The last three months of hype around artificial intelligence and semiconductors is finally coming to a head tomorrow after the bell, with Nvidia set to report. That has traders and investors on edge, as the chip giant’s results will likely trigger volatility across the market. Let’s see what you missed. 👀

Today’s issue covers Walgreens getting the boot, Walmart betting big on advertising, cyber stocks going offline, and Apple shares sitting at a potential inflection point. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

1 of 11 sectors closed green. Consumer staples (+1.05%) led, & technology (-1.02%) lagged. 💚

The U.S. Conference Board Leading Economic Index fell for the 22nd consecutive month in January but no longer forecasts a recession in 2024. It continues to signal headwinds to economic activity, but six of its ten components were positive contributors over the past six-month period, taking a recession off the table. 🙃

Real estate marketplace CoStar Group dipped 8% after issuing weaker-than-expected guidance for its current quarter. Overall, investors remain concerned about the health of the commercial real estate market. Meanwhile, Toll Brothers rose 3% after its first-quarter deliveries beat expectations, and executives forecasted strong spring demand. 🏘️

Small-cap biotech company Rapt Therapeutics plummeted 74% to a record low after the U.S. Food and Drug Administration (FDA) halted two mid-stage trials of its drug to treat eczema and asthma. 💊

Shares of Boeing and its suppliers took a momentary hit today after a United flight from San Francisco to Boston was diverted because of damage to one of its wings. ✈️

And British bank Barclays jumped 12% after announcing a major restructuring plan with significant cost cuts and a 1 billion pound share buyback plan. 💷

Other symbols active on the streams: $LUNR (+50.14%), $OCGN (+19.63%), $HOLO (-75.27%), $SISI (+55.93%), $CPOP (+171.32-%), $ICU (+22.41%), $JASMY.X (+49.70%), & $ETH.X (+1.53%). 🔥

Here are the closing prices:

| S&P 500 | 4,976 | -0.60% |

| Nasdaq | 15,631 | -0.92% |

| Russell 2000 | 2,004 | -1.41% |

| Dow Jones | 38,564 | -0.17% |

M&A

Walgreens Gets The Boot

It’s tough being part of the U.S. stock market’s largest indexes. With thousands of individual stocks to choose from, if any one component isn’t performing, it’s simply replaced by something else. 🔀

In other words, everyone is replaceable. That’s the harsh truth that Walgreens is facing today after discovering Amazon is replacing it in the Dow Jones Industrial Average. 🔀

The pharmacy-chain stock replaced General Electric in June 2018, being announced on June 19th and taking effect on June 26th. General Electric had been one of the few remaining “original members” of the Dow when it was established in 1896 and a continuous member since 1907.

Unfortunately, Walgreens’ run didn’t last nearly as long, with it being booted less than six years after being added. And it’s being replaced by none other than Amazon on February 26th. Listen, we can’t say we blame the index providers. Undoubtedly, big tech’s reach is massive and represents a significant part of the U.S. economy, probably more than a struggling pharmacy chain.

However, Walgreens shareholders might be surprised to know that being kicked out of the Dow might actually be a good thing. Studies have shown that the stocks replaced in the index tend to have better forward returns than those that replaced them. 📝

For example, look at how General Electric and Walgreens performed after their switch. While both struggled, GE had a marginal edge for much of the period and has recently taken off. It doesn’t always work out this way, but it’s an interesting thesis to ponder as Amazon is added to the mix. 🤔

While we’re on the topic of giant companies, we need to quickly mention today’s mega-merger in the financial services industry. Capital One has agreed to acquire Discover Financial Services in a $35 billion all-stock deal. Shares of Discover surged, but some investors are not getting too ahead of themselves given the Federal Trade Commission’s (FTC) recent antitrust rampage. ❌

Lawmakers like Elizabeth Warren are already calling for regulators to block the deal, which is why skepticism around its ability to close remains higher. With that said, the theme of the market recently has been the big getting bigger. We’ll have to see if that continues tomorrow with Nvidia’s results. 🤷

This Week’s Can’t-Miss Event:

Real Vision is thrilled to share Crypto Gathering 2024: Don’t F*ck This Up Edition with Stocktwits.

It’s taking place online on February 22 and 23 and is completely free to attend!

Attendees will hear from a star-studded lineup, including Beeple, Raoul Pal, OSF, Austin Federa, and many more.

They’ve curated a special content watch list just for Stocktwits’ audience, so reserve your seat now!

Earnings

Walmart Bets Big On Advertising

One of the core themes we’ve been discussing for a long time is the “ad-ification” of everything. No matter where you go or what you do, you’re likely being targeted by some form of advertising. And the reason why is because it’s such a high-margin, profitable business opportunity. 🎯

As a result, it’s no surprise to see America’s largest employer and big-box retailer, Walmart, leaning heavily into that narrative during its earnings call.

