A Kansas City jury just delivered a verdict that could shake up the residential real estate market. 😮

The National Association of Realtors (NAR), HomeServices of America, and Keller Williams were found guilty of colluding to inflate or maintain high commission rates through NAR’s Clear Cooperation Rule. The plaintiffs and lead attorney argued during the two-week trial that the trade group and corporate brokerages knowingly violated their own antitrust rules to juice their commissions. And the ruling requires the defendants to pay damages of $1.78 billion, which could be increased if “treble damages” are assessed. 💰

The judge overseeing the Sitzer/Burnett buyer-broker commission lawsuit still needs to issue his final judgment on the case. However, the guilty verdict is expected to have a significant impact on the industry’s practices and open the door to additional class-action lawsuits in other states.

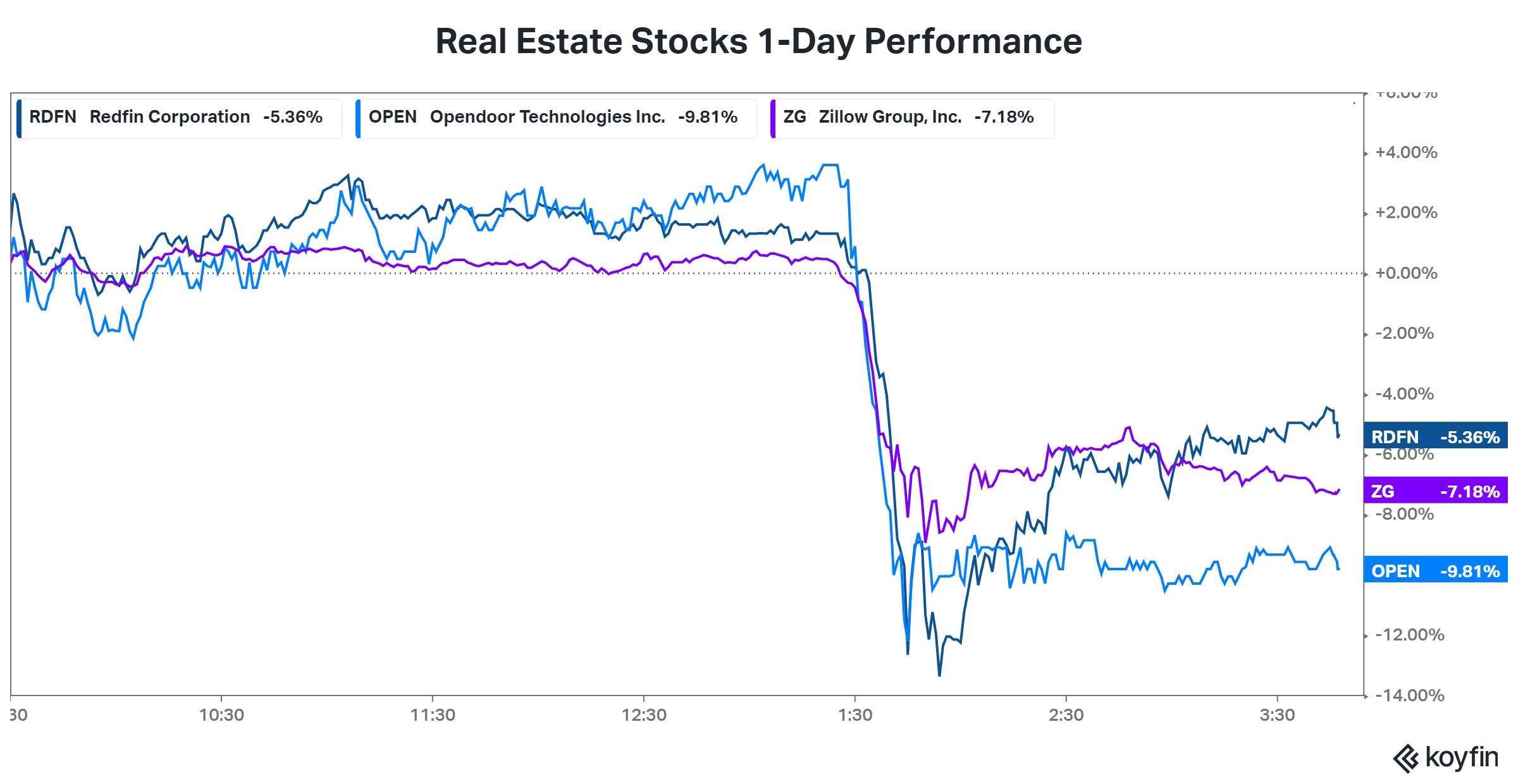

Today’s news sent residential real estate-related companies like Redfin, Zillow, and Opendoor plunging intraday. It appears that the cocktail of record-high home prices and decade-plus-high interest rates may be the catalyst needed to finally spark change in how the industry operates. 👀