Stocks and most other major assets rebounded as the safe-haven U.S. Dollar fell to kick off June. Let’s see what else you missed on this turnaround Thursday. 👀

Today’s issue covers Dollar General’s price retreat, making Lululemon-ade out of lemons, and a recap of the top tech earnings. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Communication services (+1.33%) led, and utilities (-0.71%) lagged. 💚

In economic news, the May ADP report showed private sector employment rose 278,000 vs. the estimate of 180,000. Smaller firms with fewer than 50 workers and the leisure and hospitality industry accounted for most of the job gains. U.S. initial and continuing jobless claims were essentially flat WoW, with the four-week average falling to its lowest since early March. 🧑💼

First-quarter nonfarm productivity declines were revised up from -2.7% to -2.1%. Output growth was revised from +0.2% to +0.5%. And reported hours worked growth was revised from 3% to 2.6%. 🔺

The S&P Global U.S. manufacturing PMI fell back into contraction territory after briefly expanding in April as new order inflows remain weak. The ISM manufacturing index exhibited similar weakness, contracting for the seventh straight month on slow demand. 🏭

Internationally, Eurozone headline inflation declined to a 15-month low of 6.1% YoY, and the core rate of inflation fell to 5.3% YoY. Investors are speculating whether the current progress is enough to cause the European Central Bank (ECB) to pause its rate hiking plans this summer. ⏯️

Luxury electric vehicle maker Lucid Group fell 16% after announcing $3 billion through a new stock offering, of which 60% will be a private placement with Saudi Arabia’s Public Investment Fund. 🪫

Other symbols active on the streams included: $UCAR (+144.05%), $TRKA (+24.49%), $NVDA (+5.12%), $AI (-13.22%), $PLTR (-1.16%), $SDA (+0.60%), $RETO (+4.82%), and $SOFI (-1.73%). 🔥

Here are the closing prices:

| S&P 500 | 4,221 | +0.99% |

| Nasdaq | 3,101 | +1.28% |

| Russell 2000 | 1,768 | +1.05% |

| Dow Jones | 33,062 | +0.47% |

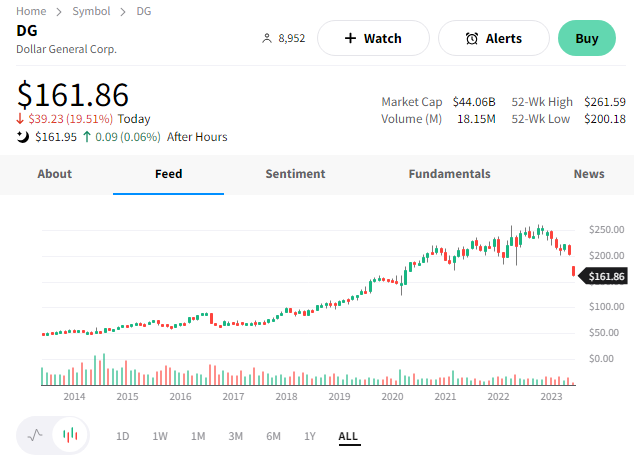

Days after Dollar Tree raised a warning flag about the lower-income consumer, Dollar General is doing the same. ⚠️

In its first fiscal quarter Dollar General reported adjusted earnings per share of $2.34 vs. $2.38 expected. And revenues of $9.34 billion vs. $9.46 billion expected. Same-store sales also rose just 1.6%, less than half the 3.8% increase Wall Street anticipated. 🛒

High inflation and concern over the economy are causing consumers to spend more on necessities. While that means more middle-income consumers are likely to trade down to retailers like dollar stores, the product mix and level of overall spending are putting pressure on earnings. Consumables remain the strongest category but were insufficient to offset weakness in higher-margin seasonal, home, and apparel categories. 🥫

CEO Jeff Owen said the macroeconomic environment “has been more challenging than expected, particularly for our core consumer.” Further, the company believes the headwinds are having a “significant impact on customers’ spending levels and behaviors.”

As a result, the company cut its fiscal 2023 full-year outlook. Its net sales growth forecast was revised from 5.5%-6% to 3.5%-5%, trailing analyst estimates of 5.7%. Same-store sales are expected to rise 1%-2%, down from 3%-3.5% and below the 3.4% consensus view. And its earnings per share forecast was revised lower from +4% to +6% to 0% to -8%, well below the +4.3% expectations. 🔻

Dollar General is the industry’s fastest-growing retailer by store count and remains bullish, planning to open 990 stores in 2023. Though, it’s cutting back on Popshelf stores, which sell discretionary items to higher-income consumers. It’s also making other operational improvements to help preserve margins.

