Stocks rallied as market participants hope for the trend of disinflation to continue in this week’s producer price and consumer price indexes. Let’s recap what you missed from the day. 👀

Today’s issue covers Palantir’s first profitable quarter, Fidelity’s spinoff news, and two stocks being pumped by analysts. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Technology (+1.73%) led, and energy (-0.25%) lagged. 💚

Inflation is center stage with week, as India’s retail inflation tops its central bank’s 6% tolerance level again in January. Meanwhile, as signs of recession moderate, European countries are looking to pare back the high debt loads used recently to keep their economies afloat. 🥵

Layoffs were top of mind, with Twilio laying off 17% of its workforce amid a reorganization that prioritizes profitability. Meanwhile, Meta’s chief business officer is leaving the company after 13 years, as morale remains weak and more cuts are rumored. Also, another prominent law firm is reducing its workforce after a rough 2022. ✂️

Uber shares fell over 2% on news it’s closing its data centers and signing a seven-year cloud contract with Oracle and Google Cloud. 🌥️

In crypto news, Coinbase CEO took to the company’s blog to defend its staking services, saying they’re not securities. Binance Coin fell 10% on news that a New York regulator said Paxos’ management of the stablecoin was not ‘safe and sound.’ And Dogecoin pumped, then slumped after Elon Musk said that he and Rupert Murdoch discussed it at the Super Bowl. ₿

Other symbols active on the streams included: $BBBY (-13.19%), $AMC (-4.49%), $TOPS (+25.95%), $OCUL (+35.14%), $CLINE (+7.41%), $GNS (+1.11%), $VLON (+90.27%), and $SEDG (+3.33%). 🔥

Here are the closing prices:

| S&P 500 | 4,137 | +1.14% |

| Nasdaq | 11,892 | +1.48% |

| Russell 2000 | 1,941 | +1.16% |

| Dow Jones | 34,246 | +1.11% |

Earnings

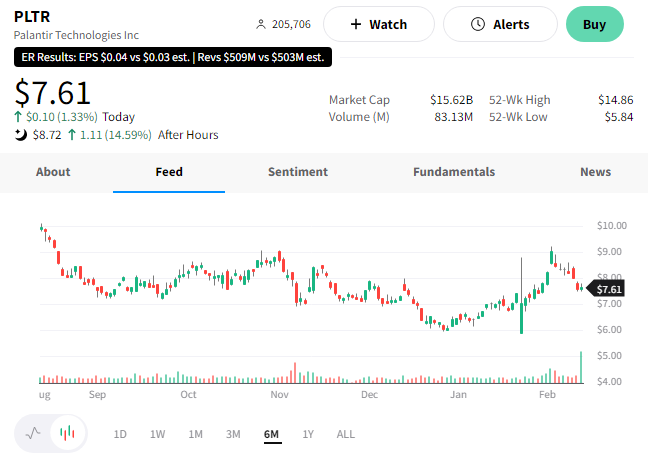

Palantir’s First Profitable Quarter

Retail-favorite Palantir Technologies is soaring after reporting its first-ever profitable quarter. 📝

Revenues of $509 million were up 18% YoY and topped estimates of $502.3 million. Driving the strong revenue number was $293 million in government sales (+23% YoY).

The company’s first-quarter and full-year revenue forecast fell below analyst expectations. 🔮

However, the company’s GAAP profitability was the star of the show, as it hadn’t expected to achieve that until 2025. Its focus on managing expenses and stock-based compensation helped it achieve sooner-than-expected profitability. That resulted in fourth-quarter earnings per share of $0.04, rising 100% YoY and beating the consensus $0.03 estimate.💰

Its Chief Executive Officer Alex Karp said, “Our commitment to and relentless focus on the long term at times has required patience. At other times, as our profitability demonstrates, we will deliver results at a rate that surpasses even the expectations of those who believed we would prevail.”

$PLTR shares were up 16% after hours. 📈

Company News

Analysts Pump Two Tech Stocks

Two tech stocks jumped today on analyst action early in the day. 👍

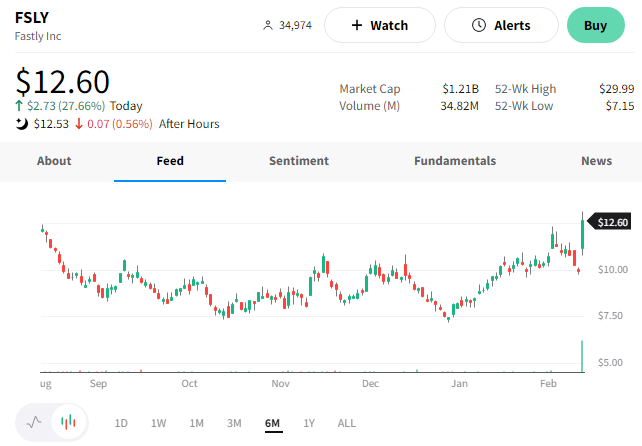

First up is Fastly, which received a rare “double upgrade” from a Bank of America analyst. Tal Liani noted that the company’s core technology and new management could allow it to achieve profitability next year. As a result, he upgraded the stock from “underperform” to “buy.”

$FSLY shares rose 28%, marking their largest percentage gain in about three years. 😮

Next is ContextLogic, better known as Wish. The struggling e-commerce platform jumped after Citron Research posted several bullish tweets about the stock following the Super Bowl. 🐦

Chinese -e-commerce giant PDD took out ads for its Temu U.S. shopping site during the Super Bowl, which sparked the flurry of tweets from Citron. They noted they were “reluctant to mention $WISH” but that Temu’s recent traction using the same business model has created the “most asymmetric opportunity in the market.”

