Attention all Litepaper readers: The U.S.S. Pampy McPamp Pamp is ready to launch! The Total Market Cap has held the critical $1 trillion level! The Altcoin Market Cap moved from $500 billion to $625 billion. If you’re like me, then you’re excited… but cautious.

I was born and raised a Minnesota Vikings fan, so I’ve learned to be a Realistic Pessimist. This means I always expect the worst to happen, and when it does, it’s not a surprise. And when something good happens, it’s a surprise, but I’m immediately suspicious of when the rug pull is going to happen.

Unless something drastic happens over the weekend, the crypto market is set to complete its fourth consecutive weekly bullish close. Additionally, the monthly chart will close in the green for the first time since March 2022, and July will be the best close the crypto market has seen since October 2022.

There’s a lot to go over today news-wise. We’re going to look at the good, the bad, and the ugly in the market. Additionally, we’re going to see which cryptocurrencies took the lead this week and which lagged.

And check out the Technically Speaking article at the end for a sneak peek into a new feature we’ll have here soon in the Litepaper and on Stocktwits.

Here’s what the crypto market looked like at the close of the regular trading session:

| Cardano (ADA) |

$0.53

|

2.73% |

| Binance Coin (BNB) |

$296.70

|

6.96% |

| Bitcoin (BTC) | $23,989 | 0.46% |

| Dogecoin (DOGE) |

$0.07

|

0.58% |

| Ethereum (ETH) |

$1,734.55

|

0.37% |

| Polkadot (DOT) | $8.26 | 5.09% |

| Solana (SOL) |

$42.22

|

0.01% |

| XRP (XRP) |

$0.37

|

0.02% |

| Altcoin Market Cap |

$624 Billion

|

0.81% |

| Total Market Cap |

$1.08 Trillion

|

0.56% |

The top fifteen cryptocurrencies by market capitalization (excluding wrapped crypto and stablecoins) are our population used to identify which cryptos made the winners and losers list.

Also – the percent of gains and losses listed below may change slightly or dramatically by the time this Litepaper hits your inbox. Just an FYI.

The Winners

Hands down, Ethereum Classic ($ETC.X) was the clear leader this week. Ethereum Classic pamped for an amazing +60%. Uniswap ($UNI.X) followed with a +31% gain, and Ethereum ($ETH.X) at +10%.

Out of the top fifteen cryptocurrencies, all save two closed in the green after the regular trading week ended. But, again – that may or may not change by the time you read this Litepaper.

The Losers

The losers category for the week is kind of moot. There were only two: Shiba Inu ($SHIBA.X) down by -1.27% and Avalanche ($AVAX.X) down -0.95%.

There were some cryptos that just missed getting added to the losers category: Solana ($SOL.X) gained +1%, Dogecoin ($DOGE.X) +1.23%, and TRON ($TRX.X) +1.75%. 🔄

Crypto

The Good – July 29, 2022

Before we dive into the good news in the crypto space (and there is), it’s important to remember that the only thing bearish about cryptocurrencies is the price action. Adoption, attention, use, and interest have only grown and continue to grow.

