The S&P 500 came within pennies of its next major milestone but failed to top it, making journalists and Fintwit peeps hold onto their pre-written copy for another day. Let’s see what you missed. 👀

Today’s issue covers Disney snagging two content whales, Arm Holdings crushing earnings, and an interesting point about the S&P 500’s upcoming milestone. 📰

Here’s today’s heat map:

9 of 11 sectors closed green. Technology (+1.32%) led, & consumer staples (-0.09%) lagged. 💚

The U.S. trade deficit widened in December but narrowed for the full year of 2023 as trade flows normalized. Meanwhile, Fed Governors Kugler, Kashkari, and Barkin all cast doubt on inflation’s recent downward progress and warned that rate cuts are still a long way out. 🦅

New York Community Bancorp shares attempted to stabilize after the regional bank said deposits are up from 2023 levels. More specifically, it holds deposits of $83 billion, of which its total liquidity of $37.3 billion more than covers its $22.9 billion of uninsured deposits. 💰

Chinese stocks remained in focus today as Alibaba fell 6%. The e-commerce giant missed revenue estimates again as it deals with increased competition and geopolitical pressures, halting its plans to split the company into six parts. It added another $25 billion to its share buyback program to help appease investors, but the market was not having it. 🛒

Solar energy stocks received a much-needed boost after Enphase Energy shares rallied sharply. Despite missing earnings and revenue expectations again. Its CEO told investors that falling interest rates and rising utility costs should help the industry rebound soon. 🌞

CVS is the latest healthcare company to cite rising medical costs as a headwind for earnings, cutting its full-year outlook after topping quarterly estimates. It joins health insurers like Humana and UnitedHealth in flagging this as a multi-quarter headwind, with people catching up on procedures delayed by the pandemic. 🏥

Other symbols active on the streams: $PYPL (-8.77%), $NVDA (+2.75%), $APPS (-20.76%), $PARA (-8.15%), $RBLX (+10.20%), $SNAP (-34.61%), $PHUN (-14.50%), & $HOLO (+1,213.72%). 🔥

Here are the closing prices:

| S&P 500 | 4,995 | +0.82% |

| Nasdaq | 15,757 | +0.95% |

| Russell 2000 | 1,950 | -0.17% |

| Dow Jones | 38,677 | +0.40% |

Earnings

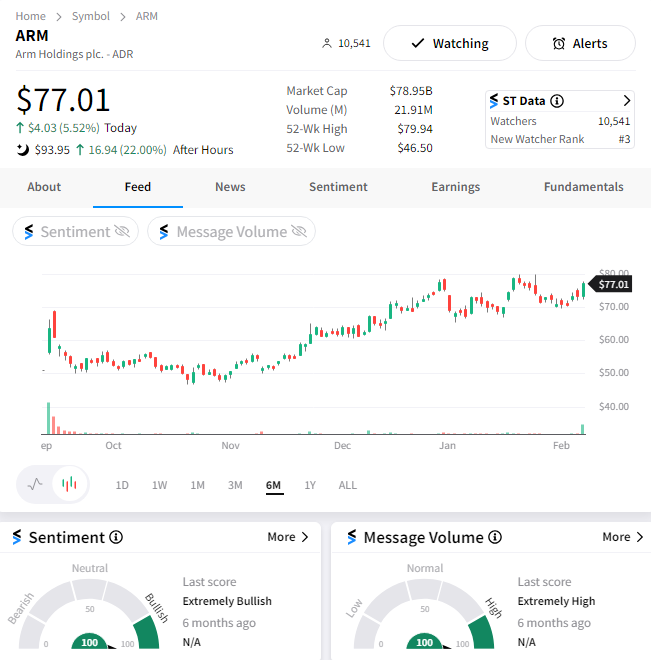

Investors Arm Portfolios With Semis

After missing out on last year’s tech run, many investors are choosing not to risk that feeling again. As a result, they continue to pile into stocks in the semiconductor industry and related fields. Arm Holdings joined the fray today, jumping sharply after reporting results.

