As the stock market melts higher, some investors are beginning to feel the fear of missing out (FOMO). Let’s recap what you missed. 👀

Today’s issue covers two stocks causing a rumble in the market, Virgin Orbit’s failure to launch, and whether the Nasdaq is in a new bull market. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Real estate (+1.30%) led, and financials (-0.25%) lagged. 💚

In economic news, initial jobless claims rose by 7,000, and continuing claims rose by 4,000 as the labor market remains historically tight. The final U.S. Q4 GDP reading was revised down to 2.6% from the previous quarter’s 3.2%. Consumer spending moved lower from 2.1% to 1% in the final estimate. And South Africa’s central bank raised its main interest rate by 50 bp to 7.75%. 🏭

Electronic Arts and Roku are coping with a slowdown, both cutting 6% of their respective workforces as they look to rein in costs. ✂️

Bed Bath & Beyond shares fell another 26% on news it will offer $300 million in stock in a last-ditch effort to avoid bankruptcy. 💰

In crypto news, crypto wallet company Ledger has raised another 100 million euros in new funding as part of its Series C funding round. Matt Damon claims he only did the now infamous Crypto.com Ad to fund his water nonprofit after a bad year. And Hong Kong is looking to raise $100 million to fund the crypto industry to regain its status as a leading hub. ₿

Other symbols active on the streams included: $TRKA (-10.37%), $GMVD (-38.29%), $MYO (+2.73%), $PYXS (+32.16%), $VHC (-17.06%), $APLM (+171.97%), and $BTC.X (-1.36%). 🔥

Here are the closing prices:

| S&P 500 | 4,051 | +0.57% |

| Nasdaq | 12,013 | +0.73% |

| Russell 2000 | 1,768 | -0.18% |

| Dow Jones | 32,859 | +0.43% |

Company News

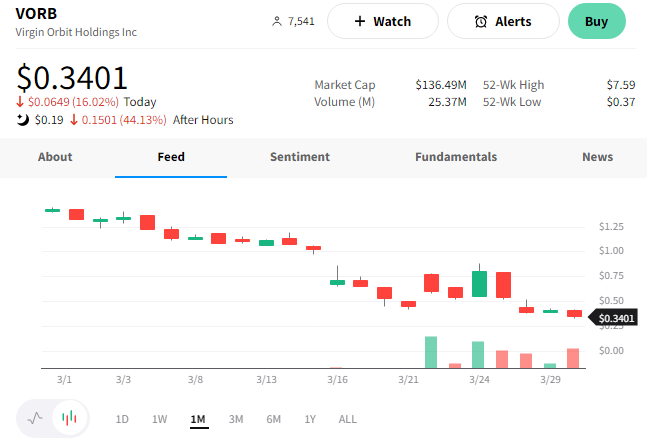

Failure To Launch

After several months of failing to secure funding, Virgin Orbit has confirmed that its last-ditch effort to team up with investor Matthew Brown has failed. ❌

The satellite launching company had furloughed its roughly 750 employees on March 15th as it looked to secure funding. Last week, it slowly brought back some of its 750 employees as funding prospects improved. However, executives announced today that they’re ceasing operations “for the foreseeable future” and will lay off 90% of their workforce. 🛑

Virgin Orbit was spun out of Sir Richard Branson’s Virgin Galatic in 2017, with him maintaining 75% ownership. The company’s system of using a modified 747 jet to send satellites into space was met with much optimism. However, the challenging funding environment caused the company to raise less money than expected via its SPAC merger in 2021. And operational issues, including a mid-flight failure of its last launch, have investors doubting the company’s long-term viability.

With its largest shareholder unwilling to provide more funding and its stock plummeting to fresh all-time lows, it’s running out of options. So it recently hired bankruptcy firms to pull together contingency plans if it cannot find a buyer or investor. 📝

Overall though, it appears the shareholders and outside debt holders will be hurt the most. Richard Branson has first priority over the company’s assets. And the Board of Directors recently approved a “golden parachute” severance plan for the company’s top executives in the event they’re terminated.