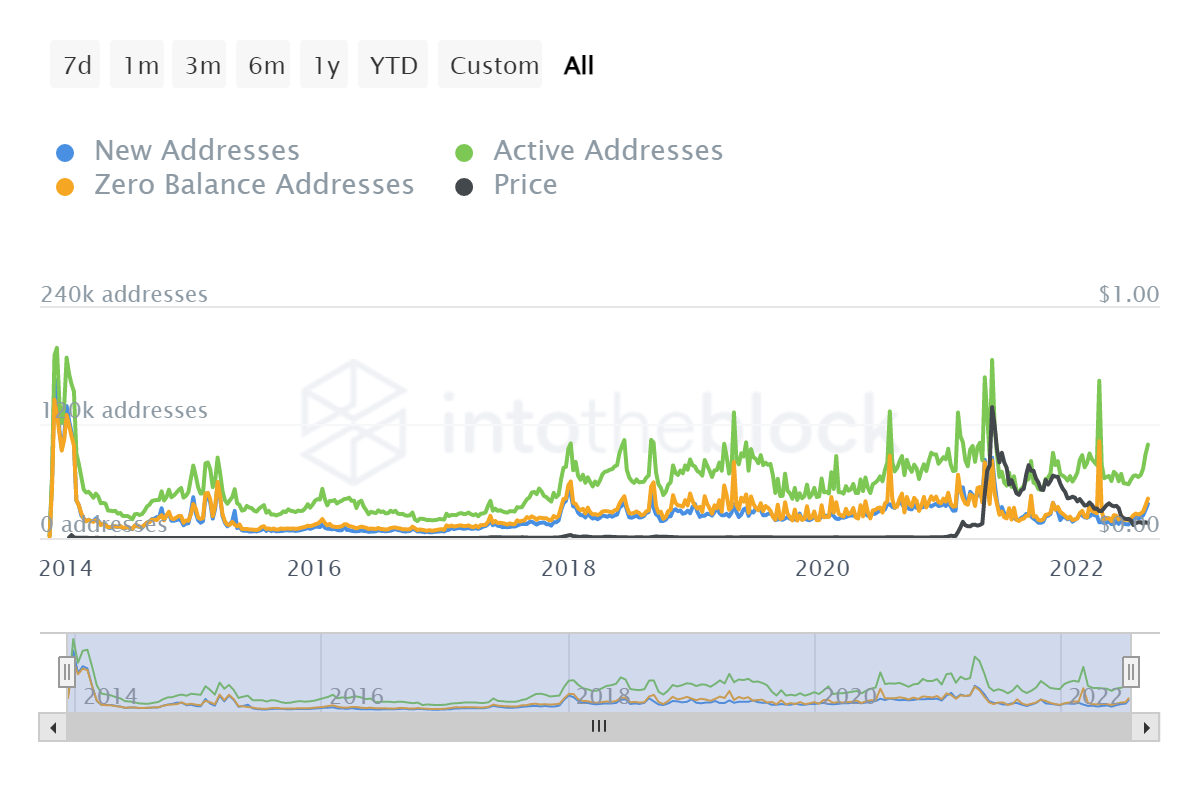

The image above is from the on-chain analytics service, IntoTheBlock. The active Dogecoin ($DOGE.X) addresses have exploded by nearly 265%. Why is this a big deal? Because Dogecoin represents a part of the cryptocurrency market that is the most speculative: memecoins.

If there is renewed interest and new participation in cryptocurrencies like Dogecoin, some analysts view that growth as a warning sign of a new ‘altcoin season’ developing. But Dogecoin isn’t the only memecoin finding buyers.

According to WhaleStats, Ethereum ($ETH.X) whales have increased Shiba Inu ($SHIB.X) holdings from $736,000 to a whopping $5 million – nearly +580% higher over 24 hours.

On the regulatory side, The Law Commission of England and Wales recommended that a new category of property is needed to provide legal protection for digital assets. The new category’s label is data objects. Existing private property laws would then extend to cryptocurrencies. 😁

Policy

The Bad – July 29, 2022

Let’s start The Bad with Voyager.

The U.S. Federal Reserve and the FDIC (Federal Deposit Insurance Corporation) issued a joint cease and desist to Voyager Digital ($VGX.X). The two agencies claim that Voyager shared “false and misleading” claims about being FDIC insured.

Technically, Voyager and customer deposits in the Metropolitan Commerical Bank are FDIC insured, but the Fed and FDIC said the FDIC does not insure Voyager itself. 😧

Terraform Labs – the one run by Do ‘Con’ Kwon – is accused of insider trading. South Korean prosecutors are pursuing claims that allege TerraForm labs manipulated its volume over the DeFi service, Anchor Protocol ($ANC.X). The manipulation enticed and attracted potential investors to trust Luna ($LUNA.X) and the stablecoin (lol) TerraUSDT ($UST.X).

