The bullish animal spirits driving biotech stocks, cryptocurrencies, and more spread further today as heavily shorted stocks like Beyond Meat blasted off. Let’s see what you missed. 👀

Today’s issue covers buyers moving Beyond tech, Apple draining its EV resources for AI, antitrust regulators targeting UnitedHealth, and another breakout in the healthcare space. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

9 of 11 sectors closed green. Utilities (+1.89%) led, & energy (-0.43%) lagged. 💚

Durable goods orders took a major hit in January, falling 6.10% because of fewer airplane contracts (thanks, Boeing). Excluding planes and cars, new orders fell just 0.3%, as the industrial side of the economy rebounds in a volatile fashion. U.S. consumer confidence fell for the first time in three months as the worries shifted toward jobs and the upcoming presidential race. 👎

The S&P Case-Shiller home price index showed prices rose 0.2% MoM and 6.2% YoY as the pace of growth slowed. Lowe’s offered similar, muted, guidance as rival Home Depot. Most home-related retailers have warned of slow housing turnover and economic uncertainty weighing on demand. 🏘️

Retailer Macy’s is still attempting a turnaround, closing 150 underperforming stores over the next few years and keeping 350 “smaller footprint” Macy’s locations. It’s also focused on capturing the higher-end consumer, investing in its Bloomingdale’s and Bluemercury brands. 🏬

Clinical-stage biotech Viking Therapeutics soared 120% after solid results from its Phase 2 GLP-1 study. Investors continue to fish for big winners in the sector, with ETFs like $XBI breaking out. 💊

Cava shares jumped 12% to new all-time highs after the company pre-maturely reported better earnings than anticipated. While Norwegian Cruise Lines was another fan favorite that soared 20% after reporting its first profitable year in the post-pandemic world. 📈

Other symbols active on the streams: $ALT (+22.00%), $LMND (-9.52%), $IFBD (-53.62%), $SOUN (+19.30%), $CXAI (+81.94%), $BBAI (+38.15%), $XRP.X (+7.93%), & $PEPE.X (+70.12%). 🔥

Here are the closing prices:

| S&P 500 | 5,078 | +0.17% |

| Nasdaq | 16,035 | +0.37% |

| Russell 2000 | 2,056 | +1.34% |

| Dow Jones | 38,972 | -0.25% |

Company News

Apple Drains EV Resources For AI

After ten years of research and development, Tim Apple is finally pulling the plug on Apple’s electric vehicle (EV) project. Because as we all know, EVs have lost their luster and given way to the business world’s new savior…artificial intelligence (AI). 😇

Bloomberg broke the news today, saying the tech giant disclosed the strategy shift internally and surprised the nearly 2,000 employees working on the project. Executives told staffers the project would begin winding down and that many of the car team’s employees would be shifted to its artificial intelligence division, focused on generative AI.

Tesla CEO Elon Musk subtly celebrated the move with a post on X after years of doubting the company’s efforts would bear fruit. Shareholders also applauded, with the 1-minute chart below showing a price surge after the announcement, with the stock holding onto its gains into the close.

While some investors are happy that Apple is shifting resources to the new AI “gold rush,” others view them throwing in the towel on electric vehicles as a contrarian signal for the space. Electric vehicle stocks, including Tesla, have been hit hard over the last two years amid demand challenges. 🪫

That’s caused many automakers to throttle their approach to the space, with traders waiting for a big news event like this to help form a short-term bottom in these stocks. We’ll have to see if their contrarian view pays off or if Apple’s retreat is just another data point signaling that the industry’s problems are here to stay. 🤷

One thing’s for sure: this move sums up the current market environment as well as anything else. 😵💫

Sponsored

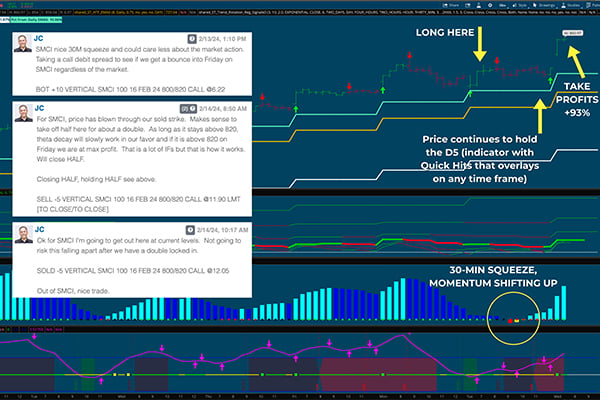

How John Carter Caught a +93% Trade on SMCI in Less than 24 Hours.

