Quickly before we dive into this Litepaper: there will be additional content starting next week (tentatively, maybe, if technology works and baring an EMP attack). Expect to see interviews with different cryptocurrency developers and leaders in the space.

We’ll also have more charts and technical analysis. The technical analysis will be broken down into three categories, but check out the end of this Litepaper for more details and an example of what that will look like.

On the docket for today’s Litepaper is Ethereum’s ($ETH.X) ‘Merge’ upgrade getting a launch date, a look at which cryptos mooned, and which ones need to be scraped up with a spatula, a

Here’s how the crypto market looked at the end of the regular trade day:

| Cardano (ADA) |

$0.447

|

1.36% |

| Binance Coin (BNB) |

$241.10

|

1.13% |

| Bitcoin (BTC) | $21,072.73 | 2.41% |

| Dogecoin (DOGE) |

$0.064

|

1.93% |

| Ethereum (ETH) |

$1,268.01

|

6.26% |

| Polkadot (DOT) | $6.93 | 3.27% |

| Solana (SOL) |

$38.72

|

4.34% |

| XRP (XRP) |

$0.335

|

0.30% |

| Altcoin Market Cap |

$523.95

|

2.71% |

| Total Market Cap |

$926.13 billion

|

2.57% |

Several Ethereum ($ETH.X) developers have hit Twitter and YouTube to discuss the anticipated ‘Merge’ update for ETH’s blockchain. The new date for the ‘Merge’ is around September 19, 2022.

BUT…

We’ve all heard this story before – not just from Ethereum’s peeps – but from many other cryptocurrency projects. A lot can change between now and September 19.

This merge timeline isn't final, but it's extremely exciting to see it coming together. Please regard this as a planning timeline and look out for official announcements!https://t.co/ttutBceZ21 pic.twitter.com/MY8VFOv0SI

— superphiz.eth 🦇🔊🛡️ (@superphiz) July 14, 2022

The ‘Merge’ is arguably one of the most important updates to Ethereum since its inception. ‘Merge’ transitions Ethereum from Proof-Of-Work to Proof-Stake. In a nutshell, the ‘Merge’ increases scalability, sustainability, and security. Furthermore, regarding sustainability, switching from PoW to PoS will reduce Ehereum’s energy costs by 99%. ❤️

Polygon ($MATIC.X) and Uniswap ($UNI.X) were the clear leaders in the cryptocurrency space this week. Both posted +20% gains and broke through stiff resistance levels on their respective charts.

From a fundamentals perspective, Uniswap caught a major momentum drive higher after getting listed on Robinhood’s ($HOOD) platform. And if you read Wednesday’s Litepaper, then you’d know that Polygon is catching some FOMO activity after Disney announced MATIC as the blockchain they are partnering with for their Accelerator Program.

The losers of the week are Cardano ($ADA.X) and Dogecoin ($DOGE.X). Cardano continues to float between the $0.45 and $0.50 value areas. While the Vasil hard-fork is just around the corner, prie action is quite muted and constricted. Cardano is currently down -5% for the week.

Elon Musk’s favorite memecoin, Dogecoin, is down an ugly -8.30% for the week. According to CoinMarketCap’s ranking by market cap, Dogecoin is the worst performing cryptocurrency out of the top 100. Some negative carry over from Musk’s decision to pull out of the Twitter ($TWTR) deal. Musk’s random Tweets involving Dogecoin have triggered massive spikes and crashes. 👍🏻

As mentioned at the beginning of this Litepaper, this new and truly exciting nerd fest section is for all of you technical analysis chart junkies – my kind of people. We’re breaking this down into three categories.

Category one for beginners: Think of this category as ‘Your Baby’s First Book on Technical Analysis’ – it will include basic trendlines and moving averages.

Category two for people who know some stuff: If you think, “Oscillators and indicators are kind of cool,” then this is for you – this will include RSI (Relative Strength Index), Fibonacci retracements, and extensions.

Category three is for full-blown nerd mode geek stuff: “OMG, WTF is this? I don’t even… why does it look like a toddler’s coloring placemat from IHOP?!” This section will include concepts like the Ichimoku Kinko Hyo system, Point and Figure charting, Gann Analysis, and other bizarre stuff that you may or may not know, but we will break down into a TL;DR version.

Beginners Technical Analysis

The chart above is Bitcoin’s ($BTC.X) weekly chart. The blue line on the chart is the 200-period moving average. That moving average is the average price of the past 200 weekly candles.