As with many revolutionary ideas, they don’t always pan out. The idea will likely live into the future, but probably not in its current form. So we’ll have to wait and see whether the company’s prospects change in the coming days. 🤷

In the meantime, $VORB shares hit fresh all-time lows on the news. 💥

Stocks

A New Bull Market?

As we’ve discussed in the past, investors tend to use a 20% rise/decline from a market low/high to signal the start of a new bull/bear market. 🧭

While that method certainly has its downsides, it does tend to get a lot of attention. And right now, with the Nasdaq 100 rising over 20% from its October lows, investors are once again asking whether a new bull market has begun.

Now, skeptics will point to previous rallies, like in August, that reached 20% but ultimately continued lower. But the believers will point out that the current market environment is different.

For example, the Nasdaq 100’s 200-day moving average, often used to indicate its long-term trend, was falling in August. But since late last year, it’s flattened out and begun rising again. 📈

They suggest this indicates a much more supportive environment for stocks today than before. And as a result, they’re giving this signal more weight than they had in the past. ⚖️

Whether this is the start of a new bull market is a question being asked by investors all over the globe. And if prices continue to rise in the face of constant bad news, some hypothesize that the fear of missing out (FOMO) could take hold and push the market even higher. 😨

Only time will tell which side of the argument is correct. But the current environment definitely has some folks changing their tune. Just ask Michael Burry, who tweeted:

https://twitter.com/michaeljburry/status/1641436280650371078?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1641436280650371078%7Ctwgr%5Ee08c7b6930621daaaa62ef1e7054916117462b97%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.fa-mag.com%2Fnews%2Fmichael-burry-says-he-was–wrong-to-say-sell—congratulates-dip-buyers-72626.html

Guess this market has even the brightest investors unsure of what’s next. 🤷

As always, that’s the conversation happening today. We’ll leave it to you to analyze what you think is coming next.

Earnings

Sending Rumbles Through The Market

Two stocks were on the move from both a price and message volume perspective after they reported earnings. Let’s recap. 📝

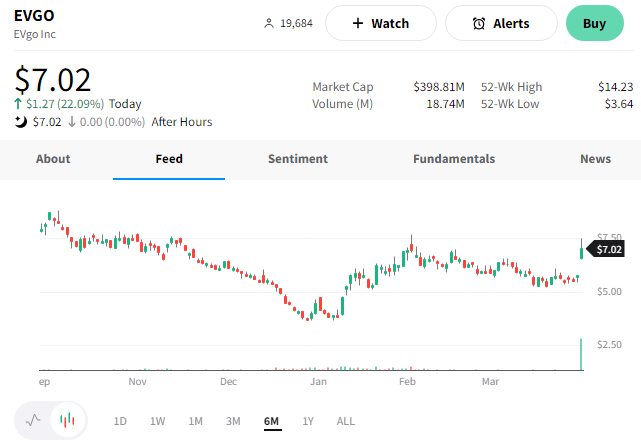

First up is the EV charging network operator EVgo. 🔋

The company reported a fourth-quarter loss per share of $0.06 on $27.3 million in revenue. That topped the expected $0.16 per share loss and $21.8 million in revenue. 👍

Executives say they added about 59,000 new customer accounts, grew network throughput by 76% YoY to 14.4 GWh, and ended the year with 2,800 fast-charging stalls in operation. Its eXtend unit saw sharp growth, rising to 61% of the company’s total revenue. The program has attracted customers like General motors, Pilot, and JPMorgan Chase.

