FOMO has apparently taken the place of panic as buyers bid up risk assets. Stocks managed to stay green despite most commodities, bonds, and currencies other than the U.S. Dollar (and crypto) falling. Let’s recap what else you missed. 👀

Today’s issue covers some sweet pre-market results, economic updates from the day, and after-hours earnings movers. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Consumer Discretionary (+1.17%) led, and energy (-1.70%) lagged. 💚

In crypto news, the bankruptcy crypto lender Celsius has reached a deal with Nova Wulf to restart its operations. Napster has acquired Mint Songs as it expands its Web3 aspirations. And FTX is seeking to reclaim $400 million from a hedge fund called Modulo, where the cash is just sitting in an interest-bearing account. ₿

Other symbols active on the streams included: $AMC (+14.89%), $PLTR (+9.55%), $QS (+32.29%), $RDW (+48.82%), $LMFA (+2.88%), $GNS (+5.22%), $SI (+28.57%), and $FLOKI.X (+61.03%). 🔥

Here are the closing prices:

| S&P 500 | 4,148 | +0.28% |

| Nasdaq | 12,071 | +0.92% |

| Russell 2000 | 1,961 | +1.09% |

| Dow Jones | 34,128 | +0.11% |

Earnings season is in full swing, which means a lot of reports to look through each day. This morning investors received some “sweet” news from three companies who delivered their results. 😊

First up was Roblox, which has struggled to deal with its post-pandemic growth slowdown over the last year. 😬

The company’s fourth-quarter loss per share of $0.48 beat the $0.52 expected. And revenue (bookings) of $899.4 million was up 17% YoY and exceeded the $881.4 million consensus estimate.

Its engagement numbers also impressed investors. The company reported 58.8 million average daily active users (+19% YoY) and said users spent more than 12.8 billion hours engaged in Roblox during the quarter (+18% YoY). However, its average bookings (revenue) per daily active user fell 2% YoY to $15.29. 🕹️

$RBLX shares were up roughly 26% on the positive news.

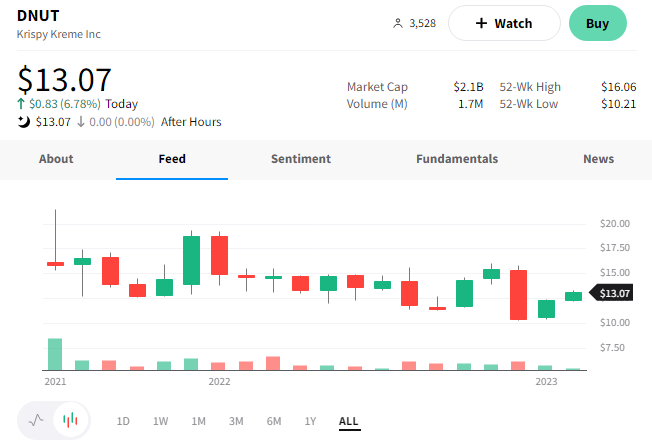

Next is Krispy Kreme, which inspired the title of this post. 🍩

The company reported adjusted earnings per share of $0.11, narrowly beating the $0.10 estimate. Its net loss per share was $0.02 but was driven by noncash charges associated with closing unprofitable restaurants.

Revenues were up nearly 10% YoY to $404.6 million, topping the $395 consensus estimate. It attributed part of its “scary good” results to the success of its Halloween and winter holiday specialty doughnuts. 🎃

Its e-commerce business also registered its best quarter since the pandemic’s start, growing 23% YoY. Helping drive that was expanding the company’s Insomnia Cookies chain delivery range to 10 miles. Executives believe that the brand “will be the next Krispy Kreme” and plan to expand into the U.K. and Canada this year.

Meanwhile, the Krispy Kreme brand continues to make its global push, expanding into five to seven new countries this year. That’ll bring it to thirty-five countries worldwide. 🗺️

Executives’ upbeat outlook included adjusted earnings per share of $0.31 to $0.34 and revenues of $1.65 billion to $1.68 billion in 2023. This forecast was mainly in line with consensus estimates.

