The Dow Jones Industrial Average soared to new all-time highs following the Fed’s forecast for three rate cuts in 2024. Let’s see what else you missed. 👀

Today’s issue covers the Fed cutting down the bears’ remaining hopes, Pfizer’s 2023 flop continuing, and Adobe dumping following earnings. 📰

Here’s today’s heat map:

11 of 11 sectors closed green. Utilities (+3.78%) led, & technology (+0.88%) lagged. 💚

Crude oil stemmed its recent decline after U.S. inventories dropped more than expected last week as refiners took advantage of cheaper local barrels. Meanwhile, Southwest Airlines fell 4% after saying it expects higher fourth-quarter fuel costs to weigh on earnings. 🛢️

Tesla shares dipped after the electric vehicle maker recalled nearly all vehicles it sold in the U.S. (over 2 million) to fix the system that monitors drivers using Autopilot. The update will increase warnings and alerts to drivers and even limit the areas where basic versions of the Autopilot can operate. It follows a two-year investigation by the National Highway Traffic Safety Administration. ⚡

Vertex Pharmaceuticals’ shares jumped 13% to all-time highs after a mid-stage trial showed that its non-opioid painkiller significantly decreased pain in patients with diabetes suffering from chronic nerve pain. It’s fueling efforts to develop a treatment without the potential risk of addiction in light of the ongoing opioid crisis. 💊

E-commerce platform Etsy fell 2% on news that the company is laying off 11% of its staff, saying that today’s macroeconomic environment and competitive realities call for sweeping changes. It updated its fourth-quarter guidance, raising its adjusted EBITDA margin range by 1% to 27%-28%. 🛒

U.S. Steel jumped 6% after reports indicated that it received multiple bids over $40 per share. U.S. Steel’s board met today to discuss the offers it’s received from five bidders. 💰

And facility management provider ABM Industries rose 18% after strong demand from airports and airlines offset weakness in its corporate offices unit. 🗑️

Other symbols active on the streams: $CAVA (+6.12%), $COIN (+7.76%), $NKLA (+11.44%), $STTK (+130.33%), $SHOT (-8.73%), $TLT (+2.35%), $CCCC (+135.47%), & $BITF (+18.47%). 🔥

Here are the closing prices:

| S&P 500 | 4,707 | +1.37% |

| Nasdaq | 14,734 | +1.38% |

| Russell 2000 | 1,948 | +3.52% |

| Dow Jones | 37,090 | +1.40% |

We said yesterday that expectations for a dovish Federal Reserve meeting were high. And for now, it appears that Jerome Powell and the FOMC have delivered just that. 🤩

The Federal Open Market Committee (FOMC) statement changed slightly vs. November, primarily adding verbiage that “inflation has eased over the past year” but remains elevated. As such, they kept rates unchanged to close out 2023.

However, the real information was in the Fed’s updated economic projections. 📝

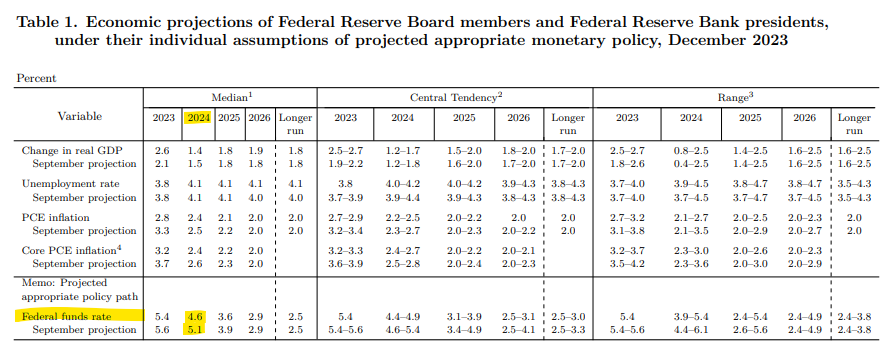

Below, we can see that the committee’s median projection for the federal funds rate in 2024 has dropped from 5.1 to 4.6, implying three rate cuts in 2024. Additionally, the median core PCE inflation expectation dropped by 20 bps to 2.40%. And although the committee anticipates slower growth in 2024, it’s projecting modest growth, not a recession. 📊

And Jerome Powell’s commentary did little to push back on those views, reinforcing that the battle against inflation will continue but that rates are likely high enough to slow the economy. As always, he hedged his comments by saying that the committee is prepared to tighten policy further if necessary and that a recession is still on the table for 2024.