However, it also needs to address workplace safety concerns at its stores. Shareholders approved an independent audit into worker safety after it was revealed 49 people died, and another 172 were injured at its stores over the last decade. That vote passed despite the board of directors recommending shareholders vote against the resolution proposed by Domini Impact Investments and worker advocacy groups. 🦺

Overall, investors remain concerned about the industry’s health in the external environment. Combine that with company-specific troubles at Dollar General, and it’s a bit of a mess right now.

As a result, $DG shares fell 20% to their lowest level in over three years. 👎

Earnings

Making Lululemon-ade Out Of Lemons

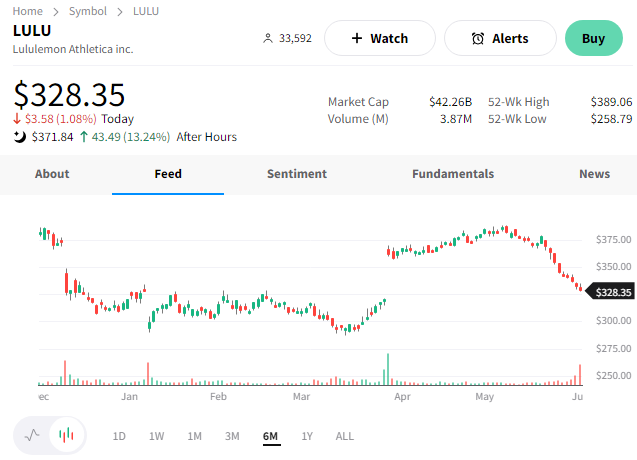

It has been a tough earnings season for clothing retailers so far. However, today we heard from Lululemon, who reported that it’s been able to make lemonade out of lemons. Let’s see what it had to say. 👇

The retailer’s first-quarter adjusted earnings per share of $2.28 beat the $1.98 expected. Revenues of $2 billion also topped the expected $1.93 billion. Sales growth was 24% YoY, with China’s revenue rising 79% YoY as the country reopened its economy.

Executives pointed to China’s rebound and lower air freight as the primary drivers of the beat. Given this quarter’s strength, it was able to ratchet up its full-year revenue and earnings guidance slightly. However, its second-quarter guidance largely aligned with expectations, signaling that much of the full-year uptick simply reflected this quarter’s strength.

Although many caution signals are coming out of the consumer environment, Lululemon has two key factors working in its favor. The first is its core customer is higher income and has been able to weather inflation pressures more easily. And two, despite discretionary spending pulling back, data suggests that some consumers have shifted their view on activewear, loungewear, and footwear from a discretionary purchase to a necessity over the last few years. 👍

Investors also view Lululemon Studio, the company’s at-home fitness business, as a potential driver of future growth. It acquired Mirror for $500 million in June 2020 and has since written down most of that investment to zero. The good thing is that once you get to zero, there’s only potential upside. Well, sort of. However, executives still need to prove they can successfully shift that business away from its hardware focus and build a subscription fitness product. 🏋️♂️

$LULU shares were down roughly 15% for the month heading into this report. The upside surprise has allowed it to recapture much of that decline after hours. 🔺

On the other end of the spectrum are retailers that haven’t yet developed a moat. For example, after reporting a first-quarter revenue miss and earnings beat, Macy’s slashed its full-year earnings and outlook. And Dollar Tree and Dollar General are sounding the alarm about the lower-income consumer. ⚠️

Overall, it remains a cautious time for shoppers across income levels. Clearly, some brands are handling this environment better than others. So far, Lululemon has been able to make lemonade out of the global economy’s lemons. We’ll have to wait and see how long that can last. 🤷

Earnings

Another Ton Of Tech Earnings

It was another busy day of tech earnings. We’re gonna hit you with the headlines to summarize the action. 🔍

Identity and access management company Okta fell 20%. Although its first-quarter results beat expectations and it hiked its full-year outlook, a slowdown in spending and weaker revenue growth remain investors’ key concerns. 🔻

