools, repair manuals, and parts to the public that they provide to their own repair technicians. More from ArsTechnica.

⚡ Will tax credit confusion drive EV purchases in 2023? Several popular electric vehicles made by Tesla and General Motors could be eligible for the $7,5000 tax credit they weren’t eligible for in 2022, but only for a few months. That’s because some of the restrictions included as part of the Inflation Reduction Act won’t go into effect until at least March, according to the U.S. Treasury Department. This leaves a short window for people to purchase these models before the tax credit restriction goes back into effect. CNN Business has more.

Links

Links That Don’t Suck:

📈 Start your 2023 resolutions with IBD Digital, now only $40 for 4 months—that’s over $99 off*

🍫 Hershey sued in U.S. over metal in dark chocolate claim

😧 Diabetes rates may surge in U.S. young people, study finds

🚴 Navigating the e-bike boom with America’s outdated infrastructure

🚗 IRS issues standard mileage rates for 2023; business use increases 3 cents per mile

📋 The U.S. passed a historic climate deal this year – here’s a recap of what’s in the bill

💊 Congressional report: U.S. FDA broke own protocols in approving Biogen Alzheimer’s drug

🫢 8,000 UK patients receive message that they are dying of cancer instead of holiday greeting

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.