Overall, it appears the market has gotten its “soft landing’ after all, which twelve months ago seemed like a dream scenario. The economy slowed enough to bring inflation down but not enough to tip us into a recession. ⚖️

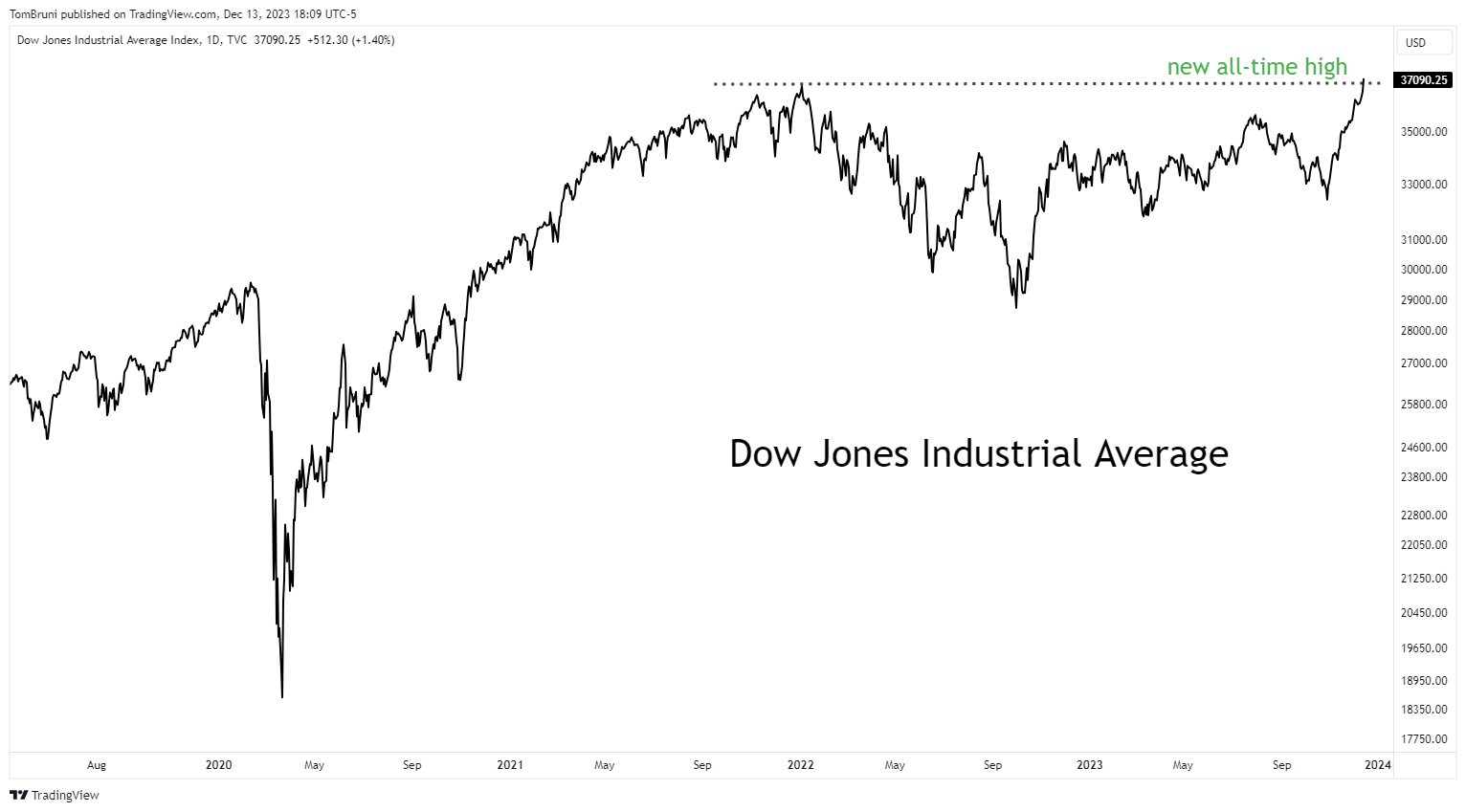

That was all investors needed to hear before getting back to buying stocks and other risk assets. The Dow Jones Industrial Average was the first U.S. stock market index to hit new all-time highs, but the S&P 500 and Nasdaq 100 are close behind. Meanwhile, the small-cap Russell 2000 surged another 3.40% as investors viewed the prospect of lower rates as supportive of the sector. 🐂

