October is seasonally a weak period for the stock market, and this year certainly lived up to that expectation. Let’s see what you missed on the final day of the month. 👀

Today’s issue covers how the market ended “Ooptober,” real estate stocks falling on the NAR lawsuit ruling, and JetBlue descending to its post-financial-crisis lows. 📰

Here’s today’s heat map:

11 of 11 sectors closed green. Real estate (+2.06%) led, & energy (+0.33%) lagged. 💚

The third-quarter employment cost index rose 1.1% QoQ and 4.3% YoY, with wages growing 1.2% and benefits staying flat. Consumer sentiment fell for the third straight month during October, with current and future economic expectations ticking down. The S&P Case-Shiller home price index showed prices rose 1% MoM and 2.2% YoY in August, marking its sixth consecutive rise. 🔺

Internationally, the Bank of Japan held its short-term policy rate at -0.1% but raised the upper bound of its 10-year JGB yield range to 1%. The bank raised its inflation outlook and took a slightly more hawkish tone as it toes the fine line of balancing economic growth and inflation risks. Additionally, the Eurozone experienced a contraction this summer as inflation ticked up. ⏯️

The world’s largest publicly traded uranium company, Cameco Corp., gave the sector a boost today after beating earnings and revenue expectations. Higher average realized uranium prices helped drive the strength, with executives raising their revenue outlook for the next quarter. ⚒️

Semiconductor maker Wolfspeed jumped 22% after posting a narrower-than-expected first-quarter loss, even as revenue missed expectations. Meanwhile, Advanced Micro Devices fell 5% after hours despite beating earnings and revenue expectations. As has been the case, weak guidance was the culprit bringing the stock down. 🏭

And WeWork shares plummeted 32% after the bell on news that the flexible-office-space company plans to file for bankruptcy as early as next week. 🏢

Other symbols active on the streams: $PAYC (-23.25%), $AMC (+7.23%), $CELH (-5.56%), $CAT (-6.65%), $LTHM (-7.15%), $ICU (-22.85%), $AVTX (+18.00%), and $SOFI (+8.79%). 🔥

Here are the closing prices:

| S&P 500 | 4,194 | +0.65% |

| Nasdaq | 12,851 | +0.48% |

| Russell 2000 | 1,662 | +0.91% |

| Dow Jones | 33,053 | +0.38% |

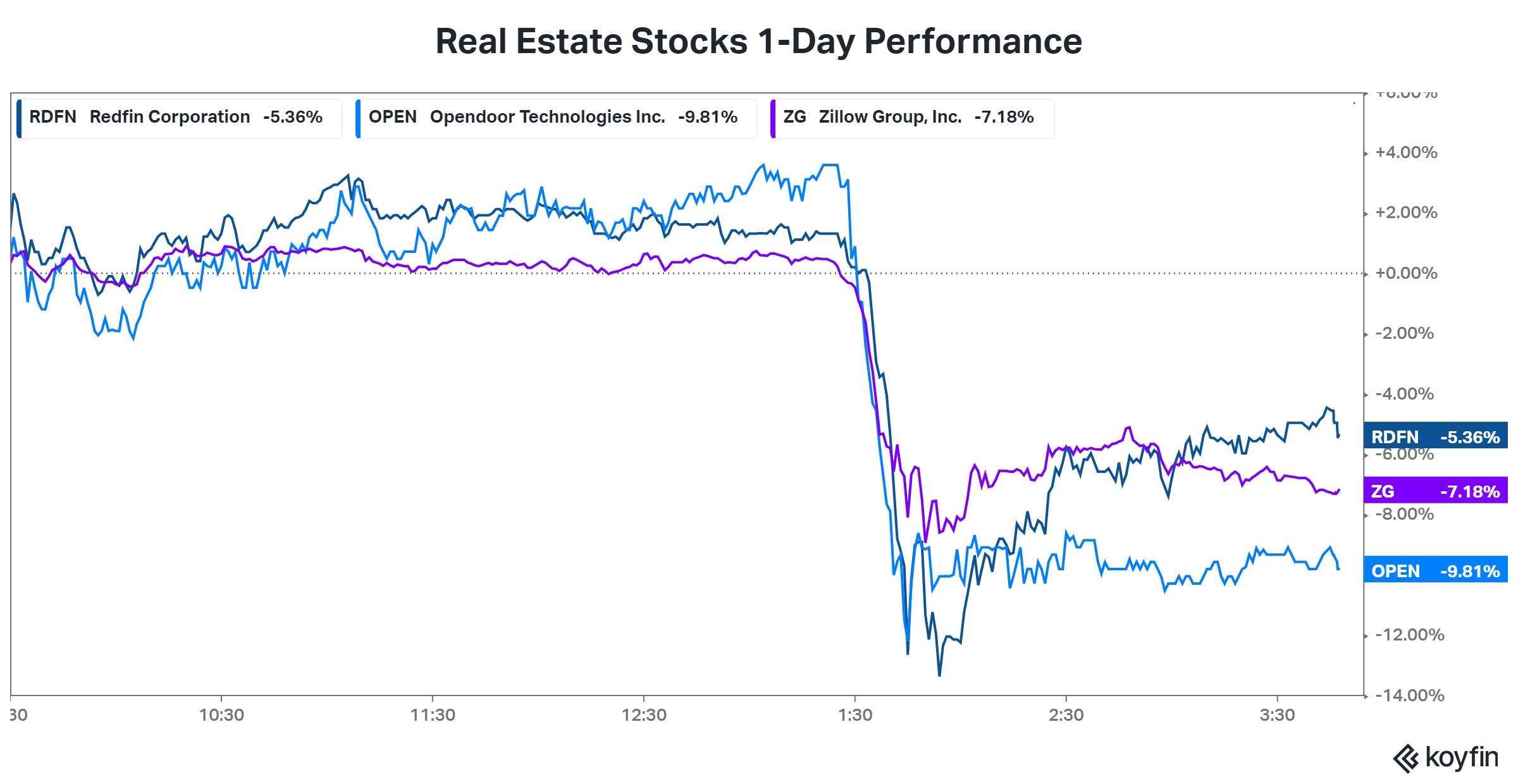

A Kansas City jury just delivered a verdict that could shake up the residential real estate market. 😮

The National Association of Realtors (NAR), HomeServices of America, and Keller Williams were found guilty of colluding to inflate or maintain high commission rates through NAR’s Clear Cooperation Rule. The plaintiffs and lead attorney argued during the two-week trial that the trade group and corporate brokerages knowingly violated their own antitrust rules to juice their commissions. And the ruling requires the defendants to pay damages of $1.78 billion, which could be increased if “treble damages” are assessed. 💰

The judge overseeing the Sitzer/Burnett buyer-broker commission lawsuit still needs to issue his final judgment on the case. However, the guilty verdict is expected to have a significant impact on the industry’s practices and open the door to additional class-action lawsuits in other states.

Today’s news sent residential real estate-related companies like Redfin, Zillow, and Opendoor plunging intraday. It appears that the cocktail of record-high home prices and decade-plus-high interest rates may be the catalyst needed to finally spark change in how the industry operates. 👀

Sponsored

Cybin Announces Unprecedented Positive Phase 2 Interim Efficacy Data for CYB003

Cybin Inc. (NYSE:CYBN) (NEO:CYBN), today announced Phase 2 interim results for CYB003, its proprietary deuterated psilocybin analog, demonstrating a rapid, robust and statistically significant reduction in symptoms of depression three weeks following a single 12mg dose compared to placebo. At the 3-week primary efficacy endpoint, the reduction in major depressive disorder (“MDD”) symptoms, defined as change from baseline in MADRS total score, was superior in participants assigned to CYB003 compared to the participants who received placebo by 14.08 points (p=0.0005, Cohen’s d=2.15). A p-value indicates statistical significance. Generally, values <0.05 are considered statistically significant and values <0.001 are considered highly statistically significant.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

