As expected, it was a light-volume half-day session with traders and investors recovering from the Thanksgiving holiday. The stock market indexes closed mixed, but some alternative assets received a boost. Let’s see what you missed. 👀

Today’s issue covers Visa visiting new all-time highs, Gold shimmering around $2,000/oz, and crypto coin-tinuing its recent run. 📰

Here’s today’s heat map:

9 of 11 sectors closed green. Healthcare (+0.54%) led, & communications (-0.34%) lagged. 💚

Turkey’s central bank surprised the market by hiking rates by another 500 bps to 40% as it looks to stem near-triple-digit inflation readings and a floundering Lira. Meanwhile, Japan’s inflation increased more than expected as it tries to balance growth and inflation. 🔺

Electric vehicle startup Fisker jumped 5% after filing its previously delayed 10-Q with the Securities and Exchange Commission. It also announced several leadership changes and reorganized its sales and delivery strategy. ⚡

iRobot shares rose 39% on reports that Amazon is about to win European Union approval to move forward with its $1.4 billion acquisition. 🤖

Other symbols active on the streams: $BKKT (+20.51%), $FEMY (+12.72%), $SPRC (+41.67%), $CLSK (+14.81%), $VFS (+6.15%), $KOLD (+2.32%), $MARA (+4.12%), & $TOPS (+16.97%). 🔥

Here are the closing prices:

| S&P 500 | 4,559 | +0.06% |

| Nasdaq | 14,251 | -0.11% |

| Russell 2000 | 1,808 | +0.67% |

| Dow Jones | 35,390 | +0.33% |

Stocks

Visa Visits New Highs

This holiday season, the talk of the town is the U.S. (and global) consumer. After all, consumer spending is two-thirds of the U.S. economy, so if we stop spending, the economy’s illusive recession could finally appear. 🎃

While many retailers have painted a cautious picture of the fourth quarter of 2023 and the beginning of 2024, some investors point to what they say is an obvious sign of strength. That is, Visa and Mastercard near all-time highs. 👀