The investigation is ongoing, and we here at the Litepaper will keep you updated. 😁

Crypto

The Ugly – July 29, 2022

The cryptocurrency exchange Zipmex officially filed for bankruptcy protection. Zipmex is one of several cryptocurrency exchanges that recently halted all trading and withdrawals on their platform due to fallout from Three Arrows Capital’s collapse.

Maybe I should add a category called ‘The Evil’ for this one: on-chain analytics firm, Chainanalysis, identified over $2.2 million in crypto donations to pro-Russian military groups. $1.45 million came from Bitcoin (BTC.X), $590,000 in Ethereum ($ETH.X), and the remainder is a mix of TRON ($TRX.X), Litecoin ($LTC.X), and Dogecoin ($DOGE.X).

$2.2 million is a lot of money, but it’s paltry compared to the estimated $200+ million Ukraine has received in cryptocurrency donations. 🤬

Axie Infinity’s ($AXS.X) public image can’t shake off controversy. Trung Nguyen, CEO and co-founder of Axie Infinity, was accused of insider trading before the announcement of the $600 million hack in March 2022.

Bloomberg reports that Nguyen moved roughly 50,000 AXS off Axie Infinity’s bridge (Ronin) into a Binance account. The parent company of Axie Infinity, Sky Mavis, froze the 50,000 AXS, essentially locking them in the game.

Nguyen and Sky Mavis vehemently deny the transfer was an attempt to sell any AXS before breaking news. Instead, they claim the move was to “… ensure that short-sellers, who track official Axie wallets, would not be able to front-run the news.” However, other wallets believed to be attached to Sky Mavis employees experienced large transactions, too.

Nguyen took to Twitter last night:

The Founding Team chose to transfer it from my wallet to ensure that short-sellers, who track official Axie wallets, would not be able to front-run the news.