JetBlue Descends To GFC Lows

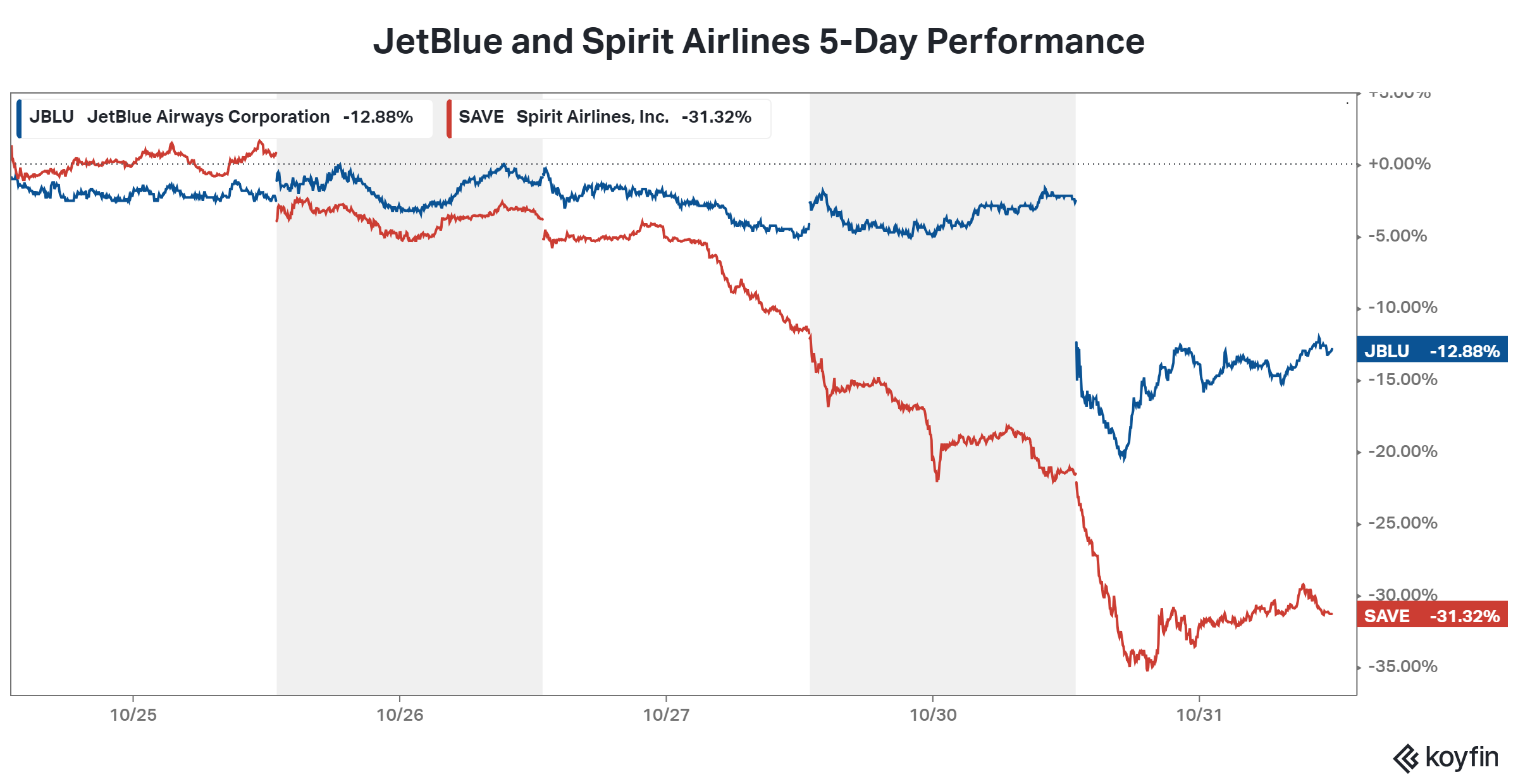

It was a rough day for New York-based airline JetBlue, with its shares sinking to a 12-year low. 🛬

The airline posted a third-quarter adjusted loss per share of $0.39 on revenues of $2.35 billion, missing expectations of $0.25 and $2.38 billion. Executives blamed a challenging operational backdrop, citing increased air traffic control and weather-related delays. 📊

Looking ahead, JetBlue increased its fourth-quarter and full-year adjusted loss guidance. Rising fuel and other costs, along with slowing domestic travel prices and demand, have been a double-whammy for the airline. As a result, it’s reducing or eliminating some schedules as the industry struggles with overcapacity.

Meanwhile, Spirit Airlines said it will have little to no capacity growth next year as slower demand and a Pratt & Whitney engine issue weigh on results. As a result, it’s pausing new-hire flight attendant and pilot training next month, cutting costs to weather the storm better. ✂️

Overall, anxiety remains high around the JetBlue-Spirit merger. It would be the first major U.S. airline combination since 2016 when Alaska and Virgin America came together. With the Biden Administration focusing heavily on anti-trust cases, the Justice Department has alleged the proposed transaction will increase fares and reduce consumers’ choices. They’re concerned most with the lower-income (budget) travelers, who will likely be impacted most. 🧑⚖️

The trial began today and is expected to take three weeks, though it could extend through December 5th. The earnings news and trial starting jolted both stocks, with $JBLU and $SAVE falling sharply over the last five days. 📉

Stocks

How Stocks Ended “Ooptober”