The chip design technology giant reported third-quarter adjusted earnings per share of $0.29 on $824 million in revenues. That topped estimates of $0.25 and $761 million. 🤩

If the semiconductor industry is going to surge, companies like Arm are well-positioned to benefit. It makes money through royalties when companies pay for access to build Arm-compatible chips. During its latest quarter, its customers shipped 7.7 billion Arm chips, driving an 11% YoY increase in royalty revenue to $470 million. 📊

Outside of royalties, Arm’s bet on licensing (swelling access to more complete designs) has also paid off handsomely. License and other revenues rose 18% YoY to $354 million, with the company seeing an uptick in demand that may allow it to charge higher licensing fees for advanced designs.

Like Qualcomm and others, the company flagged a recovery in the smartphone market as a significant driver, along with automotive and cloud provider sales. Overall, management expects the momentum to continue, with its fiscal fourth-quarter earnings and revenue guidance blowing estimates out of the water. 📈

Arm remains one of last year’s best-performing initial public offerings (IPOs). And despite some skepticism from the Stocktwits community initially, these results and after-hours move have propelled sentiment back into “extremely bullish” territory. 🐂

Elevate Your Investing Game:

Unleash your investing potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

Earnings

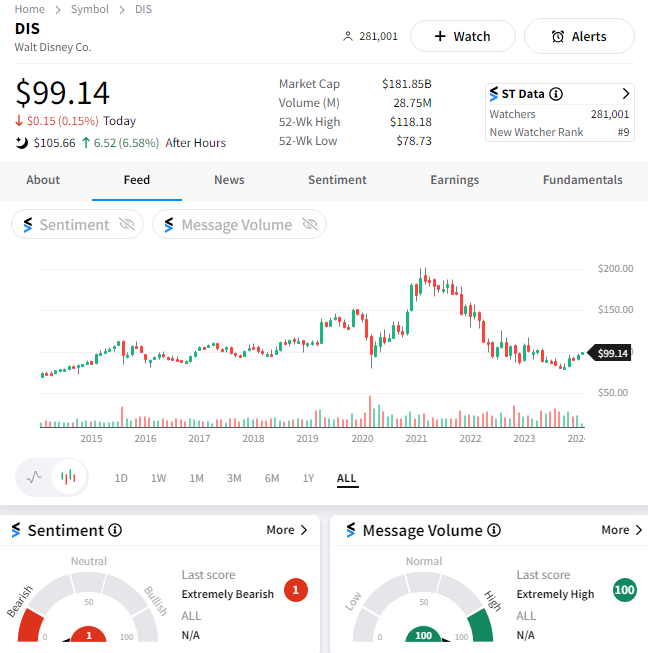

Disney Snags Two Content Whales

Disney has been struggling with a number of issues ranging from streaming losses to activist investor and political pressures. However, today’s earnings report offered some hope to investors betting on a longer-term turnaround in the stock. 🕊️

The media giant reported $1.22 in adjusted earnings per share on $23.55 billion in revenues. Earnings topped estimates, while revenues were just shy.

The company’s direct-to-consumer unit reported a $138 million operating loss. But if you include ESPN+, losses across all streaming platforms fell about 80% YoY to $216 million. Cost cuts, price hikes, and investments in content continue to drive the unit toward profitability. 📺

Speaking of content investments, investors were thrilled to hear that Disney is taking a $1.5 billion stake in Fortnite’s parent company, Epic Games, marking its largest jump into the gaming world yet. Disney will work with the gaming studio on new games and an entertainment universe. 💰

It’s also betting that Taylor Swift can boost Disney+ subscriptions. Beginning March 15th, the company will bring an “exclusive” version of her Era’s Tour movie to the platform. With the NFL and every other brand looking to capitalize on her stardom, Disney wants its piece of the action, too. 🌠

Overall, it appears investors were happy to hear the updates and significant media investments that will serve the company long-term. If the company can push its streaming businesses into profitability and fight off these messy proxy battles, the market may back off enough to let Bob Iger and his team do their thing.

