The Fed’s hawkish message couldn’t stop investors from scooping up more stocks as the tech sector approaches its all-time highs. Let’s see what you missed. 👀

Today’s issue covers the CAVA IPO comeback story, the tech sector’s continuous rally, and a slew of economic data points. 📰

Check out today’s heat map:

11 of 11 sectors closed green. Communication services (+1.59%) led, and real estate (+0.45%) lagged. 💚

Aldeyra Therapeutics initially jumped 10% after announcing positive results from its eye inflammation drug. 💊

Consolidation in the oil and gas industry continues, with NexTier and Patterson-UTI merging into a new entity worth $5.4 billion. 🛢️

Shares of Kroger fell 3% after beating earnings expectations but keeping its full-year estimates unchanged after several quarters of hiking them. 🥑

John Wiley & Sons, Inc. shares fell to the bottom of their two-decade-long trading range after missing earnings expectations and announcing a major restructuring. 📚

Virgin Galactic is targeting a June 27 launch for its first commercial space tourism flight, with a second flight to follow in early August. Shares are jumping more than 50% after hours. 🚀

Other symbols active on the streams included: $SOFI (-1.95%), $CREC (+7.31%), $GGAA (+16.10%), $MULN (+16.27%), $MVIS (+9.78%), $VEDU (+2.86%), $EDTX (+202.13%), and $NKLA (+29.63%). 🔥

Here are the closing prices:

| S&P 500 | 4,426 | +1.22% |

| Nasdaq | 13,783 | +1.15% |

| Russell 2000 | 1,889 | +0.81% |

| Dow Jones | 34,408 | +1.26% |

CAVA Group, Inc. went public today and is making many headlines. Let’s explore why. 👇

First, CAVA is a Mediterranean fast-casual restaurant brand that’s become very popular in the U.S. It has roughly 263 restaurants nationwide, generating $203.1 million in revenue during the first quarter of 2023. It operates in 22 states and Washington D.C., with 82% suburban, 14% urban, and 4% specialty locations. 🥙

For all intents and purposes, it’s similar to Sweetgreen and Chipotle, but with more healthful food and bold, satisfying flavors.

The primary reason it’s making headlines today is because it’s one of the first major companies to test an initial public offering (IPO) market that’s been frozen for the last eighteen months. Many other brands have delayed their IPO or identified other strategic options to avoid raising money in a weak environment. ⏸️

However, the U.S. stock market has rebounded significantly since October, led by the technology sector. But skepticism remains about whether we’re in a new bull market. As a result, investors are looking at IPO performance to identify the market’s current appetite.

And boy, was there an appetite…

$CAVA shares priced at $22 per share, giving the company a $2.5 billion valuation. The company initially sought to price shares between $17 and $19, raised the range to $19-$20, and ultimately priced at $22. However, even that left some money on the table as shares opened nearly double that at roughly $41. 💰

The strong opening should be a go-ahead signal to other restaurant chains considering going public. For example, Brazilian steakhouse Fogo de Chao and Korean barbecue chain Gen Restaurant Group have confidentially filed regulatory paperwork.

The second reason investors are looking at CAVA is that they’re wondering if they’re a fast-casual restaurant success story or a dud. There’s been a stark contrast between Chipotle’s performance and some of the smaller competitors like Sweetgreen, Noodles & Company, and El Pollo Loco Holdings.

Given the direct similarities between CAVA and Sweetgreen, some investors are concerned it could have the same fate, falling roughly 80% from its post-IPO highs. Others suggest its model and offering are unique enough to differentiate it from its competitors. 🥘

Time will tell. But for now, the market appears to be hungry for more IPOs. We’ll see if Wall Street delivers them. 😋