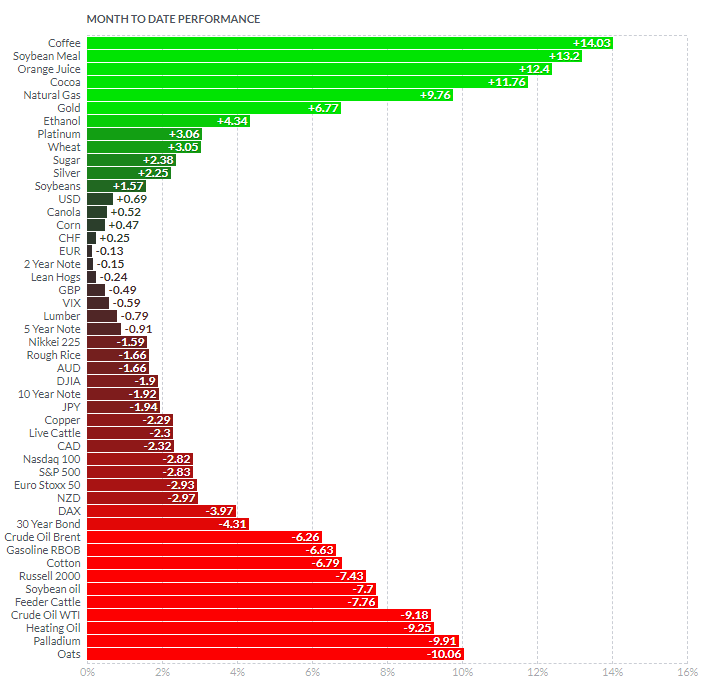

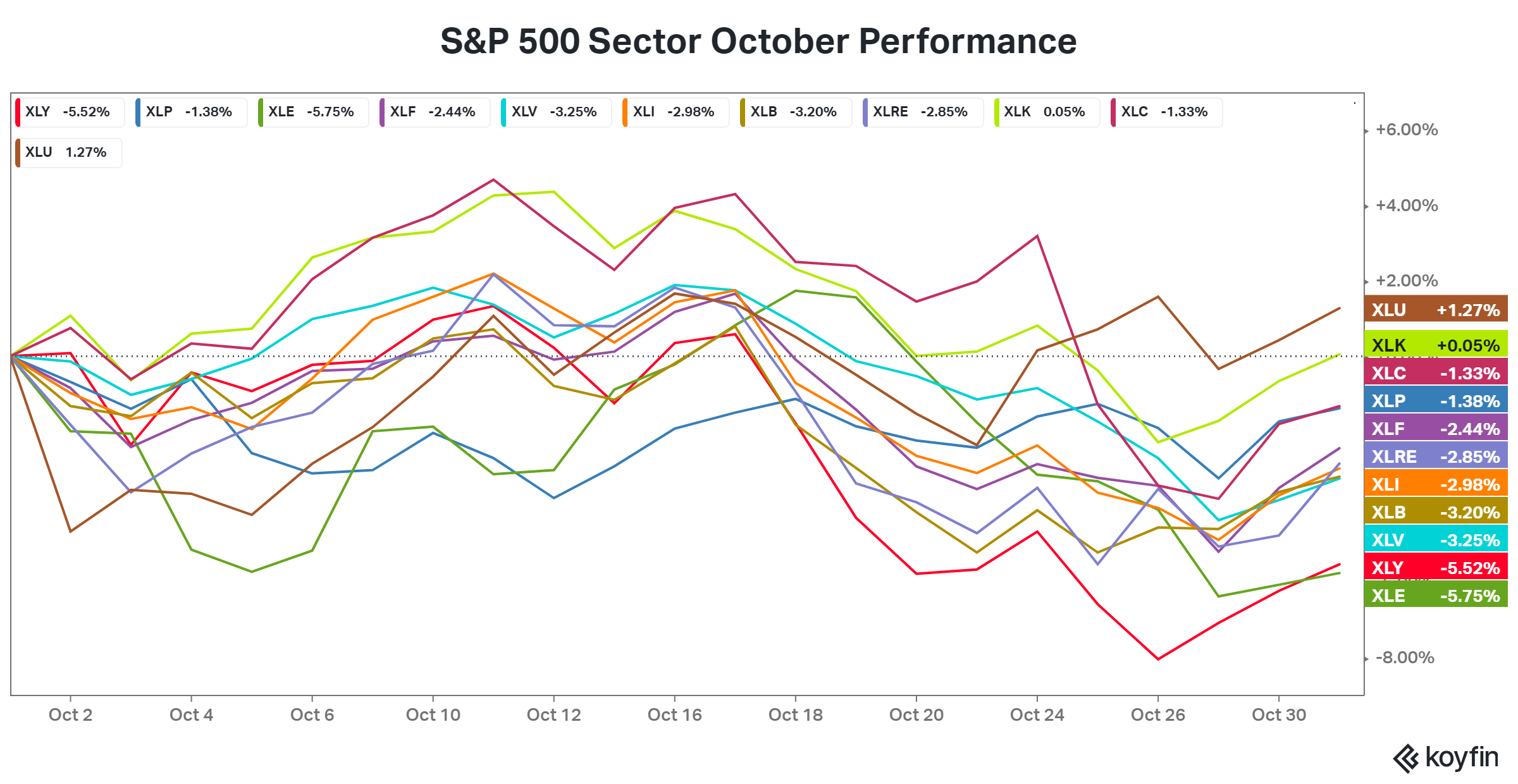

Well, it was another wild month for the markets in October. Seasonally, it tends to be a rough period for the stock market, so it certainly lived up to that by crushing investors’ hopes for an “Uptober.” Let’s see how the various asset classes did. 👇

First, we’ll start with the Finviz futures chart summarizing the major asset classes. As we can see, October was a good month for several commodities but pretty rough for the rest of the market. Bonds continued their decline, while the average stock continued to struggle.

Until last week, the “magnificent seven” mega-cap technology stocks had been holding up the Nasdaq 100 and S&P 500, but earnings finally gave bears an edge there too. 🐻

Meanwhile, consumer discretionary and energy led the sector declines while utilities and technology managed to eke out a small gain. Interest rates and earnings continue to drive sector performance right now, which has been leaning more defensive as global recession fears reverberated again. 📊

The only market to experience a significant “Uptober” was crypto, which saw its total market cap increase by a whopping 19%. That brought it firmly back above the $1 trillion mark as optimism grows that a spot Bitcoin ETF will be approved sometime soon. ₿

Overall, it was a messy month of October. With two months left in the year, there are a lot of money managers that need to catch their benchmarks. Combine that with the many macroeconomic and geopolitical concerns facing the world, and we’ve got a recipe for continued volatility. 😬

Bullets

Bullets From The Day:

🔮 Samsung predicts that the memory chip demand bottom is in. After reporting better-than-expected operating profits, the world’s largest maker of dynamic random-access memory chips said the bottom may be in. Its chips are typically found in consumer devices like smartphones and consumers, which have both struggled after booming during the pandemic era when everyone needed devices to get online. It joins Intel and others in the industry in suggesting that the market’s trough might be behind us, even in the face of current macroeconomic headwinds. CNBC has more.