Analysts view the 200-period moving average as a sort of barometer to determine if a trend is bullish or bearish. Bitcoin has closed below the 200-period moving average for five consecutive weeks – that’s a record. To some analysts, failure to move and close above that moving average is extremely bearish.

People Who Know Some Stuffs Analysis

The chart above is still Bitcoin, but it’s the monthly candlestick chart. In technical analysis, many analysts view the 50% Fibonacci retracement as a strong support and resistance level.

In other words, if the price moves down to the 50% Fib level, analysts anticipate a high likelihood of it finding support and bouncing off of it to move higher.

The Relative Strength Index (RSI) is a momentum oscillator. Analysts and traders use the RSI to help determine whether something has moved too far up (overbought) or too far down (oversold). Overbought indicates prices may be reversing lower; oversold indicates prices may turn around and move higher.

On Bitcoin’s monthly chart, many analysts believe that because price is close to the 50% Fibonacci retracement and because the RSI is at new all-time lows and just above the final oversold level, the market is severely oversold, and a move higher could occur.

However, oversold does not necessarily mean prices will reverse. Instead, some analysts believe that a lack of conviction from buyers near historical lows is evidence of continued lower prices.

Super Duper Exciting Nerd Analysis 9000

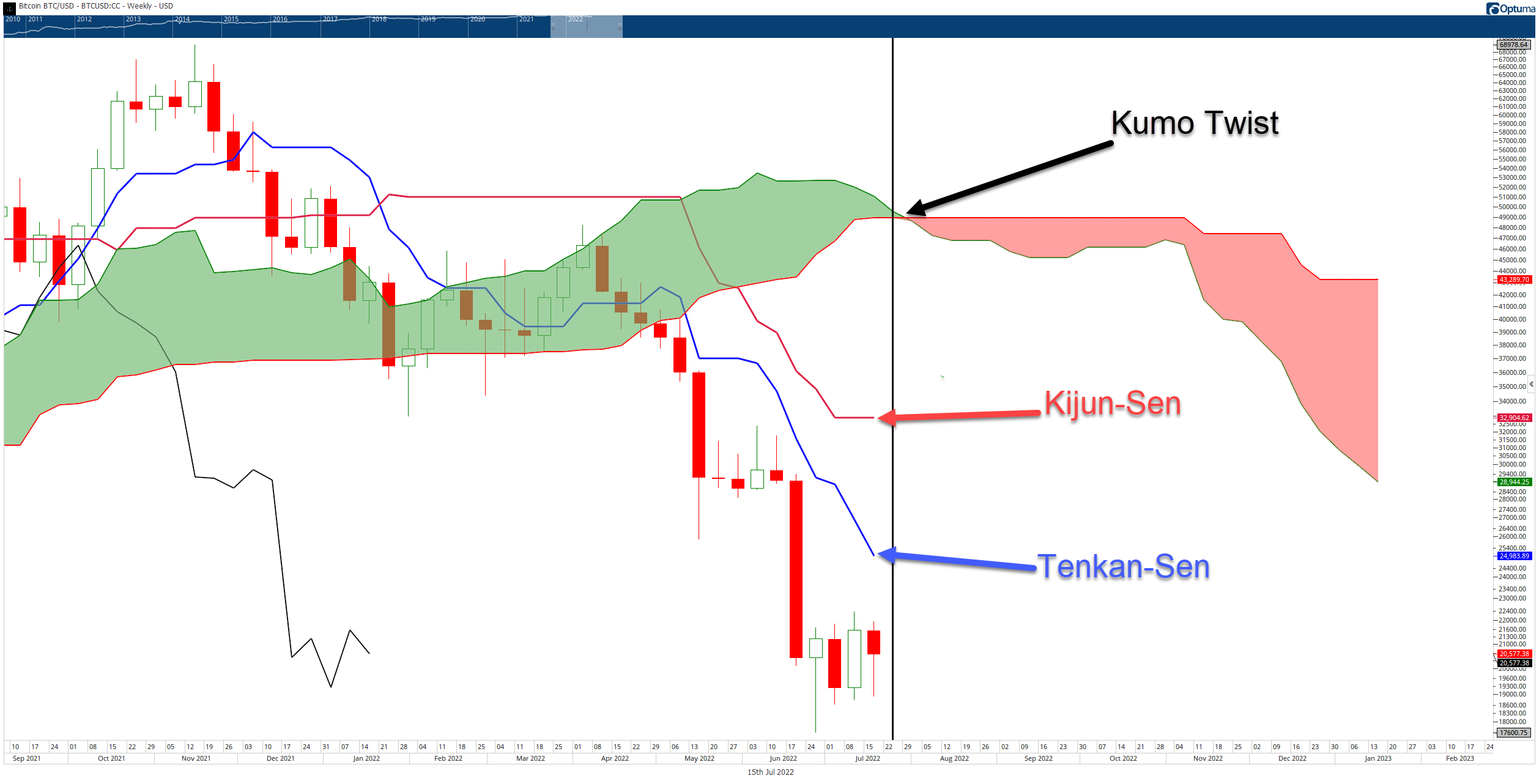

Taking another look at the weekly Bitcoin chart, this time using the Japanese technical trading system and analysis style known as the Ichimoku Kinko Hyo system. If you don’t know what the blobs of color and all the other components are, you can skip to the last part of the Super Duper Exciting Nerd Analysis 9000 for the TL;DR summary.

The gaps between the bodies of the candlesticks and the Tenkan-Sen remain large and unresolved – out of equilibrium. You can think of price and the Tenkan-Sen attached by a rubber band. The further price moves from the Tenkan-Sen, the harder it is to move further away and the increased likelihood that price will ‘snap’ back to the Tenkan-Sen and return the market to equilibrium.

The Ichimoku System does not tolerate large gaps between the bodies of the candlesticks and the Tenkan-Sen, which often resolve within three to five candles. But what if price fails to move back to the Tenkan-Sen? In the absence of price returning to the Tenkan-Sen, the factor of time will return the instrument to equilibrium.

For Bitcoin, that would mean instead of price moving up to the Tenkan-Sen, Bitcoin’s price action would likely consolidate and rest until the Tenkan-Sen moves down to price.

