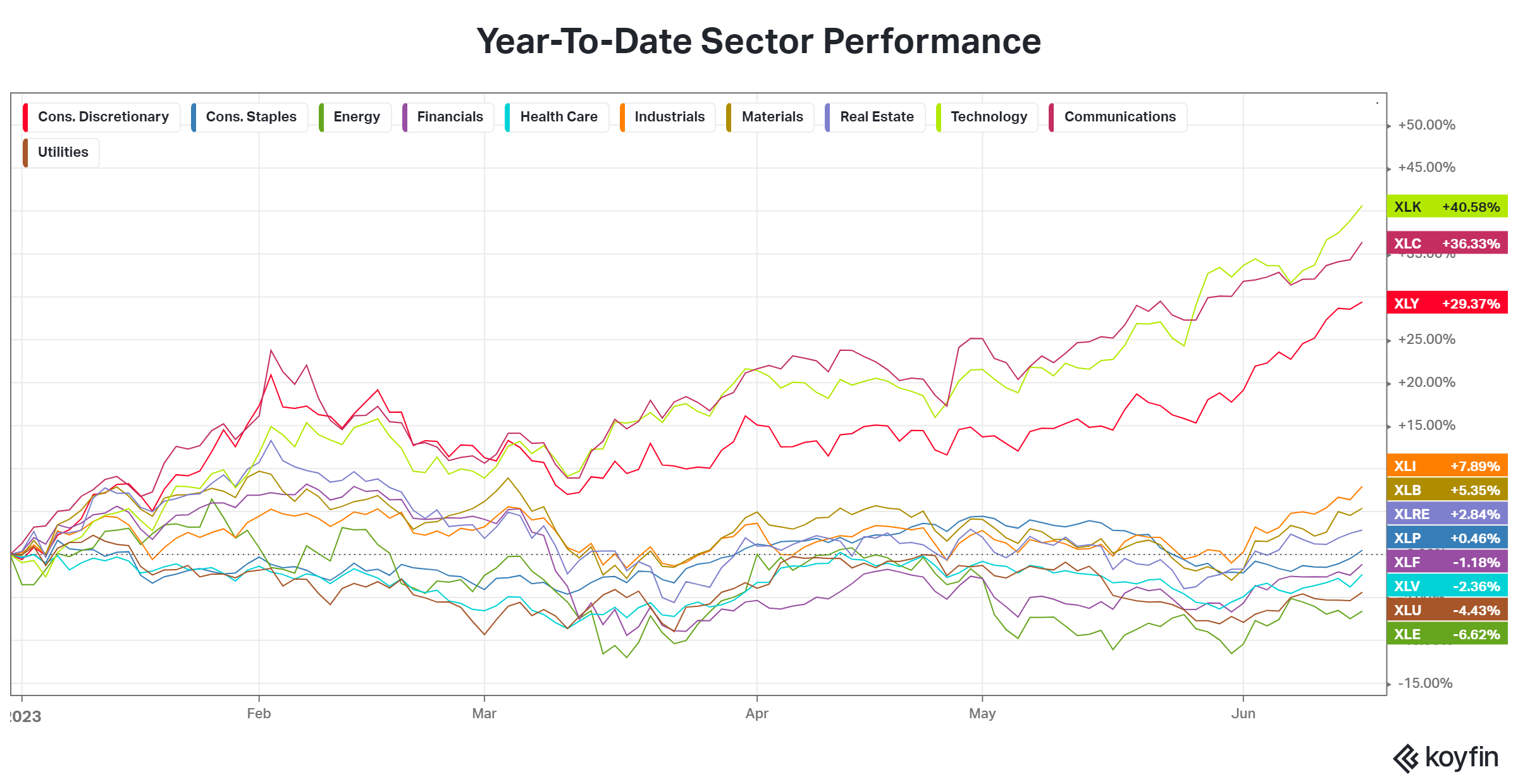

The technology sector ETF $XLK is the first sector SPDR ETF to approach its all-time highs following 2022’s market correction. 🤩

Now, that’s not terribly surprising, given that mega-cap technology stocks have been the strongest since the October 2022 bottom. However, a quick look under the surface shows that Microsoft and Apple comprise 46% of the ETF’s weighting & account for half of its 40% YTD return. With Nvidia, Broadcom, & Salesforce, that number jumps to 75% of the YTD return.

As such, that begs the question of where the market’s future leadership will come from. Mega and large-cap technology stocks cannot go up forever, so investors are looking for the next group of stocks to begin participating to the upside.

So far, we’ve seen an uptick in participation from mid and small-cap technology stocks. But outside of technology, communication services, and consumer discretionary, most sectors are up marginally or down on the year. That can continue for some time. But ultimately, market bulls want to see more sectors and stocks participating, which will help the major indexes continue to rise. 📈

While we’re on the subject of tech stocks, let’s recap a couple of earnings.

Electronics contract manufacturer Jabil hit all-time highs today. The company’s third-quarter results beat top and bottom line expectations, though its guidance for the current quarter came in below estimates. 🏭

Adobe shares are jumping 3% after the software company beat earnings and revenue expectations. Executives said the company is positioned to lead the new era of generative AI given its datasets, foundation models, and product interfaces. 🌥️

And lastly, Cognyte Software shares popped 6% after reporting better-than-expected revenues. Higher revenues offset misses on earnings per share, gross margin, operating margin, and adjusted EBITDA. 🔺