Despite the stock popping 7% after hours, the Stocktwits community is still skeptical. Current sentiment readings are in “extremely bearish” territory as the debate rages on. ⚔️

Stocktwits Spotlight:

Big round numbers in major stocks or indexes really get the technical analysts and other “behavioralists” going. As such, with the S&P 500 approaching its next major “round” number milestone at 5,000, some traders were looking to fade stocks against that level. 🚨

However, others like Stocktwits user Synaptric were quick to point out that these milestones don’t always pose trouble for the market. In the chart above, he pointed to the S&P 500’s breakout above 4,000, which was swift and continued for quite some time. 🤔

Maybe things are different this time. But with technology’s strength in the after-hours session, it looks like the milestone is all but guaranteed tomorrow morning. With that said, we’ll have to wait and see if the momentum continues as smoothly as it did during last year’s move. 🤷

Shout out to him for sharing this perspective amid all of today’s news. If you like technical analysis, empirical research, and quantitative innovation, follow Jeff McDowell on Stocktwits for more! 👀

Bullets

Bullets From The Day:

🤑 Hedge fund titan Bill Ackman to launch fund for “regular” investors. He plans to launch a closed-end fund, investing in 12 to 24 large-cap, investment-grade, “durable growth” companies in North America. While a traditional hedge fund charges a 2% management and 20% performance fee, the closed-end fund will charge a flat 2% fee and waive it for the first twelve months. CNBC has more.

⛈️ Wind power giants face significant headwinds in a higher-rate environment. The world’s three most prominent wind power groups are painting a pessimistic picture for the industry after a year of project delays, equipment problems, and rising costs. Orsted recently announced a portfolio review with job cuts after it significantly wrote down the value of delayed U.S. projects. They’re all preparing for difficult times and making the necessary cuts to get back on track. More from Reuters.

🛑 All eyes are on driverless cars again after a Waymo vehicle strikes a bicyclist. San Francisco police are investigating an incident involving a driverless Waymo vehicle and a cyclist. It’s the latest incident at a time when tensions around autonomous vehicles are high, and regulators are looking for any reason to hammer the industry further. While the cyclist reported non-life-threatening injuries, it’s another lousy stint of press for the struggling group of companies. The Verge has more.

🏷️ ChatGPT aims to help battle misinformation with tags. Generative artificial intelligence (AI) is an amazing technology that attracts attention from good and bad parties. With fraudsters using the emerging tech to scam or harm others, OpenAI is unveiling its 2024 misinformation strategy, which now includes metadata in images generated with ChatGPT to create more transparency for viewers. However, the company knows it’s a small step to address the broader issue and has more planned. More from Engadget.

₿ MicroStrategy wants to be the alternative to “spot bitcoin” ETFs. The software firm called itself a “bitcoin development company” during its fourth-quarter earnings call, even as it posted weaker-than-expected results. The company’s executive chairman, Bitcoin maximalist Michael Saylor, said it’s “committed to the continued development of the Bitcoin network through our activities in the financial markets, advocacy, and technology innovation.” With ETFs now presenting a clear path to public market Bitcoin exposure, crypto-proxies like MicroStrategy must rethink their value prop. CoinDesk has more.

Links

Links That Don’t Suck:

😨 Tesla asks which jobs are critical, stoking layoff fears

🥤 Coke’s first new permanent flavor in years adds a spicy twist

😡 Snoop Dogg claims Walmart and Post sabotaged cereal brands

💸 Cybercriminals raked in record $1.1 billion in ransom payments in 2023

🚫 U.S. court bans three weedkillers and finds EPA broke law in approval process

⚠️ German bank braces for wave of bad loans in ‘greatest real estate crisis since the financial crisis’