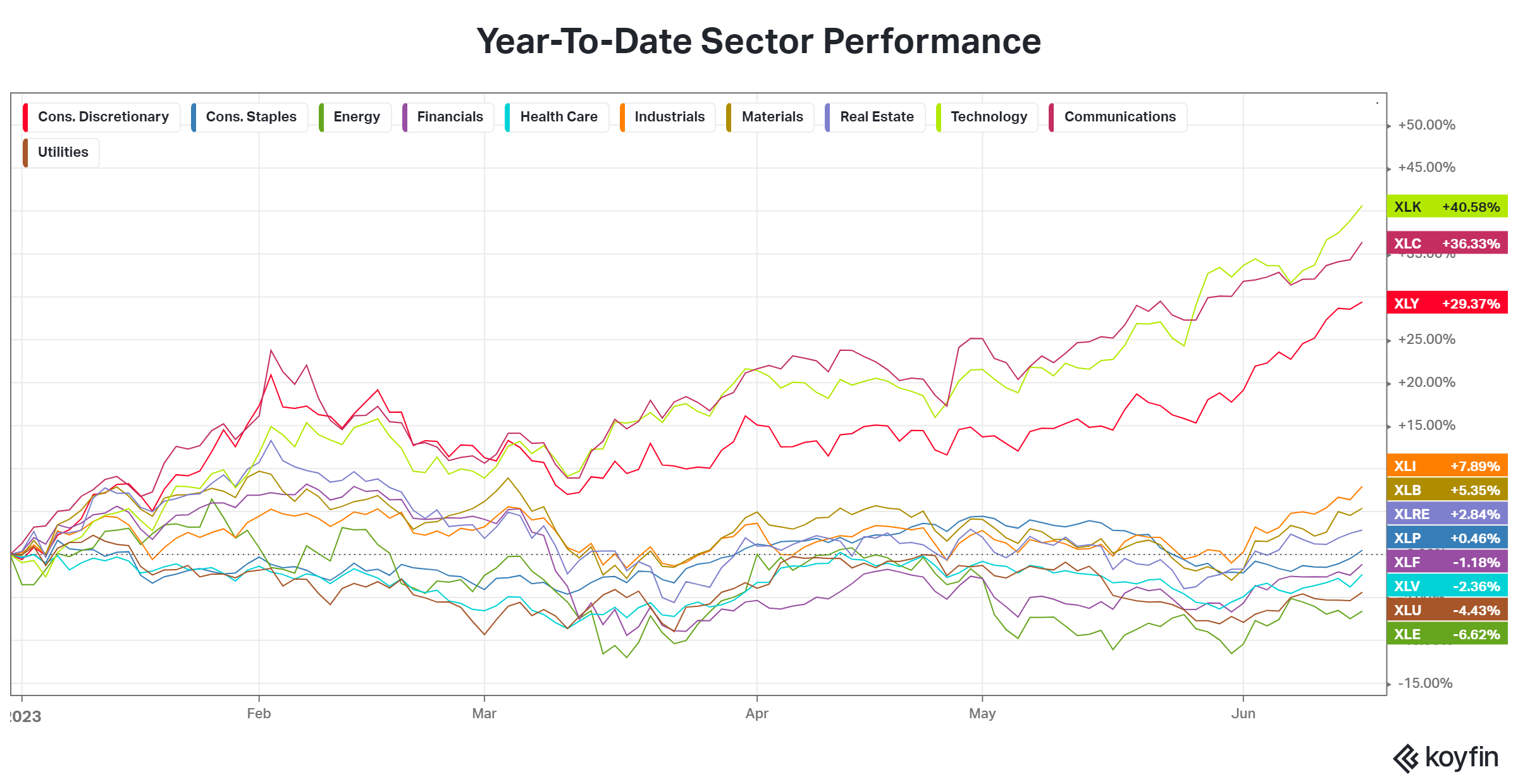

The technology sector ETF $XLK is the first sector SPDR ETF to approach its all-time highs following 2022’s market correction. 🤩

Now, that’s not terribly surprising, given that mega-cap technology stocks have been the strongest since the October 2022 bottom. However, a quick look under the surface shows that Microsoft and Apple comprise 46% of the ETF’s weighting & account for half of its 40% YTD return. With Nvidia, Broadcom, & Salesforce, that number jumps to 75% of the YTD return.

As such, that begs the question of where the market’s future leadership will come from. Mega and large-cap technology stocks cannot go up forever, so investors are looking for the next group of stocks to begin participating to the upside.

So far, we’ve seen an uptick in participation from mid and small-cap technology stocks. But outside of technology, communication services, and consumer discretionary, most sectors are up marginally or down on the year. That can continue for some time. But ultimately, market bulls want to see more sectors and stocks participating, which will help the major indexes continue to rise. 📈

While we’re on the subject of tech stocks, let’s recap a couple of earnings.

Electronics contract manufacturer Jabil hit all-time highs today. The company’s third-quarter results beat top and bottom line expectations, though its guidance for the current quarter came in below estimates. 🏭

Adobe shares are jumping 3% after the software company beat earnings and revenue expectations. Executives said the company is positioned to lead the new era of generative AI given its datasets, foundation models, and product interfaces. 🌥️

And lastly, Cognyte Software shares popped 6% after reporting better-than-expected revenues. Higher revenues offset misses on earnings per share, gross margin, operating margin, and adjusted EBITDA. 🔺

Economy

U.S. Economic Data Recap

And finally, let’s recap today’s busy day of economic data. 📝

First, the European Central Bank (ECB) raised rates by another 25 bp to their highest level in 22 years. The Eurozone remains behind the curve on inflation, expecting headline inflation to fall to just 5.4% by the end of the year and reach 2.2% by the end of 2025. Like the Fed, it’s had a tough time forecasting inflation correctly. Regardless, it believes further tightening is needed to lower prices faster, given that economic growth is holding up better than expected. 📈