$DNUT shares were up roughly 7% on the day but have remained in the middle of a wide trading range since coming public. 🤷

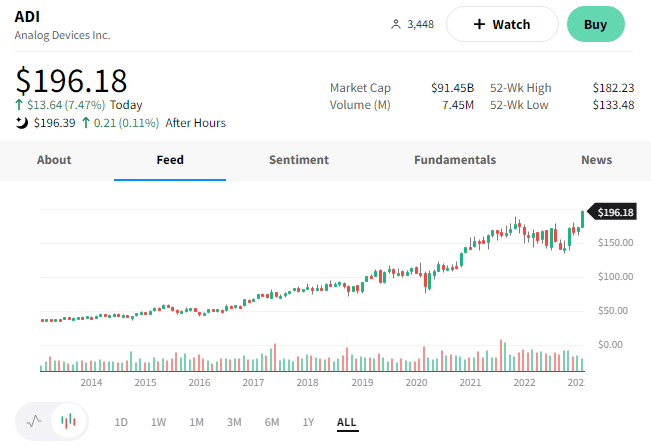

And last but not least is Analog Devices, whose shares hit a new all-time high after it reported results. 🤩

The chipmaker reported stronger-than-expected fiscal first-quarter earnings. Its adjusted earnings per share of $2.75 and $3.25 billion in revenue beat the consensus estimate of $2.61 per share and $3.15 billion, respectively.

Executives cited record automotive and industrial chip sales as the reason it handily beat expectations. In addition, its CEO, Vincent Roche, pointed to several secular trends, including AI, as tailwinds for the company and industry. He says the company is “…the bridge between the physical and digital worlds, is well-positioned to deliver breakthrough innovations that positively impact society and unlock long-term value for all stakeholders.” 🤖

Semiconductor stocks had a rough run since peaking in late 2021 but have recovered strongly since October. $ADI shares flexed their strength today, rising 7% to a new all-time high on the news.

Economy

A Swath Of Economic Updates

It was a busy day on the economics front. So let’s review what you missed. 🕵️

Firstly, across the pond, the U.K.’s inflation eased to 10.1%. Prices fell for the third straight month from their October peak of 11.1% but remained well above its central bank’s target. Food prices continued to rise sharply, furthering an already difficult cost-of-living crisis. 🥵

Back in the U.S., the Commerce Department reported that retail sales rose 3% in January, higher than the 1.8% expected. The seasonally adjusted spending increase was the largest since March 2021, rebounding from two straight months of declines. Driving the increase was dining out, autos and parts, and furniture. A strong labor market and resilient consumer spending remain complex challenges for the Fed to tackle in its battle against inflation. 🛍️

U.S. industrial output was flat in January, falling short of the 0.4% gain expected. Additionally, output in December was revised down from -0.7% to 1.0%. Meanwhile, capacity utilization fell to 78.3%, its lowest level since September 2021. Today’s data confirms what we’ve seen elsewhere, that manufacturing activity is in contraction territory. 🏭

The National Association of Home Builders/Wells Fargo Housing Market Index saw its largest MoM increase in ten years. February’s number jumped to 42, which remains below the 50 “threshold” of pessimism/optimism. For context, it hit a low of 31 in December but was at a high of 81 last February. Recent declines in interest rates have buoyed housing demand and confidence, but the housing market remains soft(er)…just as the Fed wants it. 🏘️

Lastly, as discussed yesterday, Biden officially announced his new economic team. As expected, it’s being led by Federal Reserve Vice Chair Lael Brainard, where the veteran will help guide the administration through key elements of its economic agenda. 🧭

Earnings

After-Hours Earnings Movers

A busy earnings day continued after the bell, so let’s recap the biggest movers.

First is Twilio, which followed its layoff announcement with better-than-expected results and a major share repurchase plan. Its fourth-quarter loss per share was $1.24 on $1.02 billion in revenue. The company’s CEO, Jeff Lawson, said the company would purchase $500 million in stock over the next six months and that he plans to buy $10 million in stock during his next trading window. The company’s first-quarter guidance also exceeded expectations, causing $TWLO shares to rise more than 20% after hours. 😮

Roku reported fourth-quarter earnings that topped its previously lowered expectations. The streaming device and platform company saw revenues of $867.1 million (flat YoY) and a net loss per share of $1.70. Analysts had expected $801.69 million in revenue and a $1.73 loss per share. Executives focused on the positives, noting that Roku Channel reached U.S. households with an estimated 100 million people (+25% YoY). Operating expenses also rose 71% in Q4, but the company acknowledged that it’s adjusting its expense profile to prepare for the more challenging macro environment. $ROKU shares rose another 10% in extended hours, following a 12% regular-session gain. 📺

