The volatility index, gold, and bonds rose today, with stocks falling despite decent third-quarter results from banks. Many investors appeared to reduce risk ahead of the weekend, as reports indicate Israel is preparing a ground offensive against Hamas. Let’s see what else you missed.

Today’s issue covers Progressive progressing to all-time highs, banks kicking off another earnings season, and Japanese conglomerate Canon pivoting to chipmaking equipment. 📰

Here’s today’s heat map:

5 of 11 sectors closed green. Energy (+2.16%) led, & consumer discretionary (-1.44%) lagged. 💚

The energy sector jumped after the U.S. tightened sanctions on Russia’s crude oil sales, adding to the recent rise in energy prices that’s pushed headline inflation higher and pressured consumer sentiment. The preliminary October University of Michigan consumer sentiment survey showed a large drop in respondents’ assessment of economic conditions today and six months from now. 👎

Novo Nordisk made all-time highs after the company raised its full-year sales and operating outlook, citing soaring demand for Wegovy and Ozempic. Meanwhile, Pfizer shares fell despite the U.S. Food and Drug Administration (FDA) approving its inflammatory bowel disease drug. 💊

Cassava Sciences is now down 90% from its all-time highs, falling another 15% today. A neuroscientist who worked with the company regularly was accused of ‘scientific misconduct,’ with the investigation raising serious questions about his research. ⚠️

UnitedHealth Group rose 3% after its earnings and revenue both topped expectations, which had previously been lowered due to a catchup in medical procedures delayed during the pandemic. 👨⚕️

On the Hong Kong exchange, JD.com fell to fresh all-time lows amid rumors that a businessman with the same surname as the company’s chairman had been arrested. 🚨

And U.K. regulators approved Microsoft’s restructured deal terms, allowing its $68.7 billion acquisition of Activision Blizzard to officially close. 🎮

Other symbols active on the streams: $TTOO (-52.87%), $AMC (-13.64%), $UAL (-2.76%), $UBER (-5.38%), $RVMD (+23.59%), $EH (+18.71%), $TPST (-8.54%). 🔥

Here are the closing prices:

| S&P 500 | 4,328 | -0.50% |

| Nasdaq | 13,407 | -1.23% |

| Russell 2000 | 1,720 | -0.84% |

| Dow Jones | 33,670 | +0.12% |

Earnings

Banks Kick Off Earnings

There are a lot of factors impacting stocks, but earnings season is about to throw another wildcard into the mix. Let’s see how banks fared today as they bring us into another season of earnings. 🔔

First up is JPMorgan Chase, which reported earnings per share (EPS) of $4.33 on revenues of $40.69 billion. That topped estimates of $3.96 in EPS on $39.63 billion in revenues.

Net interest income surged 30% YoY to $22.9 billion, topping estimates by $600 million. Its provision for credit losses came in at $1.38 billion, way below the $2.39 billion Wall Street estimate. 🔺

With that said, CEO Jamie Dimon warned analysts that those figures will normalize over time. Retail banking profits jumped 36% YoY, but corporate and investment banking fell 12% on tepid deal flow.

Dimon remains cautious overall, saying current economic conditions could cause interest rates to climb even further. He also referenced the potential implications of last week’s attacks on Israel, stating, “This may be the most dangerous time the world has seen in decades. While we hope for the best, we prepare the firm for a broad range of outcomes.” ⚠️

Meanwhile, Citigroup reported adjusted EPS of $1.63 vs. the $1.21 expected. Revenues of $20.14 billion topped the $19.31 billion anticipated.

Driving the strength was a 12% YoY increase in institutional clients revenue, with rates and currencies revenues the best it’s seen in a decade. Personal banking and wealth management were up 10% YoY, with Citigroup’s overall revenue growth coming in at 9%. 💰

Like JPMorgan, its total cost of credit came in lower than anticipated, primarily due to a smaller-than-expected increase in allowances for credit losses. Overall, the bank and its new CEO are focused on the restructuring plan that will divide it into five main business lines by early 2024. 🏦

And Wells Fargo also managed to top earnings and revenue expectations. Higher net interest income drove the results, but higher rates are also having an impact on credit quality.

CEO Charlie Scharf said, “While the economy has continued to be resilient, we are seeing the impact of the slowing economy with loan balances declining and charge-offs continuing to deteriorate modestly.”

Collectively, the banks warned of a slow but gradual decline in the U.S. consumers’ health and economic outlook. Although the industry is benefitting from higher rates more broadly, it understands the impact that higher costs of capital have on consumers and the overall economy. As a result, they’re erring more on the side of caution as several risks emerge into year-end. 🛍️

After an initial pop, the stocks all pulled back intraday to close well off their highs. For the last year, JPMorgan has been the clear winner in an industry that remains well off its 2022 highs. 📊

Company News

Canon Pivots From Pics To Chips

The Japanese conglomerate is best known for its printers and cameras but hopes a business pivot will help get its stock price going again. 💡

Today, the company launched a tool that helps manufacture the most advanced semiconductors. Its “nanoimprint lithography” (NIL) system is the company’s attempt to compete with Dutch firm ASML, which leads the extreme ultraviolet (EUV) lithography machine industry.