While it was a footnote in today’s data, the producer price index confirmed the continued disinflationary trend seen in consumer prices yesterday. Additionally, reports from Redfin suggest that rental rates fell the most in over three years, furthering the view that shelter prices are likely to “catch down” to other inflation components. 🔻

With the Fed meeting out of the way, it’s unclear what’s left to derail the bulls’ epic run. As always, we’ll have to wait and see. But for now, investors are partying like it’s 2023. 🥳

Company News

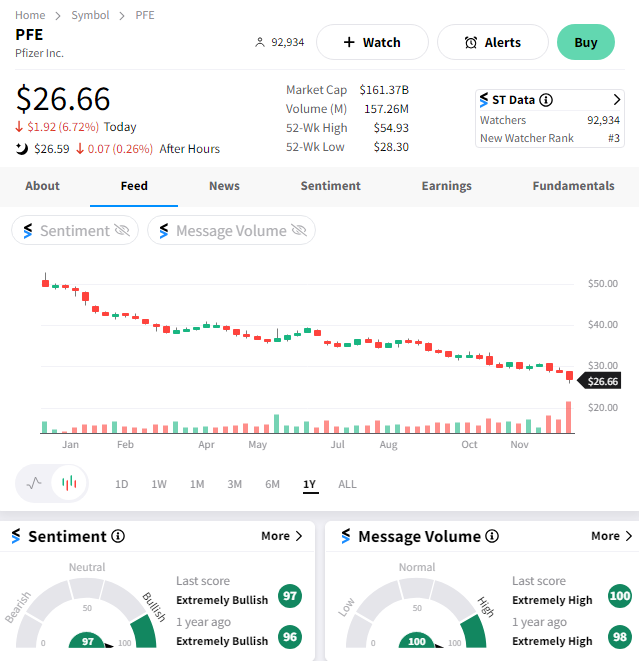

Pfizer’s Flop Continues

It’s been a rough ride for pharmaceutical giant Pfizer since the end of the pandemic, and that rollercoaster ride continues today. 🎢

The company last announced earnings in October but needed to update Wall Street on its 2024 forecast. It cited weak demand for its Covid products as the reason for a weaker-than-anticipated revenue and earnings forecast.

The company now expects $58.50 to $61.50 billion in revenues, implying essentially zero YoY growth and coming in below the $63.17 billion consensus estimate. As for earnings, it provided a range of $2.05 to $2.25 per share, well below the adjusted profit of $3.16 that analysts expected. 🔻

Since it’s unable to drive revenue growth, management is turning to additional cost-cutting to drive results. It now anticipates $4 billion in savings from its plan, up $500 million from its last estimate.

Pfizer CFO Dave Denton said, “While we do not expect Covid vaccination and infection rates to change materially in 2024 versus this year, we have set our Comirnaty and Paxlovid 2024 revenue expectations lower.”

The company looks to be setting the bar low for next year to give itself a chance to jump over it easily.