However, its 2023 guidance came with a caveat, given it’s unsure how many U.S.-made chargers it will be able to procure. As a result, it expects revenue of $105 to $150 million, an adjusted EBITDA loss of $60 to $78 million, and roughly 3,400 to 4,000 fast-charging stalls in operation or under construction. ⚡

Revenue guidance was slightly less than the $153.7 million expected. But investors appeared to look past that shortfall. $EVGO shares rose 22% on the day. 📈

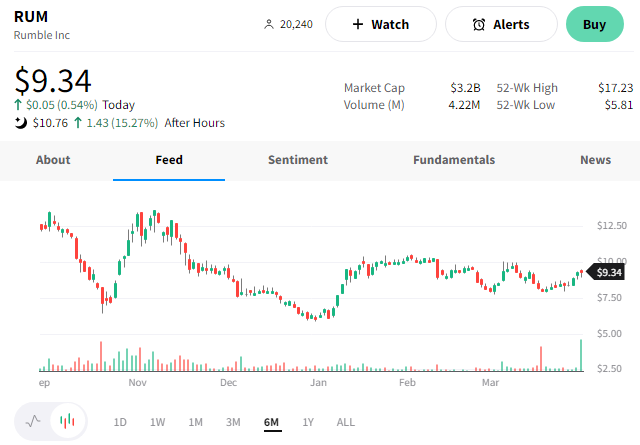

Next is the online video platform and popular YouTube alternative, Rumble. 💻

The company reported a breakeven fourth quarter, while analysts expected a $0.06 per share loss. Revenue of $20 million also topped the $10.2 million expected by analysts. Executives say the platform’s global monthly active users grew 142% YoY to 80 million.

$RUM shares rose 30% on the news, still up about 15% as of writing this. 👍

Bullets

Bullets From The Day:

📱 Meta keeps trying to deny EU users a free choice over tracking. After a major privacy enforcement action in Europe earlier this year, Meta is changing the legal basis it claims for microtargeting users in the region. While it will still not ask for up-front consent to its data-fuelled behavioral advertising, it will allow European Union users to opt out, a first for the company. The company was fined roughly $410 million for its practices, and the enforcement has hit its advertising business, forcing it to find a workaround. TechCrunch has more.

🏦 Yellen says U.S. bank rules may be too loose. Treasury Secretary Janet Yellen said that banking regulation and supervisory rules must be re-examined following the Silicon Valley Bank and Signature Bank failures to address systemic risks. Her prepared remarks to the National Association for Business Economics called for further regulation of the non-bank (shadow bank) sector, which has grown significantly over the last decade. The post-financial-crisis regulatory environment is robust, but the recent regional bank failures signal there’s still more work to be done. More from Reuters.

🤝 Constellation Brands forms a content studio partnership with Tastemade. The American beverage company is teaming up with the media company to develop a multimillion-dollar, multiyear collaboration, which builds off its prior deal to create social media content. The partnership comes as Constellation Brands looks to diversify its wine and other product categories by targeting Gen Z and millennial consumers. Content will be fed into ad-supported streaming platforms and provide programming to other streaming services. CNBC has more.

💱 China and Brazil ink deal to use their own currencies to conduct trade. The two countries will carry out trade and financial transactions directly, exchanging yuan for Reals (and vice versa) instead of first converting their currencies to the U.S. Dollar. The arrangement is expected to reduce costs, promote greater bilateral trade, and facilitate investment. This is noteworthy because China has been Brazil’s largest trading partner since 2009, accounting for over a fifth of all its imports. Meanwhile, China is Brazil’s largest export market, accounting for over a third of all exports. More from Fox Business.

🛑 Midjourney stops free trials after deepfakes go viral. After several AI-generated images have gone viral, the popular free image generator Midjourney is no longer onboarding new users. Fabricated images of Donald Trump, the pope, and other famous people have been mistaken for real photographs all over the internet, highlighting the broader concern that this technology’s capabilities can be used for good and bad purposes. For now, the company is left to identify what safeguards it can implement to prevent more unintended consequences. The Verge has more.

Links

Links That Don’t Suck:

😢 Average Wall Street bonuses dipped 26% to $176,700 last year

💊 This pill could become the U.S.’s first over-the-counter daily birth control

💎 ‘Ultra-rare’ pink diamond expected to sell for more than $35 million at auction

🤖 FTC should stop OpenAI from launching new GPT models, says AI policy group

✉️ Florida principal scammed into sending $100k check to Elon Musk impersonator

🙂 Workers are largely happy with their jobs – but not their paychecks, survey finds