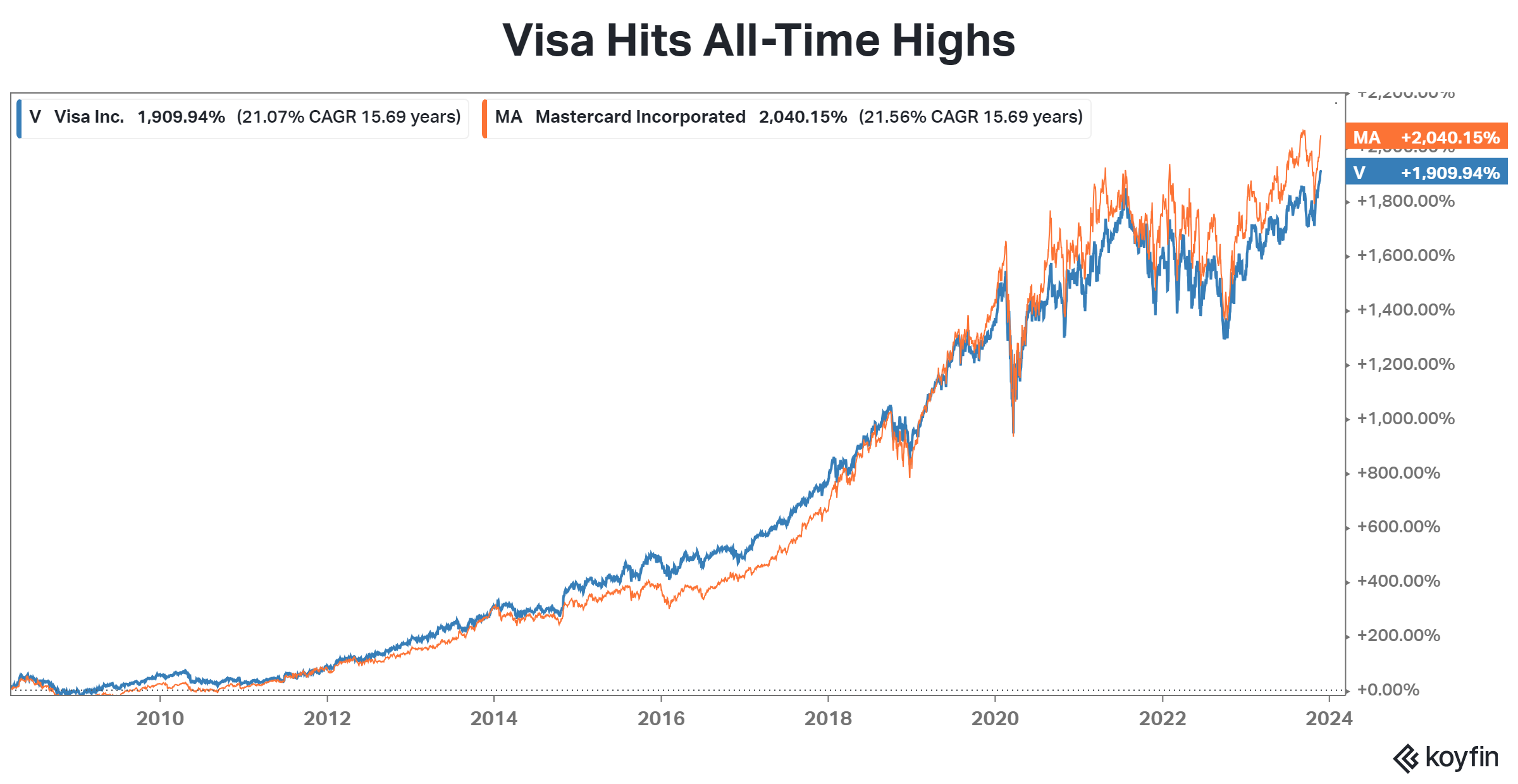

These companies have told investors that consumers are continuing to spend, but where they’re spending their money is changing. And the total return chart below shows Visa making new highs today, while Mastercard is not far below its peak set a few months back.

Whether it’s a sign of a robust economy or just strength in these individual companies’ businesses, these stocks remain on investors’ radars into year-end. Especially with holiday shopping at the forefront of our minds. 🛍️

Sponsored

Don’t Settle for Ordinary Trading Software

- Test trading strategies without needing to code.

- Discover trade ideas using flow data or scanners.

- Simplify chart analysis with auto detected Chart Patterns and Fibonacci levels.

- Manage your trades from start to finish with customizable alerts and trading bots.

TrendSpider’s BIGGEST sale of the year is closing soon!

Take advantage of deep discounts before they expire, plus get free real-time CME Futures data and a personalized one-on-one training session included with your subscription.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Wednesday, we discussed that crypto was likely to be a hotter topic than meme stocks at Thanksgiving dinner, given its recent performance. ₿

After the holiday, that trend of outperformance continues, with Bitcoin touching 1.5-year highs and many traders anticipating it will break above $40,000 this weekend.

As for what’s driving the recent strength, the theory remains that a spot Bitcoin ETF is inching closer towards approval. And once that happens, it would open the floodgates to more spot crypto ETFs and drive further industry adoption. More evidence seems to be piling up each week that the market is betting on it happening soon. 📝

For example, Eric Balchunas pointed out that the Grayscale Bitcoin Trust $GBTC is trading at its smallest discount in over two years as traders bet that its conversion could soon occur. Others pointed to Coinbase shares at 1.5-year highs. 🔺

Additionally, a U.S. Securities and Exchange Commission (SEC) Commissioner, Hester Peirce, recently emphasized that there’s “no reason for [the SEC] to stand in the way of a spot Bitcoin ETF.” However, when pressed by the Bloomberg reporter, she could not comment further on the ongoing conversations between ETF issuers and SEC staff. 🤐