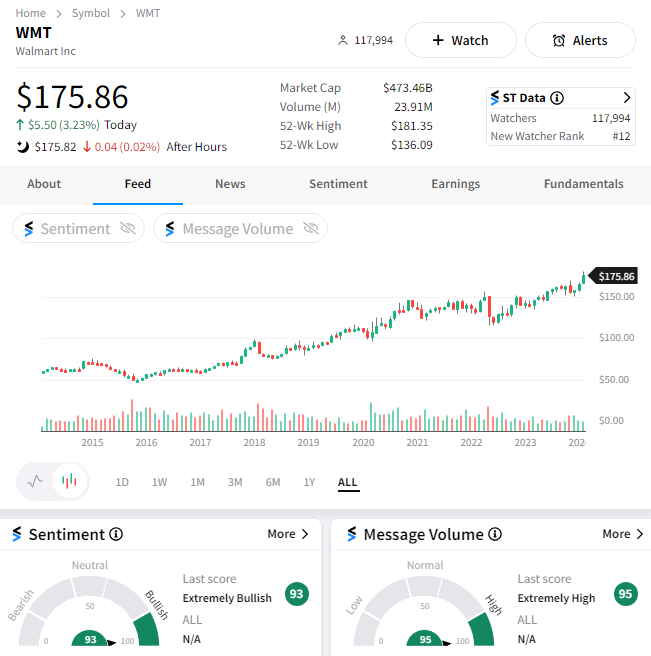

The retailer posted $1.80 per share in adjusted earnings on revenues of $173.39 billion during its holiday quarter. That topped estimates of $1.80 and $170.71 billion, with 6% YoY revenue growth being driven by its global e-commerce sales growing by double digits.

Notably, customer transactions rose 4.3% YoY, but its average ticket declined by 0.3%. That’s a great sign for the Fed and other inflation watchers but also suggests that spending on higher-priced, higher-margin discretionary items remains soft. 🔺

With customers flocking towards those lower-margin “basics” like private label goods, grocery items, and others, Walmart is leaning heavily into other business segments. It’s making money from packing and shipping online orders for its third-party marketplace of sellers. It’s also selling more ads, with that business jumping 33% YoY globally and 22% in the U.S.

On that front, the company announced it would acquire smart TV maker Vizio to help accelerate growth. It’s acquiring the company for $2.3 billion in cash and plans to use the distribution (and customer data) to help fuel its opportunity in the ad-serving space. 📺

With its share price rising towards $200, the company is splitting 3-for-1 and raising its dividend by 9% to help broaden its investor base. The Stocktwits community pushed into “extremely bullish” territory, and message activity surged on the news. 📈

In Case You Missed It…

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and chart wizard Ivanhoff every week on “Momentum Monday.”

In this week’s episode, the group discusses:

- SMCI’s potential blowoff top & Nvidia earnings expectations ☠️

- Coinbase and Robinhood reporting record profits 💸

- The “bigger picture” trends impacting the broader market 📊

- Top picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

Earnings

Cyber Stocks Get Clocked

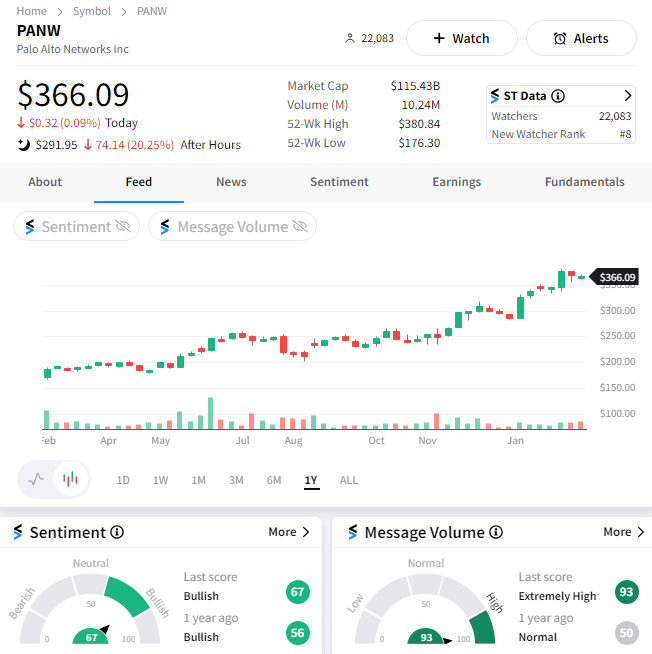

Palo Alto Networks is getting pounded by sellers after hours, dragging the rest of the sector down with it. Let’s see what happened. 👇

The cybersecurity giant reported adjusted earnings per share of $1.46 on revenues of $1.98 billion. Unfortunately, that’s where the good news ended.

