Stocks continued their pullback on the back of earnings, economic data, and a lot of Fed governor speeches — let’s see what you missed today. 👀

Today’s issue covers Netflix’s Q4 report, the U.S.’s extraordinarily ordinary debt situation, and more earnings from the day. 📰

Check out today’s heat map:

3 of 11 sectors closed green. Energy (+1.24%) led, and industrials (-2.06%) lagged. 💚

In economic news, U.S. initial weekly jobless claims fell to 190,000 as the labor market remains tight. In December, U.S. housing permits fell 1.6% MoM and 29.9% YoY, while housing starts fell 1.4% MoM and 21.8% YoY. 🏘️

Most Fed governors appear to agree that current policy is restrictive and a slower pace of rate hikes is appropriate. However, they’re also on the same page that the Fed has yet to meet the peak rate and that rates will need to stay high to have their desired effect on inflation. 🤝

Meanwhile, European Central Bank President Christine Lagarde says that despite some progress, inflation remains way too high and that she’s staying the course on rate hikes. 📈

Vice Media is restarting its sales process at a lower valuation, likely less than $1 billion. 💰

Nordstrom shares fell 6% after hours following its announcement that it experienced weak holiday sales amid markdowns and sluggish consumer demand.

In crypto news, Jim Cramer is sounding the alarm over the loan that Silvergate Capital received from the Federal Home Loan Bank. And FTX’s new head says the crypto exchange could be revived. ₿

Other symbols active on the streams included: $HKD (-6.02%), $BTB (+1.48%), $HUDI (+10.62%), $MULN (-2.64%), $GNS (+290.29%), $ENPH (-10.92%), $PRTYQ (-67.72%), and $BBBY (-3.81%). 🔥

Here are the closing prices:

| S&P 500 | 3,899 | -0.76% |

| Nasdaq | 10,852 | -0.96% |

| Russell 2000 | 1,836 | -0.97% |

| Dow Jones | 33,045 | -0.76% |

Earnings

Netflix’s Earnings Premiere

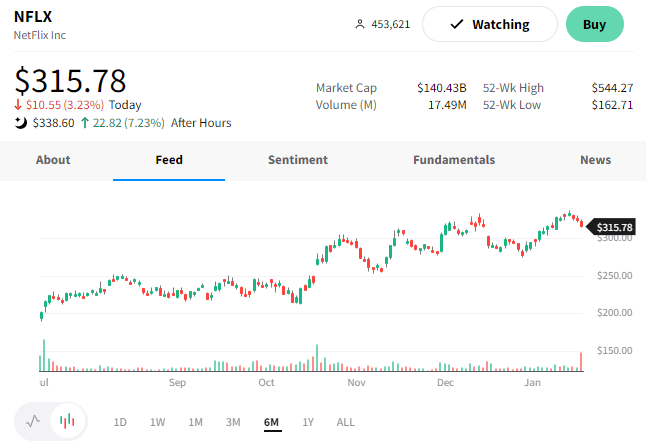

Today’s biggest earnings report by far was from Netflix, which delivered a solid showing.

The streaming giant’s earnings per share of $0.12 missed estimates of $0.45 by a wide margin. Driving the miss was a loss related to euro-denominated debt. The company reiterated that the U.S. Dollar’s depreciation during the quarter is a financial loss as opposed to an operational one. 💱

Revenues of $7.85 billion were in line with expectations, but margins of 7% topped estimates.

The primary number investors are focused on is its global paid net subscribers. It added 7.66 million subs in Q4, soaring past estimates of 4.57 million. The results also included its ad-supported service, which launched in November. However, the company did not disclose what portion of new subscribers selected this tier. 📺

Additionally, executives said they will still report subscriber numbers in future earnings reports, but they’ll no longer provide guidance. The change comes as the company shifts its focus to revenue instead of membership growth as its primary top-line metric. 💰

A higher subscriber count and a higher average price per membership caused the company to predict revenue growth of 4% in Q1. This is higher than the 3.7% Wall Street projected. It’s also rolling out additional features like its paid sharing program during the quarter, which could boost revenues.

Finally, the company disclosed that co-CEO Reed Hastings is stepping down from his position and transitioning to executive chairman. Greg Peters, who is currently chief operating officer, will replace him as co-CEO alongside Ted Sarandos. 👨💼

$NFLX shares were up about 7% after hours on the news. 👏

Economy

Extraordinarily Ordinary

The Treasury Department is taking “extraordinary measures” to pay the federal government’s bills after hitting its debt limit.

While we’re not sure an almost annual event qualifies as “extraordinary,” let’s roll with it and explain what’s happening. 📝

First off, the current $31.4 trillion debt limit was hit on Thursday. As a result, Janet Yellen says the Treasury is suspending new investments in two federal government pension plans until early June. These include the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund.

