The stock market indexes continued their winning streak, but buyers remained wary of this season’s latest initial public offering (IPO), Birkenstock. Let’s see what else you missed. 👀

Today’s issue covers why LVMH is betting on average results, the IPO window shutting on Birkenstock, and producer prices rising for the third straight month. 📰

Here’s today’s heat map:

8 of 11 sectors closed green. Real estate (+2.02%) led, & energy (-1.29%) lagged. 💚

The volume of adjustable-rate mortgage (ARM) applications rose 15% week over week, raising its share of all applications to a one-year high of 9.2%. ARM rates momentarily fell, causing strapped homebuyers to opt for the product and hope that rates eventually decline. 🏘️

Novo Nordisk’s Ozempic displayed early signs of success in delaying the progression of kidney disease in diabetes, sending shares of dialysis service providers and their product suppliers down sharply. Meanwhile, Tempest Therapeutics shares soared 4,000% after seeing positive study results for its investigational liver cancer treatment TPST-1120. 💉

Samsung Electronics shares jumped despite the company expecting third-quarter profit to plunge 78%. It continues to cut production to cope with the weak demand environment, not expecting a meaningful price recovery until the second quarter of 2024. 📺

Electric vehicle charging network operator ChargePoint said it’s raising $232 million in stock sales, sending shares down 16%. Its CFO says the raise and its recently secured credit line will support the company into early 2025. ⚡

Goldman Sachs fell slightly after warning that selling its fintech lending platform GreenSky would negatively impact third-quarter earnings. 📊

Other symbols active on the streams: $TTOO (+6.90%), $NVOS (-11.75%), $AKRO (-17.14%), $MTNB (+313.55%), $PLUG (+5.31%), $SILK (-49.03%), $REQ.X (+45.41%). 🔥

Here are the closing prices:

| S&P 500 | 4,377 | +0.43% |

| Nasdaq | 13,660 | +0.71% |

| Russell 2000 | 1,773 | -0.15% |

| Dow Jones | 33,805 | +0.19% |

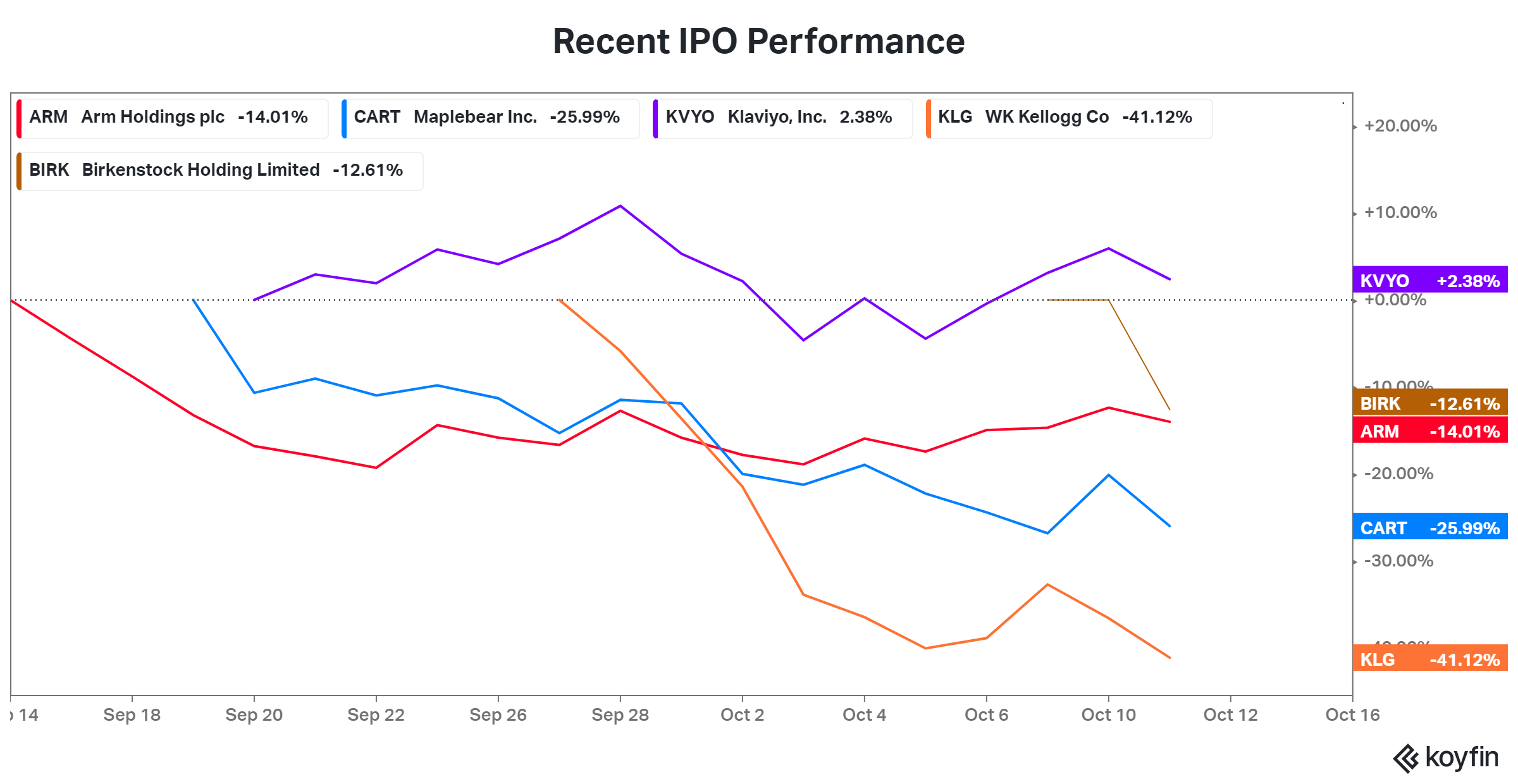

Although the initial public offering (IPO) market is trying its best to revive itself, investors remain skeptical of new issues. Birkenstock, the market’s latest suitor, failed to attract first-day fanfare. 🥱

The German shoemaker expected to price its IPO between $44 and $49 per share, according to its initial Securities and Exchange Commission (SEC) filings. However, it ultimately priced last night at $46 per share, raising $1.5 billion and giving it a market value of roughly $8.6 billion.

Still, at that valuation, it is still worth more than peers like Allbirds, Crocs, and Steve Madden. It was also double the $4.3 billion private equity firm L Catterton acquired it for in 2021. Because of that somewhat lofty valuation, investors hesitated to jump on board. ⚠️

Shares opened late in the day at $41.30, representing a roughly 10% discount from yesterday’s pricing. Although they saw an initial 4% pop, they could not make their way up toward that $46 level and quickly faded, closing down at the day’s lows. 🙃

Despite solid growth over the last few years, analysts say the company is fairly valued at current levels and doesn’t give the public markets much to chew on. Additionally, the recent fanfare from its appearance in the hit movie Barbie failed to impress retail investors, who worry that it’s simply a shoe company facing the same consumer slowdown the rest of the industry is battling.

Given the lackluster performance from other high-profile IPOs, what will set Birkenstock apart from the rest of the group remains unclear. Some argue that its profitability is a major differentiating factor, especially in the current high interest-rate environment. 🤔

As always, we’ll have to wait and see. But for now, follow along with the 555 other $BIRK stream watchers and share your thoughts! 👀