The company said it saw its ten highest-spending customers raise their spending by 36% YoY, but they’re beginning to see fatigue in cybersecurity budgets. The trend started late in the first quarter and continued into the second, with it expected to impact the next two quarters well. Its reliance on U.S. Federal government spending during an election year is proving difficult. 💸

As a result, management now expects full-year total billings of $10.10 to $10.20 billion, down from its previous guide of $10.70 to $10.80 billion. That means its full-year revenue range was also adjusted downward from $8.15 to $8.20 billion to $7.95 to $8.00 billion.

CEO Nikesh Arora said the guidance cut represents a “shift” in strategy, “wanting to accelerate growth, our platform migration, and consolidation and activating AI leadership.” There are a lot of buzzwords there, but not enough to keep shareholders on board, especially as management says they expect a “difficult customer” in the near term. ⚠️

Who knew it could be so challenging to make money in cybersecurity when there’s a hack or data breach seemingly every day? Nonetheless, investors were not happy with what they heard and sent $PANW shares plummeting 20% after the bell. 📉

With the stock pulling back from all-time highs and still in a long-term uptrend, it’ll be interesting to see how eager the bulls are to “buy the dip” in this industry leader. As always, time will tell. 🤷

Stocktwits Spotlight:

Although everyone is focused on Nvidia ahead of its results, some investors haven’t taken their eye off the second-largest company on the planet…Apple. 🍎

While many have abandoned the stock over the last few months in search of more exciting opportunities, the bearish rhetoric has certainly picked up recently. For example, the last time the Stocktwits community was “bullish” on the stock was six months ago, with readings sitting in neutral territory since then. 😴

Channeling his inner contrarian, Stocktwits user gpaisa shared the chart above that shows the stock may be settling into another “buy zone” for technical traders. Shares are currently trying to stabilize above former support/resistance levels near 180 and the uptrend line from its Jan lows. 🎯

He pokes a bit of fun at the bears in his message, referring to Apple’s last two major drawdowns that buyers quickly snatched up.

We’ll have to wait and see if history repeats itself. But while the bears are getting greedy and bulls are partying elsewhere, this could be a sleeper setup in the making. 🧐

To follow along with how this chart develops and see more like it, follow gpaisa on Stocktwits! 👀

Bullets

Bullets From The Day:

🧑⚖️ Cox Communications overturns $1 billion copyright verdict. The cable television and internet service provider convinced a U.S. appeals court to throw out a $1 billion jury verdict in favor of the several major record labels that accused it of failing to curb piracy. In the age of artificial intelligence, where copyright law and piracy are hot-button issues, the outcome of this new trial will undoubtedly be on investors’ radars. CNBC has more.

💳 Debit card ‘swipe fee’ rule throws Supreme Court for a loop. A North Dakota convenience store’s challenge to government regulation on debit card “swipe fees” is proving more challenging than anyone imagined for the nation’s highest court. The case could make it easier for businesses to challenge longstanding federal rules, with arguments focused on whether the store was too late bringing its 2021 lawsuit challenging a 2011 Federal Reserve regulation. More from Reuters.

🚨 A Wyze camera breach exposed 13,000 customers’ homes. The security camera company is blaming a “third-party caching library” for an issue that allowed certain users to briefly see into a stranger’s property because they were shown an image from someone else’s Wyze camera. Of the thousands impacted, roughly 1,500 people tapped to enlarge the thumbnail of another person’s home, with the company reiterating that 99% of all its customers weren’t affected. Nonetheless, the damage has been done, and the company likely has a long road ahead in winning back public trust. The Verge has more.

📺 Fubo TV sues over sports streaming pact. The company is trying to block the planned sports streaming service from Disney, Warner Bros. Discovery, and Fox. Fubo said in its press release that the joint venture would give those three networks less incentive to make their channels available on Fubo and other distributors, with them also charging above market rates. The lawsuit highlights growing unrest in the sports and pay-TV community as content owners and distributors fight over the highly sought-after content. More from Axios.

💰 Microsoft expands its AI infrastructure in Spain. The U.S. tech giant is expanding its artificial intelligence and cloud infrastructure in the European country with a $2.10 billion investment over the next two years. It comes shortly after it announced a roughly $3.50 billion investment in Germany over two years, showcasing the voracious appetite for investing in the infrastructure needed to support a technology (and AI) driven future. Reuters has more.

Links

Links That Don’t Suck:

👋 New features, powerful upgrades and a new name… MarketSmith becomes MarketSurge on March 4th!*

🤖 AI hiring tools may be filtering out the best job applicants

🧳 American Airlines raises bag fee by $10 for luggage checked at the airport

🏡 Homeownership gap between Black and White owners is worse now than a decade ago

🗺️ How far will $100,000 take you in the U.S.? Here’s where it’s worth the most — and least.

◀️ Biden administration considers slowing key emissions rules – a potential blow to EV growth

👵 Ex-Yahoo CEO Marissa Mayer discusses the current tech scene from vantage point of her AI startup

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.