These suspensions should allow the government to pay its obligations until early June. However, Yellen is urging Congress to increase or suspend the debt limit promptly. With that said, the Biden administration is not expected to prioritize negotiations for a debt limit bill until after the April 18th tax deadline. 📆

In the meantime, politicians will continue using the debt limit to push their agendas. Republicans have already called for significant spending cuts to balance the budget and reduce the overall debt burden. And given their majority in the house of representatives, it’s likely that the debt ceiling debate will be settled before June.

So, in other words, we’re kicking the can down the road for a few months. But we can expect the rhetoric and market reactions to continue until a resolution is reached. 🗫

Ultimately this all matters because it impacts the U.S.’s credit rating. If the government were to default on its debt, that would cause investors to lose faith in the government’s ability to pay and raise its borrowing costs. And while many countries around the globe have defaulted before, the U.S. has not. That’s partially why the U.S. Dollar is the world’s reserve currency. 💵

The bad news is this conversation isn’t going anywhere. The good news is that means you’ve got plenty of time to learn about it.

If you want a place to start, The Brookings Institute has a good breakdown of what you need to know. And also, check out this because you’ll inevitably hear the term “trillion-dollar coin” if you haven’t already. 👀

Earnings

Earnings Recap – 01/19/23

Earnings season continues; let’s recap today’s most prominent reports.

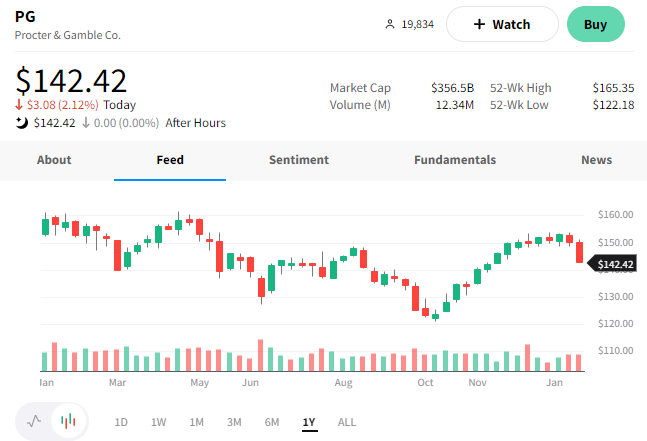

Consumer goods giant Procter & Gamble beat revenue and met earnings expectations. 📈

The company reported adjusted earnings per share (EPS) of $1.59 and revenues of $20.77 billion vs. the $20.73 billion expected.

The YoY declines in revenue and profit were primarily driven by declining volumes, with all of the company’s divisions reporting declining sales volumes. Executives noted that roughly half of the 6% decrease is due to weakening consumer demand, while the other half is due to overseas factors. 📦

Despite falling sales volume, the company will continue with planned price hikes. It even increased its full-year sales growth range by 1% to 4% to 5% and lowered its foreign exchange impact by 1% to 5%.

CEO Jon Moeller had this to say about the current macroeconomic backdrop; “The world seems to want everything to be better, as do I.” … “That’s not really the reality. It’s not the time to be taking guidance to the top range of possibility.”

Investors took the cautious comments to heart, sending $PG shares down roughly 2%. 🔻

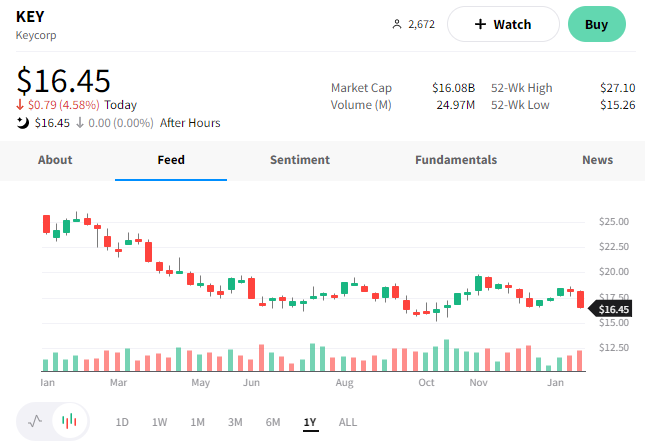

National bank KeyCorp reported earnings and revenue that missed expectations.

Earnings per share of $0.38 missed the $0.54 expected. Driving the decline was a deterioration in credit quality, including a provision for credit losses of $265 million. This was up from just $4 million in the prior-year quarter. Allowance for loan and lease losses also rose 26% YoY to $1.33 billion. 📈

Revenues fell 2.5% YoY to $1.89 billion, below the estimated $1.92 billion. The rise in net interest income and strong average loan growth supported revenues. However, a 26.2% drop in non-interest income weighed on the bank’s results. This non-interest income primarily includes mortgage income and investment banking/debt placement fees.