U.S. retail sales rose 0.3% in May and 0.4%, excluding automobiles and gasoline. Spending increased in ten of the thirteen categories, showing that consumers remain resilient, likely due to the tight labor market. 🛍️

Business inventories rose just 0.2% in April, with the inventory-to-sales ratio remaining at 1.40 months. In response to slowing demand, businesses continue to reduce production as they attempt to avoid excess inventories. 📦

Industrial production snapped a two-month winning streak in May, falling 0.2%. Manufacturing and motor vehicles saw slight increases, but a 1.8% decline in utilities and a 0.4% drop in mining weighed on the index. Capacity utilization also edged down ten bps to 79.6%. 🏭

The Philly Fed manufacturing index recorded its tenth consecutive negative reading at -13.7, though the six-month outlook rose into positive territory for the first time in four months. The New York Fed manufacturing index jumped into positive territory for the first time in six months, driven by a rise in new orders, shipments and increased optimism about future business conditions.

Initial weekly jobless claims were unchanged WoW at 262,000, with continuing claims rising by 20,000 to roughly 1.8 million. Overall, these numbers remain at historically low levels but continue to trend higher. Many analysts see this trend, a drop in job openings, and slowing wage growth as early indications of the labor market softening. 👨💼

And lastly, a tentative agreement is ending the labor dispute that’s crippled West Coast ports for the last two weeks. The six-year tentative agreement covers 22,000 workers and 29 West Coast ports. Though no details were released, it’s certainly a positive that they can begin to work on clearing the port congestion that’s developed. 🚢

Overall, the U.S. economy continues to hum along as inflation comes down. A strong labor market keeps money in people’s pockets, which is eventually spent in the economy. Ultimately the Fed wants to see jobless claims and other labor market indicators begin to trend higher and bring unemployment toward their forecast of 4.1% by the end of 2023. 🔺

Bullets

Bullets From The Day:

🏈 NFL looks to boost minority-owned banks via loan business. The organization consulted with Bank of America and the National Black Bank Foundation as it looks to borrow $78 million from a syndicate of Black and minority-owned banks and community development financial institutions. As the sports business grows, organizations seek to support smaller regional and community banks that service nearby communities. Business from these large corporations can be seen as a sign of confidence in an industry recently shaken by failures. CNBC has more.

💵 Twitch looks to hold onto creators by upping its revenue split. As the competition for creators heats up, live streaming service Twitch is beginning to grandfather in some streamers to a premium revenue share. The new arrangement would allow streamers to keep 70% of the first $100,000 earned on the platform before defaulting back to the current 50/50 rate. With that higher rate comes tougher requirements to qualify, needing 350 paid subscribers for three consecutive months to gain access to the program for the following 12 months. More from TechCrunch.

🎫 Live Nation and Ticketmaster will now have to disclose fees up front. Ticket sellers will still be able to charge outrageously high fees but need to disclose them up front to do so. President Joe Biden announced that two industry behemoths have pledged to allow U.S. consumers to see the total price of tickets up front, minimizing the frustrating experience of seeing more fees show up during the checkout process. It’s similar to the ‘all-in pricing’ model that Airbnb and others have recently had to adopt following consumer backlash. CNN Business has more.

₿ Former FTX executives find new homes in the industry. Amy Wu, who most recently led FTX Ventures, joins Menlo Ventures as an NYC-based partner focused on consumer startups. Analysts say she thrives in the areas of deeper psychology, gaming, and the creator economy, all of which impact consumer startups significantly. With that said, critics say this is another example of the elite getting to “fail upward,” being rewarded with a new gig after being duped by FTX along with everyone else. More from Axios.

🎶 Music publishers sue Twitter over the platform’s copyright enforcement. The National Music Publishers’ Association (NMPA) is suing the social media company on behalf of 17 music publishers representing the business’ most prominent artists. The lawsuit claims that Twitter “fuels its business with countless infringing copies of musical compositions, violating Publishers’ and others’ exclusive rights under copyright law.” Ultimately they allege Elon Musk’s cavalier attitude towards the topic (and running Twitter) will only create more issues for the music industry’s presence on the platform. The Verge has more.

Links

Links That Don’t Suck:

🏌️ U.S. Dept. of Justice said to probe PGA-LIV Merger

⚠️ New report flashes a warning light over 401(k) account balances

✈️ Qantas reveals economy seats for 19-hour NYC-Sydney ultra-long-haul flights

🧑⚖️ U.S. withdraws new charges in Sam Bankman-Fried case, punts them to 2024

⚡ Toyota stock having best week since 2009 after annual meeting, new EV goals

🪓 Odey Asset Management to be broken up after harassment claims against its founder

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.