They argue that if this business model is going to work, $WISH is being very mispriced by the market. It has a lot of cash on hand, no debt, and a $280 million credit line available. That should give it plenty of time to execute on the longer-term business opportunity. 📈

Whether or not they’re right remains to be seen. But some technical analysts pointed to today’s 37% rally in $WISH shares could be the start of a potential long-term trend reversal. 🤔

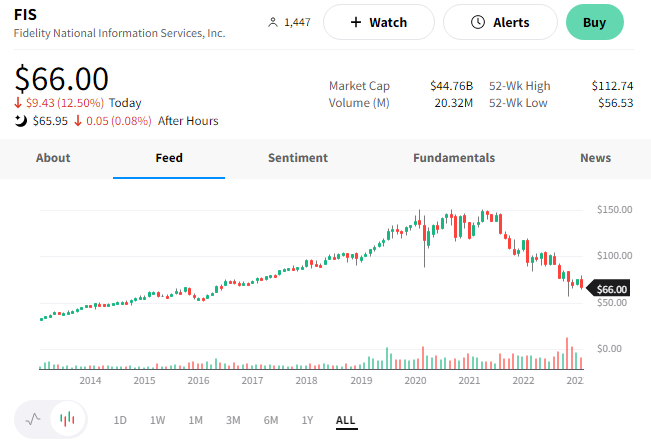

When people think of Fidelity, they think of a financial services company. However, there’s a $45 billion IT services provider called Fidelity National Information Services listed on the New York Stock Exchange.

And today, that company is making headlines after announcing weaker-than-expected results and a spin-off. 📰

The payments giant announced that it plans to spin off its merchant business, essentially reversing its $43 billion acquisition of Worldpay in 2019. It expects to complete the tax-free spin-off within a year, saying the companies will maintain a commercial relationship. Additionally, the split will allow its core business to secure a solid investment-grade credit rating and allow Worldpay to invest more aggressively for growth.

The decision comes as new CEO Stephanie Ferris leads a strategic review of the company’s business and operations. Analysts say the decision highlights the weakness in its core business and that the “sum of the parts” clearly indicates the two businesses could create more shareholder value as separate entities. 🧮

Additionally, its fourth-quarter earnings barely topped estimates. Its full-year 2023 earnings guidance of $5.70 to $6.00 per share was well below the $6.57 consensus forecast.

$FIS shares fell another 12% today. It’s now 56% off its 2021 all-time high. 🔻

Bullets

Bullets From The Day:

🤝 Lidar makers Ouster and Velodyne complete their ‘merger of equals.’ The new company creates a major player with more than 850 customers and about $315 million on hand. It’ll retain its Ouster name, with Ouster’s CEO, Angus Pacala, leading the new company. Velodyne’s CEO, Ted Tweksbury, will chair the new firm’s board of directions. Both companies have a positive gross margin, meaning their products are sold for more than it costs to make them. That, plus the company’s cash balance, will help it survive in a challenging environment for lidar companies and tech in general. CNBC has more.

🚕 Amazon tests its robotaxi with its California employees. Its Zoox robotaxi is being rolled out on California public roads roughly two years after the subsidiary unveiled an electric, autonomous robotaxi built from scratch. The two-mile test route will run as a shuttle service between Zoox’s two main buildings in Foster City, California. The company currently tests Toyota Highlander vehicles with its self-driving system on public roads in a few major cities. Still, this push is a big step for its fully-autonomous car. More from TechCrunch.

🔋 Ford announces $3.5 billion Michigan battery plant, as expected. As part of the automaker’s $50 billion global investment in electrification, Ford is building a $3.5 billion EV battery plant in Marshall, Michigan. It’ll produce LFP, or lithium iron phosphate, batteries for Ford’s electric vehicles. That makes it the only U.S. automaker to build both LFP and nickel cobalt manganese (NCM) battery chemistries. The investment will create 2,500 jobs, and production is slated to begin in 2026. As reported over the weekend, the Ford-owned plant will work with China’s CATL to produce the batteries. Yahoo Finance has more.

🚗 Renault & Nissan announce India investment. As part of their broader partnership restructuring, the two companies announced they’re investing $600 million to make six new models in India. Each automaker will make three models that will be built on joint platforms and will also be exported outside of India. They currently plan to produce two electric vehicles and four sports utility vehicles (SUVs). This joins the list of their joint projects that span Latin America, India, and Europe. More from CNBC.

💰 Transit tech company Via raises $110 million. The latest round of funding comes at the same $3.5 billion valuation as its November 2021 fundraising and brings its total funding to around $1 billion. The company will use its new funding to further its vision of being “able to provide every city in the world access to this end-to-end digital infrastructure, where they can plan, operate, analyze, and continue to optimize their transit networks across every vertical in that transit networks.” In other words, they need the money to continue expansion and increase their optionality to go public if the market environment improves enough. TechCrunch has more.

Links

Links That Don’t Suck:

😮 Amazon’s average cut of each sale surpassed 50% in 2022.

🏢 Remote work costs Manhattan $12.4 billion per year: report

💥 American Airlines plane and bus collide at LAX airport, 5 people hurt

🩲 The US government says women’s underwear should cost more than men’s

🏠 The 15 U.S. cities where home prices are growing the fastest – none are in New York or California