The market has presented John Carter with some rare opportunities lately… Some more obvious than others…

He recently closed a trade on SMCI, resulting in a +93% gain in less than 24 hours. In fact, he set this up while other traders were panicking and the market was trending down.

He even talked about this trade live in our Simpler Central Room (and sent out trade alerts to our members), where our trading team makes live trades and shares their trading strategies Monday – Friday.

That’s why having a trading mentor can make all the difference. You can shorten the learning curve, learn from some of the best and even ask questions.

Want to follow John and our entire team of pro traders as they trade futures, options, ETFs, stocks and so much more? If you’re interested, you can start a 60-day trial to Simpler Central for just $1.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

Buyers Move Beyond Tech

Animal spirits have been a big theme of this newsletter since October, and boy, are things getting wild. While the mainstream media continues focusing on tech giants like Nvidia, investors and traders are searching far and wide for new opportunities to squeeze the shorts and make a killing. 🕵️♂️

Today’s surefire sign of this speculative fervor building in the market is everyone’s favorite non-meat meat stock, Beyond Meat. 🫨

The company’s share price is soaring despite reporting a $2.40 per share net loss and a nearly 10% YoY revenue decline to $73.70 million. While revenues beat expectations, its net loss was far wider than expected.

Even the company’s net revenue guidance of $315 to $345 million for 2024 was lackluster compared to analyst estimates of $344.40 million. But management’s focus on cost-cutting and forecast for gross margins in the mid to high teens range sent investors into a frenzy. That would be a crazy difference compared to 2023, where gross margins were firmly in negative territory. 🤯

However, traders (and algos trading the news) do not care how the company plans to meet that outlandish forecast. All they heard was a 20-point increase in gross margin is coming this year, which would be an absolute game-changer for the company.

Objectively, this is a crazy measure the company is unlikely to meet, but with 36% of the float short, there’s a ton of squeeze potential. That’s why shares are up over 75% after hours and will likely remain on traders’ radars in the days and weeks ahead. 📈

And if you need more evidence that this “pain trade” for shorts is back in action, take a look at the charts of stocks like Carvana, Big Lots, Robinhood, and more. You’ll get the gist real quick. 😆

We all know how this will eventually end, but for now, the Bulls are partying like it’s 2021 all over again. Enjoy responsibly. 🍻

Company News

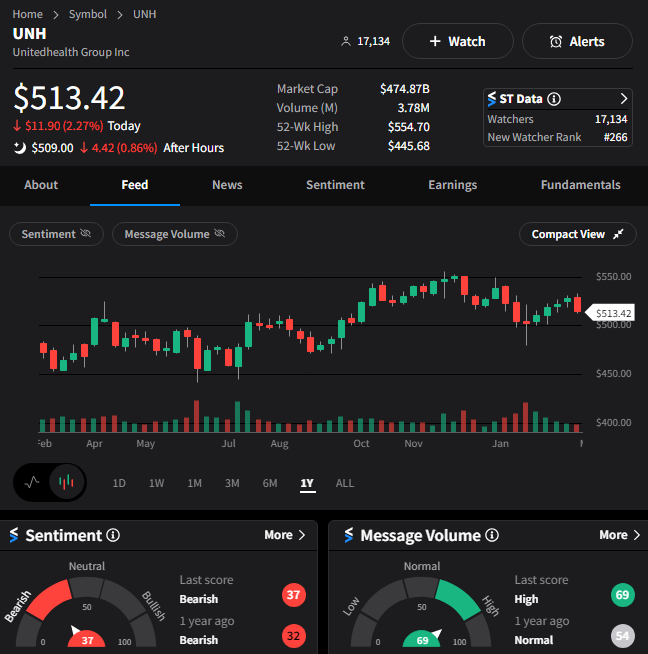

Justice Department Targets UnitedHealth

With the upcoming presidential election looming, the current administration is itching to accomplish more before a potential shakeup. While antitrust regulators have had a field day with big tech, airlines, grocery chains, and others this year, they’re taking another look at UnitedHealth, especially given its recent cybersecurity issues. 🕵️♂️

