Stocks had a relatively quiet session before the Thanksgiving holiday, with buyers managing to keep the market green despite pressure on Nvidia. Let’s see what else you missed. 👀

Today’s issue covers Deere falling as demand waivers, meme stocks coming off the Thanksgiving menu, and more from the day. 📰

Here’s today’s heat map:

10 of 11 sectors closed green. Communication services (+0.79%) led, & energy (-0.05%) lagged. 💚

Consumer sentiment fell for the fourth consecutive month in November, with expected business conditions offsetting a more favorable assessment of personal finances. U.S. durable goods orders tumbled 5.4% in October, exceeding expectations for a 3.4% decline as fewer Boeing passenger plane contracts weighed on the numbers. 🔻

Boeing continued to rebound today after the U.S. Federal Aviation Administration (FAA) confirmed it granted type inspection authorization for the 737 MAX 10. That’s meaningful because the move is typically associated with the kickoff of the certification process. ✈️

Microsoft shares hit new all-time highs after investors gained more clarity about what’s happening with OpenAI. The company announced that Sam Altman will return as CEO of the Microsoft-backed startup, with a new board composed of Bret Taylor, Larry Summers, and Adam D’Angelo. 😮

Trending stock Safety Shot plunged 26% today after Capybara Research published a report that questioned the efficacy and legitimacy of the company’s alcohol detox drink. 🕵️♂️

Broadcom shares continue to sit near an all-time high as the company closes its $69 billion VMware acquisition following China’s regulatory approval. 🤝

Binance users pulled over $1 billion from the exchange following the world’s largest crypto exchange and founder Changpeng Zhao (CZ) settling with U.S. regulators. The exchange’s native token, Binance Coin, was down about 10% yesterday but rebounded today as investors assess the news’ impact. ₿

Other symbols active on the streams: $BIDU (+5.91%), $BODY (+10.74%), $LYFT (-0.87%), $FSR (+6.00%), $PLTR (-0.56%), $MARA (+5.92%), $COIN (+3.56%), & $BTC.X (+1.87%). 🔥

Here are the closing prices:

| S&P 500 | 4,557 | +0.41% |

| Nasdaq | 14,266 | +0.46% |

| Russell 2000 | 1,796 | +0.69% |

| Dow Jones | 35,273 | +0.53% |

Earnings

Deere Falls As Demand Wavers

Farm and construction equipment manufacturer Deere & Co. spent most of the last three years trying to keep up with demand amid supply chain issues. However, things took a turn this quarter after the company lowered its full-year earnings outlook. ✂️

This quarter’s earnings per share of $8.26 came in above the $7.46 estimates. However, Deere’s sales fell 0.8% YoY to $15.41 billion but were above analyst estimates of $13.64 billion. 💪

Here’s how its segments stacked up vs. expectations:

- Production and precision agriculture sales of $6.97b vs. $6.60b

- Small agriculture and turf sales of $3.09b vs. $3.17b

- Construction and forestry sales of $3.74b vs. $3.70b

For fiscal 2024, it expects the first two segments’ sales to grow 10% to 15%, while construction and forestry sales fall 10%.

However, the company now expects fiscal-year 2024 net income of $7.75-$8.25 billion, well below the $9.31 billion anticipated by analysts. After several years of going gangbusters, executives expect volumes to return to mid-cycle levels. 🔮

It’s a significant change from last quarter’s when management said government spending would support an “elongated cycle” for construction equipment sales into 2024 and 2025.

$DE shares fell 3% on the day, sitting 20% off their all-time highs as investors look for opportunities outside of farming and construction. 📉

Thanksgiving is often a time we reconnect with friends and family we may not see often, and almost no topic is off-limits. 🗫