Pure Storage soared 19% after the tech company reported better-than-expected Q1 results and announced Q2 revenue guidance that topped estimates. 💾

Computer application company Veeva Systems experienced an un-be-Veeva-ble 20% run after beating Q1 expectations and raising its full-year earnings guidance. 😮

CyberSecurity company SentinelOne is plunging 30% after missing revenue expectations and cutting its full-year guidance. Executives cited a slowdown in business spending, with macro pressure impacting deal sizes, sales cycles, and pipeline conversion rates. 🛡️

Electric vehicle infrastructure company ChargePoint fell 5% after lowering its revenue growth forecast to below analyst estimates. ⚡

Work management software company Asana rose 6% after reporting a narrower-than-expected loss and beating on revenue. Its revenue outlook also met expectations. 🧑💼

PC manufacturer Dell released earnings early, showing the largest sales decline on record. It still topped expectations but did not provide a second-quarter forecast or update annual guidance due to the current uncertainty around the PC market. 🖥️

Software company MongoDB jumped 22% after its current-quarter results and fiscal 2024 forecast topped analyst expectations. 🔺

Semiconductor giant Broadcom fell 2% after reporting its slowest revenue growth in years. The company’s shares have been propelled to all-time highs on the recent artificial intelligence (AI) hype, as investors hope that it can drive future growth. 🤖

Bullets

Bullets From The Day:

🤝 Microsoft partners with Nvidia-backed CoreWeave in a new AI deal. Despite being at the center of the artificial intelligence (AI) boom due to its investment in OpenAI, Microsoft isn’t placing its bets on just one horse. An insider report indicates that the company has agreed to spend potentially billions of dollars over several years on cloud computing infrastructure from startup CoreWeave, which raised $200 million after achieving a $2 billion valuation last month. The deal will help ensure OpenAI has adequate computing power to support future growth. CNBC has more.

🔍 Web browsers will never be the same after AI is implemented. Browser makers across the spectrum are betting big that giving users easy access to chatbots taught by users’ unique browsing history will make their web experience better. Applying this technology to broad-based applications like search will also serve as a way of reaching a critical mass of users needed to both prove out and improve the technology over time. Clearly, we’re in the early stages of the “new web search” race. More from The Verge.

👓 Meta debuts Quest 3 headset ahead of expected Apple product launch. The company debuted its latest VR/AR headset just days before its biggest competitor is expected to announce its product during the WWDC developer conference on June 5. Mark Zuckerberg said the headset features twice the graphics performance and is 40% thinner than the Quest 2. Additionally, it includes a full-color passthrough feature, allowing users to see the world in full color due to new built-in front-facing cameras. With 2022 sales of devices falling 20% alongside the broader gaming industry, Meta’s hoping the improvements can help spur demand. Yahoo Finance has more.

❌ Oil & gas shareholders continue to reject climate-related petitions. Exxon Mobil and Chevron shareholders opposed more robust measures to mitigate climate change, dismissing over a dozen climate-related proposals during their annual meetings. The two largest U.S. oil producers were feeling pressure to follow European rivals in committing to tougher emissions reduction goals. However, those pushes have also faced shareholder pushback due to their potential profit impact. More from Reuters.

💳 Fintech behemoth Stripe is entering the credit card business. The privately-held financial infrastructure company announced a new charge card program from its commercial card issuing product, Stripe Issuing. Initially launched in 2018, it’s helped companies issue over 100 million cards globally and supports half a million daily transactions. Previously these cards could only be used to spend money from a refunded account. Still, now companies can create and distribute virtual or physical charge cards allowing customers to pay on credit. For Stripe, it provides a new revenue stream and the option to offer customers new financing capabilities. TechCrunch has more.

Links

Links That Don’t Suck:

⚠️ Ozempic craze has spawned a sketchy black market, FDA warns

🤑 31 billionaires are worth more than the U.S. Treasury has in cash

📧 WordPress.com challenges Substack with launch of paid newsletters

🧑⚖️ U.S. Supreme Court throws out ruling against Slack over direct listing

🛰️ Pentagon awards SpaceX with Ukraine contract for Starlink satellite internet

🍩 National Donut Day 2023 deals: Get free donuts at Krispy Kreme, Dunkin’ and more Friday

🛒 Apple generated $1.1 trillion in total billings and sales in the App Store ecosystem during 2022