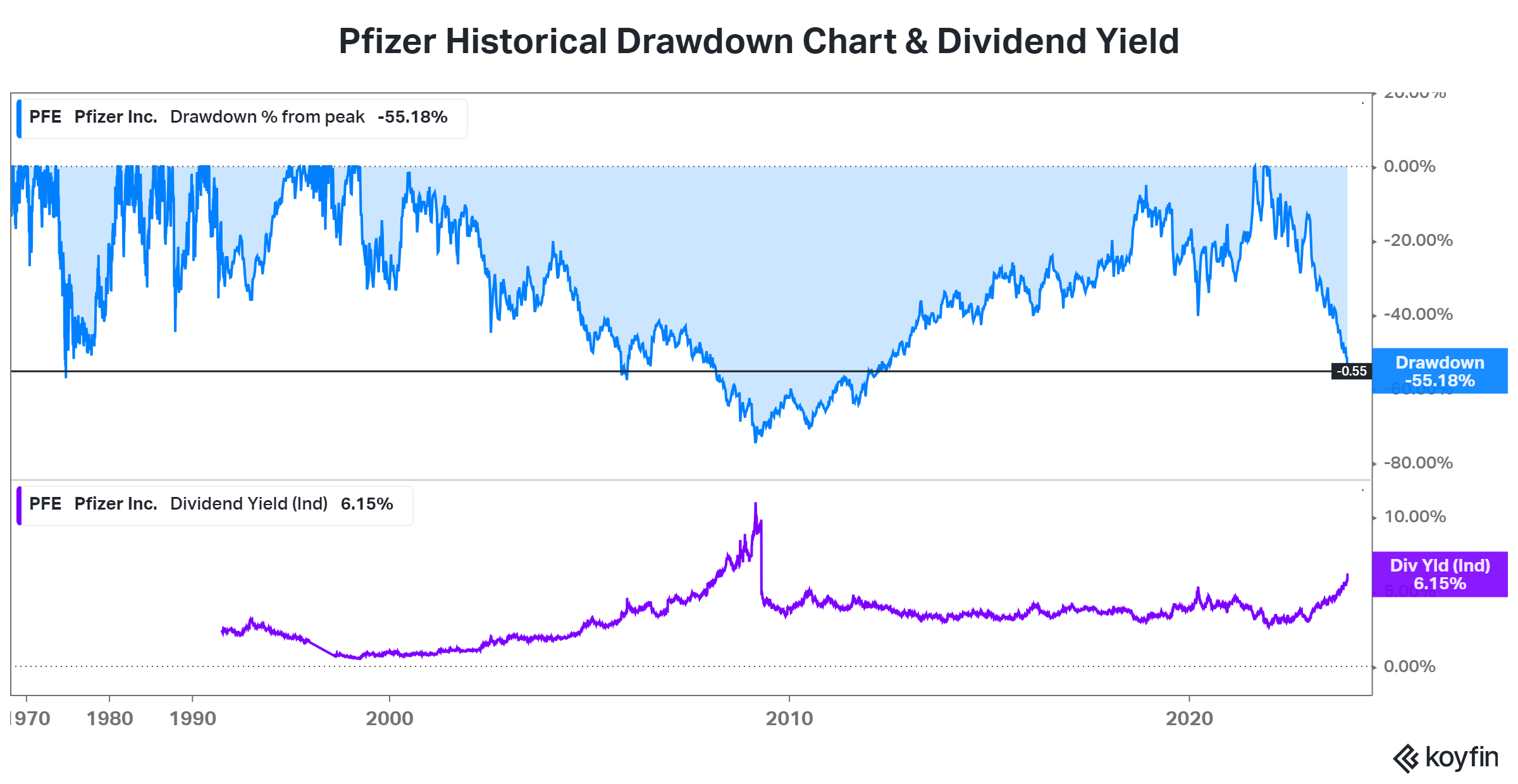

However, the short-term impact is that the stock extended its historic drawdown from all-time highs to 55%. This decline matches one of the largest in history, only meaningfully surpassed by the great financial crisis. Its dividend yield is now also the highest in years, though some investors fear it may have to be cut. 😱

As for the price chart, $PFE shares fell another 7% on the day despite the broader market being up handily. Despite prices being in a sustained downtrend for well over a year, the Stocktwits community remains bullish on the stock. We’ll have to wait and see whether their bet pays off. 🤷