We’ll have to wait and see what the coming weeks hold, but the crypto bull run continues for now. And it’s not catching as many people’s attention as we thought it would. 🤷

Commodities

Gold Shimmers Around $2,000/Oz

Precious metals have not gotten much fanfare lately, especially with palladium in a downtrend and platinum and silver stuck in messy ranges. 💤

However, one that continues to pop up on investor and trader radars is gold, which is once again trying to break above $2,000/oz. Below is a chart showing prices stuck in a range for the last 2.5 years, each time failing to sustain a break above resistance. 🔐

With the disinflation trend continuing and rates expected to stay higher for longer, the bullish catalyst many traders are discussing is a possible recession. But as we discussed with the Visa story, the market remains mixed on its recession outlook, as the consensus view is now that the Fed has pulled off a “soft landing.” 🐂

Bears say that gold missed its opportunity to shine when inflation was roaring in 2021 and 2022 and that there’s little reason for investors to seek the perceived safety of gold when the risk-free rate is above 5%. Especially if the economy doesn’t fall into a recession. 🐻

We’ll have to wait and see who is right. But what’s clear is that gold is on people’s radars into year-end as we all wait to see how it handles this $2,000/oz level again. Time will tell… 🤷

Bullets

Bullets From The Day:

🛳️ Carnival U.K. accused of plan to fire and rehire employees. Just one day after beginning talks with union members, the cruise line operator is accused of unveiling a “fire-and-rehire” plan that would impact 919 crew members if they did not accept new terms. Last year, a separate company did something similar. It replaced 800 employees with foreign agency workers paid less than the U.K. minimum wage but ultimately was forced to admit the practice was illegal. BBC News has more.

👀 Barclays plans $1.25 billion in cost cuts. The British bank is reportedly looking to cut as many as 2,000 jobs, mainly impacting its back office staff, as it looks to bolster profitability. The potential cuts would primarily be at Barclays Execution Services and form part of an overall target of reducing expenses by up to 1 billion pounds across the group over several years. More from Yahoo Finance.

🏈 Amazon’s Black Friday NFL game could change holiday shopping. The company is flexing its muscles by hosting the first-ever Black Friday NFL game, with a strategy that’s expected to drive football fans to cut their in-store shopping trips short. The game begins at 3 pm ET and is free for anyone with an Amazon account to watch on Amazon Prime Video. With more people at home (with Amazon on their minds), the retail giant expects people to spend more time shopping on its site. Axios has more.

🎧 Spotify unveils new royalty scheme. Starting early next year, Spotify will begin charging labels and distributors a fee when “flagrant” streaming fraud is detected on their accounts. “Noise” tracks will only be monetized after two minutes of listening (vs. 30 seconds typically). And the company will only monetize tracks with 1,000 plays in the past twelve months. While these issues impact a small percentage of total streams, fixing them now will clear the path to making an additional $1 billion in revenue available to artists over the next five years. More from The Verge.

🚫 India seeks to regulate deepfakes amid ethical concerns. The country’s regulators are drafting rules to detect and limit the spread of deepfake content and other harmful artificial intelligence (AI) media, as this type of content has recently become prolific on social platforms. The tech giants it’s met with have a shared understanding that deepfakes are not free speech and are harmful to society. As such, the private and public sectors are working together to draft regulations for how the industry will handle this emerging technology. TechCrunch has more.

Links

Links That Don’t Suck:

🥫 Food bank demand high but donations fall

🟢 British investment managers get green light for tokenized funds

🏭 Nissan leads $2.5 billion investment to build two more EVs in U.K.

⚠️ China wealth manager Zhongzhi flags insolvency, $64 billion in labilities

🧑💼 Bill Gates says AI could allow humans to work three days a week: ‘That’s probably OK’

🙊 NVIDIA sued for stealing trade secrets after screensharing blunder showed rival company’s code