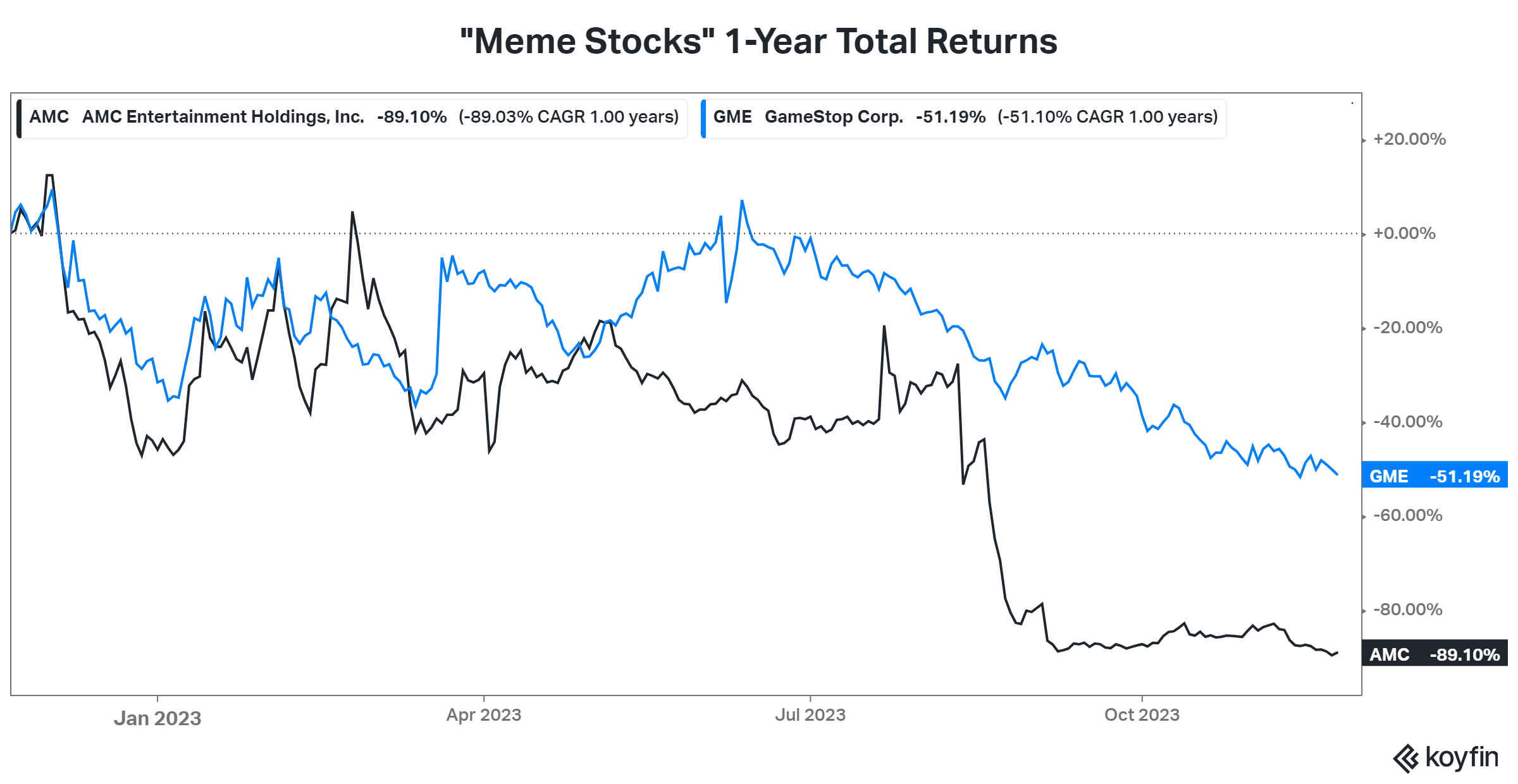

However, traditional meme stocks like AMC Entertainment and GameStop will unlikely be making the rounds for the second straight year. While they were hot topics back in 2020 and 2021, lackluster performance has seen them fall to the wayside of other more trending assets.

For example, over the last year, AMC is down 89%, and GameStop has been cut in half. And data from various platforms suggests that retail investor interest and sentiment have waned as market participants look for opportunities elsewhere. 🕵️♂️