The Kumo Twist is the most important factor on Bitcoin’s weekly Ichimoku chart. A Kumo Twist is an event where the Cloud changes color from red to green or green to red. The black vertical line shows where the current twist is at.

Ichimoku traders and analysts look for Kumo Twists to identify possible turns in a market. For example, if an instrument is trading near a major/minor swing high/low near the time of a Kumo Twist, then there is a high probability of a major move occurring soon.

TL;DR Summary For Bulls

Analysts continue to point at new all-time lows found on the monthly RSI and continue to point at extreme oversold levels. Price action, likewise, continues to display evidence that a bottom of the current bear market may be complete or is nearing completion.

TL;DR Summary For Bears

While oscillators and price action may point to a strong case for a near-term bullish bias, oversold conditions do not guarantee an end to selling pressure. The consolidation and formation of a floor may just be consolidation that occurs before another leg down.

From an Ichimoku perspective, because the Tenkan-Sen is acting as a resistance level, the closer it gets to the price, the more likely price is to remain away from the Tenkan-Sen – thereby moving lower. ⏰

Bullets

Bullets From The Day:

🦊 Shiba Inu ($SHIB.X) is now the largest token held by Ethereum whales. After flip-flopping positions with ShibDoge ($SHIBDOGE.X). Probably a whole bunch of people underwater, too, considering Shiba is still down over -87% from its all-time high. Get more from Bitcoinist

💵 Yes, you are reading the next sentence correctly: Celsius ($CEL.X) is owed $439 million from the firm EquitiesFirst. Celsius took out a loan in 2019 from EquitiesFirst and it became overcollateralized, converting Celsius into a creditor instead of a debtor. Read the full story at cryptobriefing.com

⏰ Ripple Lab’s CTO says that no matter how high XRP ($XRP.X) trades at, the cost to transact on their blockchain will remain stupidly cheap. The CTO sparred on Twitter with some critics regarding the cost to transact if XRP dramatically increases in value. CryptoGlobe.com has the Twitter drama and explanation

Links

Links That Don’t Suck:

🗣 Binance takes a more tentative step with its investment in Axie Infinity (AXS.X)

💼 DOJ may pew pews Googles prior concessions, setting the stage antitrust lawsuits

🎅🏽 Boomer tells boomer that Millennials are to blame for inflation

⚔️ Russian dictator Vladimir Putin signed a bill banning digital assets as payment into law

🪠 Elon Musk’s poop emoji is getting used against him in his about-face with his Twitter bid