Earnings

Betting On Average

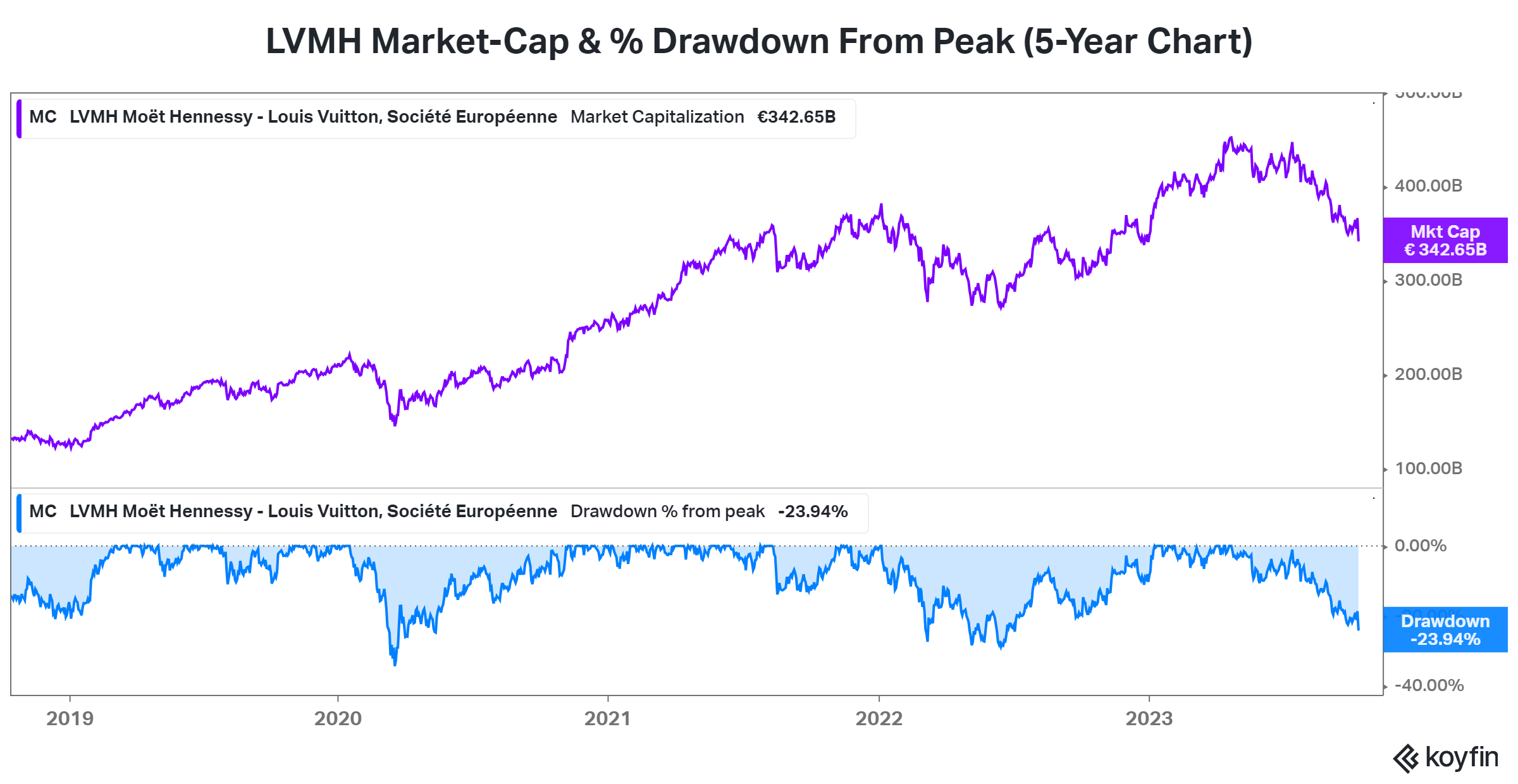

Luxury goods conglomerate LVMH was the talk of the town earlier this year after it briefly became Europe’s most valuable company by topping a $500 billion valuation. However, it’s seen a slow descent back to Earth since then. Today, that trend continued, with shares falling another 7% after management’s comments stoked growth fears. 😰

Third-quarter revenues grew 9% YoY to roughly $21 billion, down from a 17% increase in the second quarter. Driving the decline was a 14% YoY decline in sales from its wines and spirits division. And Asia’s slow recovery continues to weigh on results, with revenues from Asia excluding Japan rising just 11% YoY, down from 34% in the second quarter. 🔻

CFO Jean-Jacques Guiony had this to say, “After three roaring years, and outstanding years, growth is converging toward numbers that are more in line with historical average.”

While average growth may be acceptable in some environments, it’s much harder to swallow after your stock has experienced a significant rally. With the stock extending its recent drawdown to 24%, it’s clear the market was expecting above-average growth to justify recent above-average returns. 👎

It’s unclear where the stock will find its footing. But what is clear is evidence is building that even the higher-end consumer is beginning to pull back. And that means management at LVMH and its peers will likely need to do more to reset expectations among stock market investors. 🔮