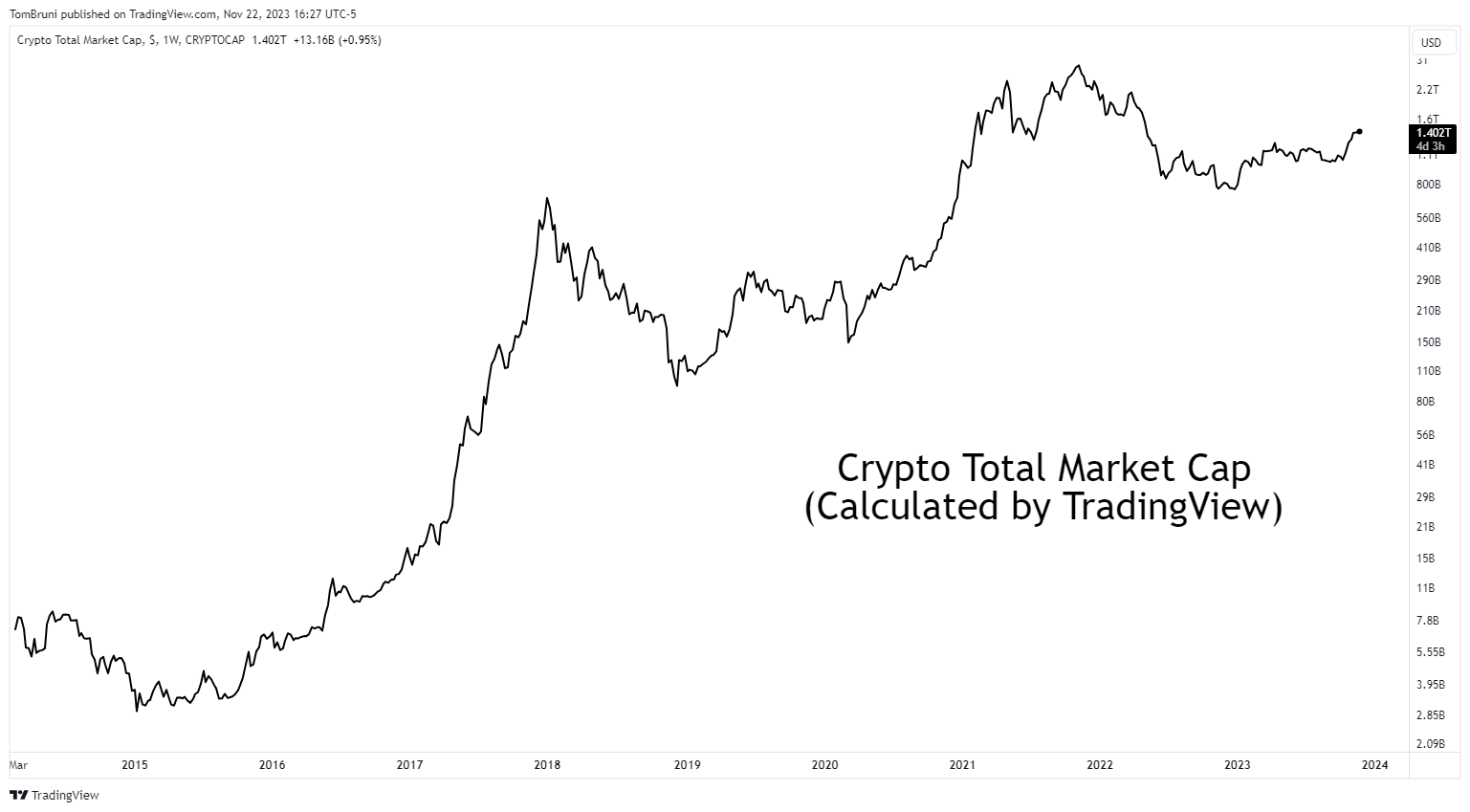

One of those areas they’re looking for opportunity is the crypto market, which has seen its total market cap surge over 60% in the last year. While U.S. regulators have done their best to continue cracking down on crypto, the market has remained resilient and is one of the best-performing asset classes this year. ₿

For those of you who need a refresher on crypto, our Litepaper newsletter has two introductory lessons for you (Crypto 101 and Blcokchain 101). 📝

Regardless of what markets you discuss this Thanksgiving, we want to hear about it. Make sure to hop on the streams to share what you learned and tag @Stocktwits so we can follow along! 📱

Bullets

Bullets From The Day:

🖥️ HP CEO says AI capabilities will double PC category growth. CEO Enrique Lores said HP’s new computers with artificial intelligence capabilities will help accelerate and grow the PC market. He reiterated his view that it should double the growth of the PC category beginning in 2024, with more momentum building after. Notably, he claimed that these new computer models will not be much more expensive than others, estimating an average price hike of 5%-10%. CNBC has more.

🔋 China’s Nio partners to develop battery-swapping EVs. It’ll partner with Changan Automobile to create a new technology focused on easing costs, as the two will build and share battery-swapping stations and standardized batteries. Nio has recently cut its workforce and deferred long-term investments as it looks to improve profitability. Battery-swapping electric vehicles (EVs) would allow consumers to replace depleted packs quickly with fully charged packs rather than waiting for their existing batteries to charge. More from Reuters.

❌ X loses Paris Hilton’s 11:11 Media partnership as more brands pull out. Since last week, advertisers have been fleeing from X over concerns about antisemitic content on the site, with Parison Hilton’s media company now pulling out of its partnership. The campaign was touted as a high-profile win for X, as Hulton would have promoted key X features like live video, live e-commerce, Spaces, and more over two years. Meanwhile, X is focused on suing Media Matters for defamation after claiming it manipulated its service to cause the troublesome ads to appear in its feed. TechCrunch has more.

🚫 FCC proposes a ban on certain early termination fees. The Federal Communication Commission’s (FCC) Chairwoman proposed new rules that would prohibit cable and satellite companies from charging subscribers for canceling their service before the end of their contracts. It would also target requirements that subscribers pay for the entire billing cycle when they end their service before that date. The regulator argues that companies limit consumers’ freedom to choose their services. More from Deadline.

🧑⚖️ Judge finds evidence that Tesla and Musk knew about Autopilot defect. A Florida judge found “reasonable evidence” that Tesla CEO Elon Musk and other managers knew the company’s vehicles had a defective Autopilot system but still allowed the cars to be driven unsafely. He ruled last week that the plaintiff in a lawsuit over a fatal crash could proceed to trial and bring punitive damages claims against Tesla for intentional misconduct and gross negligence. Reuters has more.

Links

Links That Don’t Suck:

🧑💼 Zoomers will overtake boomers at work next year

🥚 Kraft, others to seek damages after winning U.S. egg-pricing verdict

🫙 Kim Kardashian is investing in the maker of truffle-infused condiments

⚠️ European Central Bank VP says escalation in geopolitical risk could spark market correction

⏸️ Jack Ma halts plans to cut his Alibaba stake after shares in the Chinese e-commerce giant drop

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.