The Justice Department is poking around to figure out the relationship between the company’s UnitedHealthcare insurance unit and its Optum health-services division. They’ve asked how UnitedHealth’s acquisitions of doctor groups might affect competitors and consumers. 🤔

With UnitedHealth being the dominant U.S. health insurer in commercial markets, this isn’t the first time regulators have scrutinized the company. The Justice Department sued to block its acquisition of Change Healthcare Inc. in 2022 but ultimately failed in court.

However, it’s still investigating the company’s planned acquisition of home-health company Amedsiys, among other relationships.

Given the recent aggressive nature of antitrust regulators, further scrutiny of UnitedHealth makes investors feel a bit uneasy. $UNH shares had already been under pressure because rising medical costs were hurting margins, so this added another layer of risk to the stock. ⚠️

As the image below shows, the Stocktwits community is currently negative on the stock. We’ll have to see if their negative approach continues to pay dividends. 🐻

Stocktwits Spotlight:

With the healthcare sector continuing to catch investor attention, some traders and investors are finding opportunities in names that many have never even heard of. 🤷

Stocktwits user upsidetrader pointed out the nice base breakout in Mind Medicine Mindmed Inc. As his message pointed out, the small-cap pharmaceutical company is beginning to play catchup with the rest of the space that’s been catching fire. Where it’s headed remains to be seen, but it’s certainly an underfollowed setup worth highlighting. 👍

If you want to see how this chart develops and see more charts like this one, follow upsidetrader on Stocktwits! 👀

Bullets

Bullets From The Day:

🤖 Microsoft diversifies its AI bet with Mistral AI investment. The U.S. tech giant is catching the eyes of European antitrust regulators after making a 15 million euro investment in French AI startup Mistral AI. It’s the latest move that Microsoft has made to diversify its exposure in the generative artificial intelligence (AI) space as it tries to avoid betting too heavily on OpenAI. However, some analysts say that its stake in the company could amount to less than 1% should the next funding round come in at or above its last ($2 billion) valuation. TechCrunch has more.

🎮 Sony joins a growing wave of gaming layoffs, with 900 cuts. The Japanese tech giant is laying off 900 employees from its PlayStation division, reducing its global headcount by around 8%. Management said after months of analysis and consideration; it’s clear that changes need to be made to continue growing the business and developing the company over the long term. Investors have been concerned about the overall gaming industry lately, and Sony missing a key PS5 sales target recently renewed pressure on its stock price. More from The Verge.

❌ Warner Bros. Discovery and Paramount merger talks stall. The two media giants have reportedly halted potential merger talks amid the industry’s consolidation and shakeup. Paramount has reportedly received several officers in the last few months, including David Ellison’s Skydance Media, Byron Allen, and more. However, it remains unclear whether any of these suitors will get to the closing table in this rapidly changing media landscape. Yahoo Finance has more.

Link

Links That Don’t Suck:

😎 New features, powerful upgrades and a new name… MarketSmith becomes MarketSurge on March 4th!*

🍔 Wendy’s will experiment with dynamic surge pricing for food in 2025

🦺 Boeing’s safety culture is ‘inadequate’ and ‘confusing’, new FAA report finds

🚀 We finally know why SpaceX’s Starship exploded (twice) during Its second flight

🐀 Family Dollar to pay nearly $42 million in connection with rodent-infested warehouse

🥣 Let them eat Flakes: Kellogg’s CEO says poor families should consider ‘cereal for dinner’

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.