Cisco’s fiscal second-quarter results beat top and bottom-line estimates. Its adjusted earnings per share were $0.88, and revenues were $13.59 billion (+7% YoY). Executives noted that demand remains stable, but some sales cycles are taking longer than usual. Additionally, its public sector business outperformed its historical benchmarks, and product/service improvements in its service provider category helped boost results. The company raised its full-year fiscal 2023 guidance and now expects 9% to 10.5% revenue growth and $3.73 to $3.78 in earnings per share. $CSCO shares rose as much as 8% after-hours before settling up 3.5%. 🖥️

Zillow reported better-than-expected results. Its adjusted earnings per share of $0.21 and revenues of $435 million topped the expected $0.07 and $415 million. Its largest business segment, Internet, Media, and Technology, saw revenue decline 14% YoY to $417 million. Traffic to its mobile apps and websites was flat QoQ at 198 million average monthly unique users. Zillow’s rentals revenue rose 13% YoY to $68 million as it continues to see strong traffic and growth in multifamily properties. $Z shares added to their regular-session gains, rising 3% after hours. 🏘️

Shopify bucked the trend of positive results, surprising investors with a weaker-than-expected 2023 revenue outlook. Fourth-quarter earnings of $0.07 per share and revenues of $1.7 billion were mixed versus estimates. Analysts had expected a $0.01 per share loss and $1.65 billion in revenue. It now expects full-year 2023 revenue growth in the “high teens,” while analysts expected over 20%. $SHOP shares are down roughly 10% after hours. 🛒

Bullets

Bullets From The Day:

🔐 A startup creating a passwordless future closes a $53 million seed round. Descope is entering a competitive space but has bucked the recent fundraising drought to raise a massive seed round for its “developer-first” authentication and user management platform. The lead fundraisers were Lightspeed Venture Partners and GGV Capital. The firm will use the new funds to expand its product capabilities, invest in research and support open-source initiatives around authentication, authorization, and user management. TechCrunch has more.

🍽️ Chipotle set to launch a new spinoff restaurant. The fast-casual chain is looking to make some extra “guac” by launching the Farmesa Fresh Eatery brand in a Santa Monica ghost kitchen. This is CEO Brian Niccol’s first spinoff attempt after Asian ShopHouse and Tasty Made both failed under founder Steve Ell’s leadership. The new spinoff will lean on Chipotle’s “tried and true” bowl method, with prices ranging from $11.95 to $16.95. In addition, the ghost kitchen model, which focuses only on delivery, will allow Chipotle to test out the new brand with reduced risk. More from CNBC.

✈️ Tesla will double its supercharger network and open it to all EVs. To qualify for the Biden administration’s $7.5 billion electric vehicle (EV) charging initiative, Tesla and its competitors must meet a new set of requirements. The final standards for the government’s plan to build a network of 500,000 EV chargers along highways include a requirement that all EV chargers funded through the Inflation Reduction Act must be made in the U.S. All chargers are also required to use a standardized payment system that is smartphone-friendly. All connectors must also use the “combined charging system” (CCS). That means Tesla needs to adjust its network, which currently uses a proprietary connector. TechCrunch has more.

📝 Tech companies are raising performance standards for employees as they cut costs. As activist investors increase their pressure on Salesforce, the company is stepping up its pressure on employees. According to an Insider report, the company is implementing much stricter performance measures for engineering and reassuring some salespeople to quit or receive harsher performance policies for their department. It’s also switching to a hybrid office approach to management, which is a significant shift for a management team that’s been promoting the idea of an “all digital, work-from-anywhere workplace” since the pandemic began. More from TechCrunch.

🚨 ASML’s proprietary chip technology data was stolen by an employee. One of the semiconductor industry’s most prominent suppliers said it recently discovered the “misappropriation” of data related to its proprietary technology. The security incident occurs when the company and the Netherlands’ government are caught in the middle of the U.S. and China’s battle for technology supremacy. It does not believe the leak is material to its business but that the event may have violated specific export control regulations. As a result, it’s working with the appropriate authorities to address the situation. CNBC has more.

Links

Links That Don’t Suck:

🏈 Super Bowl betting sets records for sportsbooks

⚖️ J&J must face baby powder suit by 24-year-old dying of cancer

🏠 The 11 U.S. cities where rent prices fell the most in January

👨💼 Elon Musk wants to find someone to replace him at Twitter by year-end

🏬 Retailer Tuesday Morning filed for bankruptcy on a…Tuesday morning

🤖 Microsoft’s Bing is a liar that will emotionally manipulate you, and people love it

💳 Goldman Sachs scraps idea for direct-to-consumer credit card after strategy shift