— Trung Nguyen (@trungfinity) July 28, 2022

We’ll keep you updated as this story develops. 😁

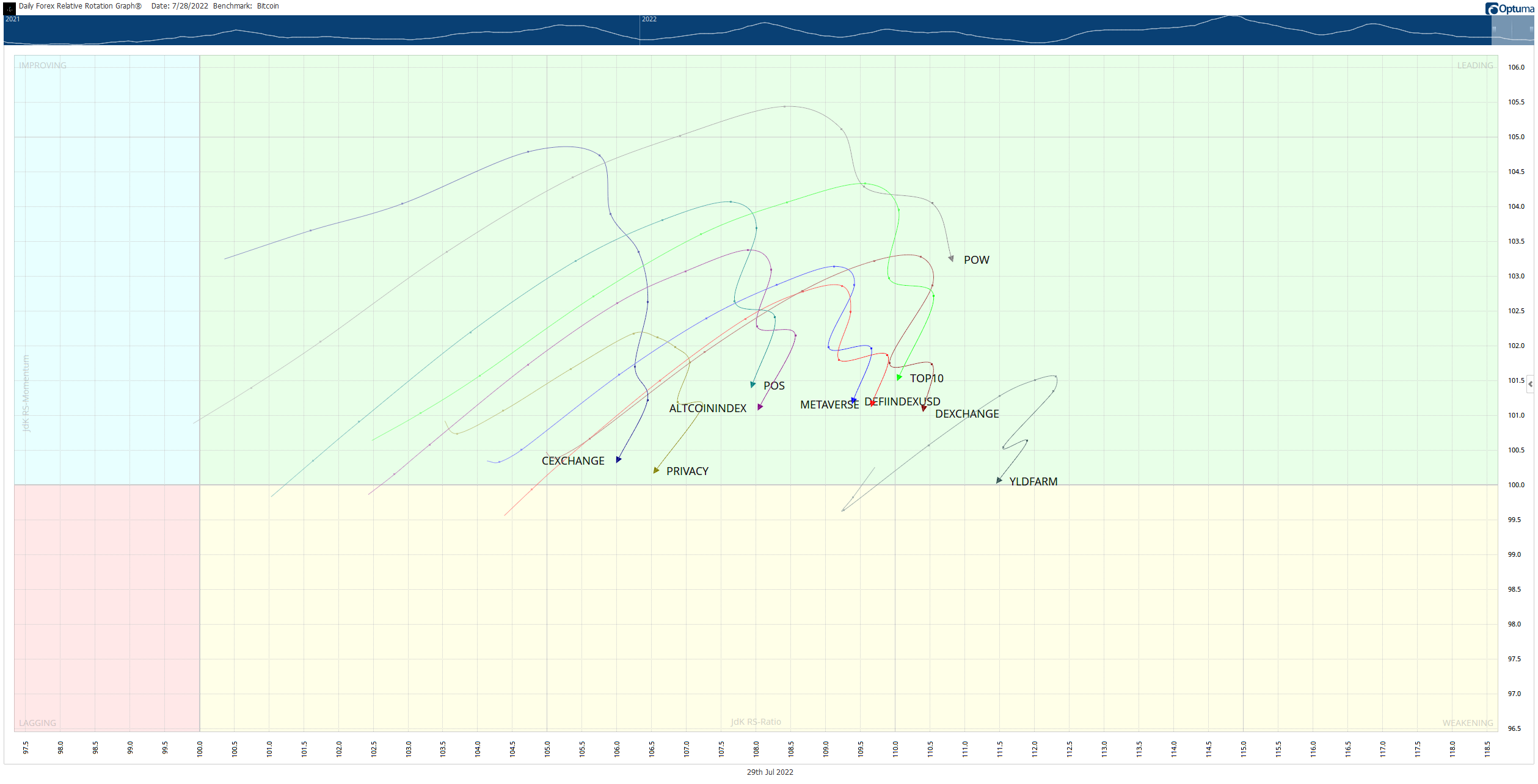

This is more of a ‘sneak peak’ into something new you’ll be seeing in the Litepaper – and possibly in the crypto streams on StockTwits.

Knowing what cryptocurrencies are leading or lagging the market is important – but I also want to know what ‘sectors’ are leading and lagging. Unfortunately, many sites and services offer a juiced-up version of an Excel spreadsheet, but nothing graphical.

I’m a visual person. I was the kid who wanted pictures in the books versus just a bunch of pages with stoopud wurds.

I’ve created several custom indices for the cryptocurrency market. Those indices are Top 10, Yield Farming, Privacy, Proof-of-Work, Proof-of-Stake, Metaverse, DeFi, DEX, CEX, and Altcoins. Others will be added – I would love to hear your suggestions!

The indices are comprised of the top 10 cryptocurrencies by market cap in their category and are rebalanced monthly. I use the professional technical analysis software, Optuma, to create a Relative Rotation Graph which then displays how the indices are performing.

The image above won’t be the one we’ll end up using – the team of artists here at StockTwits who know how to make awesome fire-blingy-looking graphics will make it look better soon. 🎯

Bullets From The Day

Bullets From The Day:

👍A new crypto-themed ETF from Charles Schwab is debuting on the NYSE (New York Stock Exchange) next Thursday. The new ticker will be ($STCE). The index will follow companies that are involved in digital assets as payment as well as those that develop dapps. Read more at Blockworks

🍪More escalation in the Ripple vs. SEC debacle. The SEC raised yet another objection to an order to deliver documents related to the Hinman speech. dailyhodl has the full story

🌎Ethereum Classic claim the 19th most valuable cryptocurrency spot. After a massive run of wins and a close near the 60% range, investors and traders wonder if momentum will continue. A full report from bitcoinist can be found here

📈Brazil continues to add more and more crypto-friendly platforms and services. The most recent is Santander Brazil – which plans to open its door over the next couple of months. More from CryptoSlate

Links That Don't Suck

Links That Don’t Suck:

🚑 Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

⏳CoinFLEX says it has laid off staffers to cut costs by 50-60%

🪃 Bitcoin price rejects at $24K as ‘classic short setup’ spoils bulls’ fun

🎁Babel Finance lost $280 million of customer funds from unhedged trading

💾 Yuga Labs adjusts Meebits royalty terms to receive 5% cut of secondary sales

🎙️ Crypto crash increases supply of luxury watches on the second-hand market