🛑 YouTube launches global effort to block ad blockers. The world’s leading video platform says it’s implementing measures that encourage users to either allow ads or try YouTube Premium, its ad-free version of the platform. However, how it’s rolling out those efforts appears to depend on the user for now. Some users are experiencing “soft gating” that pushes them to subscribe or allow ads but still allows them to watch the video. Others are experiencing a “hard gate” that requires a user to choose one of those two options before proceeding. More from The Verge.

⚡ Toyota doubles down on North Carolina EV investment as competitors pull back. The Japanese automaker is increasing its battery capacity in the U.S. more than expected, raising its North Carolina battery manufacturing plant investment by $8 billion. The new investment brings the total outlay to $13.9 billion, with 5,000 total jobs created. Production at the plant will begin by 2025, matching the timeline it will offer an “electrified” version of each Toyota and Lexus vehicle. Yahoo Finance has more.

🤑 Biden’s junk fee crackdown targets retirement advisers next. The new rules for retirement plan providers look to close loopholes that regulators argue allow the industry to sell products that boost their revenues at their customers’ expense. It would require them to only sell commodities and insurance products to clients when doing so is in the customer’s best interest. They also seek to create a higher standard for the advice provided when people roll over assets from an employer plan to another account type. Reuters has more.

✂️ X’s valuation is reportedly down 57% from Musk’s $44 billion purchase price. A year ago, the billionaire tech giant griped that he was “obviously overpaying” for Twitter, but he had to complete the deal after it became clear he’d be forced by the court to do so. In that short time, the steam has come out of the technology market, and X’s operational issues have led to declines in the business’ key metrics. Those combined factors have led to a significant valuation decline, with many speculating where the company will end up this time next year. Variety has more.

Links

Links That Don’t Suck:

🗓️ Forbes buyer asks to extend deal deadline amid scramble for funds

🧬 A landmark gene-editing treatment for sickle cell disease moves closer to reality

💵 Treasury Department announces new Series I bond rate of 5.27% for the next six months

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.