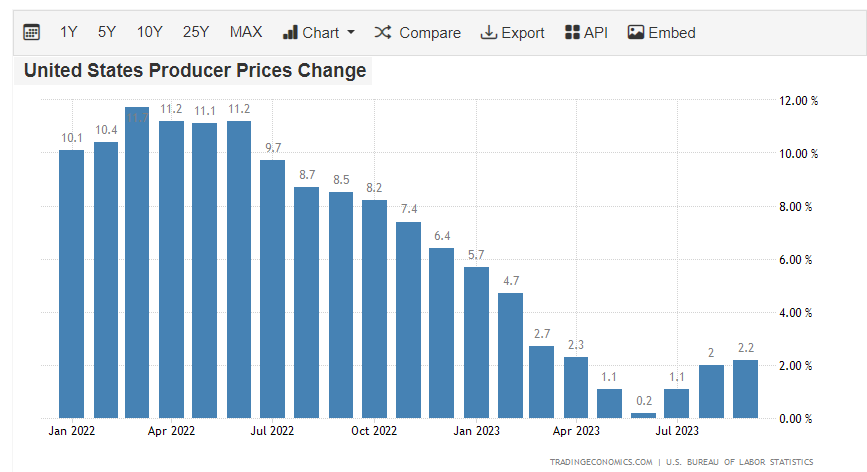

After twelve straight months of year-over-year declines, producer prices have stabilized and are back on the rise these last three months. That, combined with the stickiness in core consumer prices, has investors wondering if inflation could return from the dead. 😬

The headline producer price index (PPI) rose 0.5% MoM and 2.2% YoY in September. Excluding food and energy, core PPI rose 0.3% MoM as services drove the larger-than-expected increase. 🔺

Analysts say today’s report suggests that sticky inflation and higher interest rates are here to stay. Although inflation has fallen significantly from last year’s peak, getting it down to the Fed’s 2% target and keeping it there steadily will take time and patience. 🕰️

Investors hoping to gain additional insights from September’s FOMC Minutes were left disappointed, with the Fed echoing what it did in recent weeks. They’re remaining data-dependent and not taking another rate hike off the table until they’re fully convinced inflation has been conquered.

All eyes will turn to tomorrow’s consumer price index (CPI), where analysts will most closely assess the progress in services inflation. 👀

Bullets

Bullets From The Day:

🔋 Stellantis and Samsung SDI to build a new U.S. EV plant. The two plan to invest over $3.2 billion in a new electric vehicle battery plant in Indiana, with the news coming amid contentious U.S. labor strikes between the Big Three automakers and the United Auto Workers (UAW) union. Battery plants have been a central sticking point in the labor costs, as the jobs they create will be crucial to the union’s long-term viability. CNBC has more.

🛢️ Exxon Mobil confirms purchase of Pioneer Natural. The oil and gas giant is doubling down on fossil fuels with its $59.5 billion all-stock deal and largest buyout since acquiring Mobil two decades ago. Including debt, Exxon will commit $64.5 billion to the acquisition as it expands its presence in the oil-rich Permian Basin, straddling the border between Texas and New Mexico. Combining Pioneer’s more than 850,000 net acres with its own 570,000, the contiguous fields will give the company 15 to 20 years of remaining inventory (~16 billion barrels). More from AP News.

🎯 Biden administration eyes junk fees in latest consumer protections push. On Wednesday, the Federal Trade Commission (FTC) proposed a new rule that would ban “bogus fees” as it battles hidden costs amounting to tens of billions of dollars annually. Junk fees are any additional costs disclosed after a consumer has decided to purchase a service or product, meant to obscure the actual price. The new rule would make businesses disclose all mandatory fees when listing a price, providing consumers with a clear apples-to-apples basis comparison. Axios has more.

📝 Right-to-repair is officially law in California. The law makes it easier for owners to repair devices themselves or take them to independent repair shops. Given California is one of the world’s largest economies, the bill will make it easier for consumers all over the U.S. to repair their devices. California took a stricter stance than other states that passed similar bills, requiring manufacturers to make appropriate tools, parts, software, and documentation available for seven years after production for devices priced above $100 and three years for those under $100. More from The Verge.

🤝 Menstrual product makers form a coalition to reimburse ‘tampon tax.’ The group announced “The Tampon Tax Back Coalition,” which they say is an effort to refund consumers the “unjust tax” on feminine hygiene products that shoppers currently pay in 21 states. The group said shoppers who purchase products from any of these brands can now submit their receipts and be reimbursed the sales tax on their purchases. While 19 states have removed the sales tax on period products, the coalition says much more work must be done on this front. CNN Business has more.

Links

Links That Don’t Suck:

🤔 America’s biggest bond buyers aren’t buying bonds

🗳️ Steve Scalise wins internal vote to become GOP’s speaker nominee

🍕 Domino’s introduces free Emergency Pizza when fans ‘need it most’

🗓️ U.S. SEC shortens deadline to disclose 5% stock ownership to 5 days

😨 ‘Too dangerous:’ Why even Google was afraid to release this technology

🤢 Restaurant charges ‘vomit fee’ for customers who have too many mimosas at brunch