This technology is in high demand because it plays a significant role in manufacturing semiconductors at 5 nanometers and below. Essentially, there’s a race to make semiconductors smaller and more powerful. And whoever can develop the tools needed to do that should benefit strongly from this secular growth trend. 🏭

Canon says its latest machine is able to make semiconductors equivalent to a 5nm process and go as small as 2nm. For context, Apple’s most recent iPhone models use a 3nm semiconductor. With TSMC and Samsung looking to make 2nm chips in 2025, Canon will likely attempt to siphon off some market share from ASML as overall industry demand surges.

While the company has been developing its NIL technology since 2004, it’s failed to gain meaningful traction in the world of increasingly complex semiconductors. 📊

However, it hopes the world’s renewed focus on the industry and rising geopolitical tensions between the West and China will help it secure a leadership spot in this space. It’s still unclear, though, if the company can ship this technology to China or if it will fall under current sanctions.

$CAJ shares were flat on the day as investors assessed whether this is all hype or a meaningful shift in the company’s business prospects. 🤔

Earnings

Progressive Progresses To New Highs

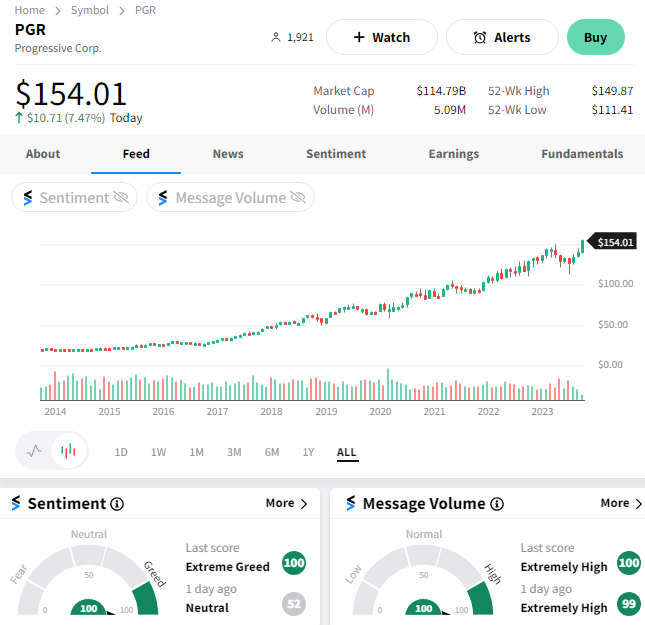

Insurance company Progressive jumped to all-time highs after reporting third-quarter results. 📈

Its adjusted earnings per share of $1.89 topped estimates of $1.72, while net premiums written and earned both rose 20%. Analysts had anticipated net premiums written of $15.38 billion vs. actual results of $15.59 billion. 🔺

The insurance industry has been facing significant cost pressures over the last few years but has compensated for that by raising customers’ premiums. Progressive’s diversified mix of policies and coverage areas has allowed it to hold up better than some of the more concentrated insurers.

$PGR shares continued their upward trend on the news. 🤩

Bullets

Bullets From The Day:

💰 Spotter raises funds to invest in YouTuber’s back catalogs. The investment industry is looking beyond traditional artists’ royalties as the search for yield continues and the creator economy grows. Los Angeles-based startup Spotter raised another $200 million to invest in YouTubers’ growth, receiving future ad revenue from their uploads in exchange for an upfront cash investment. Just four years after being funded, it’s on track to have invested a cumulative $1 billion in creators, betting big that its content catalogs will generate returns for its investors. TechCrunch has more.

🚫 Biden Administration eyes more AI chip restrictions. The latest action would close a loophole that gives Chinese companies access to American artificial intelligence (AI) chips through overseas units. Over the last year, tensions between the U.S. and China have risen sharply as the West diversifies its manufacturing away from the country and looks to thwart Beijing’s access to new technologies deemed critical for the future. While the efforts have paid some dividends, it’s clear U.S. regulations still have significant gaps to fill if the policies will be effective. More from Reuters.

🔌 U.S. invests $7 billion in hydrogen hubs. As the U.S. and other developed nations look to transition their infrastructure to clean energy, hydrogen will need to play a major role. However, the environmental benefits of this fuel source hinge on recreating the way it’s traditionally made, as it’s significantly more expensive to produce hydrogen using renewable energy like solar, wind, and nuclear. Still, hopes are these seven hubs can progress the U.S. toward its goal of reducing the cost by 80% (to $1 per kilogram) in the next decade. The Verge has more.

🤝 TikTok secures a major partnership with Disney. The social media site has landed its latest big-name publishing partner for its premium ad product, Pulse Premiere. The media giant joins NBCU, Conde Nast, DotDash Meredith, BuzzFeed, and others already using the product. However, its deal differs because it will develop a “first-of-its-kind” content hub, suggesting its partnership includes special accommodations that could be extended to future brand partners. TechCrunch has more.

💸 Trump Media’s SPAC partner is returning $1 billion to investors. The funding partner for Trump Media & Technology group received $467 million in canceled investor commitments, causing it to proactively return the remaining $533 million it raised from institutional investors. Executives say this is a positive development in the company’s merger prospects. However, it’s unclear how it would finance its operations after the merger since the initial plan was for DWAC to provide it capital once the deal closed. CBS News has more.

Links

Links That Don’t Suck:

🏬 Netflix is planning to launch retail destinations in 2025

⚠️ The housing market looks like a bubble, 2008 regulator says

🔺 Medicare monthly Part B premiums to rise nearly $10 for 2024

😡 T-Mobile is pushing some unlimited customers onto pricier plans

🧾 Gap between U.S. income taxes owed and paid is set to keep growing, the IRS says