Looks like the market gave us at least one day of pumping before the year of dumping ends — let’s see what you missed. 👀

Today’s issue covers good news for Apple’s supply chain and why a major threat to one of America’s most readily available protein sources is under threat. 📰

Check out today’s heat map:

11 of 11 sectors closed green. Communication Services (+2.69%) led, and consumer staples (+0.40%) lagged. 💚

The 30-year fixed-rate mortgage ticked higher to 6.42% from 6.27% this week, ending six consecutive weeks of trending lower. Freddie Mac’s chief economist reports the housing market remains “in the doldrums”. 🏠

Initial weekly jobless claims hit 225k, as expected. However, continuing claims were higher at 1,710,000 vs. the 1,686,000 expected. Not enough people have lost their jobs to make the Fed happy; the 300k jobless claims target is still a bit away. ↕️

One of the most popular, active, and watched ticker on the Stocktwits app, $MULN, is up +24.38% for the day. 🔋

In crypto news, bankrupt crypto exchange FTX reportedly moved $200 million of customer funds to its FTX Ventures entity on two startups that made the SEC go ‘hmmm?’. The Wolf of Wall Street, Jordan Belfort, believes SBF will be sentenced to around 50 years. And someone hacked Kevin O’Leary’s Twitter account and started spamming crypto giveaway scams. ₿

Other symbols active on the streams included: $SATX (+66.16%), $HOTH (+9.78%), $LUV (+3.82%), $CALM ($-12,72%), $TSLA ($+5.92%), $AMC (+4.09%), and $APE (+4.14%). 🔥

Here are the closing prices:

| S&P 500 | 3,849 | 1.75% |

| Nasdaq | 10,478 | 2.59% |

| Russell 2000 | 1,765 | 2.53% |

| Dow Jones | 33,220 | 1.05% |

Stocks

Another Type Of Apple Season

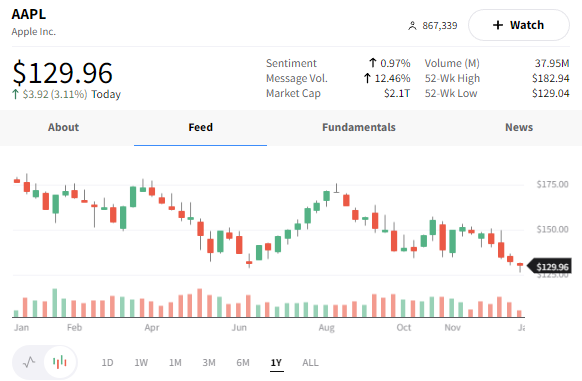

$AAPL, like the rest of the tech sector, has been hit hard in 2022. Selling pressure from sector exposure and the production slowdowns/shutdowns in China have weighed heavily on investors and Apple’s shares. 📊

But there is some reprieve coming. With China’s easing of lockdowns, J.P. Morgan analysts believe that the supply chain is likely to improve and is already showing signs of recovery.

The primary Foxconn factory has reportedly recovered to about 70% of its capacity, bringing hopes that the newest iPhone models will ship out sooner. J.P. Morgan reported that the wait time for the latest iPhone model is down to two weeks versus 30-40 days.

Apple is trading higher today at +3.14% at the time of writing. Technically, it is above yesterday’s open and is testing Tuesday’s close of $130.03 as resistance. 🍎

Commodities

Eggstra High Egg Prices Eggspected To Continue

The extensive price jump in eggs in 2022 is eggspected to eggstend well into 2023. 🐔

Eggs will have increased by over 49% in 2022. Compared to other core categories, the price of eggs has skyrocketed.

It is a concern because eggs are considered a kind of ‘holy grail’ for protein: complete protein profile, plentiful and cheap. But that’s changing.

Egg layers have two major problems: high input costs and the continuing avian flu.

CFO Michael Morgan of Dakota Layers, a family-owned egg layer in Flandreau, South Dakota, said, “We don’t anticipate prices going higher, but we don’t see them going down yet, either.”

Morgan explained that “Cost inputs are just one of the primary drivers. Chicken feed and rations use corn and soybeans, commodities which are still high.”

Corn and soybean prices pit egg layers against livestock and ethanol producers – which exasperates an already competitive supply chain.

“The chief culprit behind the price rise is the avian flu affecting the nation’s bird populations,” Morgan said.

The 2022 avian flu is the worst bird flu outbreak in U.S. history.

According to the United State Department of Agriculture (USDA), national depopulations have totaled an estimated 44 million YTD out of 325 million birds (egg-laying hens) – that’s 13.5% of the total hens.

Until the bird flu has run its course and feed commodity prices drop, eggs are eggspected to remain at elevated prices. 🐣

Bullets

Bullets From The Day:

🏦 A giant in the ETF space, VanEck, is winding down its Russia ETFs. Due to broad international sanctions, VanEck’s Russia-heavy ETFs were effectively cut off from U.S. and E.U. VanEck said, “The Funds’ inability to buy, sell, and take or make delivery of Russian securities has made it impossible to manage the Funds consistent with their investment objectives. The Funds will not engage in any business or investment activities except for the purposes of winding up their affairs.” CNBC has more.

🧾 The Bank of Japan made another surprise move hitting the bond and FX markets overnight. The BoJ made two more unscheduled bond purchases – sometimes called ’emergency’ buys. First, they offered to buy an unlimited amount of two and five-year notes at a fixed yield, 600 billion yen of one to ten-year bonds, all on top of the daily offer to buy ten years at the new 0.50% yield. As a result, the Dollar Index (DXY) is down -0.48%, and the Yen Index (JXY) is up +0.95%. More from DailyFX.

💳 China’s experiment with the digital yuan didn’t go as planned. A former People’s Bank of China (PBOC) director-general of research, Xie Ping, said participation was “… low and highly inactive.” Ping reported that “… “the cumulative circulation of the digital currency in the two years of trial has been only ¥100 billion.” He stressed it would be very difficult to change a system that is already working (cash, debit cards, etc.) for regular consumer needs. Reuters has more.

💊 A congressional report over $BIIB‘s Alzheimer’s drug, Adulhelm, said the FDA’s’s interactions with Biogen were” “atypical.” The report noted that Biogen set a” “unjustifiably high” price – $56,000/year, without any demonstrable benefits in the targeted population. Biogen’s own internal report highlighted the drug as a burden for patients and Medicare due to its price. The most contentious issue the congressional report noted was none of the advisory panel members voted to approve Adulhelm – the FDA used its accelerated approval pathway, approving the drug after three weeks of review instead of the traditional nine months. More from Yahoo! News.

Links

Links That Don’t Suck:

🚢 China to import 44 foreign video games, grants multiple licenses to Tencent

🤑 Egypt leads 2022 gains, Saudi marks first annual loss in 7 years

💍 Lost engagement ring found in toilet 21 years later

🎮 Gaming takes over everything

🏥 The Top 5 healthcare trends in 2023

💻 Tech in 2023: Here’s what is going to really matter

👨🚀 Peru launches $1.6 bln economic recovery plan after protests

🎰 Man buys last two scratch-off lottery tickets in store’s roll, wins $4 million