Earnings

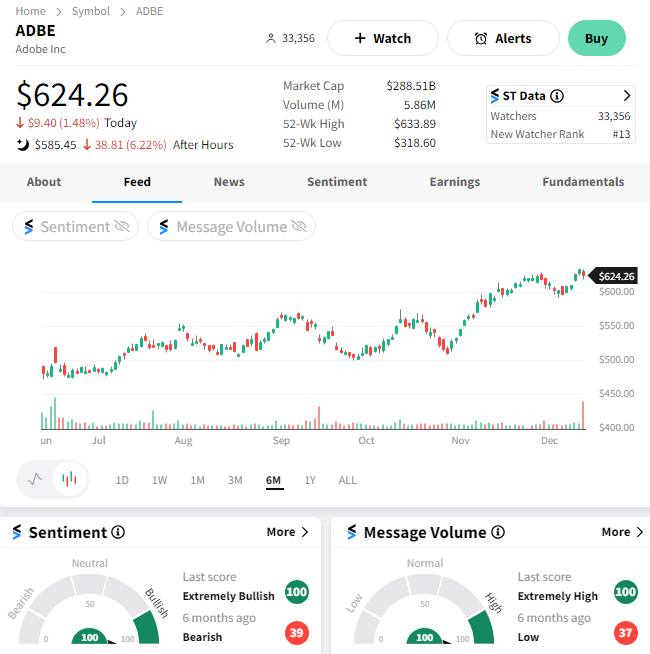

Adobe Dumps Following Tepid Forecast

Software giant Adobe is the latest tech company to provide a weak revenue forecast. Let’s recap its results. 👇

The company’s fourth-quarter adjusted earnings per share of $4.27 topped analyst estimates of $4.13. Revenues grew about 10% YoY to $5.05 billion, narrowly exceeding the $5 billion anticipated.

However, a weak sales forecast caused investors to rethink their bullish thesis. Management expects $5.10 to $5.15 billion in revenues, below the $5.16 billion estimate. Its full-year guidance of $21.33 to $21.50 billion was also shy of the $21.73 billion expected. 👎

Analysts anticipated a blockbuster quarter after executives predicted “really strong” performance during their analyst day in October. And with the stock up about 80% since its May introduction of AI tools, there’s little room for error, even if management’s forecast was slightly off.

$ADBE shares fell 6% after hours. With that said, the Stocktwits community remains bullish, so we’ll have to see if investors buy the dip in the days ahead. 👀

Bullets

Bullets From The Day:

🏭 Samsung and ASML invest in a South Korean chip plant. The two tech giants agreed to invest 1 trillion won, or $760 million, to build an advanced chip plant in South Korea. The announcement came as South Korean President Yoon Suk-Yeol is in the Netherlands for a four-day visit, which seeks to forge a “semiconductor” alliance between the two countries. CNBC has more.

🎯 U.S. FTC targets junk fees in the car buying process. New rules proposed by the U.S. Federal Trade Commission (FTC) would bar auto dealers from luring vehicle buyers with promises they do not intend to keep. It could fundamentally change how Americans buy vehicles annually by requiring up-front pricing in dealers’ advertising and sales discussions. It would also bar the sale of add-on products or services that don’t benefit consumers. More from Reuters.

🤖 Google unveils a family of healthcare-focused generative AI models. The company believes there’s an opportunity to offload more healthcare tasks to generative AI models or at least an opportunity to recruit those models to aid healthcare workers in completing their tasks. There are currently two MedLM models: a larger model designed for what Google describes as “complex tasks” and a smaller, fine-tunable model best for “scaling across tasks.” TechCrunch has more.

💸 Developing nations spent a record amount on public debt service in 2022. According to the World Bank, developing countries paid $443.5 billion last year. While that represents just a 5% YoY increase, the organization estimates that figure could surge by as much as 39% in 2023 and 2024 due to higher rates. There are 28 countries eligible to borrow from the World Bank’s International Development Association that are now at high risk of debt distress, while 11 are already in distress. More from CNBC.

💳 Mastercard and Visa’s post-Brexit card fee cap. The European Union (EU) has a cap on so-called “cross-border interchange fees,” which retailers pay when customers in the U.K. buy from the European trading bloc. The cap was previously applied to the U.K. before Brexit, but Mastercard and Visa have significantly raised the fees charged to retailers in Britain since then. As a result, a U.K. payments watchdog has proposed an initial, time-limited cap of 0.2% for debit card transactions and 0.3% for credit cards for transactions made online at U.K. businesses. BBC News has more.

Links

Links That Don’t Suck:

❄️ Level up your investing during IBD’s 12 Days of Holiday Deals and unlock a new offer every day.*

🔬 FDA may review MDMA for the treatment of PTSD

⚠️ Parent and consumer groups warn against ‘naughty tech toys’

🛰️ Starlink loses out on $886 million in rural broadband subsidies

🎫 A $44 million lotto ticket in Florida expired after no one claimed it

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.