Investors are also concerned with the bank’s deteriorating capital ratios. That, combined with uncertainty over the consumer banking business in the current economy, pushed $KEY shares down 4.55% on the day. 📉

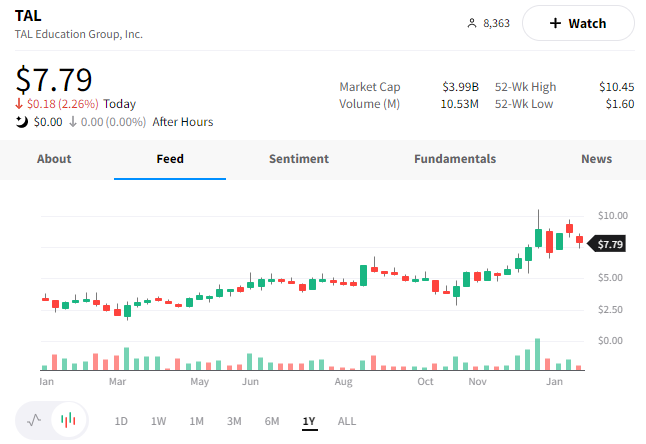

And TAL Education is worth noting because of investors’ recent focus on Chinese stocks. 🔍

The online education company reported earnings per share of $0.02 vs. the estimates for a $0.04 loss. Meanwhile, revenues of $232.7 million missed estimates of $239.8 million.

$TAL shares were down 2%, extending their pullback following a strong run. ◀️

Bullets

Bullets From The Day:

📺 DISH-owned Sling TV is losing subscribers amid price hikes, rising competition. The streaming service finished 2022 with 2.33 million subscribers, essentially where it was in 2018. It recently raised the prices of its plans by $5, pushing its prices closer to those of cable TV that streaming services are purported to replace. Meanwhile, its satellite service, Dish TV, also lost approximately 200,000 subscribers. The preannouncement comes ahead of the company’s Q4 earnings report, which it’s set to report in late February. TechCrunch has more.

⚡ Another major city is investing in its EV-charging infrastructure. Hertz is partnering with the city of Denver to bring 5,000 EVs to its fleet for daily customers and ongoing rentals to ride-sharing drivers. It will also install EV chargers around the city and offer tools and training to the city’s technical high school. It hopes this public-private partnership can help support the country’s ongoing transition to electric vehicles. In addition, the company is looking to expand the program, called “Hertz Electrifies,” to other cities across the U.S. More from CNBC.

🫘 The USDA is stepping up its efforts to crack down on ‘organic’ fraud. The Agriculture Department’s new guidelines for products labeled organic aim to close loopholes that allow ingredients that don’t meet the criteria to end up on store shelves. These updates represent “the single largest revision to the organic standards since they were published in 1990” and raise the bar to prevent bad actors. Sales of organic foods in the U.S. have doubled over the last decade to roughly $62 billion as consumers became more health conscious. Yahoo Finance has more.

✂️ Amazon is cutting costs everywhere it can, including its charity program. In addition to this week’s layoff of 18,000 workers, the tech giant announced that it’s ending its AmazonSmile charity program. The donation program redirects 0.5% of the cost of all eligible products towards charities, resulting in $400 million in donations since 2013. However, in its announcement, the company said it would continue its other charitable endeavors with a greater impact. More from TechCrunch.

🔋 U.S. tech giants buy more clean energy than any other companies. Amazon, Meta, and Alphabet are the top three corporate purchasers of wind and solar energy, according to the American Clean Power Association. Its report showed that in 2022, 326 companies contracted 77.4 gigawatts of wind and solar, which is enough energy to power over a thousand data centers of 18 million American homes. More companies are turning to clean energy as prices have dropped significantly over the last decade and will continue to as technology and adoption evolve. CNBC has more.

Links

Links That Don’t Suck:

📆 Google is delaying a portion of employee bonus checks

💉 The only HIV vaccine in advanced trials has failed. What now?

✈️ NASA selects Boeing to develop new fuel-efficient aircraft

💅 Getting your nails done frequently could damage the DNA in your hands

🌡️ Parts of Greenland now hotter than at any time in the past 1,000 years, scientists say

⚠️ Behind your speedy Amazon delivery are serious hazards for workers, government finds

❌ India’s top court rejects Google plea to block Android antitrust ruling in major blow

📱 Instagram just got an update that gives you more control over what you see in your feed

🍽️ Intermittent fasting may not be as helpful for losing weight as once thought, study funds

🪧 Striking French workers lead 1 million people in protest over plans to raise retirement age

🐔 High egg prices may tempt you to start your own backyard flock, but chickens carry some health risks